6 minutes reading time

For a long time, the worlds of fixed income and US technology stocks were largely separate. The hyperscalers marched to their own tune, enjoying unmatched growth while remaining immune to the broader business cycle. Investors remained attracted to capital-light business models that delivered outsized revenue growth and margins, helping multiples expand even as real yields reached post-GFC highs.

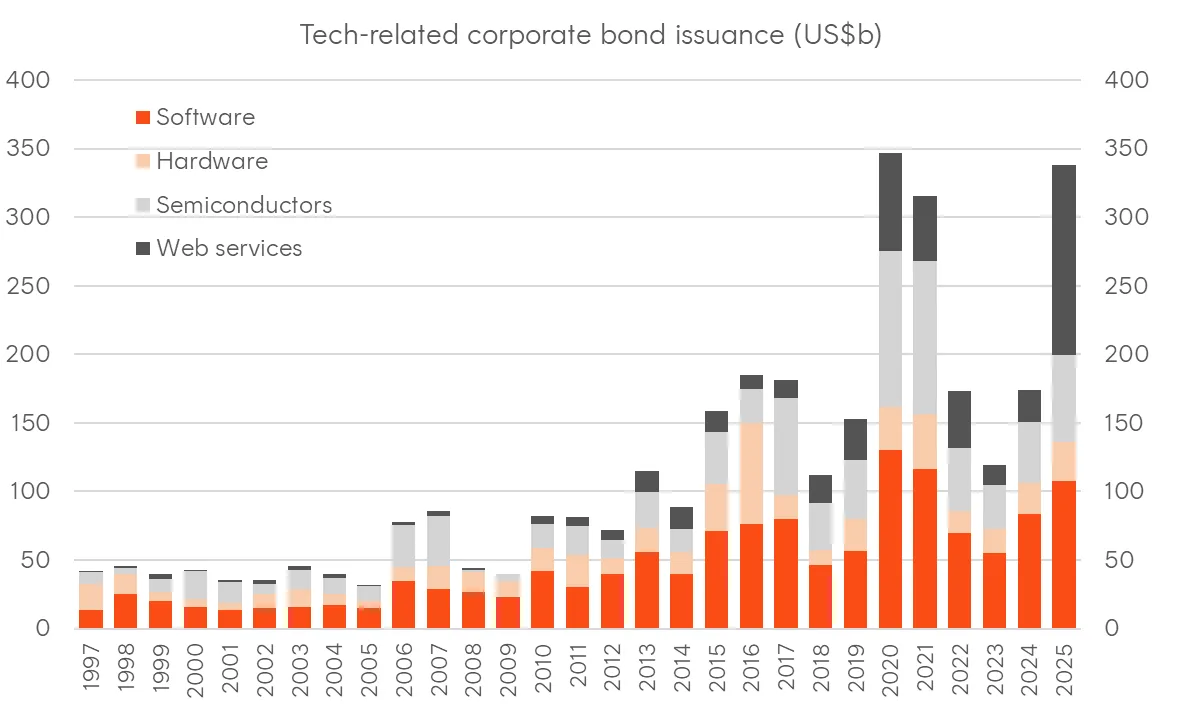

Recently, AI-related capex has become a major story for the US economy, but it’s also emerged as a focal point in credit markets. During November, concerns around debt-financed capex drove credit spreads wider and spilled over to stock prices, with activity in markets for credit protection surging for selected cloud names. Although spreads across the technology sector more generally have since retraced, some names like Oracle remain elevated, and the collision between Silicon Valley’s ambitions and the bond market’s demand for cash flows will likely define credit markets for years to come.

Figure 1: USD investment grade (IG) credit spreads

Source: As at 5 December 2025. Bloomberg

Why Generative AI is different

Generative AI is a very different technology from prior waves like web 2.0 and cloud that enabled Software as a Service (SaaS) business models and democratised access to powerful computing and storage. Cloud ultimately became about better utilisation of infrastructure that could serve millions at minimal marginal cost. The hyperscalers did spend heavily on data centres initially, but they could achieve fantastic margins and operating leverage because the incremental cost of adding new customers and delivering output was minimal.

Generative AI has extremely high computational needs for both training large language models and delivering outputs (the process known as inference). It requires data centres and cutting-edge chips that many argue depreciates rapidly compared to traditional equipment (although the effective life has become a topic of much debate). This creates a competitive arms race where companies must constantly upgrade or risk falling behind. The result is a capex treadmill that’s difficult to step off, with high marginal costs for inference compute, plus substantial ongoing costs for powering and cooling.

Will the bond market finance the stock market’s dreams?

“Stocks are stories, bonds are contracts” – Torsten Slok, Chief Economist at Apollo

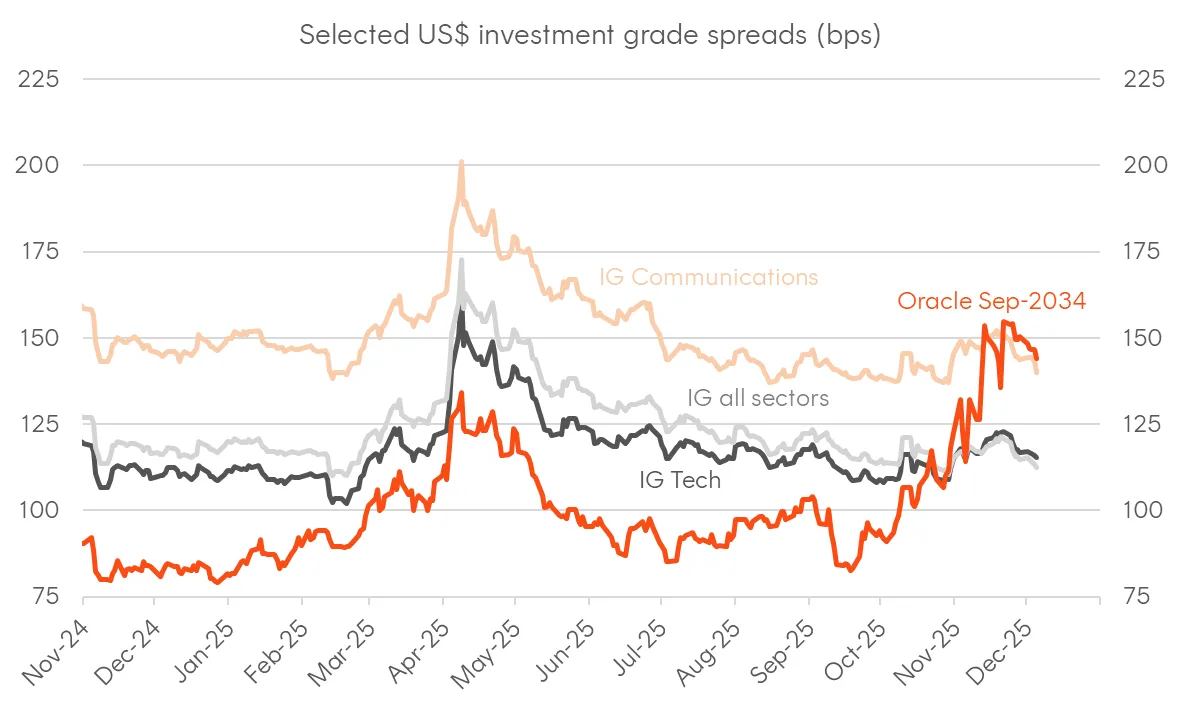

The capex numbers that the hyperscalers and AI labs are committing to are simply eye-watering. It’s so large that it will require substantial levels of debt, and we’re already seeing issuance ratchet higher. While the big technology stocks have accessed bond markets before and built consistent issuance programs over the years, prior waves of debt raising – like in 2020-2021 – were opportunistic, taking advantage of ultra-low corporate borrowing costs coming out of the pandemic. Throughout, the hyperscalers maintained some of the best credit ratings in the US corporate universe.

However, with US yields now much higher compared to 5 years ago, and annual AI-related capex expected to grow from US$400 billion this year to over US$2 trillion by 2029 (according to forecasts from Citi)1, there are legitimate concerns about the bond market’s capacity to absorb such issuance. While the hyperscalers have previously been viewed as high-quality credit, the same can’t be said for smaller players in the AI ecosystem, like the “neoclouds” that specialise in providing GPU-as-a-service for AI workloads.

Further complicating matters, this new issuance will clash with rising refinancing needs from the maturity wall of 2020-2021’s issuance boom. The corporate bond market will also need to compete with elevated US Treasury issuance for the foreseeable future amid the US budget deficit still running close to 6% of GDP.

Figure 2: Selected tech-related US dollar corporate bond issuance by calendar year

Sources: Bloomberg, Betashares

How this is being funded so far

“I suspect we can design a very interesting new kind of financial instrument for finance and compute that the world has not yet figured it out. We’re working on it.” – Sam Altman, CEO of OpenAI

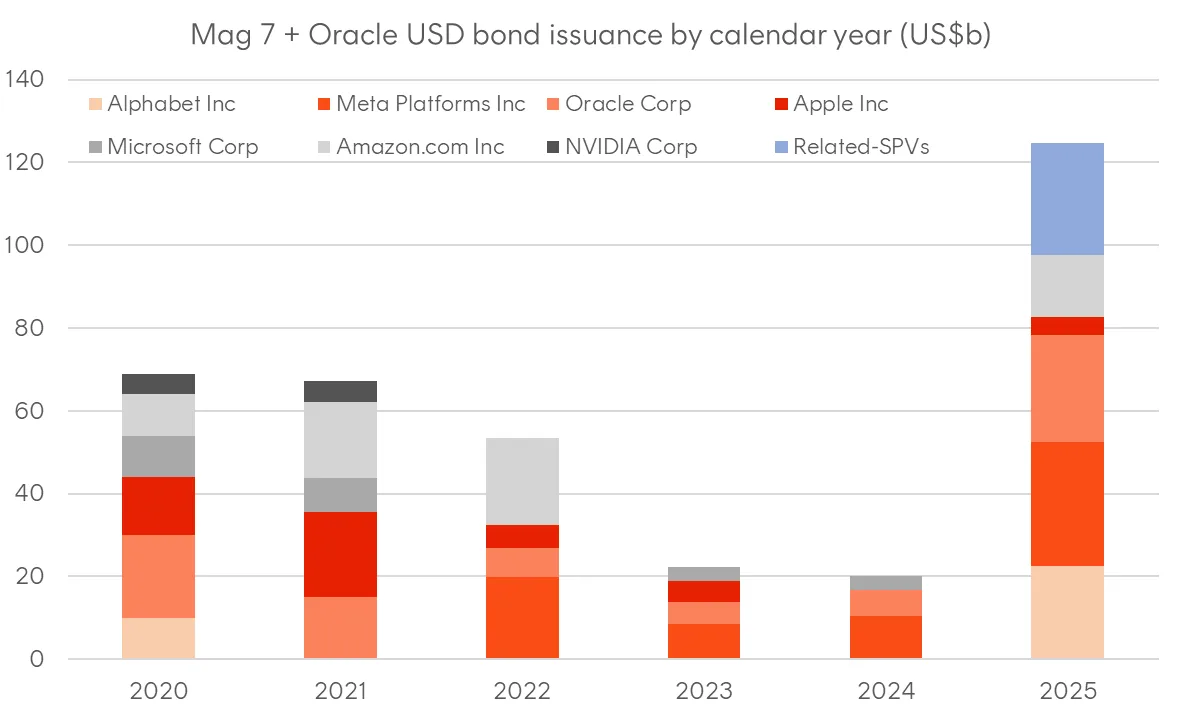

2025 has already seen a surge in technology-related bond issuance alongside activity in syndicated loan and private debt markets. Over US$300 billion in corporate bonds have been sold from the technology sector, with the Magnificent 7 and Oracle collectively issuing US$100 billion.

Beyond traditional on-balance sheet debt, we’re seeing novel financing structures, including off-balance sheet SPVs to finance data centre buildouts. The most notable example was the US$27 billion debt sale via the “Beignet” SPV, which finances Meta’s Hyperion data centre. For issuers like Meta, such deals keep debt off their balance sheet and transform financing expenses (interest payments) into operating expenses (lease payments), theoretically preserving credit quality and ratings. Additionally, by leasing data centres and their compute resources, they can offload depreciation to providers like the neoclouds. Given the expected issuance volumes, we’ll likely see many more of these off-balance sheet structures and its likely we’ll see a boom in asset backed finance deals.

Figure 3: Calendar year bond issuance from selected issuers

Sources: As at 8 December 2025. Bloomberg, Betashares

The big story for credit markets in 2026

The story for credit over the coming years will be how well it handles this supply surge, especially against a backdrop of elevated US Treasury yields and continued US government issuance. A gradual grind wider in spreads will probably be welcomed by most bond investors, and the bond market may ultimately instil some discipline over capex spending plans. The elephant in the room is OpenAI. Despite making US$1.4 trillion in spending commitments over eight years2, they’ve yet to tap debt markets. When they do come to market, it could be a pivotal moment for how bond investors view the entire AI buildout.

Can debt markets finance a technological revolution whose revenue model remains unproven? The hyperscalers are betting they can bridge this gap with balance sheet strength and cut through with their enterprise customers, and the AI labs are betting on achieving some form of “super-intelligence” while the supply of capital remains abundant. Unlike equity investors who can dream of infinite upside, bond investors need to be paid back on time, and that reality and the demand for cash flows may prove to be the discipline this AI boom needs or the constraint that slows its development.

Sources:

1. https://www.reuters.com/world/china/citigroup-forecasts-big-techs-ai-spending-cross-28-trillion-by-2029-2025-09-30/ ↑

2. https://www.axios.com/2025/10/28/openai-1-trillion-altman ↑