Charts of the month: March 2025

5 minutes reading time

There is a common perception that when volatility returns to markets investors should favour active management and stock picking over passive investing. During the 2020 COVID-19 sell-off, many active managers asserted they were better placed to provide some downside protection, yet, on average, actively managed funds underperformed passive during that episode (further details of which are discussed later in this article).

At the start of 2022, against the backdrop of elevated stock valuations, rampant inflation and a possible recession, we again heard that familiar rhetoric that active management can provide investors with better outcomes through market volatility.

This narrative is intuitively appealing. In this insights piece, we investigate the extent to which it is supported by the evidence so far (keeping in mind that past performance is not indicative of future performance).

How did active managers fare in 2022 and what longer term outcomes have they delivered?

In any investment period there will always be some active funds that outperform and some that underperform. The question is, what are the chances of any one active fund outperforming?

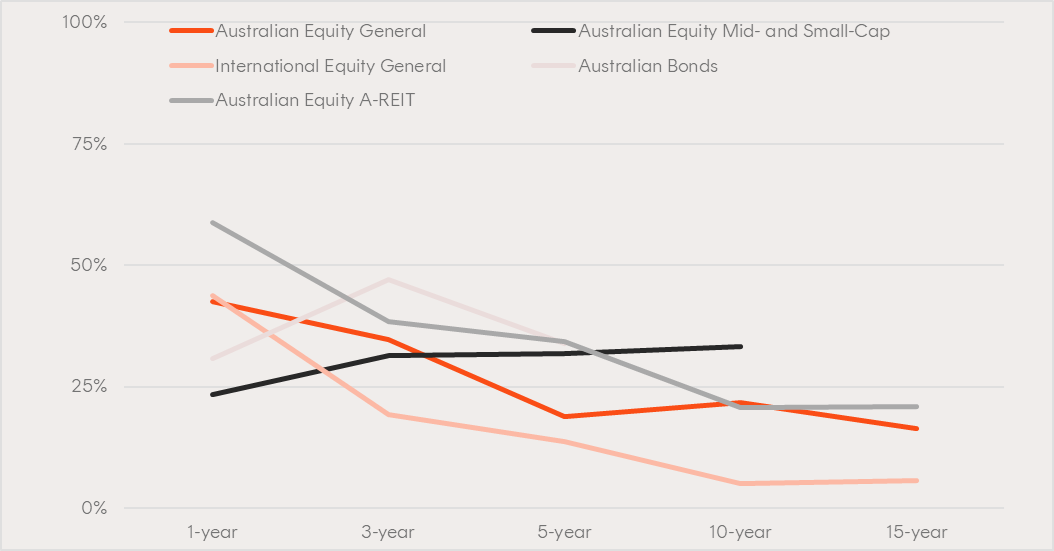

The SPIVA (S&P Index vs. Active) Scorecard tracks how actively managed funds all over the world have fared against passive benchmarks. The chart below shows the outcomes over various time frames for Australian-domiciled actively managed funds from the SPIVA Australia Year-End 2022 Scorecard . For example, the dark orange line shows the proportion of Australian Large Cap Active funds (the ‘Australian Equity General’ category) that beat the S&P/ASX 200 Index over the 1, 3, 5, 10 and 15 year time periods ending 30 December 2022.

SPIVA Australia Year-End 2022 Scorecard:

Proportion of active managers, by fund category, beating benchmark (comparison index) over different return periods

Source: S&P Dow Jones Indices LLC, Morningstar. Data as of Dec. 30, 2022. Chart is provided for illustrative purposes only. Underperformance rates for Australian Bonds and Australian Equity Mid- and Small-Cap categories are reported for time horizons over which the respective benchmark indices were live. All fund categories and comparison indices are defined in the SPIVA Australia Year-End 2022 Scorecard (https://www.spglobal.com/spdji/en/spiva/article/spiva-australia/). You cannot invest directly in an index. Past performance is not indicative of future performance.

2022 was supposed to be the perfect environment for active to beat passive strategies – economic uncertainty, no more easy monetary policy providing a floor for equity valuations, the business models of previous market darlings challenged – a stock picker’s “paradise”. Yet, for the calendar year, only ~43% of active Australian and International equity large-cap managers (‘Equity General’ categories) actually beat S&P’s comparison indices. In the Small- and Mid- Cap category, the proportion of active managers beating the comparison index was less than a quarter. The only category win for active in 2022 came in Australian Real Estate Investment Trusts (A-REITs).

Is this period of market volatility different? What happened in the Covid sell-off in Q1 2020?

SPIVA assessed the performance of Australian-domiciled active funds during Q1 2020 across all the major asset classes. For the quarter, in all asset class categories except A-REITs, most active funds underperformed their respective benchmarks. For example, 61% of funds categorised as ‘Australian Equity General’ failed to beat the S&P/ASX 200 Index over the quarter.

The figures were slightly better for Australian equities in the month of March 2020 alone, during the worst of the drawdown, where 51% of Australian Equity General funds underperformed against the comparison index. However, the ability of these active managers to take a defensive tilt during a bear market appears to have had a muted effect on relative performance. The proportion of active fixed income and global equity funds that underperformed in March 2020 was significantly higher.

Time to reconsider the conventional wisdom?

Unlike actively managed funds, passive ETFs:

- Tend to be much lower cost, more liquid and can offer much better diversification – three desirable characteristics in a market where positive returns are hard to come by.

- Offer full portfolio transparency. Often, getting a handle on why an active fund is underperforming is difficult, whereas all passive ETFs traded on the ASX are obligated to publish all their holdings each trading day, so you can see exactly what is driving performance.

There is a wide range of passive ETFs available on the ASX from Betashares and other ETF issuers. It might be time to reconsider the conventional wisdom that active management thrives in volatile markets and have regard to the benefits of low-cost, passive ETFs that could offer a more effective approach to navigating market turbulence and growing wealth over the long term.

Betashares Capital Limited (ABN 78 139 566 868 AFSL 341181) (Betashares) is the issuer of the Betashares Funds. Before making an investment decision, investors should consider the applicable Product Disclosure Statement (PDS), available at www.betashares.com.au, and obtain financial advice. Investors may also wish to consider the relevant Target Market Determination (TMD) which sets out the class of consumers that comprise the target market for each Betashares Fund and is available at www.betashares.com.au/target-market-determinations. This information does not take into account any person’s objective’s financial situation or needs. Investors should consider the appropriateness of the information taking into account such factors and seek financial advice. Investments are subject to investment risk, investment value may go down as well as up, and investors may not get back the full amount originally invested. The information provided is not a recommendation or offer to make any investment or to adopt any particular investment strategy.

10 comments on this

Thanks for the article. As you point out, it is highly unlikely that active managers (as a group) will outperform broad index/ETFs, particularly over longer time frames and regardless of the prevailing market conditions. I have read several articles recently which state that now is a good time for active management – this is patently false and you have demonstrated why that is the case in your article. For the vast majority of investors, ETFs are an excellent way to invest and to also outperform a large percentage of active managers without having to do any work!

Thanks for the comment David!

Regards,

Betashares Client Services

I think this is not a fair comparison. 2020 & covid have been exceptions. Whenever liquidity is too high, I guess indices deliver great returns. But during the period of liquidity squeez (high inflation, recession, etc.) active value investing works better. Take 1929 to 1954, when index didn’t move, Ben Graham delivered 20% CAGR. Take 1970s & early 1980s, active value investing delivered fantastic returns. Whereas indices didn’t perform much. Take the lost decade of 2000-2010, active value investing did wonders when indices didn’t return much. I think if the economic circumstances are grim over this decade (which is a higher probability), active value investing (I am not talking about the nonsense of Growth at Any Price) should do mich better than passive as the costly index heavyweights will be tone down. Now this doesn’t mean all active investors will do better. Because that’s not practically possible. But the good ones should do extremely well.

Hi Akshay,

Data from SPIVA doesn’t go back as far as the 80s, let alone the 30s and 40s. I think it’s fair to say that the market is a very different place now than it was when Benjamin Graham was investing though. The huge increase in the number of professional and institutional investors, as well as the data that’s instantly available to all, plus much better regulation, has significantly evened the playing field.

As to what the future holds, it’s impossible to say with any confidence. But the 20 years of data that is available from SPIVA does appear to support the case for passive management. Even Ben Graham’s ‘disciple’, Warren Buffett, said in his 2017 letter to Berkshire Hathaway shareholders: “Both large and small investors should stick with low-cost index funds.”

Regards,

Betashares Client Services

I’m curious, there are those managers that do in fact outperform the market over periods of time. Who’s to say that we as advisers can’t pick those managed funds – given the amount of data available, such as said managers returns. Do those managers that outperform the benchmark rotate too often or is that actually something viable picking those outperforming funds?

Hi Louis,

As you’ve no doubt said to clients yourself before, “past performance is not an indicator of future performance”. This is not just a legal disclaimer, the data backs this up. To quote one of my colleagues, who wrote about this topic previously:

“The SPIVA Persistence Reports show the percentage of funds that remain in the top-quartile or top-half rankings over consecutive three- and five-year periods.”

The mid-2022 US Persistence Report found that within each of the reported domestic equity categories, among all the funds whose performance placed them in the top quartile for the 12 months ending June 2020, the percentage of funds that managed to remain in the top quartile over the next two years was… zero. Not a single fund that was in the top 25% in the year ending 2020 remained there for the following two years.

The report also looked at the top 50% domestic equity funds in the 12 months ending 30 June 2018, and their performance over the subsequent four years. It found that amongst all domestic equity funds, there was a 1% chance of a top half performer, as of 30 June 2018, still being a top half performer as of 30 June 2022. For perspective, if performance was randomly distributed (i.e. the chances of being in the top 50% were the result of a coin toss), that chance would be 6.25%.”

It seems that historically at least, outperformance among active managers has not been persistent.

If you’re interested in exploring this topic in more detail, we have an adviser-only version of this report that provides additional context. Please contact us at [email protected] if you’d like a copy.

Regards,

Betashares Client Services

Hmmm. Is this one of those, “Can you see the Dolphin in the 3D picture” tests? I can’t see the green line in the diagram, or the Large Cap Active Funds line, as you state, “the green line shows the proportion of Australian Large Cap Active funds (the ‘Australian Equity General’ category) that beat the S&P/ASX 200 Index over the 1, 3, 5, 10 and 15 year time periods ending 30 December 2022”. Must be me…can never see those dolphins…

Sorry Ho, the text has been corrected. The legend for the chart is correct though.

Generally the share market is highly overvalued. With a downturn imminent within the next 12 months of the order of 30 to 50%, isn’t it better to be in cash? Protect the downside although one may lose some due to inflation.

Hi Max,

Investors always have the option of managing their own cash balances if they so wish, simply by reducing their equity holdings. As you point out though, this does introduce the risk of making a loss in real terms due to inflation.

It’s also notoriously difficult to time the market. The market might continue to rally while an investor sits in cash, but even if they were to get the initial call right, they still need to decide when to reinvest. Two very difficult calls to make!

As we discuss in this article (https://www.betashares.com.au/insights/why-timing-the-market-is-a-fools-errand/), the biggest one-day rallies have historically occurred either during or soon after a major market crash. While, research from the Schwab Center for Financial Research, Does Market Timing Work? found that even badly timed stock market investments were much better than having no share market investments at all.

Regards,

Betashares Client Services