ETF distributions: frequently asked questions

5 minutes reading time

Sure, it has come down a long way from its peak, but it’s now been over three years since inflation first broke out of the Reserve Bank of Australia’s (RBA) 2-3% target range, and the June quarter data from the ABS still has the Consumer Price Index (CPI) at 3.8% year-on-year1.

With the RBA holding rates again last week, our Chief Economist David Bassanese noted in his Market Update that the RBA had continued to express concern about inflation and did not seem to be of the mind to cut interest rates anytime soon.

With that said, inflation could be here for some time yet. Sticky inflation means higher interest rates are likely to hang around for longer. And indeed, economists at each of the Big Four banks are not forecasting rate cuts from the RBA until November2. If these forecasts are correct, we may not see home loan interest rates fall below 5% p.a. until 2026 or beyond3.

If inflation does stick around for a while, or longer than current expectations, which investments might be well placed to benefit?

Passing on the higher prices

While there are few obvious winners from lingering high inflation, some companies may be better equipped than others to deal with economic uncertainty.

Companies that produce high returns on invested equity and have consistency in their earnings from year to year could be thought of as having ‘pricing power’ – i.e. the ability to raise prices without losing market share.

This is particularly important in an environment where inflation in producer prices is both higher than inflation in consumer prices, and accelerating4.

Any additional rate rises could also slow down economic growth and flow through into the cost of borrowing for businesses. If this were to occur, having low levels of leverage could be a highly desirable trait.

Betashares AQLT Australian Quality ETF selects Australian companies based on ‘quality’ metrics of high return on equity, low leverage and relative earnings stability. Quality strategies may be particularly appealing in an inflationary environment, as companies with strong balance sheets and consistent earnings generally are better positioned to weather economic volatility and maintain their value.

Offsetting falling dividends

Another possible outcome from higher interest rates and slowing economic growth is reduced dividend growth. In fact, we’ve already seen this with the annual distribution return on Australian shares having fallen from 7.54% in the year to July 2023, to 4.16% in the year to July 20245.

One option for income investors is to seek out equity income strategies that aim to produce a higher level of income, such as YMAX Australian Top 20 Equities Yield Maximiser Complex ETF . YMAX employs a ‘covered call’ strategy to enhance income while potentially providing downside risk management.

Could higher oil prices pour fuel on the inflation fire?

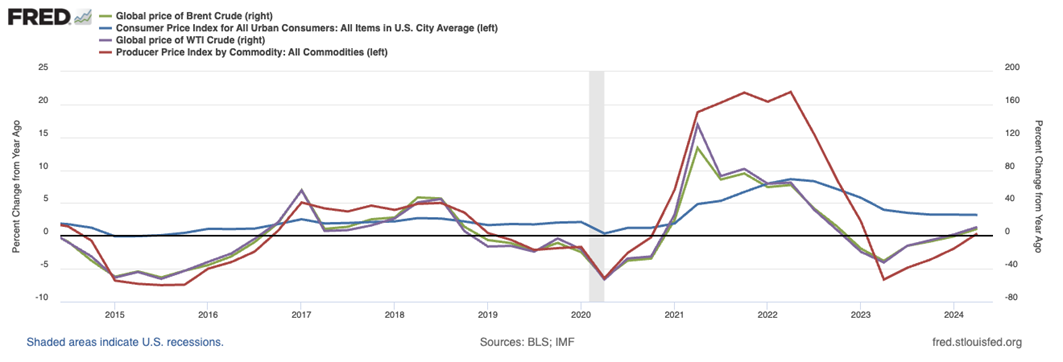

Historically, higher oil prices have been strongly correlated with higher inflation. According to analysis undertaken by the Federal Reserve Bank of St. Louis in 2018, there was found to be a strong positive relationship between oil and producer inflation, and a weaker, but still positive, relationship for consumer inflation7. More recent data (as set out below) indicates that the relationship has tended to hold up over more recent periods as well.

Source: Federal Reserve Bank of St Louis. Data covers Q3 2014 to Q2 2024. Past performance is not indicative of future performance.

Additionally, geopolitical tensions in the Middle East, as well as the ongoing war in Ukraine, may continue to present heightened risks for oil supplies, and therefore prices.

If oil prices do march higher again, global energy companies may be beneficiaries. FUEL Betashares Global Energy Companies Currency Hedged ETF allows investors to access a portfolio of the world’s largest energy companies (ex-Australia), such as Chevron, ExxonMobil, and Shell, in one ASX trade. Currency hedging allows Australian investors to gain exposure to the share prices of these companies, while seeking to minimise exposure to fluctuations in exchange rates.

Fixed income without the ‘fixed’

Fixed income can be an effective portfolio diversifier, offering defensive characteristics in addition to attractive yields. The challenge for investors in an environment of rising interest rates is that the prices for traditional fixed rate bonds fluctuate with movements in interest rates. Put simply, bond prices move in the opposite direction to yields. So rising yields mean falling bond prices, and vice versa.

One potential solution is floating rate bonds. As the name implies, the yield on floating rate bonds changes as interest rates change.

QPON Australian Bank Senior Floating Rate Bond ETF invests in a portfolio of some of the largest and most liquid, floating rate bonds issued by Australian banks, with up to 80% of the portfolio allocated to bonds issued by the Big Four Australian banks. Australian bank senior floating rate bonds historically have had a high level of capital stability. The portfolio currently offers an estimated yield to maturity of 4.51% per annum, with an average credit rating of AA-8.

Diversifying for an uncertain economy

Most investors today have been lucky enough to invest during several decades of low inflation and falling interest rates. While this new regime may require some adjustments in thinking and positioning, there are plenty of options for building a resilient and well diversified portfolio, however long inflation hangs around.

Disclaimer

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in a Betashares Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Betashares Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

References:

1. Source: Australian Bureau of Statistics

2. Source: Canstar. As at 10 July 2024.

3. Source: RateCity.

As at 27 June 2024.

4. Source: ABS. As at 30 June 2024.

5. Source: Betashares.

6. Source: FRED.

7. Source: Betashares. As at 2 August 2024.