ETF distributions: frequently asked questions

4 minutes reading time

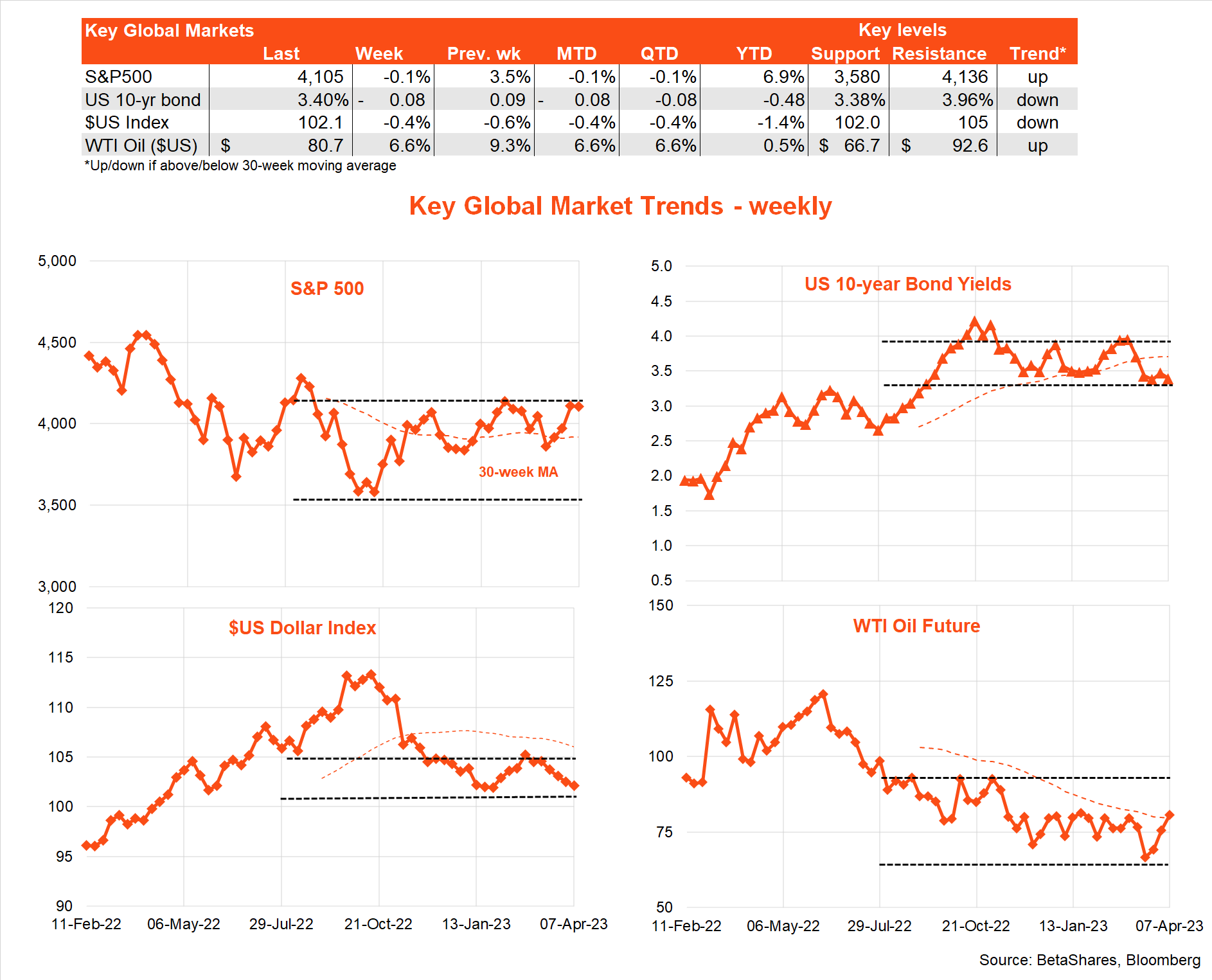

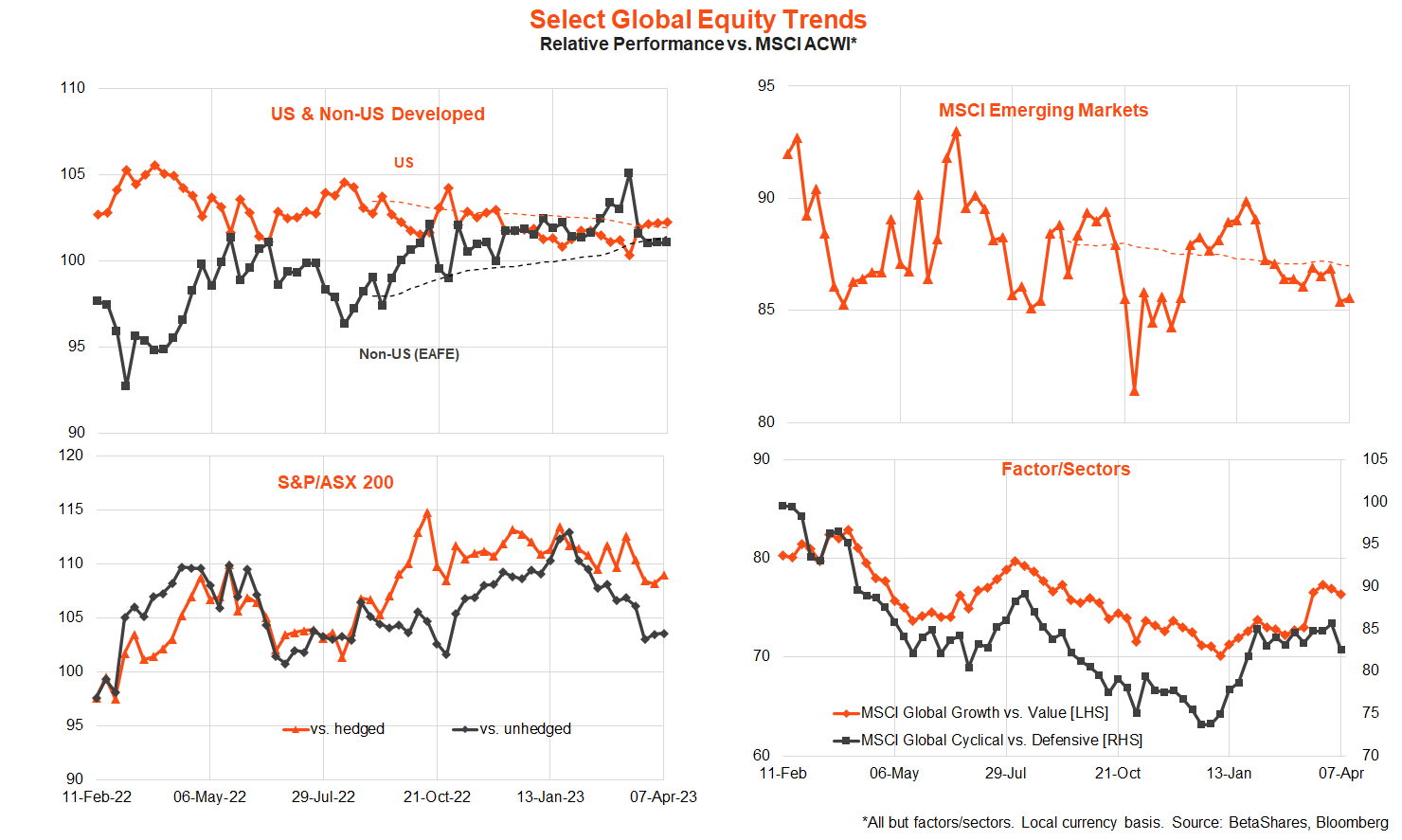

Global markets

Global markets were buffeted by bittersweet news over the past week: growing signs of a slowing in the US economy, but also encouraging signs of an easing in inflation pressure. The question remains the same – will inflation slow sufficiently quickly to allow the Fed to pivot and avoid a hard landing?

As it stands, the US S&P 500 is testing upside resistance at the end-January high of 4,100, while US 10-year bond yields are testing their lows of the year at just under 3.5%. Either this implies a fast drop in inflation is just around the corner, or one or both of these markets are wrongly priced.

Signs of slowing growth were apparent in weaker than expected ISM manufacturing and ADP employment reports, a drop in job openings and an upward revision to the level of weekly jobless claims so far this year.

The week ended with a still solid payroll gain of 236k in March, which the ever-hopeful equity market took as a reassuring sign that the economy was at least not yet tumbling into recession, judging by the positive reaction of futures market (Wall Street was closed for good Friday). That said, bond yields also rose on the solid employment result, with the market now pricing a 66% chance of a US rate hike in May.

Encouraging inflation news, however, came from a further easing in price pressures in the ISM manufacturing report, and an easing in annual growth in average hourly earnings from 4.3% to 4.2%. Low job openings also point to potentially less wage pressure down the track.

All that said, job openings and wage growth remain reasonably high and the unemployment rate very low. And this week the March consumer price index report on Wednesday is expected to show core prices (i.e. excluding food and energy) rose a still firm 0.4%, with annual growth up from 5.5% to 5.6%.

Retail sales on Friday will also provide an important gauge of consumer spending, while there’s an array of Fed speakers who will provide hints on the likelihood of a May rate hike.

This week also sees the US March quarter earnings season kick off, with the major banks as usual leading the pack. Overall earnings for companies in the S&P 500 Index are expected to be 7% lower than in the March quarter of last year, though bank stocks should report positive annual earnings growth. With their low-cost deposit base under growing competitive pressure, however, doubts remain whether bank profits will remain as resilient.

Indeed, according to FactSet, there’s been a higher-than-normal level of pre-season earnings warnings and the market is again entering the reporting season with some trepidation. That said, with the economy holding up, it would not surprise if overall earnings this season again end up being “better than feared”. Earnings are a lagging, not leading indicator of recession!

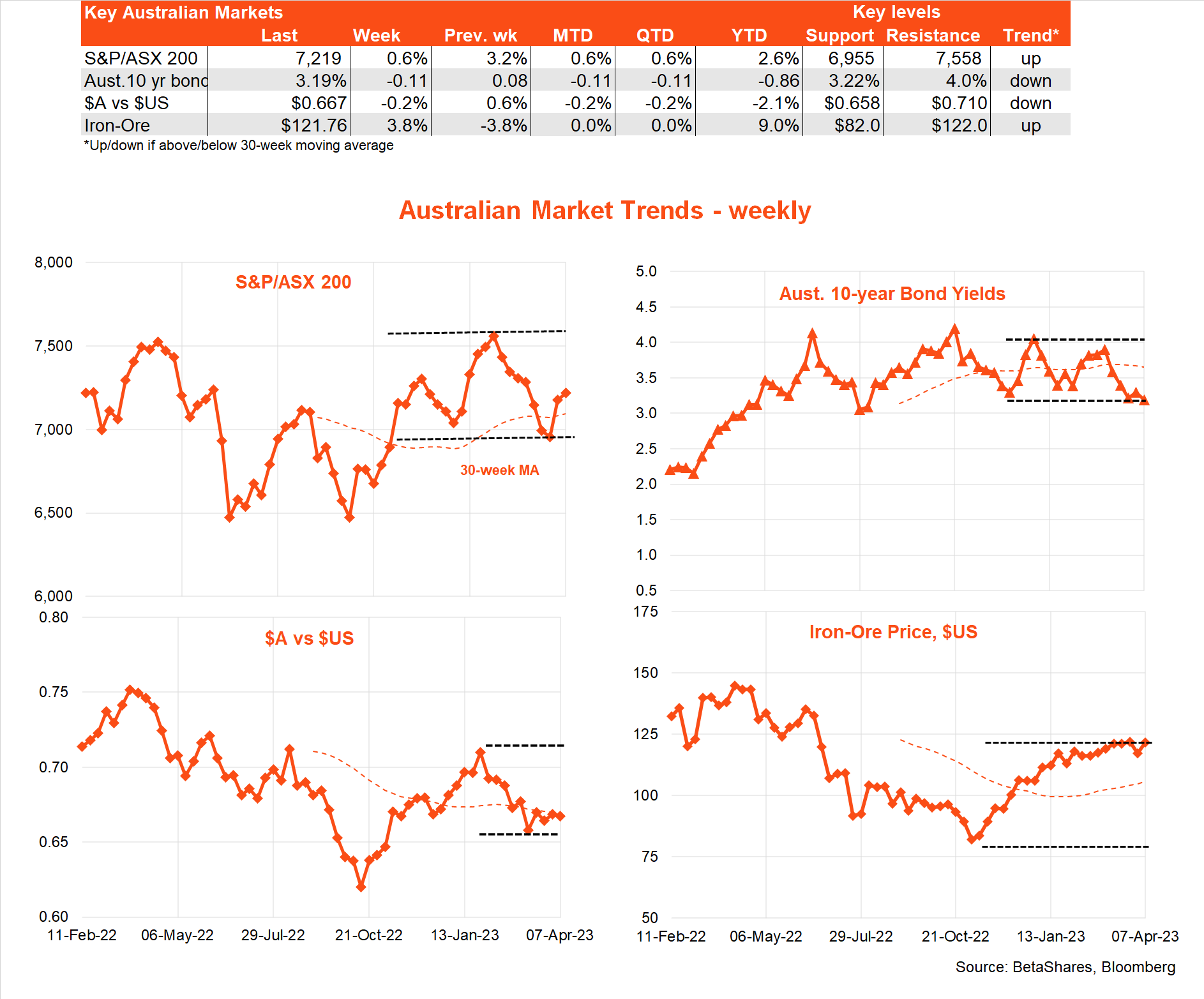

Australian market

The local highlight last week was the RBA’s decision to hold off on another rate hike – as confidently expected by the market though not by every economist. My own view was that, on balance, the RBA would likely get one more hike under its belt and then be more confident in announcing a multi-month pause. As it turned out, it preferred to pause now and keep markets (and yours truly) guessing about what it might do for a few more months!

Market news of interest this week will be today’s consumer and business confidence surveys from Westpac and the National Australia Bank respectively. With easing price pressure and talk, at the time the survey was taken, of an imminent RBA pause, it would not surprise if both showed a bounce in sentiment. Thursday’s labour force report is expected to show another solid employment gain in March of around 20k, helped by immigrants filling vacancies.

Along with the usual consumer spending and employment data, a factor determining whether there’ll be a May rate hike is the March quarter consumer price index (CPI) report on April 26. Judging by the monthly reports so far this year, the report should reveal a welcome easing in annual inflation, which would likely be enough to allow the RBA to remain on hold in May. Beyond May, I anticipate enough further evidence of easing growth and inflation that the RBA won’t feel the need to hike rates again this cycle – with a rate cut pencilled in for Melbourne Cup Day!