ETF distributions: frequently asked questions

1 minutes reading time

Better investing starts here

Get Betashares Direct

Betashares Direct is the new investing platform designed to help you build wealth, your way.

Scan the code to download.

Learn more

Learn more

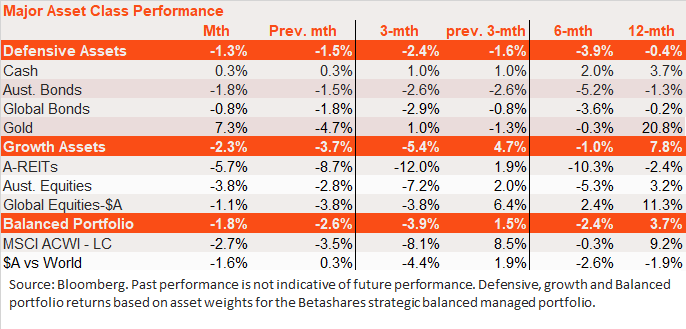

Both defensive and growth assets weakened further in October, reflecting another solid increase in global bond yields. The Hamas attack on Israel was a major development in the month, which initially led to a spike in oil prices and renewed global inflation concerns.

Growth assets declined more than defensive assets, with global (hedged equities) down 2.7% and Australian equities down 3.8%. The interest rate-sensitive listed property sector weakened by 5.7%.

Among defensive assets, bonds underperformed cash, reflecting the rise in bond yields. Despite higher bond yields and a strong US dollar, gold prices rose due to the rise in geopolitical concerns.

The full Market Trends report is available here.

Explore

Macro & markets