5 minutes reading time

After a relatively benign start to the year in financial markets, volatility has reared its head again over the last week. Banks have failed, equities have been sold off, bonds have rallied, and US regulators have stepped in to reassure markets.

For those with long enough memories, echoes of 2008 can be heard. But despite the apparent similarities, what’s happening under the surface is very different to the Global Financial Crisis.

So what happened? And should investors be concerned?

A prelude

On 8 March, a relatively unknown American bank called Silvergate, which specialised in banking for the crypto industry, announced that it would be liquidating its assets and closing1. For those outside crypto, this didn’t seem significant. But with the benefit of hindsight, it’s now clear that Silvergate was just the beginning.

Silvergate suffered from two main issues:

- Rising interest rates had caused the value of their assets to fall.

- Their customers were withdrawing their deposits.

Though the details varied in each case, these issues popped up repeatedly in the days ahead.

The second largest bank collapse in US history

Until Friday last week, Silicon Valley Bank (SVB) was the 16th largest bank in the US2. As at 31 December 2022, it held US$175.4 billion in deposits3 , of which US$151.6 billion were uninsured4.

Deposits under US$250,000 are insured by the Federal Deposit Insurance Corporation (FDIC) to prevent small depositors from losing their money if a bank fails. However, many of SVB’s accounts were large, belonging to tech firms, venture capital (VC) funded start-ups, and VC funds themselves. Most of the bank’s funds deposits fell outside that limit.

Depositors with SVB were worried about the bank’s ability to meet demand for withdrawals and began taking their funds out of the bank. This resulted in the largest bank run in history, with US$42 billion withdrawn in the space of 10 hours5.

This became a self-fulfilling prophecy. SVB was unable to meet demand, and on 10 March, it collapsed.

The response

Over the weekend, concerns spread that other banks may be in a similar situation. Indeed, the New York State banking regulator announced on Sunday that they would be closing down Signature Bank, which also offered services to businesses in the crypto industry.

Signature Bank was the third largest bank collapse in US history – just days after the second largest6 .

Fearing a loss of faith in banks, the US Treasury, Federal Reserve, and FDIC issued a statement on Sunday, saying that “all depositors would be made whole”, and “no losses will be borne by the taxpayer.” How they achieved this is fairly technical, but for those interested, the Fed has provided an explainer here.

Markets’ reaction

When markets opened on Monday, we saw some of the largest movements in government bonds in history. In the US, 2-year Treasuries staged the biggest three day rally since October 1987. In Germany, the three-day drop in 2-year government bond yields was the largest ever seen. Statistically, this was what’s called a “10-sigma event” – an event that’s so unlikely that it’s used as a metaphor for “it can never happen”.

Equity market reactions were relatively muted, with the S&P 500 falling 3.4% over three days7 . For US regional banks, the situation was significantly worse though, with the Dow Jones U.S. Select Regional Banks Total Return Index falling 13.79% on 13 March.

What does all this mean?

For Australian investors without exposure to US regional banks, the direct impact will likely be negligible. However, Australian shares have not been spared from the broad volatility, with the S&P/ASX 200 falling 4.2% over the last three trading days8 .

For those holding fixed-rate bonds, they’ll likely have seen an increase in their value in recent days, with government bonds in the US and Australia rallying in the last few days. Another reminder of the value of diversification!

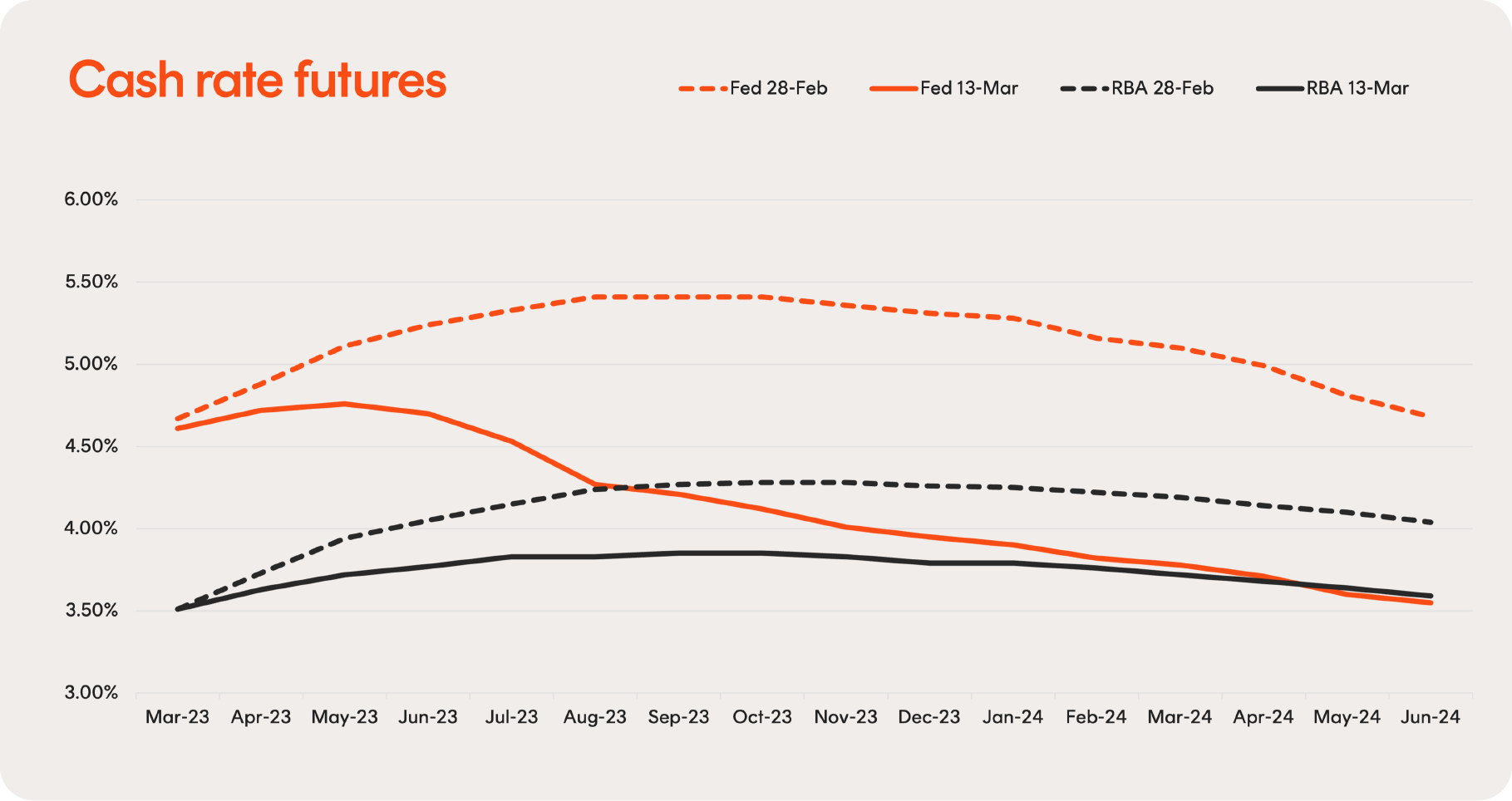

The big question for many is whether central banks continue with their plans to keep raising rates. If the Fed and the RBA choose to pause their rate hikes or even begin cutting rates proactively, this could be welcome news for equity and fixed income investors and mortgage holders.

The chart below shows how interest rate expectations have changed over the last two weeks, with markets now pricing in a lower peak in interest rates and rate cuts starting sooner.

Source: Bloomberg, Betashares. Data shows market-implied expectations based on US Federal Reserve Funds Rate and RBA Cash Rate futures as at 28 February and 13 March 2023. Actual outcomes may vary materially from market expectations.

What can investors do?

Nobody really knows what will happen from here. It may turn out to be nothing, a major financial crisis, or something in between.

Whatever happens, history has shown that markets have tended to recover over time. While market volatility can be painful at the time, for long-term investors with a regular savings and investment plan, it can act as an opportunity to buy assets at a reduced price.

Investors can take a few simple steps to navigate challenging periods:

- Have a defined plan. This should include understanding your risk tolerance and picking an investment strategy to match. It may also outline strategies such as Dollar Cost Averaging, which can help to smooth out returns or take advantage of market volatility. Investors should consider speaking to a licensed financial adviser to ensure their strategy is suitable.

- Make sure your portfolio is well diversified. An investor holding just US regional banks would have had a bad week. But holding a mix of fixed income and equities, and diversifying by region and sector, can help reduce volatility.

- Stay the course. It’s one thing to have a plan, but it’s no use unless you stick to it. As the saying goes, it’s time in the market not timing the market that produces returns over the long term.

References:

1. Crypto-focused bank Silvergate is shutting operations and liquidating after market meltdown

2. How Silicon Valley Bank failed

3. FDIC Creates a Deposit Insurance National Bank of Santa Clara

4. FDIC Will Protect All Silicon Valley Bank Deposits After Sudden Collapse

5. The largest bank run in history

6. Why regulators seized Signature Bank in third-biggest bank failure in U.S. history

7. 9 March to 13 March 2023. Source: Bloomberg, Betashares.

8. 10 March to 14 March 2023. Source: Bloomberg, Betashares.

1 comment on this

Interesting and informative article.