5 minutes reading time

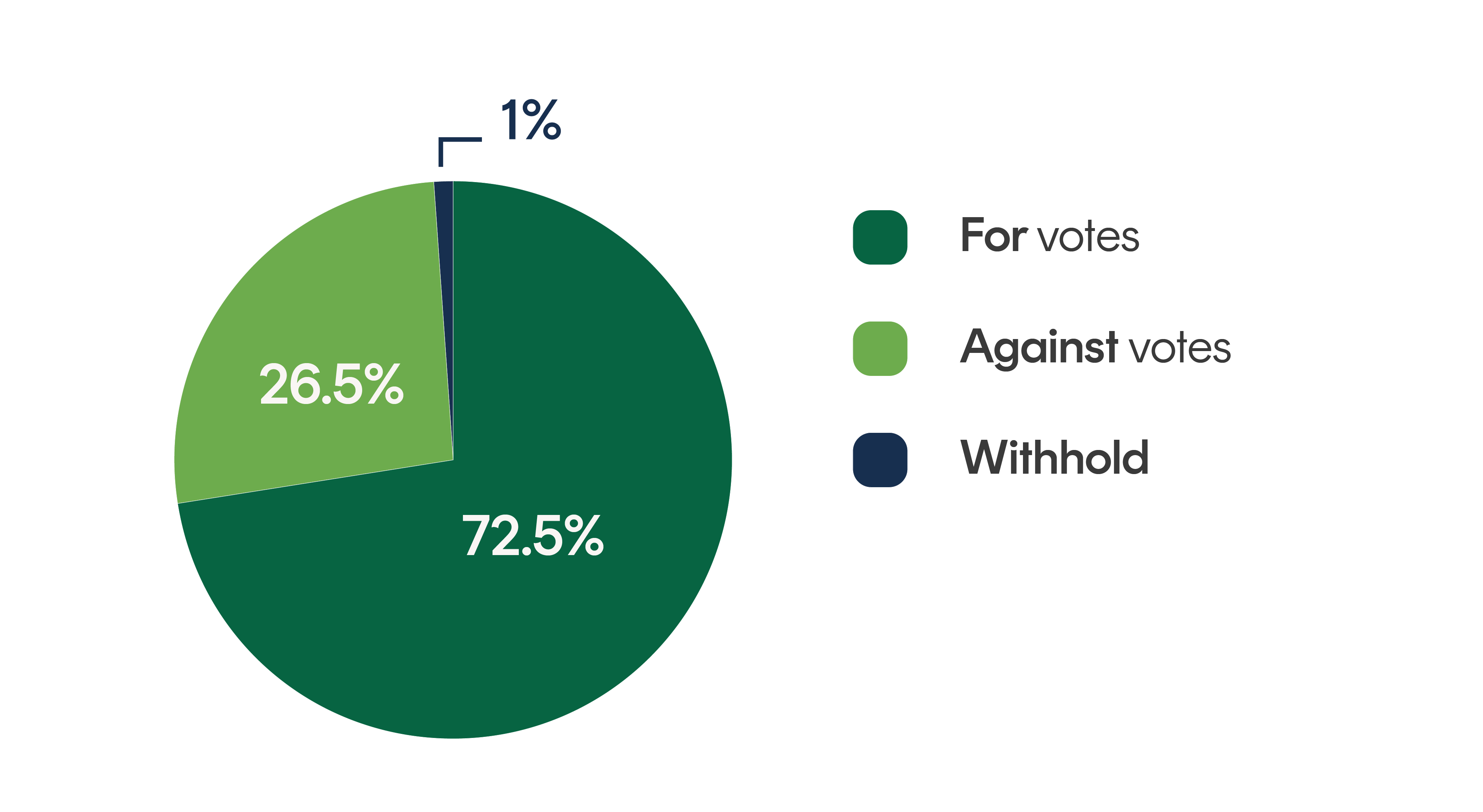

Across Betashares’ range of ethical and impact ETFs1, we voted at 28 shareholder meetings in the quarter ending 30 September 2023 on 291 individual proposals. We voted FOR 211 times, AGAINST 77 times and withheld our vote three times.

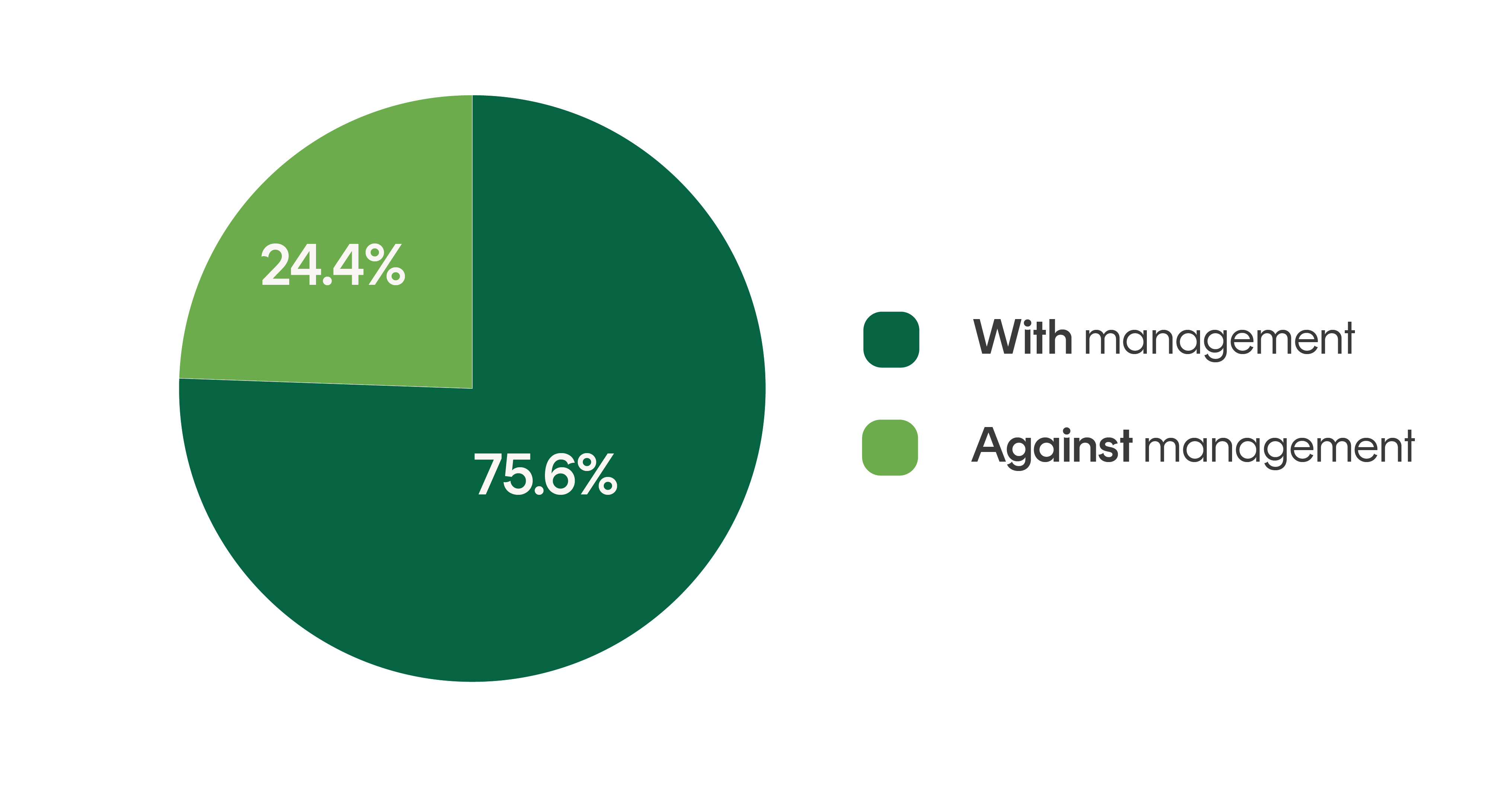

We voted WITH management 220 times and AGAINST management 71 times.

Among the proposals, we supported a proposal at Steris Plc in favour of adoption of an annual say-on-pay vote in line with corporate governance best practice, which enables shareholders to evaluate executive pay on an annual basis.

Engagement activity

Engagement activity over the quarter was focused on corporate governance, supply chain sustainability, biodiversity, and human rights issues. We engaged with Commonwealth Bank of Australia (CBA) to understand CBA’s new policy on lending to the fossil fuels sector. CBA has significantly reduced its fossil fuel financing activities and ceased all project finance for fossil fuel exploration and production as well as corporate finance for companies that generate more than 25% of revenue from thermal coal. From 2025, all lending to fossil fuel-related entities will be subject to published, science-based transition plans. CBA has set financed emissions targets for most sectors. Several of the more challenging sectors are expected to be updated in their 2024 policy update, namely transport, agriculture, and construction. CBA has set an objective of establishing emission reduction targets covering 75% of its financed emissions by 20252.

We engaged with Amazon by co-signing a letter with other institutional investors urging Amazon to provide more transparent disclosure of its Scope 3 emissions. In 2019, Amazon co-founded and signed the Climate Pledge – a seemingly ambitious commitment to reach net zero emissions by 2040 – ten years ahead of what is required to meet the goals of the Paris Agreement3. Given the vast scale of Amazon’s operations, the company and those in its value chain have a significant impact on the environment. However, according to reports, Amazon is excluding a significant proportion of its emissions from reporting, as it does not appear to report on some categories of Scope 3 completely4. Betashares was therefore happy to support a collaborative engagement initiative requesting more granular reporting on Scope 3 emissions.

We engaged with Nike by co-signing a letter with other institutional investors urging Nike to address allegations of wage underpayments to workers in factories in Cambodia and Thailand. As per press reports, garment workers employed by the Ramatex Group, a major supplier to Nike, are still owed wages because of non-payment of termination compensation and because of a temporary factory shutdown5.

We engaged with Woolworths to discuss concerns around the use of proceeds from Woolworths’ Green Bond. Our engagement focused on whether the application of bond proceeds to building leases met the Low Carbon Buildings Criteria of the Climate Bond Standard. We also engaged directly with representatives of the Climate Bonds Initiative (CBI) certifications team to flag our concerns.

We engaged with Suncorp to understand their plans for measuring their impacts and dependencies on nature, and how they’re assessing the risks and opportunities in their business, particularly to understand the role land clearing and deforestation plays in meeting their net zero commitment. A report by the Australian Conservation Foundation (ACF) alleged Suncorp has significant exposure to potential illegal deforestation in Queensland. The report claims that more than 364,000 hectares of native vegetation cleared in Queensland from 2018 to 2020 likely had a significant impact on a listed threatened species or ecological community – and was done without Federal approval, making it potentially illegal. More than 50% of the land cleared was on just 267 properties, and 13% of the properties were subject to a security held by Suncorp6.

We engaged with the Northern Territory Treasury Corporation (NTTC) to understand how it is addressing concerns from First Nations people relating to the proposed Middle Arm industrial hub. The NTTC in its response said that it will consult closely with First Nations people through working groups to seek knowledge and understanding of the cultural and social values associated with Middle Arm and Darwin Harbour more broadly, as well as economic opportunities associated with the Precinct. While it’s concerning the Government didn’t include traditional owners from the start, it has since committed to funding and resources for a First Nations-led cultural values survey of Middle Arm which will inform the Cultural Heritage Management Plan. We will monitor the process on an ongoing basis to ensure that the project adheres to the values of free, prior and informed consent of the traditional owners.

Betashares Capital Ltd (ABN 78 139 566 868 AFS License 341181) is the issuer of the Betashares funds. Read the Target Market Determination and PDS at www. betashares.com.au and consider with your financial adviser whether the product is appropriate for your circumstances. The value of the units may go down as well as up. The Fund should only be considered as a component of a diversified portfolio.

1. Being Betashares Global Sustainability Leaders ETF (ASX: ETHI), Betashares Australian Sustainability Leaders ETF (ASX: FAIR) and Betashares Climate Change Innovation ETF (ASX: ERTH).

2. https://www.commbank.com.au/content/dam/commbank/about-us/download-printed-forms/environment-and-social-framework.pdf

3. https://www.theclimatepledge.com/us/en/the-pledge/FAQ

4. https://revealnews.org/article/private-report-shows-how-amazon-drastically-undercounts-its-carbon-footprint/

5. https://cleanclothes.org/news/2023/nike-board-executives-under-fire

6. https://www.acf.org.au/banks-financing-nature-destruction-in-qld