4 minutes reading time

Global markets

Global stocks continued their rebound last week, driven by robust US economic data and renewed hopes for an easing in US-China trade tensions.

Despite anecdotal reports of potential economic disruptions from Trump’s tariff hikes, last week’s wave of economic data pointed to a slowing (but not recessionary) economy.

- Weekly jobless claims edged higher but remained low

- The ISM April manufacturing index dipped modestly lower (and by less than the market expected)

- Job openings dropped more than expected but remain reasonably high

- Consumer spending remained firm in March

- April employment was stronger than expected; and

- Annual inflation (per the core consumption deflator) was 2.6%, in line with market expectations.

Of course, Q1 GDP was weaker than expected with -0.3% annualised growth. But this reflects slower consumer spending and a DOGE-related fall in public demand. A surge in imports did mechanically reduce economic growth, though it shouldn’t diminish production. In addition, the impact was partially offset by a buildup in inventories. Finally, a diversion of consumer spending from domestic production toward imported goods was also likely a factor behind the weak GDP result.

Markets look past economic weakness

That said, markets seem to be looking past signs of economic weakness. They are focusing instead on the escalating game of chicken between the US and China over trade. Investor sentiment was buoyed last week by Trump’s decision to water down the 25% auto tariff, as well as by China’s announcement that it was evaluating a US proposal to begin trade talks.

In some ways, the current situation reminds me of mid-2020, when COVID-19 lockdowns threatened to derail the global economy. And yet, markets remained focused on reopening prospects and the ‘race against time’ to develop a vaccine. As it turned out, vaccines arrived relatively quickly, helping to contain the economic fallout.

This time, however, we’re in a race against time to negotiate trade deals before America’s tariff agenda pushes the economy into recession.

In other notable global news last week, the Bank of Japan scaled back its growth and inflation expectations in light of trade tensions. Markets are now only attaching a modest risk to a further rate hike this year.

Global week ahead

The key global event this week will be the US Federal Reserve meeting (Thursday morning Australia time).

No one expects a rate cut from the Fed. Instead, focus will be on its latest assessment of the tariff impacts and whether it will signal a potential rate cut in the months ahead. Markets are fully priced for a rate cut in July and currently see a 30% chance of a rate cut in June.

Of course, investors will be watching for further signs of US-China trade talks. My sense is that both sides desperately want to start talking but that neither want to be the one to blink first.

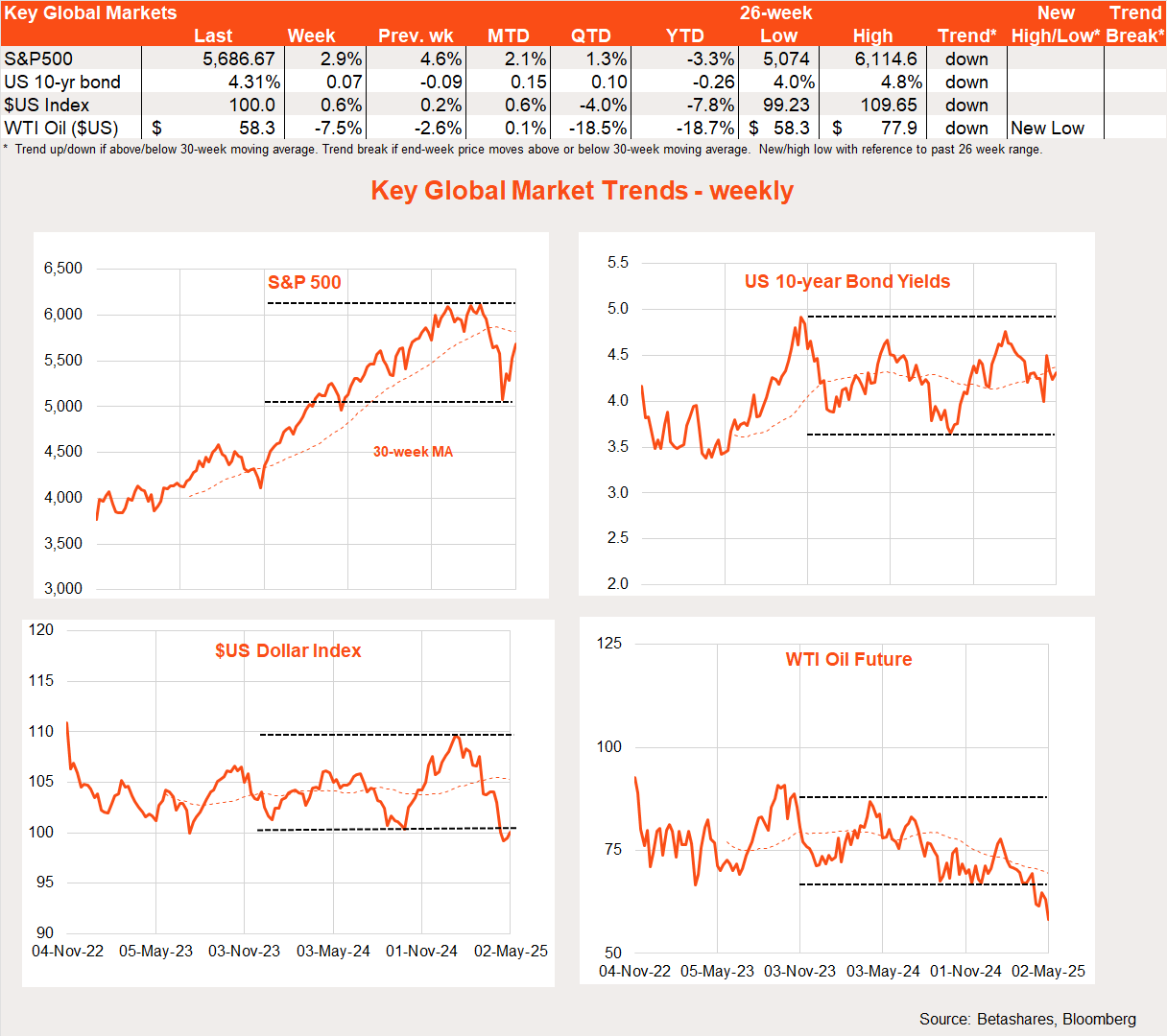

Global market trends

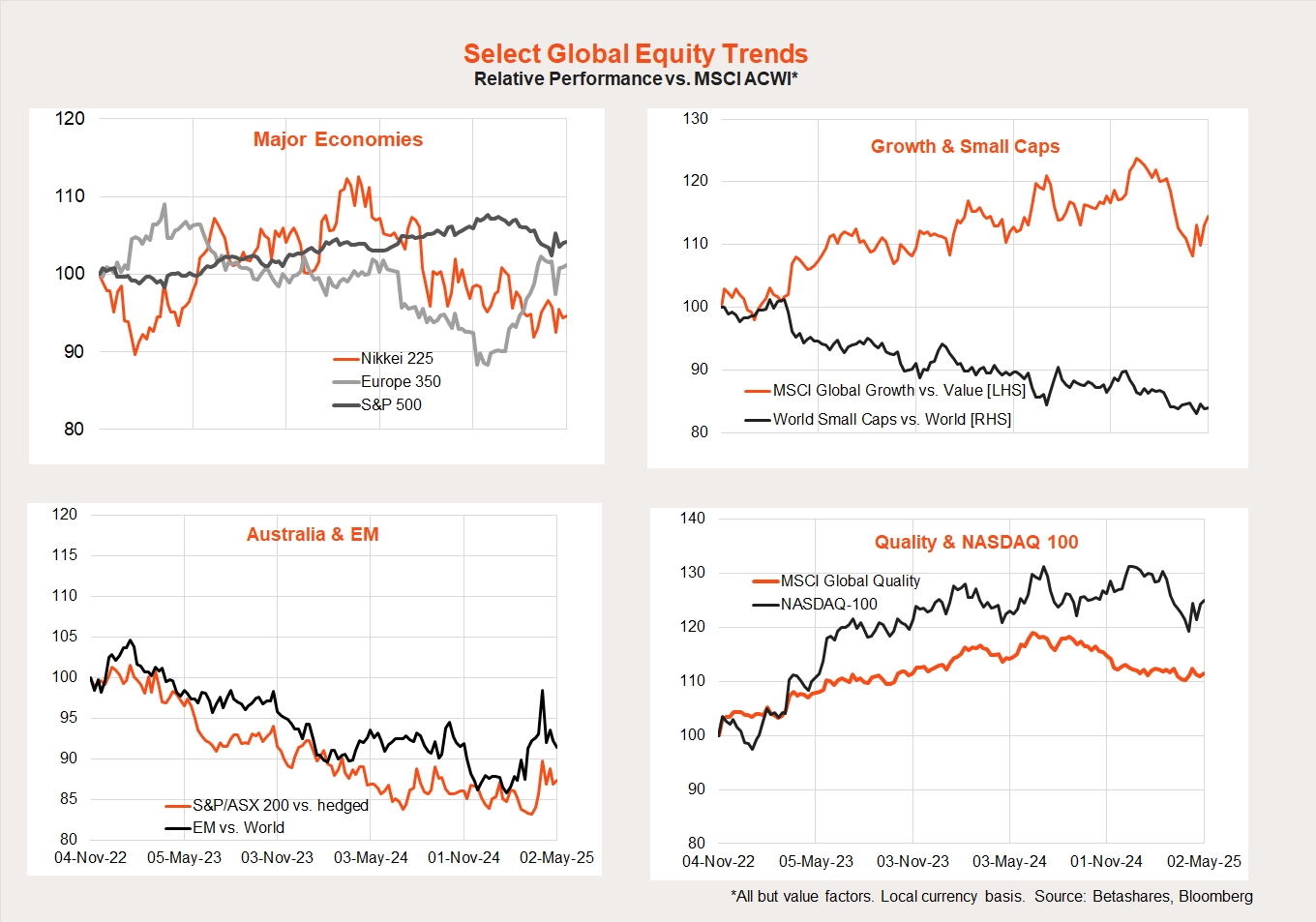

The recent rebound in global equities has also driven a rebound in the performance of growth over value stocks, developed markets over emerging ones and US markets compared to their international counterparts.

These trends seem tied to equity market direction. If stocks fall further, I expect growth and US equity markets to be hit hardest.

Australian markets

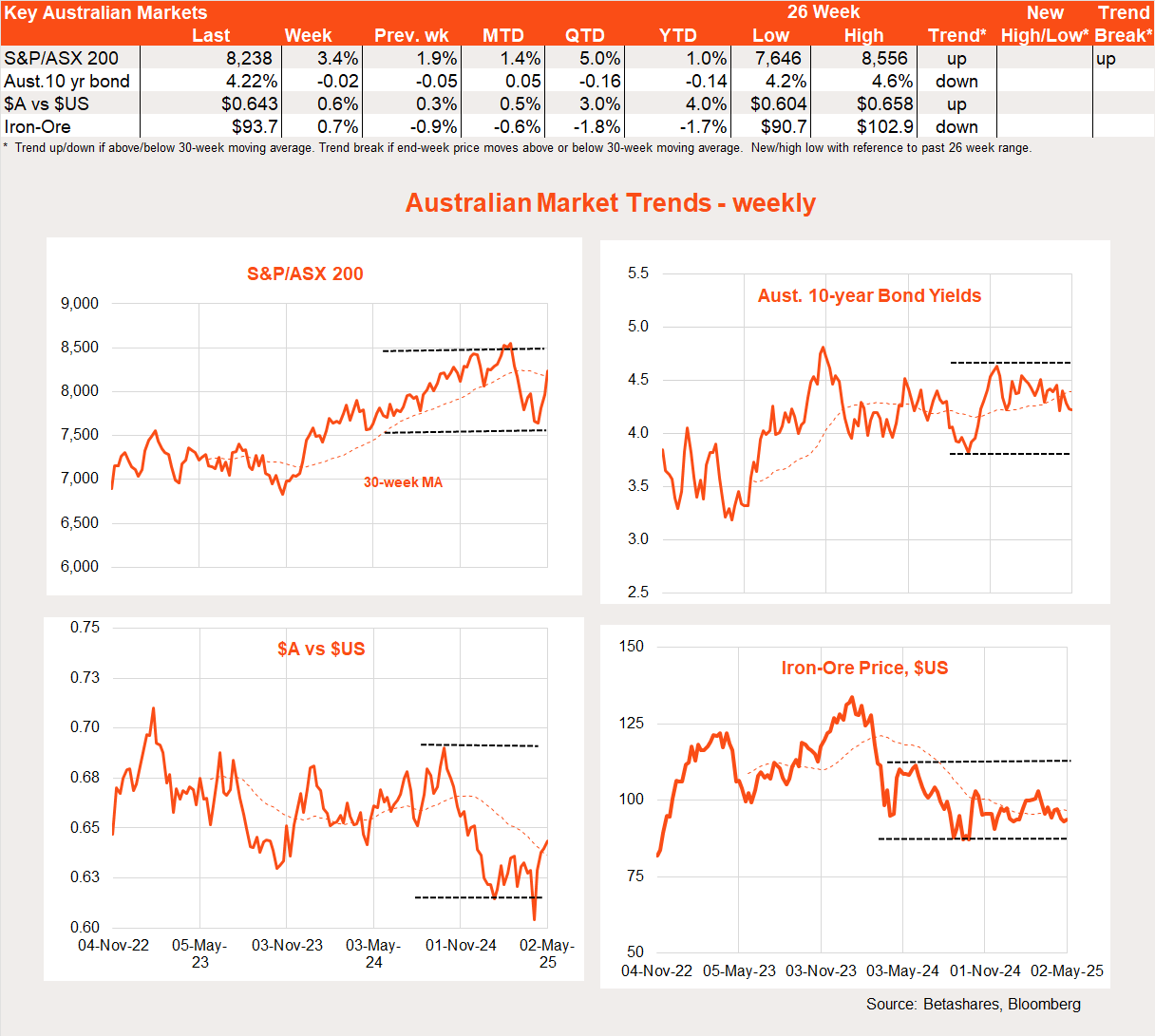

Global optimism, combined with a benign local inflation report, enabled Australian stocks to notch a third consecutive weekly rise. The S&P/ASX 200 posted a 3.4% gain.

The key local highlight last week was the Q1 consumer price index (CPI) report. Although annual trimmed mean inflation was a little higher than market expectations, it was still good enough to likely cement the case for a rate cut from the RBA at its May policy meeting. An easing in housing and service sector inflation is helping to suggest at least two more rate cuts this year.

The weekend’s federal election also showed a stronger than expected showing for the Labor party. The Albanese government was returned with a larger majority in the House of Representatives. Labor also picked up seats in the Senate, making it somewhat easier to pass legislation. That is because it now only needs support from either the Greens or Liberals to pass legislation (not Jacqui Lambie or David Pocock).

Dwelling approvals is the only local data of note this week. Attention for local investors will likely be focused on global developments and the final make up of the next federal parliament.

Have a great week!