Wet lettuce

6 minutes reading time

Asset allocators face three key challenges in portfolio construction. Namely, how to:

- achieve diversification over the market cycle

- minimise ongoing fees, turnover, transaction costs and tax impacts

- deliver strong, long-term performance.

Many active managers fail to address these points, pursuing investment strategies that are high conviction or skew to a particular style or risk premia, charging fees that are sometimes many multiples above passively managed funds and/or failing to deliver outperformance.

A core portfolio constructed using low-cost index tracking funds, including broad market exposures, together with ‘smart-indexing’ exposures, has the potential to solve these issues and provide a strong core over the long term.

Building a core portfolio in a world of uncertainty

So far, the economic backdrop for 2023 has looked like a continuation of 2022:

- inflation persistently high despite central bank rate hiking

- leading indicators of activity and sentiment pointing towards elevated recession risk

- yet surprisingly robust “hard” economic data, particularly in the labour market.

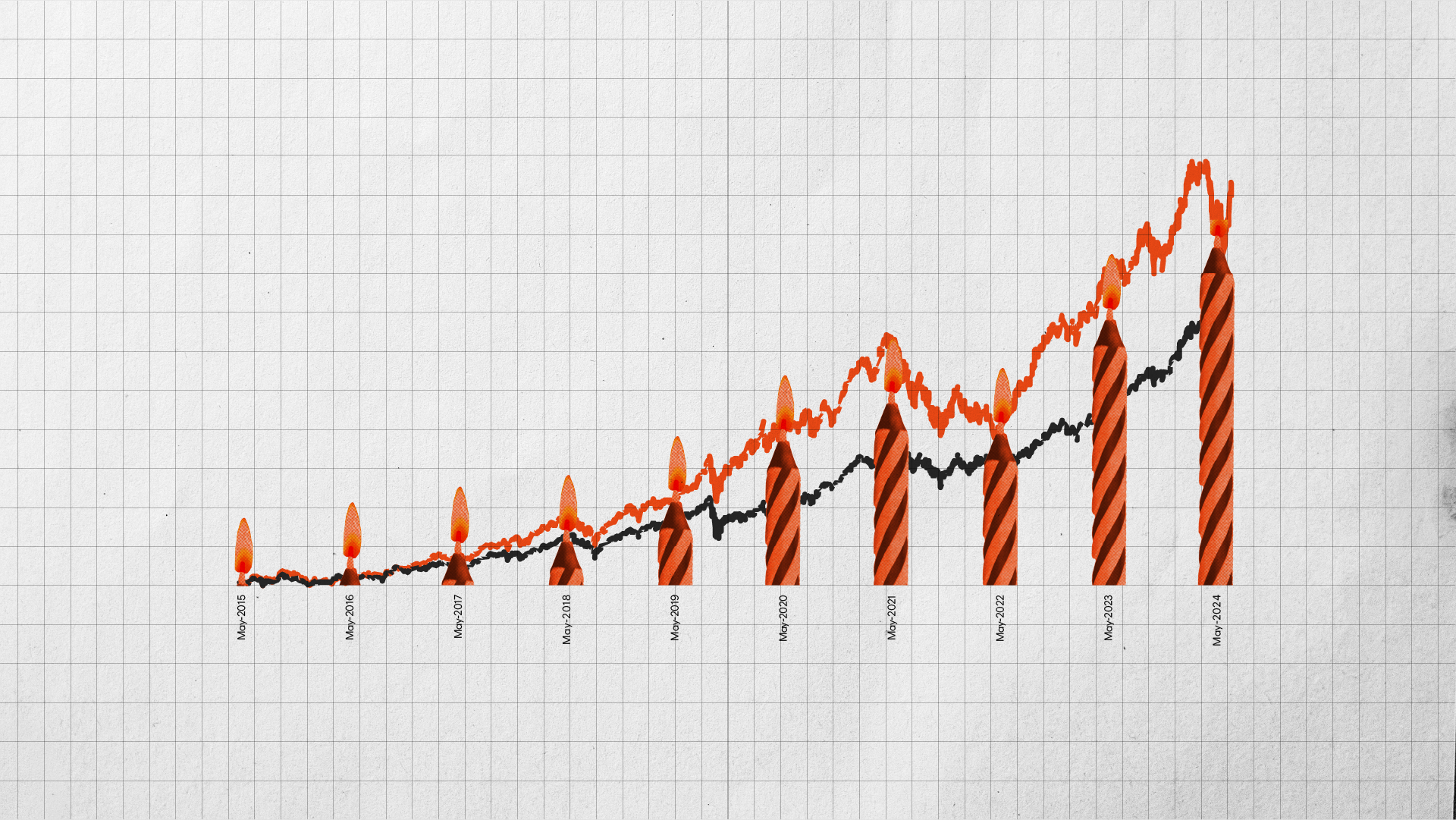

Where this year has been very different to the last has been in the turnaround in performance of various asset classes. Among the worst drawdowns in 2022 were in global equities and fixed rate bonds, but so far this year those asset classes have provided some of the highest risk-adjusted returns.

Source: Bloomberg. H1 2023 figures are as at 30 June 2023. Past performance is not an indicator of future performance. ‘Global Equities ex Australia’ is Solactive GBS Developed Markets ex Australia Large & Mid Cap Index, ‘ASX Small Caps’ is S&P/ASX Small Ordinaries Index, ‘ASX A-REITs’ is S&P/ASX 200 A-REIT Index, ‘Cash’ is Bloomberg AusBond Bank Bill Index, ‘Australian Hybrids’ is Solactive Australian Hybrid Securities Index, ‘AusBond Composite’ is Bloomberg AusBond 0+ Yr Index, ‘Australian Government Bonds’ is Solactive Australian Government 7-12 Year AUD TR Index, ‘Commodities Basket’ is Bloomberg Commodity Index, ‘USD Gold’ is XAU Currency Index, and ‘Oil’ is Bloomberg WTI Crude Oil Subindex Index. You cannot invest directly in an index.

Yet despite these reversals of fortune, significant challenges exist for asset allocators.

- Equity markets remain ‘priced for perfection’, despite elevated recession risk.

- The recent rally in global equities has largely been driven by an incredibly narrow group of perceived AI ‘winners’, underwritten primarily by multiple expansion rather than earnings growth.

- As a result, some global exposures, and the US market in particular, appear concentrated, and broad market beta may not offer the diversification it once did.

- Factor or investment style leadership has flipped again, with quality switching from the doghouse to the penthouse.

- Fixed rate bonds are now offering income, but uncertainty on rates has led to continued volatility this year.

- Markets appear to be trending towards a world of shorter, sharper cycles.

So, given the economic outlook and these challenges in markets, how should investors approach portfolio construction?

Key principles for building a robust core portfolio

The core of a portfolio is, by definition, the ‘anchor’ of any investor’s portfolio. We believe the investments used to construct such a core should have the following characteristics:

- Provide diversified exposure to the specific asset class, to help ensure the strategic asset allocation can be achieved across the portfolio as a whole

- Be able to be held for the long run, to reduce turnover and transaction costs, and to avoid the temptation to try to time markets

- Demonstrate compelling ‘value’, usually reflected in strong, long-term, net-of-fee performance, before and after tax

- Contribute to the overall risk characteristics of the portfolio from a volatility and drawdown perspective.

Selecting the core of your portfolio to best match the asset allocation objectives is likely to result in a more efficient portfolio with desirable risk and return outcomes.

What type of investment strategies can deliver on the requirements above?

Many investors start with a choice between broad market index funds (essentially low-cost broad market beta exposures) and actively managed funds that attempt to outperform their chosen benchmark (such as a broad market index).

Despite the opportunity to generate outperformance in a volatile market from careful security selection, historical evidence shows there have been very few active managers that have actually managed to deliver on that promise of outperformance1. It’s hard beating the market on a risk-adjusted basis, especially after fees and costs.

It’s generally proven to be even harder to do this consistently over long periods of time, amid greater competition among active managers2. Active manager alpha or outperformance is overwhelmingly transient. This means that, for an investor using active funds to stay ahead, they need to successfully time switches into the minority of active funds that actually outperform in the subsequent period. Ignoring the challenge of successfully timing manager selection, such an investment process violates a number of key principles of ‘core’ as outlined above, as it increases turnover and potential performance drag through transaction costs and tax impacts.

For many investors, including at least some allocation to broad market beta within a core portfolio at the lowest possible cost is an effective long-term investment strategy.

Build a stronger core with Betashares

Betashares core ETFs provide a range of diversified building blocks to construct robust portfolios for your clients.

Learn more about Betashares core funds here.

References:

1. S&P Dow Jones Indices, SPIVA® Australia Year-End 20222.For more on this, read Larry E. Swedroe and Andrew L. Berkin, The Incredible Shrinking Alpha: And What You Can Do to Escape Its Clutches (BAM ALLIANCE Press, 2015) and Charley Ellis, Winning the Loser’s Game: Timeless Strategies for Successful Investing (McGraw-Hill, 2002).

There are risks associated with an investment in each Betashares Fund. Investment value can go up and down. An investment in any Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on the risks and other features of a Fund, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.

This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

Betashares Capital Limited (ABN 78 139 566 868 AFSL 341181) (Betashares) is the responsible entity and issuer of the Betashares Funds.

Before making an investment decision, read the relevant Product Disclosure Statement, available from www.betashares.com.au or by calling 1300 487 577, and consider whether the product is right for you. You may also wish to consider the relevant Target Market Determination, which sets out the class of consumers that comprise the target market for the Betashares Fund and is available at www.betashares.com.au/target-market-determinations.

This information is general in nature and doesn’t take into account any person’s financial objectives, situation or needs. Investors should consider its appropriateness taking into account such factors.

Investments in Betashares Funds are subject to investment risk and the value of units may go up and down. The performance of any Betashares Fund is not guaranteed by Betashares or any other person.