The rise of HCRD - and where Aussie credit goes from here

8 minutes reading time

- Thematic

Royalties are integral part of the global commerce as they allow the legal sharing of valuable physical and intellectual assets in exchange for income payments made to the owner. They were first paid to kings and queens for the right to extract deposits from the mines they owned – hence the name “royalties”.

Today, the royalties business model has moved far beyond mining. In this article, we shine a spotlight on two leading royalties companies that you may never have heard of. Both companies play critical roles in their respective spheres, one in advanced communications and the other in cutting-edge biotechnology.

An Apple a day: Royalties in technology IP

What if you could earn a dollar every time someone, somewhere in the world bought an iPhone? Or a Samsung Galaxy, for that matter?

You may have never heard of InterDigital, but every time you read the news on your smart phone, watch a cat video on your laptop or turn on your TV it’s highly likely that you are relying on their technology.

InterDigital is an R&D company that focusses on developing high-end technologies in areas such as wireless communication and video, then earns royalties on its patents though licensing agreements with companies like Apple, Samsung, Lenovo, and Amazon.

InterDigital’s leading 5G intellectual property (IP) is used by smart phones to determine bandwidth allocation, facilitate roaming, and optimise power efficiency and system performance. Much of this IP is covered under what are known as “standard essential patents” that include the industry technical standards that must be conformed if you want to implement certain technologies. In other words, a manufacturer of a 5G device must use InterDigital’s IP, creating a monopolistic position for the company.

And as smart phones and electronics have become more advanced, the reliance of InterDigital’s technology has increased, and so have the royalty payments. InterDigital signed its first licensing agreement with Apple in 2007, which enabled the development of 3G iPhones, for US$20 million in royalties payments over seven years1. In September 2022, InterDigital signed its latest licensing agreement with Apple, for an expected ~US$1 billion in royalties over the next seven years2. Their current royalties deal with Samsung is due to be renewed in the fourth quarter of this year.

This growth can be seen in InterDigital’s financials, and it is likely to continue as 5G rolls out around the world. 5G adoption rates have been faster than previous generation of mobile network, and it is predicted that more than 27% of the world will be 5G connected by 20253.

Chart 1: InterDigital’s growth in adjusted EBITDA

Source: Interdigital, June 2023

New industry verticals have emerged for InterDigital too. The integration of wireless technology into connected cars recently allowed InterDigital to sign licensing deals with GM, Ford, Toyota, Kia and Hyundai.

InterDigital is an interesting case study of growth of the royalties business model within the technology sector. Intellectual property rights allow InterDigital to generate high margins, avoid the operational complexity of having to make or sell something and leverage long-term structural trends.

Oh, and in case you were wondering, InterDigital currently trades of a forward price-to-earnings ratio of 18.4x, much lower than Apple’s 27.4x.4

The King of biopharma – Royalty Pharma

Biopharmaceutical is not a household word. Nor does it need to be. It describes complex medicines made from living cells or organisms, often using cutting edge biotechnology. More commonly we know some of these medicines as allergenics to treat allergies, vaccines for viruses, and essential antibodies to treat cancers.

Even without this knowledge, investors often seek out the potential of the biopharma industry. An industry which is expected to grow from $US373 billion today to $US856 billion over the next seven years5 as increasingly complex technologies spur breakthroughs and innovations. However, investing in potentially successful medicines is not straight forward.

Industry expertise is necessary to identify pre-approved biopharmaceuticals with the greatest potential for success and profitability. Further, without isolating the potentially successful medicine from the company producing it, investors risk returns being diluted by company factors like R&D spending on unsuccessful products for small and mid-caps, or other business lines for large pharmaceuticals.

Achieving these two goals, industry expertise and product isolation, may seem unattainable to traditional investors. However, this is exactly what biopharmaceutical financing giant Royalty Pharma does.

Identifying a gap in the drug venture market, Royalty Pharma started co-funding late-stage clinical trials and new product launches in 1996 in exchange for a cut of the drug’s future revenues. Since this time, they have grown both their expertise and their network of researchers, biotech firms and leading global pharma companies, to account for ~50% of royalty transactions in biopharma, taking a stake in the revenues of 15 ‘billion-dollar drugs’ along the way6.

In 2020, seeing potential in the product, Royalty Pharma provided Biohaven Pharmaceuticals $US250m in funding to advance their experimental migraine nasal spray development in exchange for future milestone and revenue royalty payments. In March of this year, the nasal spray was approved by the FDA. Pfizer have since acquired Biohaven, paying Royalty Pharma US$475m as part of the agreement. Royalty Pharma will continue to receive royalties on the net sales of this product, along with their portfolio which includes 35 FDA approved products.

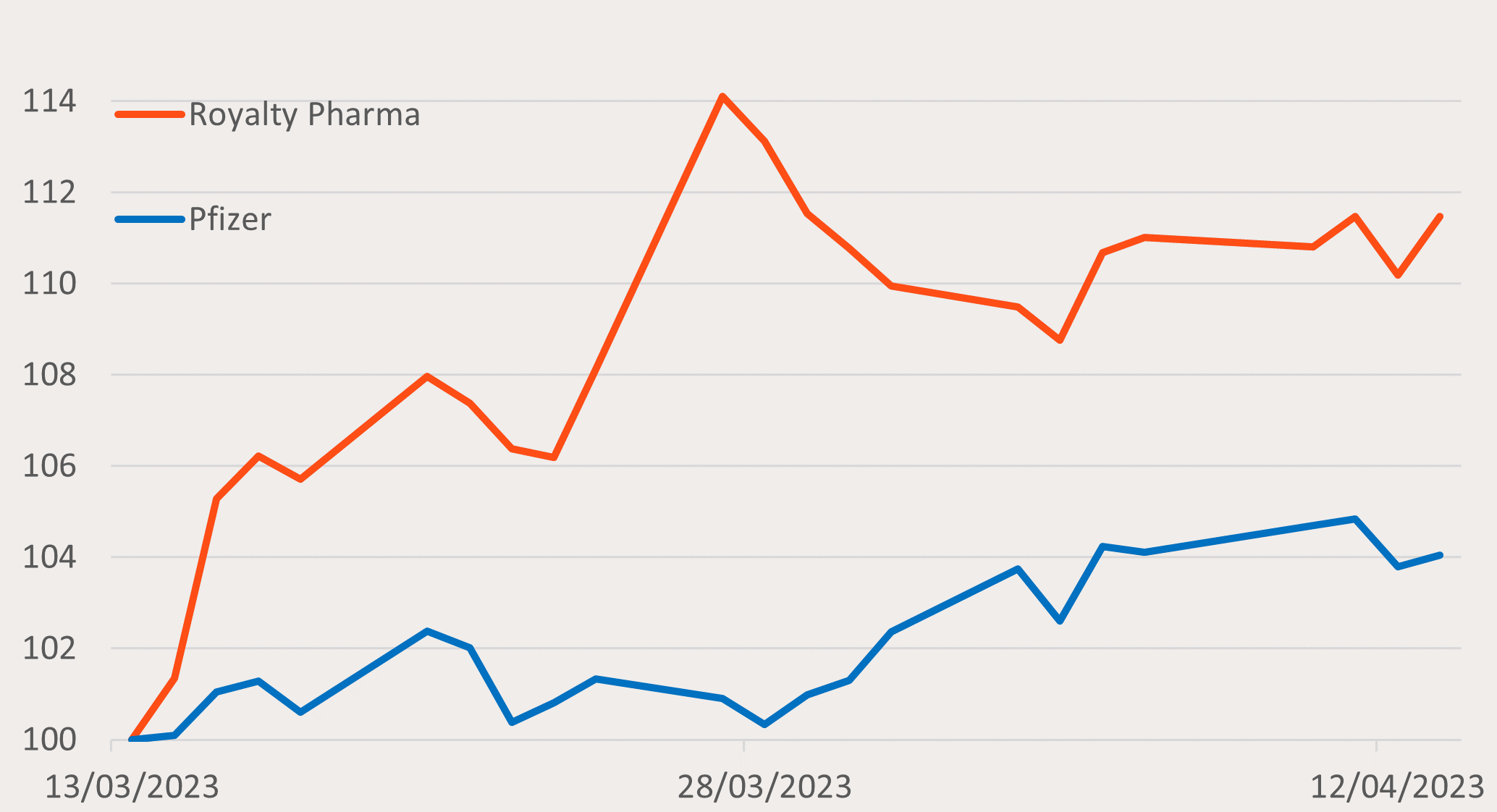

Highlighting the potential this business model provides investors, Royalty Pharma’s share price rose 10% in the month following the FDA approval, while Pfizer’s rose by 6%.

Chart 2: Royalty pharma and Pfizer stock price return in the month following FDA’s approval of Pfizer’s Zavegepant nasal spray, which Royalty Pharma has royalty rights to (indexed to 100)

Source: Bloomberg. Past performance is not an indicator of future performance.

Royalty Pharma is one great example of how investors can benefit from royalty companies. Often experts in their respective fields, these companies fund upfront projects they see potential and profitability in and reap the rewards if they come to fruition.

Royalties: an attractive risk-return business model

Given royalty payments are typically paid on the revenue earned from the use of an asset, they offer several advantages to investors. Companies like InterDigital and Royalty Pharma generate revenue from use of their assets (in this case, IP and new drug developments) without exposure to production costs or the broader operational and financial risks associated deriving profit from the asset.

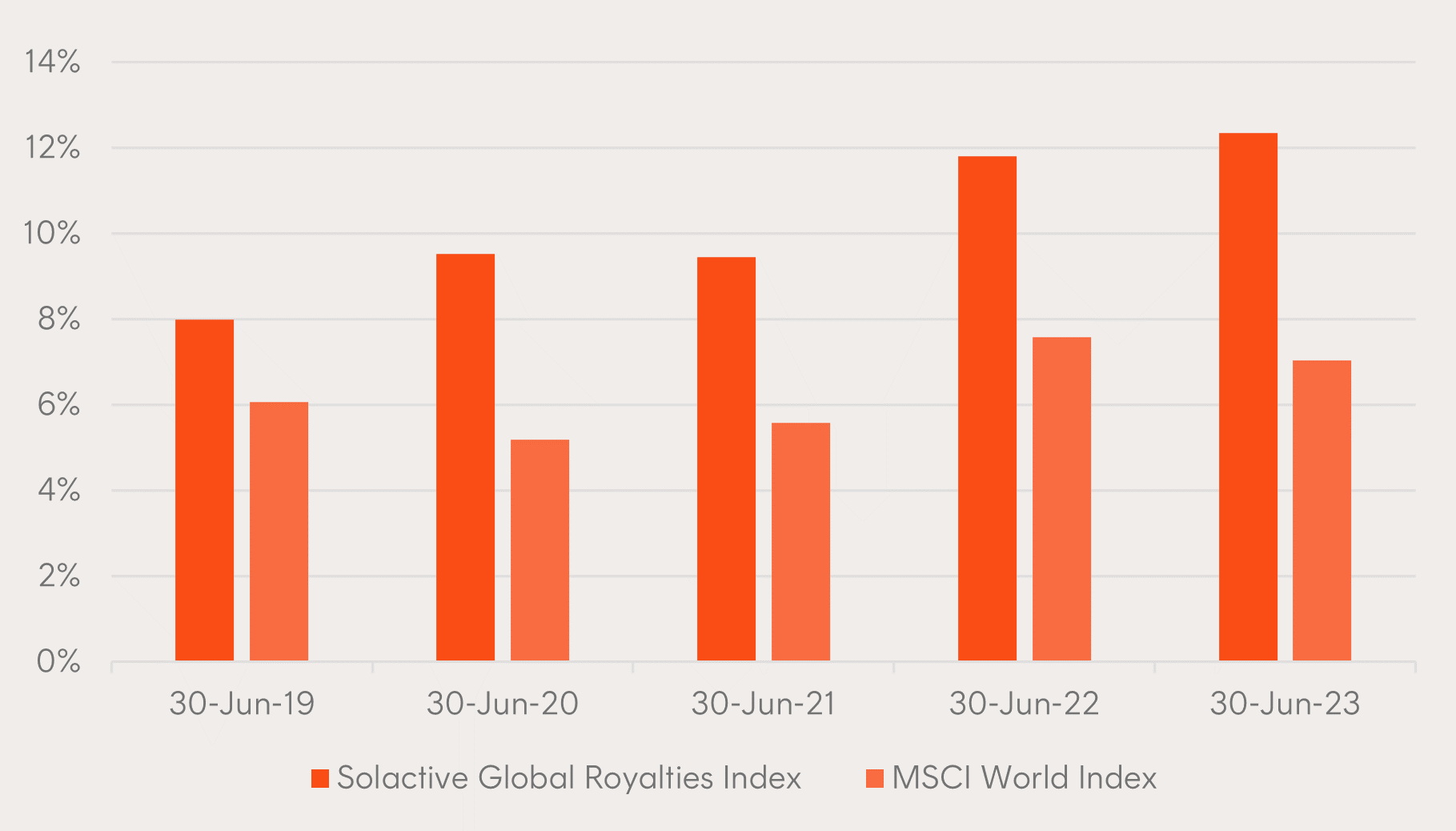

By limiting exposure in this way, companies that own and manage royalties tend to have relatively low capital requirements and enjoy good profitability. As evident in the charts below, companies included in the index tracked by Betashares Global Royalties ETF (ASX: ROYL) have enjoyed higher gross margins and returns on capital than a global equity benchmark over the five years to 30 June 2023.

Chart 3: Average Gross Margin of Solactive Global Royalties Index versus MSCI World Index

Source: Bloomberg. Past performance is not an indicator of future performance. Gross margin figures are calculated based on the companies in the Solactive Global Royalties Index (the index which ROYL aims to track) as at 30 June each year. You cannot invest directly in an Index. ROYL’s inception date was 9 September 2022.

Chart 4: Average Return on Capital of Solactive Global Royalties Index versus MSCI World Index

Source: Bloomberg. Past performance is not an indicator of future performance. Return on capital figures are calculated based on the companies in the Solactive Global Royalties Index (the index which ROYL aims to track) as at 30 June each year. You cannot invest directly in an index. ROYL’s inception date was 9 September 2022.

These stronger fundamentals have historically resulted in strong performance too. Since common inception, the Solactive Global Royalties Index has returned 12.38% p.a. compared to 10.96% p.a. for the MSCI World Index. Just as importantly though, global royalties companies provide diversification benefits from broad market equities, with the two indices having a correlation of only 0.497.

How you can access global royalties companies

You can tap into the unique and attractive investment characteristics of royalties through ROYL Global Royalties ETF , which invests in a global portfolio of royalty companies from a variety of industries. ROYL aims to track an index (before fees and expenses) of companies that earn substantial revenues through royalty income and intellectual property income as well as royalty finance and royalty streaming.

On the ASX there are a handful of mostly very small, mining-focused royalties companies. By way of comparison, ROYL provides diversified access to global leaders in mining royalties, like Franco Nevada, as well as a range of other industries, for example Texas Pacific Land (oil & gas royalties), Royalty Pharma (medical and biopharma), InterDigitial (technology IP) and Universal Music Group (music and publishing).

There are risks associated with an investment in ROYL, including market risk, sector risk, international investment risk, royalties-related risks and concentration risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of ROYL, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

References:

1. https://arstechnica.com/gadgets/2007/09/apples-deal-with-interdigital-all-but-guarantees-3g-iphone/

2. https://www.sec.gov/ix?doc=/Archives/edgar/data/0001405495/000114036122035581/brhc10042540_8k.htm

3. According to GSM Association

4. Source: Bloomberg, 20 October 2023, Forward Price-to-Earnings Ratio is based on Bloomberg consensus next 12 months earnings.

5. https://www.biospace.com/article/biopharmaceuticals-market-size-to-hold-usd-856-1-bn-by-2030/

6. Royalty Pharma Corporate Presentation September 2023

7. Source: Bloomberg, Betashares. Returns and correlation calculated since common inception, 7 November 2018, to 20 October 2023.