5 minutes reading time

The Reserve Bank on Tuesday cut interest rates for the second time this year, a move in line with my long-held expectation of a May rate cut.

The RBA cut rates by 0.25% to 3.85%. Although Governor Michele Bullock indicated in her press conference that a 0.5% rate cut was considered, my view is this was likely not given very high consideration.

Trump concessions take a 0.5% cut off the table

A 0.5% cut may have seriously been on the table a few weeks ago. At the time, global market volatility and recession concerns were elevated in the wake of the steep US tariff increases proposed on ‘Liberation Day’ on April 2.

Since then, however, the US has at least postponed steep tariff increases and announced it will begin a process of negotiating trade deals with its major trading partners. Fears of a US recession have eased and, with that, the sense of emergency that might have led the RBA to cut by 0.5%.

Easing inflation cements case for a cut

The key rationale for the RBA’s rate cut decision was not sudden fear for the growth outlook. Rather, it reflects the simple fact that underlying inflation is falling back into the RBA’s 2-3% target band.

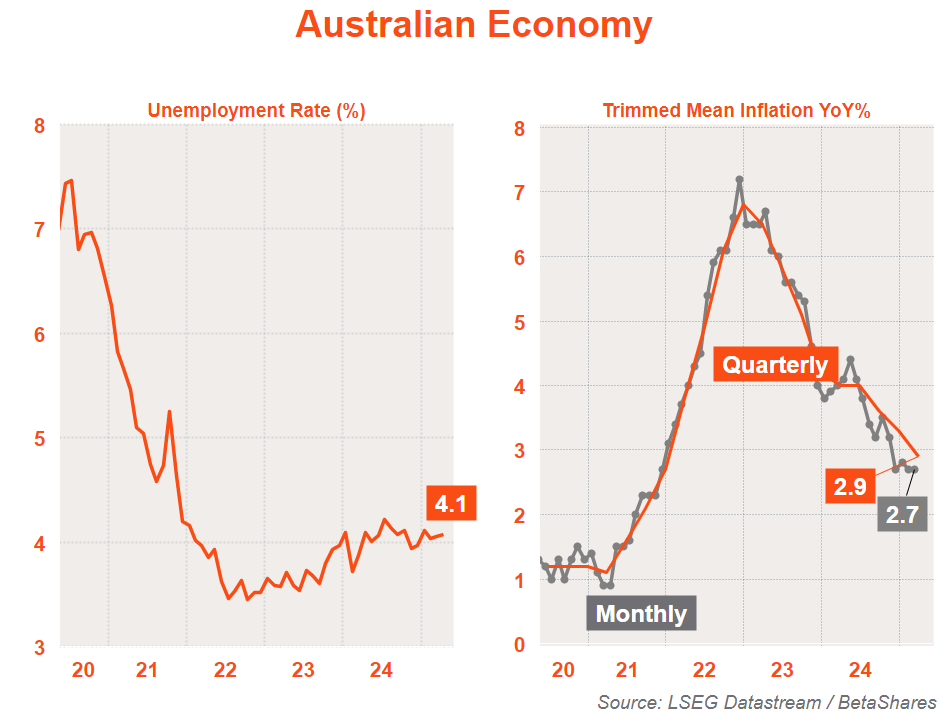

On 30 April, the Q1 Consumer Price Index report showed that annual trimmed mean inflation fell from 3.2% in the December quarter to 2.9% in the March quarter. Since that time, I’ve considered a May rate cut almost a done deal. Recent US tariff concerns only strengthened the case.

Why does the RBA cut rates when employment growth is so strong?

Although employment has been strong, this has also been associated with solid labour supply – both from higher immigration and high workforce participation by working age Australians.

Despite strong employment growth, the unemployment rate has remained largely unchanged over the past year at just over 4%. Even more importantly, this low level of unemployment has not prevented a slowing in wage growth and consumer price inflation.

Source: LSEG Datastream, Betashares

Despite strong employment growth, other parts of the economy have been weaker. Most notably, consumer spending has declined due to the squeeze on real incomes brought about by recently high inflation and the relatively high level of interest rates.

Cruising back to neutral

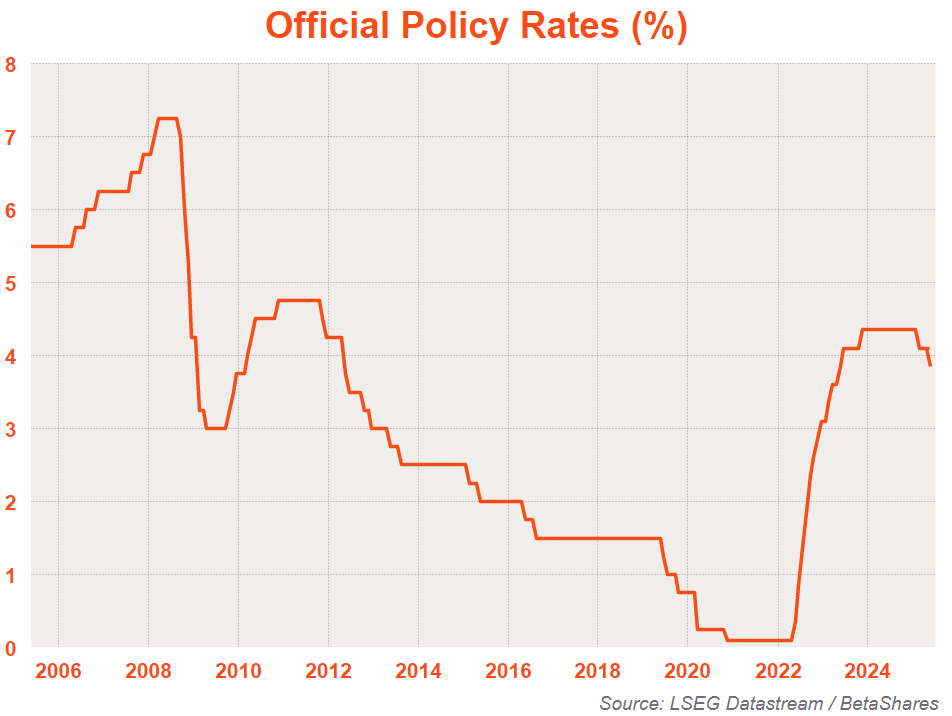

With inflation back to more normal levels (i.e. within the RBA’s 2-3% target band), the RBA can also return interest rates to more normal or ‘neutral’ levels. That means a level of interest rates that neither overly stimulate or restrict local economic growth.

Even after February’s rate cut, the 4.1% official cash rate was still considered restrictive. Making interest rates less restrictive, with Tuesday’s 0.25% cut to 3.85%, was justified.

Where to from here?

My expectation is in line with the RBA: that annual underlying inflation will ease further in coming months – from the top-edge (2.9%) to the mid-point of the RBA’s 2-3% target band.

The RBA expects annual inflation to ease to 2.6% in the June quarter CPI report at end-July – and remain there over the next year.

If so, this should allow the RBA to cut the official cash rate further toward a more normal or neutral level. I consider a neutral level to be around 3%, allowing for three further rate cuts up until early next year – from 3.85% to 3.1%.

Barring an upsurge in global or local economic growth concerns, the RBA may likely cut rates following each of the next few CPI reports. This is providing these confirm a further easing of inflation in line with the RBA forecasts.

Source: LSEG Datastream, Betashares

Global tariff concerns should hopefully ease. If not, the RBA will cut by more

What about US tariff mayhem and the implications for economic growth?

The openness of the Trump administration to lower tariffs in exchange for trade deals has been a major development in recent weeks. It should be enough to avoid the US tumbling into a serious recession. But if the US does fall into recession, the RBA could easily cut rates into expansionary territory – as far as 2% or even lower.

My expectation is that most countries will eventually only face a tariff rate of 10%. This is still onerous but less than feared a few weeks ago – in exchange for relatively token concessions to the United States. This would allow President Trump to claim a victory in terms of both raising tax revenue and gaining concessions. He could then pivot to focusing on tax cuts – which will be more market supportive.

If so, the RBA would likely not need to do more than cut interest rates back to a more neutral level by early next year.