3 minutes reading time

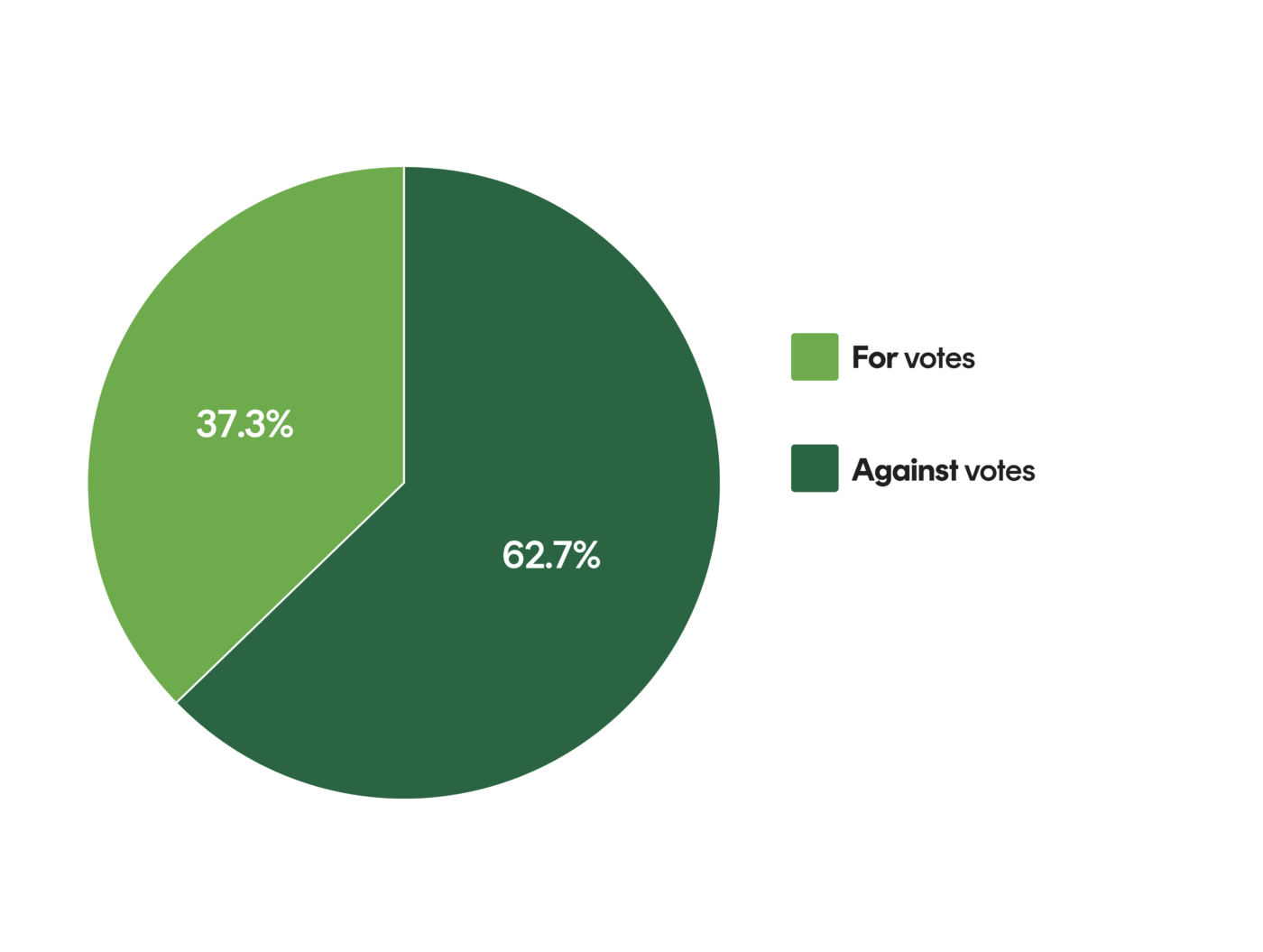

Across Betashares’ range of ethical and impact ETFs1, in the quarter ending 31 December 2024, we voted at 84 shareholder meetings on 515 individual proposals. We voted FOR 323 times and AGAINST 192 times.

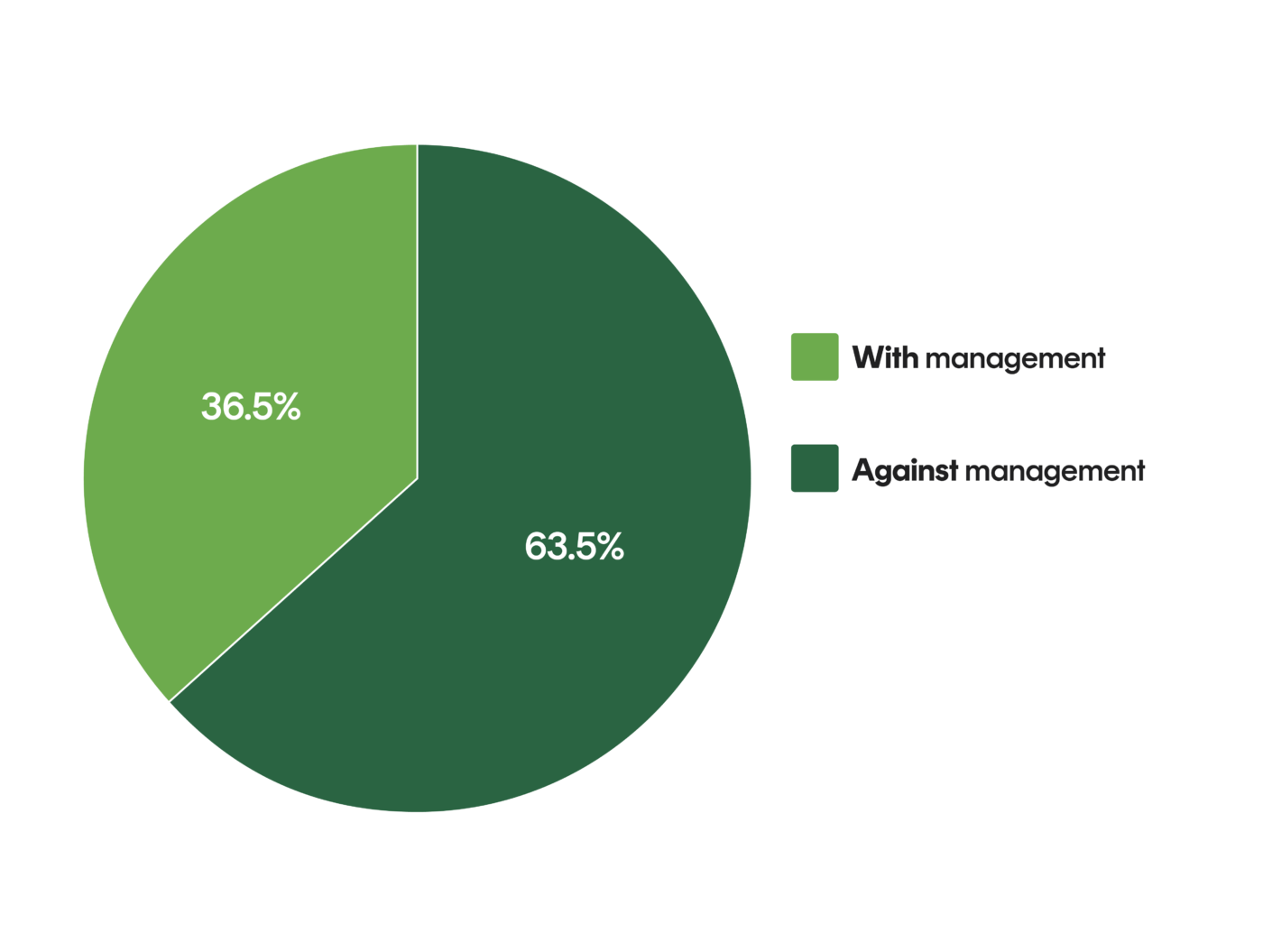

We voted WITH management 327 times and AGAINST management 188 times.

Among the proposals, we supported shareholder proposals at Woolworths Group and Coles Group that would require both companies to identify and report on the environmental impact of farmed seafood procured for their own brand of salmon products. A report on how farmed seafood sourcing practices affect endangered species would demonstrate a commitment to environmental stewardship and responsible business practices. It would also help to address concerns raised by shareholders and potentially mitigate reputational risks associated with this issue.

Engagement activity

Engagement activity over the quarter was focused on diversity, equity and inclusion (DEI) practices, corporate governance, climate change and remuneration practices.

The Responsible Investment Committee (RIC) engaged with Lowe’s Companies Inc. in relation to changes announced to its DEI policies. Lowe’s confirmed that it has modified its DEI policy with a focus on increasing the efficiency and effectiveness of its approach going forward. The company reiterated that its commitment to inclusion is unchanged. The RIC intends to continue to monitor and engage with the company.

The RIC engaged with WiseTech Global following media reports relating to the alleged actions and behaviours of CEO Richard White in his personal capacity, and that the company had failed to disclose the salary of a key management personnel between 2017 and 2020. The RIC met with the Chair to understand the steps being taken to address shareholder concerns relating to the media reports. The company subsequently released an initial report into the findings of a review that was conducted following the media reports. Following the release of the initial findings, the RIC wrote to the company requesting further information and detail relating to the findings and review.

The RIC engaged with Toyota regarding its compliance with the US Environmental Protection Agency (EPA)’s new 2032 emissions standards. In response, Toyota highlighted challenges in meeting emission standards and emphasised that battery electric vehicles (BEVs) and plug-in hybrids are key components of its strategy to reduce emissions. The RIC plans to continue engaging with Toyota on its emissions reduction strategy.

The RIC met with Woodside Director and Chair of the Human Resources and Compensation Committee Arnaud Breuillac to discuss a range of issues. These included remuneration arrangements for senior executives and whether it was in the interest of shareholders for fossil fuel companies facing climate change transition risks to incorporate production volume metrics in bonus structures. The RIC advocated for incentive structures to be primarily based on total shareholder return (absolute or relative) subject to positive gating. We also discussed the rejection by shareholders of the company’s second Climate Transition Action Plan. Mr Breuillac said the company had no plans to put a third ‘Say on Climate’ vote to shareholders in the near term.

Footnote:

1. Being Betashares Global Sustainability Leaders ETF (ASX: ETHI), Betashares Australian Sustainability Leaders ETF (ASX: FAIR) and Betashares Climate Change Innovation ETF (ASX: ERTH). ↑