ETF distributions: frequently asked questions

4 minutes reading time

Week in review

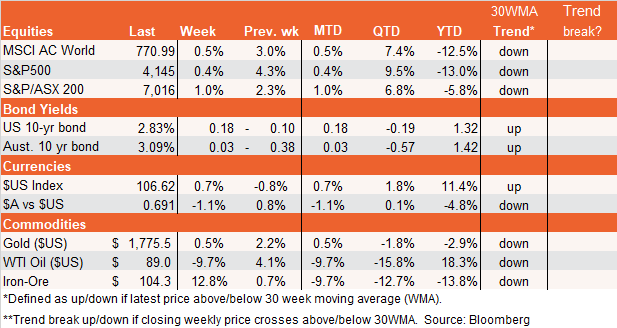

It was a mixed week for global markets, with investors still unsure whether to laugh or cry about the fact the US is not yet in recession. After some early fleeting geo-political concerns surrounding US House speaker Pelosi’s visit to Taiwan, US stocks were buoyed mid-week by a stronger than expected services survey. But the joy was not repeated on Friday after a much stronger than expected July gain in US employment, especially as it was associated with equally strong wage growth.

The good news is that the US is clearly not in recession now. The bad news is that the economy is so hot that hopes of a Fed pivot sometime soon are diminishing – as evident by a chorus of Fed speakers last week who remained consistently hawkish (trying as they can to quash the dovish spin the market placed on Powell’s post-meeting comments a week earlier).

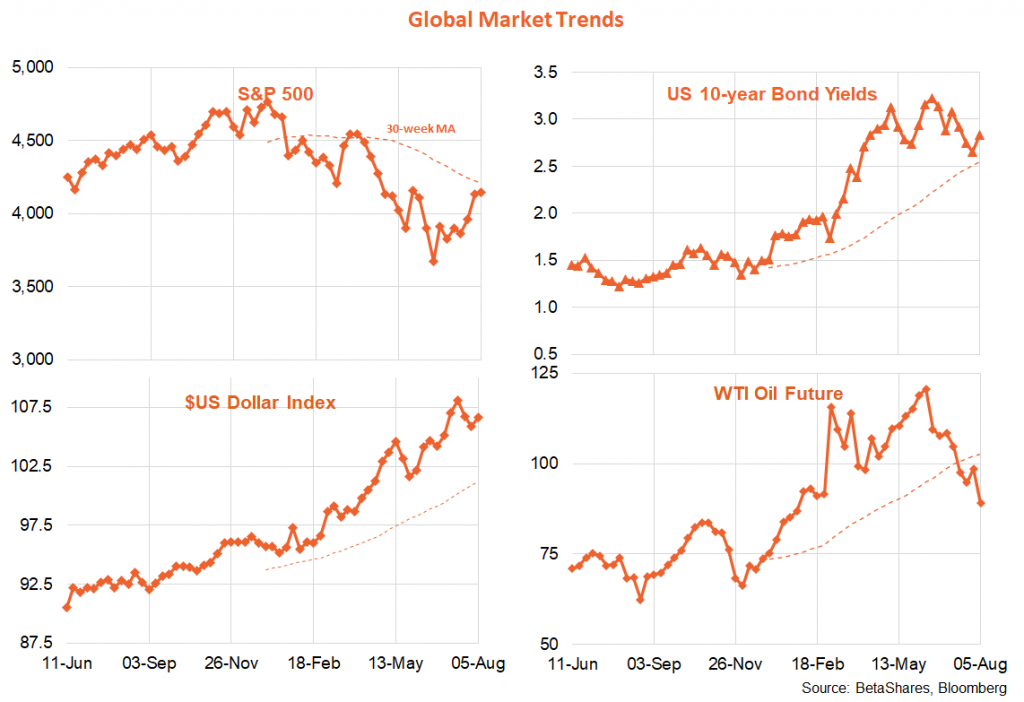

Overall, a rethinking of the Fed pivot trade saw global stocks consolidate last week after recent solid gains while bond yields and the $US bounced back. Oil prices continued to tumble.

We’re left with a race against time – can inflation slow quickly enough to satisfy the Fed that an eventual recession is not required? Falling commodity prices will help push down headline inflation in coming months, though a sustained slowing in commodity prices likely requires the weaker economic growth (and likely recession) that equities markets are trying to avoid thinking about. Meanwhile, core inflation is likely to fall more slowly – due to still strong wages and housing rents.

On this score it was notable last week that the Bank of England hiked rates by 0.5% even while explicitly forecasting a nasty UK recession.

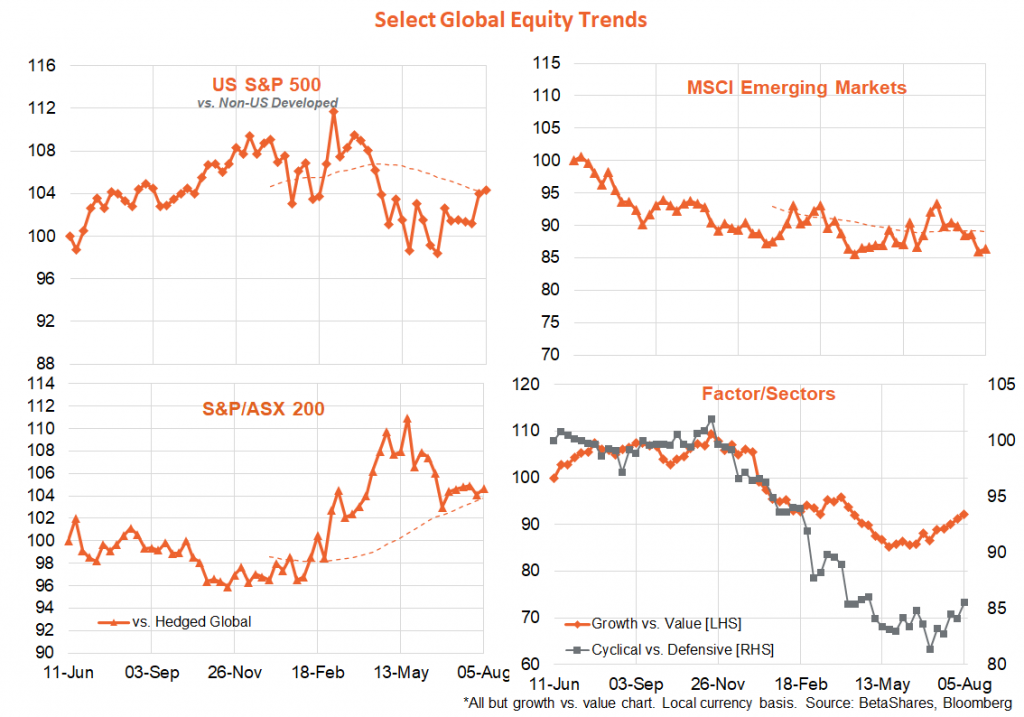

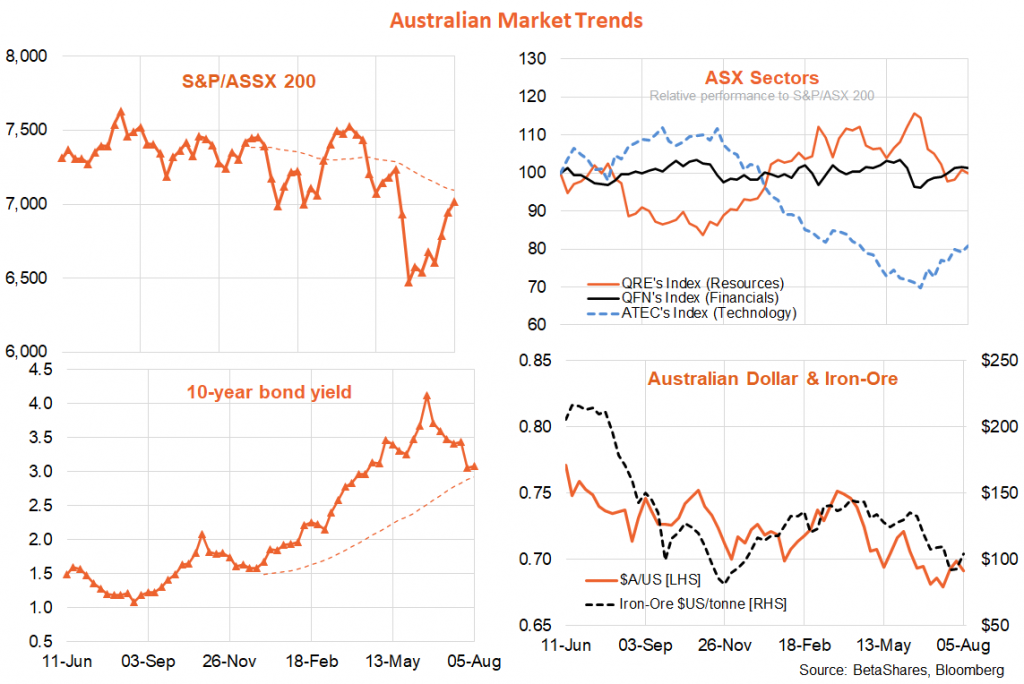

In terms of equity trends, the recent equity recovery on Fed pivot hopes has seen a bounce back in the relative performance of growth over value and cyclical over defensive stocks – though weaker commodity prices have not helped the relative performance of emerging markets or Australia.

In Australia, the RBA hiked rates by 0.5% as widely expected even as we got more news of falling house prices and home building approvals – though retail spending in Q2 remained firm. In its Quarterly Statement on Policy, the RBA forecast a stagflationary scenario of sorts – uncomfortably high inflation though with a notable slowing in economic growth next year. The RBA may well stop raising rates at around the 2.5 to 3% level, but it seems unlikely to cut rates quickly even as the unemployment rate starts to rise. As evident globally, the bounce in stocks of late has favoured interest rate sensitive growth/technology thematics.

Week ahead

The main focus of markets this week will be the US consumer price index report on Wednesday. The good news is that lower oil prices are likely to see a quite small monthly gain in headline inflation – with the annual rate dropping from 9.1% to around 8.7%. The bad news is that core inflation is likely to remain firm, with the market expecting a 0.5% monthly gain which will push up annual inflation from 5.9% to 6.1%.

Also of further relevance is a chorus of Fed speakers who – subject to the CPI – are likely to remain ‘on song’ in hosing down talk of a Fed pivot anytime soon. Indeed, a higher than expected CPI result this week could see market expectations for a 0.75% US September rate hike build (from the 60% probability at present) – and markets may even come to flirt again with the idea of a 1% hike next month. My base case is the Fed will hike by 0.75% next month and a 1% hike can’t yet be ruled out.

Last but not least, an update on US consumer sentiment (and especially the long-run inflation expectation) is out on Friday. Given falling oil prices of late, a further bounce in sentiment and easing in inflation expectations would not surprise – which could provide markets at least an end of week reprieve.

In Australia, we get updates on business and consumer confidence on Tuesday and Wednesday respectively – neither of which are likely to be upbeat given the trend higher in interest rates and trend lower in house prices.