Bitcoin surged above $100,000 for the first time in its 15-year history as the broader crypto market and bitcoin continued to make new all-time highs. Helping push the cryptocurrency through the historic milestone was President-elect Trump announcing his pick for SEC Chair.

Bitcoin and Ethereum were up 3.50% and 7.57% respectively over the seven days to 8 December. Bitcoin’s market capitalisation is above US$1.97 trillion, making it the seventh largest asset by market cap. The global crypto market cap is up to ~US$3.67 trillion, while bitcoin’s market dominance has slid to 53.8%.

|

Price |

High |

Low |

Change from previous week |

| BTC (in US$) |

$99.766 |

$103,587 |

$93,645 |

3.50% |

| ETH (in US$) |

$3,981 |

$4,087 |

$3,504 |

7.57% |

| |

|

|

|

|

Source: CoinMarketCap. As at 8 Dec 2024. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Trump’s pick for SEC Chair

US President-elect Donald Trump announced last Thursday that he plans to nominate Paul Atkins as Chair of the US Securities and Exchange Commission (SEC). The nomination still has to be approved next year by the Senate, but this should not pose any problems as the Senate will be Republican-led. Trump has pledged to make the US the “crypto capital of the planet” and create a “strategic reserve” of bitcoin.

On truthsocial.com, Donald Trump said: “Paul is a proven leader for common sense regulations. He believes in the promise of robust, innovative capital markets that are responsive to the needs of Investors, & that provide capital to make our Economy the best in the World. He also recognizes that digital assets & other innovations are crucial to Making America Greater than Ever Before.”1

Solana ETF Filings

Two of the five prospective issuers seeking approval to list a Solana (SOL) ETF have been rejected, according to latest reports2. It is expected that the other applications will also be rejected by the SEC, given that multiple asset managers were given bitcoin ETF approvals all at once.

However, there is hope that pro-crypto advocate Paul Atkins, who has been nominated as the new SEC Chair and takes charge in January, will ease the regulatory environment for digital asset products. Issuers will have an opportunity to seek approval from the new leadership.

CRYP company spotlight

Coinbase hits listing milestone

Coinbase International Exchange reached a significant milestone by listing its 100th perpetual futures contract. A perpetual futures contract allows traders to speculate on the price of an asset without an expiration date. Coinbase is one of the largest cryptocurrency exchanges, processing billions of dollars in trading volume daily3.

Coinbase Global Inc. is held in the Betashares Crypto Innovators ETF (ASX: CRYP)4. CRYP provides exposure to global companies at the forefront of the crypto economy.

Bitcoin (BTC): Realised Cap

This metric values different parts of the bitcoin supply at different prices (instead of using the current daily close). Specifically, it is computed by valuing each Unspent Transaction Output (UTXO) by the price when it last moved.

According to data from Glassnode, the realised cap has grown from $430 billion in January to $755 billion as of 6 December. This reflects the broader adoption of bitcoin among investors and institutions post the listing of US spot bitcoin ETFs.

Source: Glassnode. Past performance is not indicative of future performance.

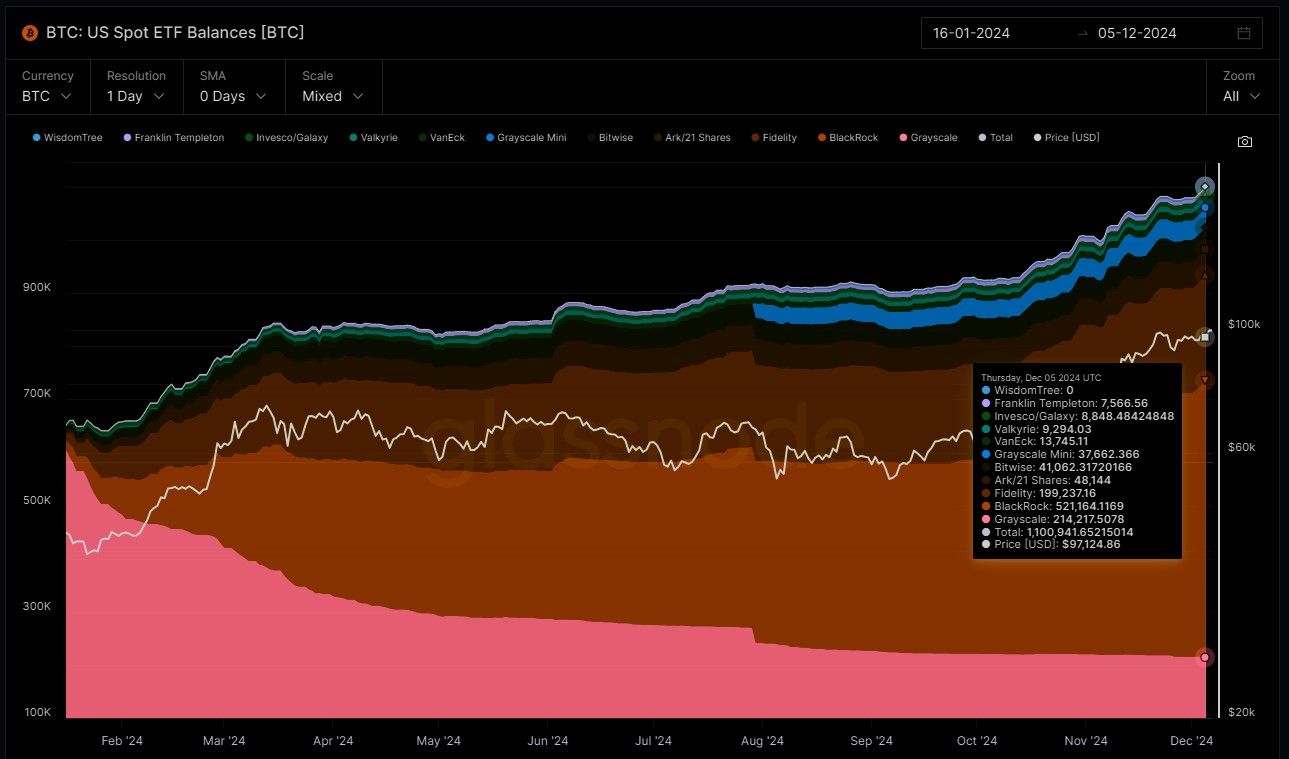

Bitcoin (BTC): US Spot ETF Balances

The crypto market cap hit record highs last week of US$3.8 trillion, with memecoins reaching $148 billion. Excluding the two largest cryptocurrencies, bitcoin and Ethereum, memecoins made up over 11% of the crypto market capitalisation as at 1 December 2024. The largest memecoin, Dogecoin (DOGE), has risen over 168% since Donald Trump’s election and is currently the seventh largest cryptocurrency with a market cap of almost $67 billion.

Over the weekend, memecoins traded almost $30 billion in volume in a 24-hour timeframe.6

References:

1. https://truthsocial.com/@realDonaldTrump/posts/113595807734621827

2. https://cointelegraph.com/news/sec-reject-bids-solana-etfs-report

3. https://u.today/coinbase-announces-major-listings-with-four-new-crypto-assets

4. As at 8 December 2024. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

5. https://cryptopotato.com/blackrocks-ibit-becomes-fastest-etf-in-history-to-hit-50b-in-aum/

6. https://news.bitcoin.com/meme-coin-madness-pepe-market-cap-smashes-10b-mark-in-epic-weekend-surge/

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

2 comments on this

Hi Justin.. do you play a very active roll in the etf? eg do you sell out of stocks v’s other? is there much turnover in the ETF itself..

Hey Michael, CRYP is an index tracking ETF, therefore, we don’t actively add or remove companies. Companies are included if they meet the rules of the index at the respective rebalance dates. You can read more about the index methodology in the PDS, under section 2.1.5 https://www.betashares.com.au/files/collateral/pds/CRYP-pds.pdf

Regards,

Betashares Customer Support Team