ETF distributions: frequently asked questions

4 minutes reading time

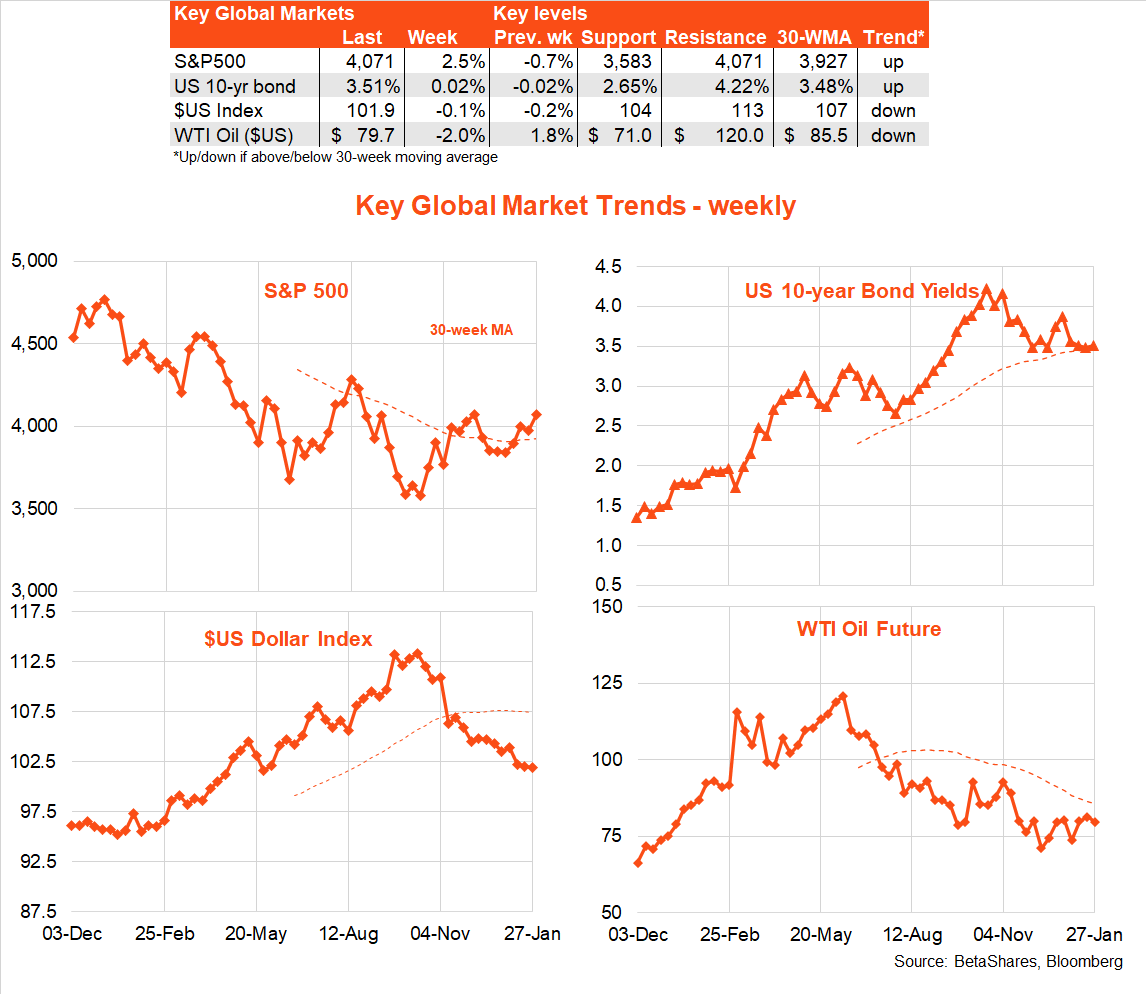

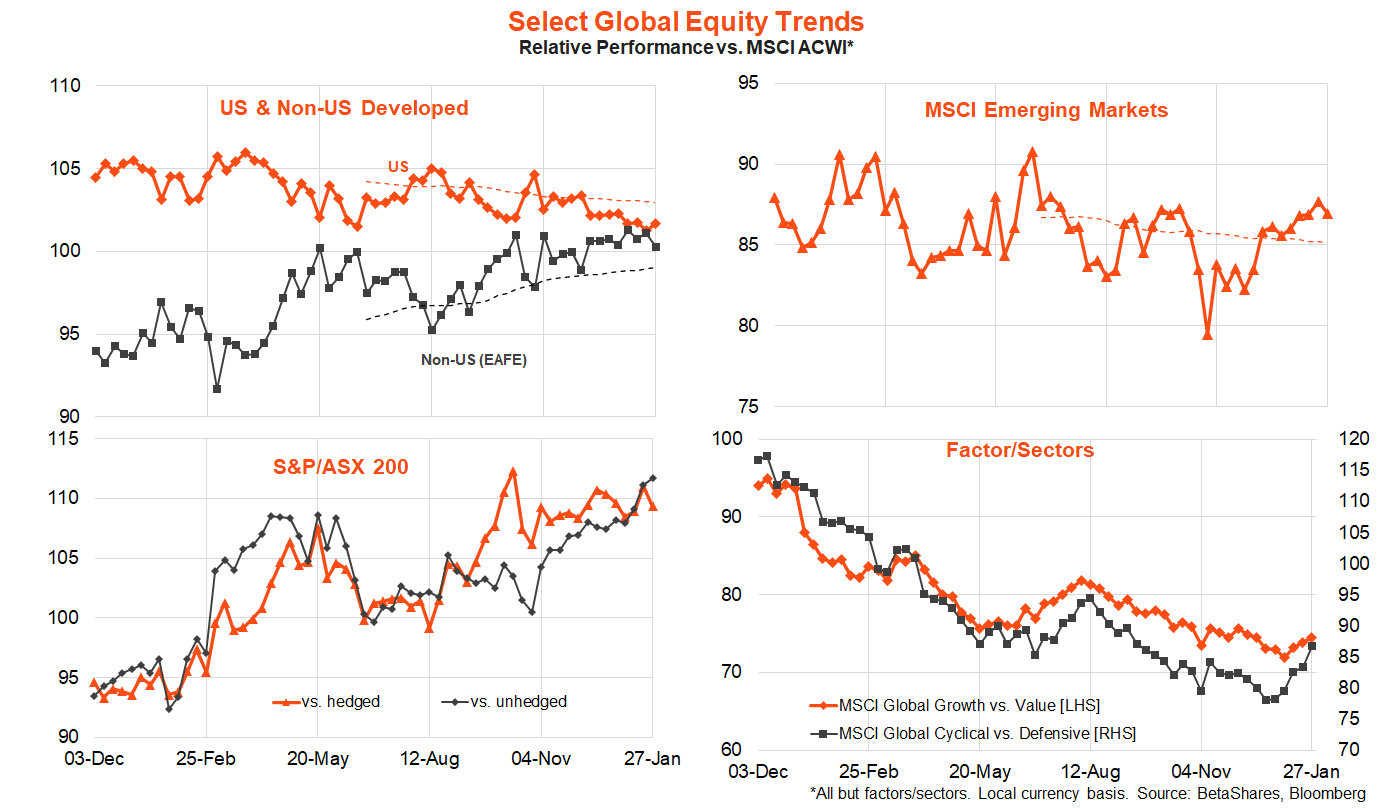

Global markets

It was another positive week for risk sentiment globally, with mixed US activity data consistent with the continued possibility of a soft landing, while a key US inflation report was no worse than feared. All up, it left markets with the view that the Fed would raise interest rates by only 0.25% at this week’s policy meeting, and ever hopeful that Fed chair Powell might even signal a pause sometime soon.

With regards to key US data last week, both the manufacturing and service sector PMIs remained in contraction territory (i.e. sub-50) but actual outcomes were a bit better than expected. Weekly jobless claims remained stubbornly low, indicative of a very tight labour market. At 2.9% annualised, Q4 US GDP was also a bit better than expected, albeit suggestive of a slowdown in the consumer spending juggernaut. Of most importance, the consumer deflator revealed a further easing in inflation, albeit more slowly than market expectations.

The Q3 US earnings season meanwhile remained downbeat, but not shockingly so. According to FactSet, of the 30% of S&P 500 companies that have reported so far, 69% have beaten estimates – which is modestly below the 5-year average of 77%. At this stage, earnings look like being down 5% on year-ago levels.

Nonetheless, soft landing hopes saw the S&P 500 lift a further 2.5% last week, to be up 14% from its end-week low on October 10 last year. Technology stocks, left behind so far, mounted a catch-up, with the NASDAQ-100 rising a lazy 4.7%.

The S&P 500 has broken above its downtrend line from the market’s high of early last year and on the cusp of breaking through its recent end-week high on 28 November. All up, the technical signs at this stage look bullish! The fundamentals, however, are another concern – with valuations high, earnings declining, and a steady drumbeat of recession indicators quietly accumulating.

Since the October 10 weekly low, US 10-year bond yields have dropped from 4.2% to 3.5% as markets price in deep rates cuts from H2’23 onward. The $US has also dropped by around 10%, contributing to a surge in the $A from US62c to over US 71c. Oil prices continued to broadly trend down from their mid-2022 high of US$122 a barrel. Gold is on a tear, benefitting from both lower bond yields and a weaker $US.

In terms of the week ahead, markets are very confident the Fed will hike by only 0.25%, but less sure how hawkish Powell will be. My sense is that markets expect him to remain hawkish, suggesting perhaps “there are hopeful signs, but the job is not yet done.” He will also likely push back strongly against the prospect of rate cuts later this year. But with the data still not clearly inconsistent with the soft-landing hopes, I suspect this expected hawkish rhetoric will be like water off a duck’s back.

What could spoil the party is the wages outlook, with a critical employment cost index report one day ahead of the Fed meeting, and average hourly earnings with the payrolls report on Friday. If either or both show stubbornly firm wage growth it will make the Fed all the more convinced the economy needs to slow – potentially tipping into recession – to get inflation sustainably lower.

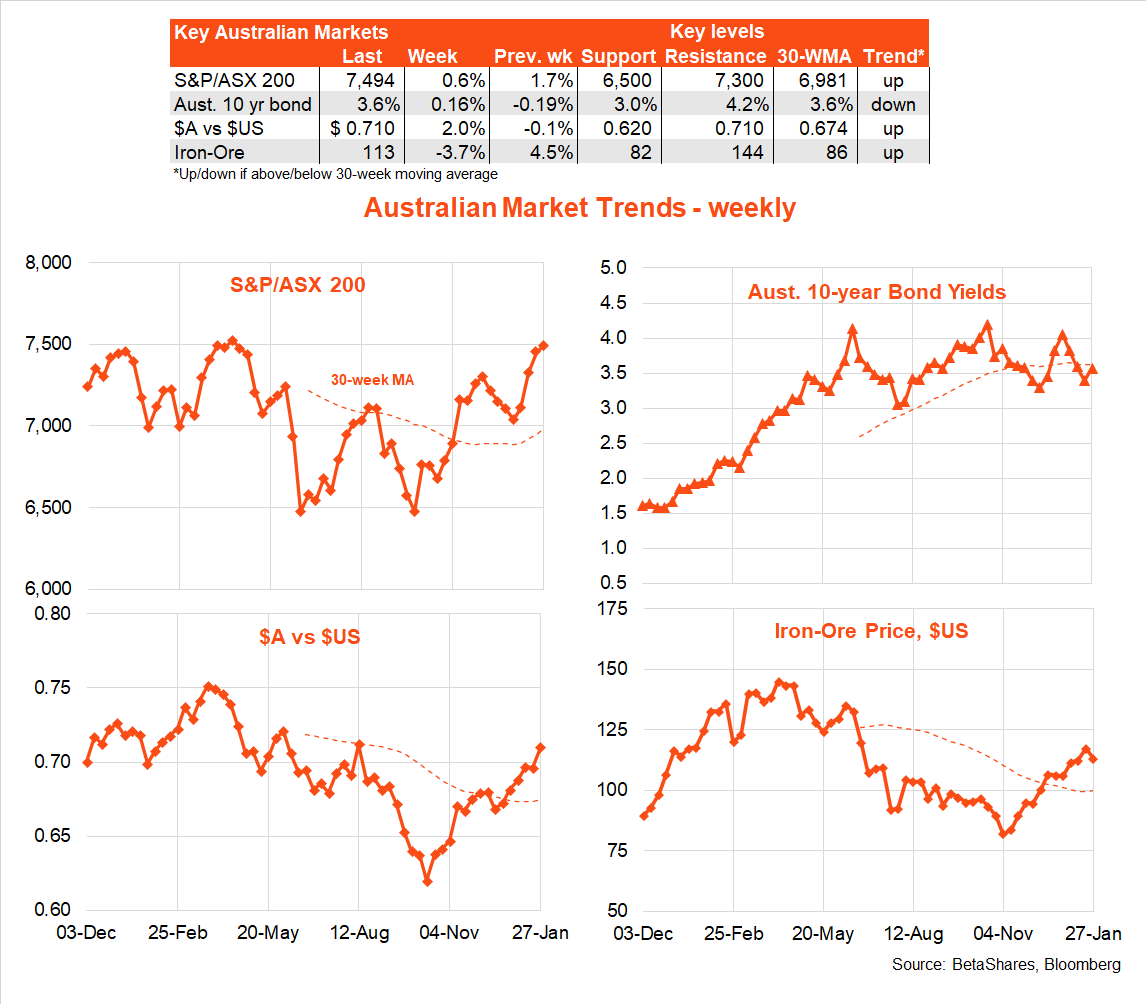

Australian markets

In Australia, the key data highlight last week was the higher-than-expected Q4 consumer price index report – reflecting broad-based cost pressures that are being easily passed into consumer prices due to strong underlying demand. In turn, this quashed hopes that the RBA might actually pause at next week’s policy meeting – with my long-expected 0.25% hike now fully anticipated by the market.

Interest this week will be in any signs of a slowdown in consumer spending in tomorrow’s December retail sales report, which is expected to show a 1% decline in sales. That said, this would follow a stronger than expected November report, which in turn reflected strong “black Friday” related sales. Question over a potentially shifting seasonal pattern in spending will cloud any firm conclusions over a supposed consumer slowdown.

Along with US soft landing hopes, the other major theme supporting markets of late is the ‘China re-opening’ trade. Consistent with this, manufacturing and service sector surveys released today are expected to show some improvement over January.