4 minutes reading time

Major asset classes: Equities, bonds and cash

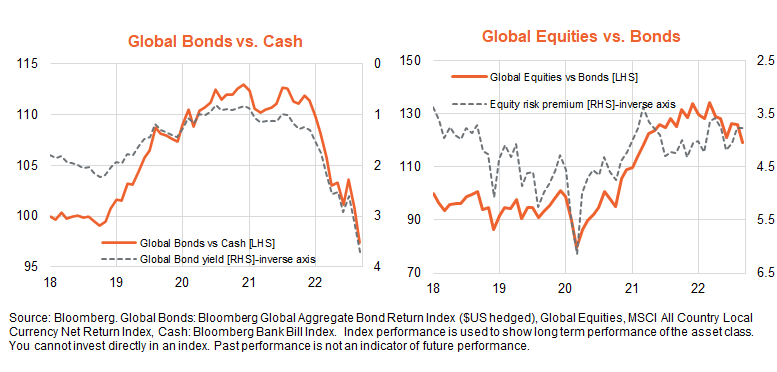

Both global bonds and equities fell further in September, with equity returns again weaker than that of bonds. Cash remained king.

The key development in the month was a higher than expected US inflation outcome which made the US Federal Reserve reaffirm its intention to raise interest rates aggressively.

As a result, the Bloomberg Global Aggregate Bond Return Index ($US hedged) was down 3.2% in the month, reflecting a 0.6% rise in the index’s yield-to-maturity to 3.7%. In turn, this reflected a notable increase in central bank tightening expectations, with the US Fed funds rate expected to reach 4.4% in 12 months (up from a 12-month expectation of 3.85% at the end of July).

In Australian dollar hedged terms, global bonds declined by 3.5%.

The MSCI All-Country World Equity Return Index in local currency terms declined by 8.4%, as higher interest rates pushed down valuations. The global market’s price-to-forward earnings (PE) ratio fell 8.5% to 13.1%, while forward earnings edged down by 0.2%. Reflecting weakness in the $A, global equity returns in unhedged $A terms declined by a smaller 3.6%.

All up, September market performance reaffirmed the trend so far this year of both bonds and equities underperforming cash due to high post-COVID inflation and aggressive central bank tightening expectations.

That said, with aggressive central bank rate hikes priced into the market, and inflation likely past its peak, the period of bond underperformance versus cash seems to be near an end. The outlook for equities, however, is less optimistic given the growing downside risk to corporate earnings. The one upside risk to equities is a speedy decline in global inflation which would then allow central banks to ease back on their policy tightening intent – in which case both bonds and equities would be expected to rally.

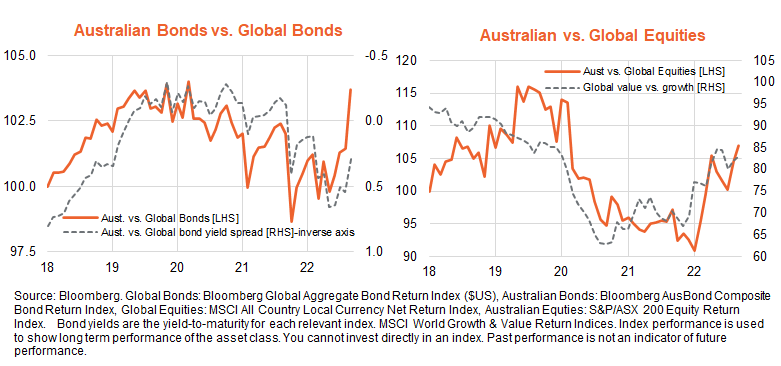

Australia vs. the world

Australian bond yields rose somewhat less than global yields over the past month, resulting in local bond outperformance – with the Bloomberg AusBond Composite Bond Index declining by a smaller 1.4%. Australian bonds have now modestly outperformed global bonds so far this year, after earlier choppy month-to-month performance.

On the view that local policy tightening expectations are likely to remain too aggressive, there is scope for spread narrowing and Australian bond outperformance over coming months. The RBA’s decision this week to raise rates by only 0.25% (compared to a market expectation of 0.5%) supports this view.

Australian equities also outperformed (unhedged) global stocks last month, consistent with higher bond yields hurting the growth/technology sectors harder than value exposures such as financials and commodities. The S&P/ASX 200 Return Index declined by 6.2%. Assuming slowing global growth begins to place downward pressure on global bond yields and commodity prices, however, there is a risk of Australian equity market underperformance in the months ahead.

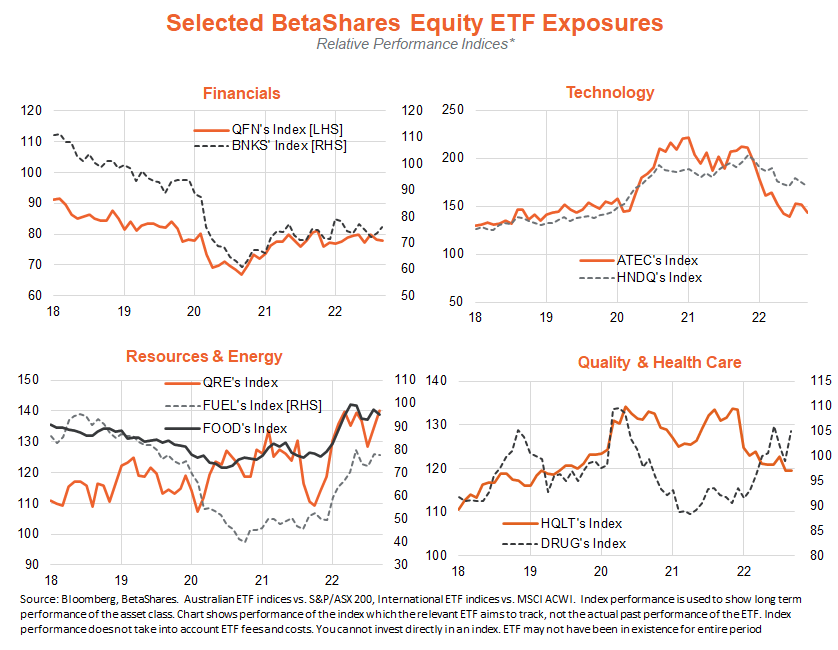

Selected equity themes

As might be expected, the lift in bond yields and associated weakness in equity markets again hurt growth more than value over September, though the difference was more marginal than in the previous month. With bond yields still moving higher in recent months, and global growth still fairly resilient, the trend at present still tends to disfavour growth-orientated technology and quality exposures, is more neutral for financials and still somewhat more positive for commodity/resources and even defensive exposures such as health care.

On the basis that global growth will slow further and bond yields soon peak, it seems likely that the value/resource/energy exposures will come under greater downside pressure, while growth/technology/quality exposures might at least stop underperforming. The health care sector remains well placed to outperform in a weak equity market environment.

Further information on the complete range of BetaShares exchange traded products can be found here.