8 minutes reading time

This information is for wholesale client use only.

In summary

In a world of near zero interest rate differentials, AUD hedging is unlikely to generate additional returns over the long run, while also potentially increasing portfolio volatility and magnifying equity drawdowns relative to an unhedged global equity exposure

The AUD is highly correlated with risk assets throughout the cycle, the correlation has been increasing over time, and the beta is highest during periods of elevated volatility.

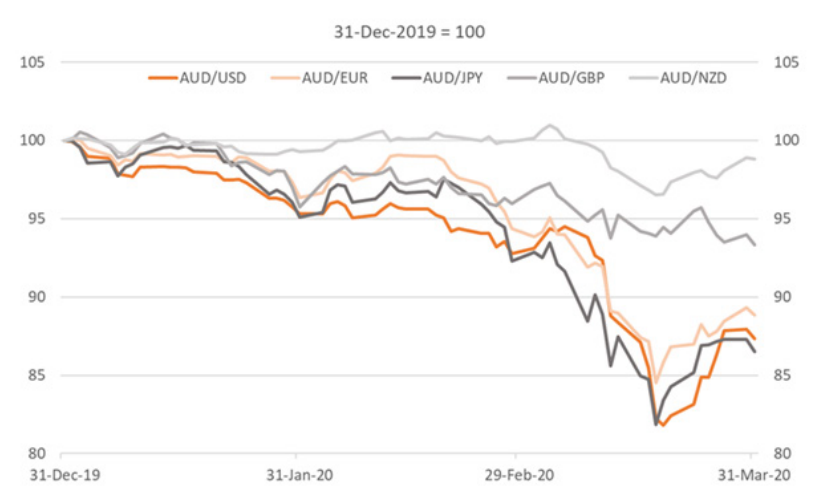

The AUD tends to sell off against ALL major crosses (USD, EUR, JPY, GBP and NZD) in stressed markets, whereas the USD tends to rally against most currencies, as such episodes are characterised by an unwind of carry trades and leverage, and by definition, increased demand for funding currencies

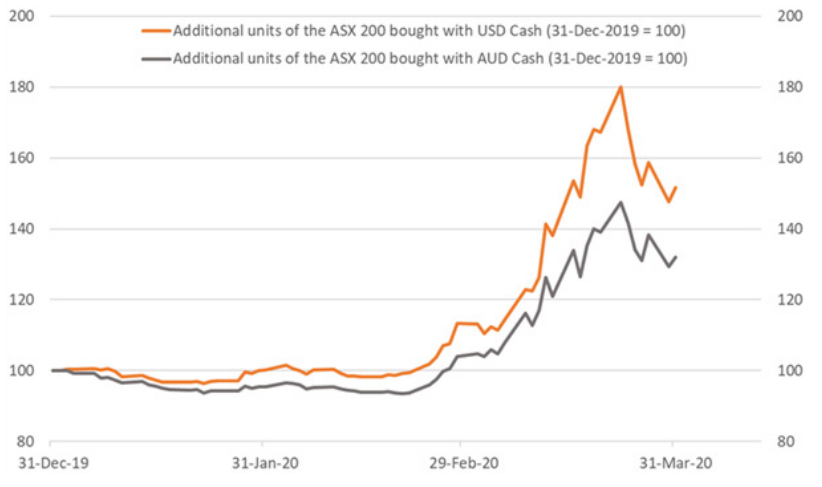

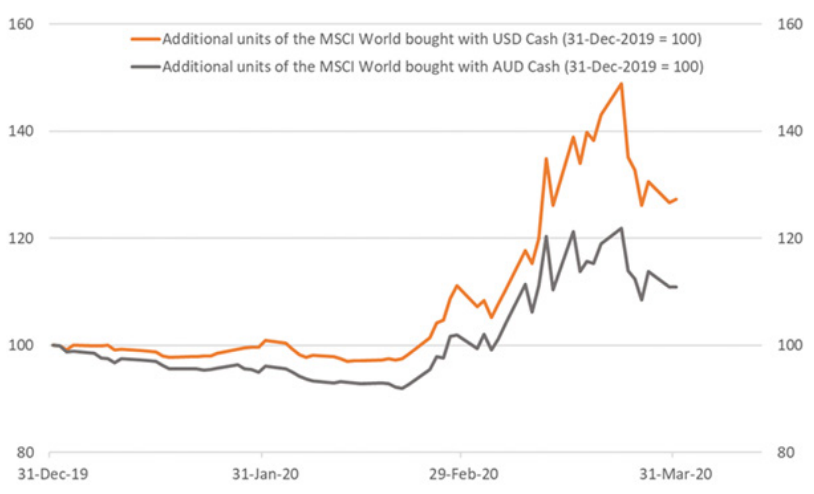

USD cash is a superior form of liquidity than AUD cash during deep market drawdowns and dislocations, as it can buy you far more risk assets – both AUD and foreign currency-denominated.

Overall, FX hedging is not costless to implement, can have adverse tax outcomes, and may provide unfavourable risk return characteristics for portfolios over the long run.

Many of us don’t formally consider currency as part of our asset allocation decision and are naturally biased towards AUD exposures. On the surface, it’s understandable: we report returns in AUD, the direction of currencies is notoriously hard to predict, and holding AUD makes sense for the end investor, given it’s how most of us will pay for living expenses and taxes for the foreseeable future. However, a greater understanding of the AUD’s role as a risk asset and its relationship to global financial conditions can help us construct better portfolios. The AUD is a risk asset that is unlikely to deliver any excess returns against the USD over the strategic horizon (5-10 years). This has big implications for not only optimal currency hedging decisions, but also what we should hold in our defensive portfolios and liquidity sleeves.

AUD-hedging is a FX carry trade (with near zero carry going forward)

The first thing to remember when deciding whether to hedge global equities is that the FX hedge overlay is a long position in the AUD and a short position in the relevant foreign currency. Given our global equity portfolios will be dominated by USD, EUR, JPY and GBP exposures, which tend to be lower-yielding currencies, the FX hedging overlay is a long carry trade. AUD-hedging is rolling a long forward position in the Australian dollar, which means it accrues the implied interest rate differential embedded in the forward points (the difference between the forward rate and spot rate) in a way that’s functionally identical to borrowing foreign currency (e.g. the USD) and investing it in an AUD deposit.

Before drilling into the correlations with broader risk factors, we should remember the biggest driver of long-run total returns of a carry trade is the interest rate differential between the carry currency (AUD) and the funding currency (the currency we’re trying to hedge out). The global trend in monetary policy has been for developed market interest rates to converge and we should not expect this to reverse any time soon.

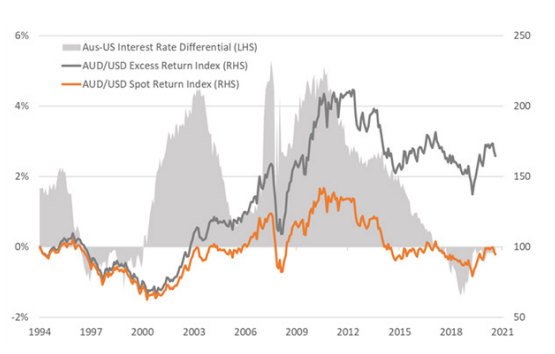

The chart below shows the excess return index for a AUD/USD carry trade, which is effectively the same as the return on a AUD-hedging overlay of an underlying USD asset exposure. The table below the chart shows the composition of hedging returns over various 5-year periods. As you can see, the periods where hedging added the most benefits were periods where the interest rate differential was large.

Chart 1: AUD/USD Excess Return Index and Spot Return Index (31-Dec-1994 = 100, RHS); Forward-implied interest rate differential in shaded area (LHS)

Sources: Bloomberg; Betashares Capital. Past performance is not an indicator of future performance.

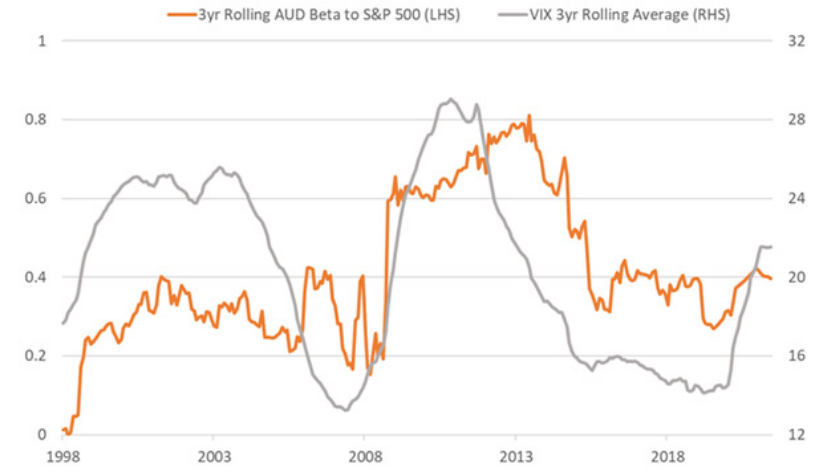

Table 1: Components of AUD Currency Returns (in USD)

Sources: Bloomberg; BetaShares Capital. Past performance is not an indicator of future performance.

*Bloomberg’s AUD/USD total return less the return on US T-bills

**Based on implied differentials from the historical 1-month AUD/USD forward points

The correlation between AUD total returns and global risk-on indicators is increasing

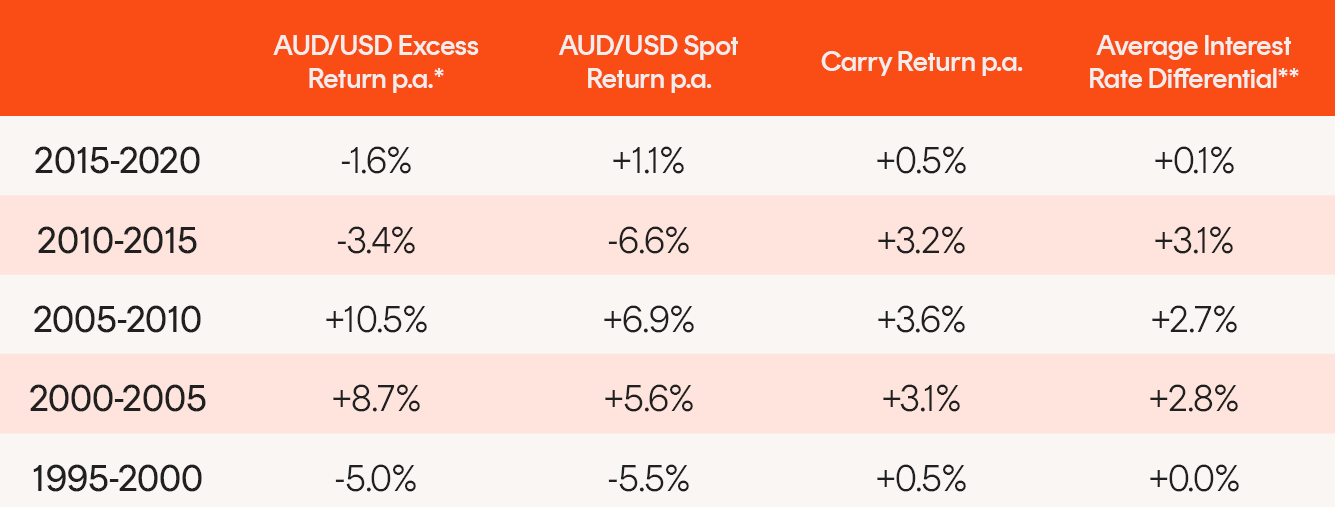

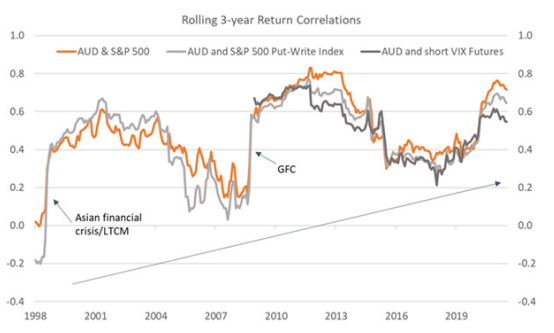

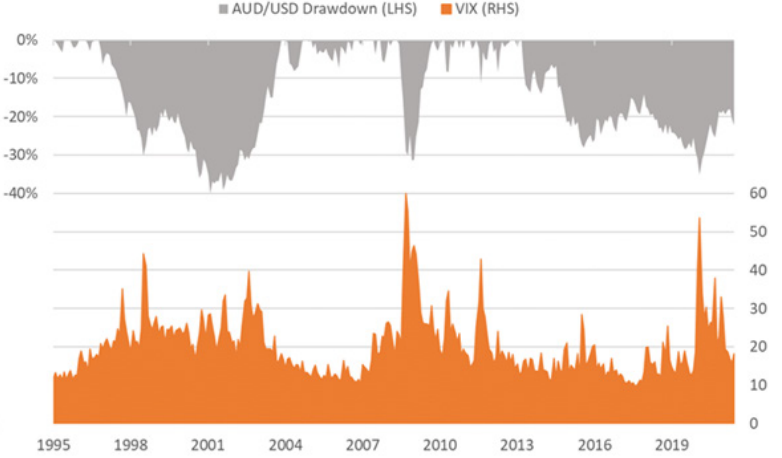

The AUD/USD has been positively correlated with global equities over the past 20 years, and this correlation has tended to increase over time. In addition, the AUD also behaves as a short volatility expression and the beta with the S&P 500 tends to rise with the VIX – i.e. when volatility rises, the AUD is not only more correlated to US equities, but more sensitive.

One feature of modern market structure is the growing relationship between carry, leverage, credit and short volatility, and there are good reasons to expect the AUD will continue to behave as a risk-on proxy. This relationship will be reinforced as super funds continue to grow in size and maintain overlay strategies and constant hedging ratios – AUD forwards must be purchased as global equities rally (to maintain hedging ratios) and must be sold as global equities decline. The implication is the AUD will continue to behave like a risk-on carry trade regardless of the interest rate differential. In addition, this relationship between the AUD and global liquidity potentially has adverse after-tax implications for hedged products, with periods of drawdowns often requiring the assets to be sold in order to cover FX hedging losses, which may need to happen in illiquid markets and needlessly crystallise capital gains prematurely.

Chart 2: Correlation of AUD/USD Returns with the S&P 500, the CBOE Put Write Index (SPX put selling) and short VIX futures index

Sources: Bloomberg; Betashares Capital. Past performance is not an indicator of future performance.

Chart 3: 3-year Rolling AUD/USD Beta to the S&P 500 and 3-year VIX moving average

Sources: Bloomberg; Betashares Capital. Past performance is not an indicator of future performance.

Chart 4: AUD/USD Total Return Drawdowns and the VIX

Sources: Bloomberg; Betashares Capital. Past performance is not an indicator of future performance.

We want our defensive assets and liquidity sleeves to put us in a position of strength to take advantage of global market dislocations

Assuming we’re running a balanced or growth asset allocation, the role of defensive assets in our portfolio, aside from dampening overall volatility, should be that of ‘dry powder’, allowing us to respond to market crashes and dislocations from a position of strength. This means being able to opportunistically buy more risk assets at temporarily distressed prices.

Many investors prefer to hold cash over bonds in their liquidity sleeves. The case I’m making here is that USD cash is far better for taking advantage of distressed prices in risk assets, due to the fact that periods of global market stress typically coincide with surging demand for USD liquidity, given it’s the largest funding vehicle for most risk-on exposures and carry trades, and such episodes also coincide with position unwinds that see the AUD sold heavily against other major currencies (including even other high beta currencies like the NZD). As investors would naturally be looking to accumulate both AUD and USD-denominated risk assets during a market decline, it makes sense to have USD liquidity on hand.

Another way to think about it is if the risk asset you want to buy is getting cheaper, wouldn’t you also want your dry powder to increase in value?

Chart 5a: The AUD sells off against all major currencies during the GFC; H2 2008

Sources: Bloomberg; Betashares Capital. Past performance is not an indicator of future performance.

Chart 5b: The AUD sells off against all major currencies during the Covid-19 crash; Q1 2020

Sources: Bloomberg; Betashares Capital. Past performance is not an indicator of future performance.

Chart 6a: Dry powder for ASX 200 Dip buying – additional units relative to 31-Dec-2019 that cash on hand can buy

Sources: Bloomberg; Betashares Capital. Past performance is not an indicator of future performance. You cannot invest directly in an index.

Chart 6b: Dry powder for MSCI World Dip buying – additional units relative to 31-Dec-2019 that cash on hand can buy

Sources: Bloomberg; Betashares Capital. Past performance is not an indicator of future performance. You cannot invest directly in an index.