4 minutes reading time

If you’re investing in offshore assets, the decision whether to hedge your currency exposure is an important one as movements in the Australian dollar can either erode or add value to your investment. If you want to minimise this uncertainty, currency hedged ETFs are worth considering.

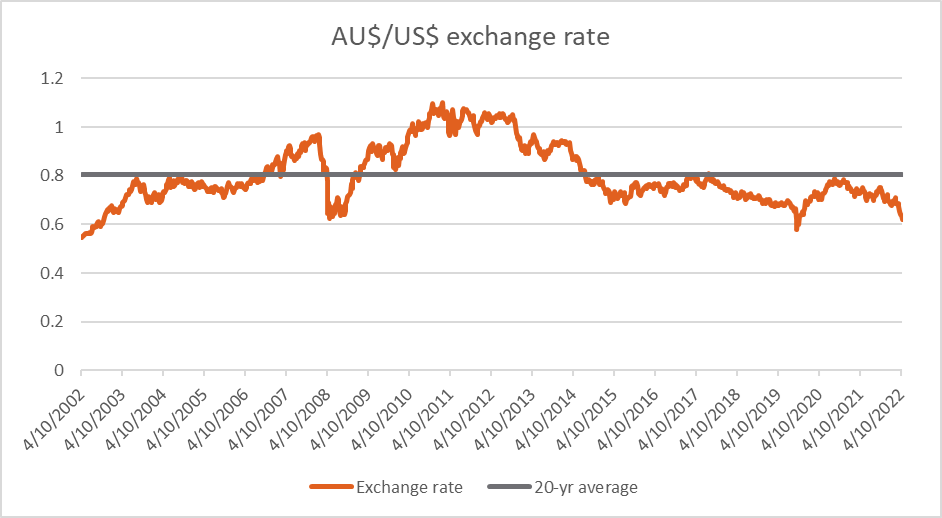

Australian dollar near long-term lows

The Australian dollar dropped in October to a fresh 30-month low as share markets sold off, with more money leaving local shores and heading back to the perceived relative safety of the US.

Any fall in the Australian dollar generally will boosts returns when overseas assets are converted into the local currency. If, for example, the Australian dollar fell by 10 per cent against the US dollar, the value of your investments denominated in US dollars would generally rise by 10 per cent, assuming no change in the price of the investments themselves. If, however, the local dollar rose by 10 per cent against the US dollar, then the value of your investments denominated in US dollars would generally fall by 10 per cent.

The Australian dollar fell early in October to US62c, its lowest level since April 2020, continuing a downward trend since April 2022. The US dollar has surged on “safe haven” buying given worries about falling share markets, quickly rising US interest rates and fears of global economic recession. With markets likely to remain volatile in 2023, the US dollar could potentially strengthen further, which could see the Australian dollar fall towards US60c or below. Any further falls in the Australian dollar would potentially improve returns from unhedged offshore investments.

On the other hand, if the global economic outlook improves in 2023, or the US Federal Reserve reverses course and cuts interest rates next year, this could benefit the Australian dollar. However, this may erode the value of unhedged US dollar investments.

Source: Bloomberg, Betashares, as at 18 October 2022. Past performance is not indicative of future performance.

Role of currency hedging

Hedging your offshore investments could appeal if you don’t like the uncertainty that comes with foreign currency exposure. The Australian dollar is now trading well below its average of US80c over the last 20 years – so it may rise again at some point.

Hedging is like insurance; the fund manager aims to protect against the impact of currency movements so that returns more closely reflect the change in the asset’s underlying value in local currency terms.

Whether you hedge may depend on your risk tolerance and the timeframe of your investment. If you are investing for the shorter term, then hedging could make sense to offset the impact of any rise in the Australian dollar. Hedging can also play a part if you simply don’t want to expose your investments to currency volatility.

Over the longer run, hedging may be less important as currency risks tend to even out – what goes up, usually comes down. As a result, there could be less reason to hedge against currency movements over the longer term, as compared to a shorter-term investment.

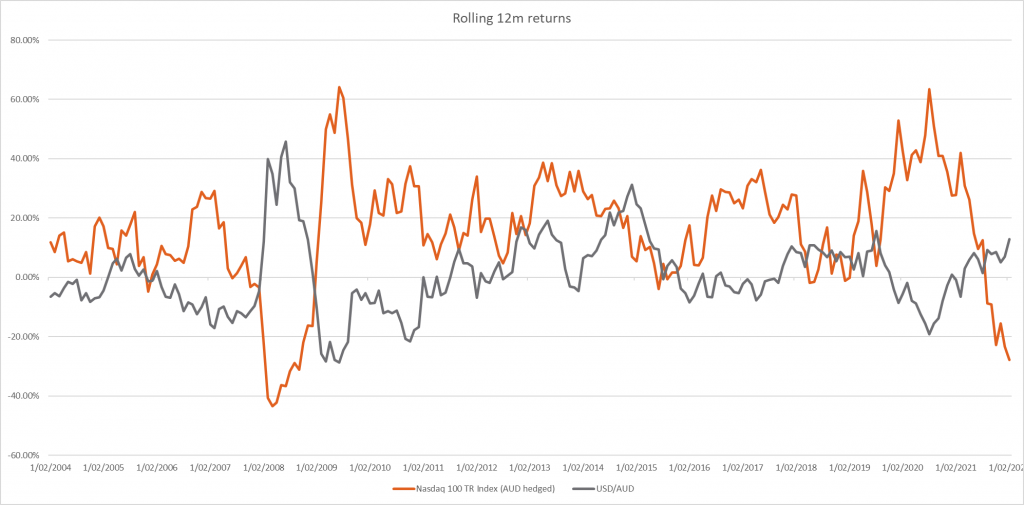

The chart below shows the rolling 12-month returns of the Nasdaq 100 Index in US$ versus the USD/AUD. The US$ has tended to rally against the A$ when equities have sold off, so being unhedged has helped in those conditions. However, during recoveries the A$ has tended to rally, therefore currency hedged exposures have generally provided better relative returns for Australian investors during those periods.

Source: Bloomberg, Betashares, as at 18 October 2022. Past performance not an indicator of future performance.

Options for hedging

Currency movements are notoriously difficult to predict. The Australian dollar could fall further from current levels, stabilise or rebound relative to the US dollar. However, with the Australian dollar approaching historically low levels, investors who have a view that the Australian dollar is at its lower bound may wish to consider currency hedged exposures for some of their global equity allocations. This reduces foreign currency risk from a potential rebound in the Australian dollar.

Betashares offers a number of funds on a currency hedged basis. Betashares’ range of currency hedged global equity funds.

Each of these funds hedges foreign currency exposure back to Australian dollars. These ETFs could have a role to play in your portfolio if you would like to seek to minimise the impact of currency movements on the value of your international equity investments.