Wet lettuce

4 minutes reading time

Global markets

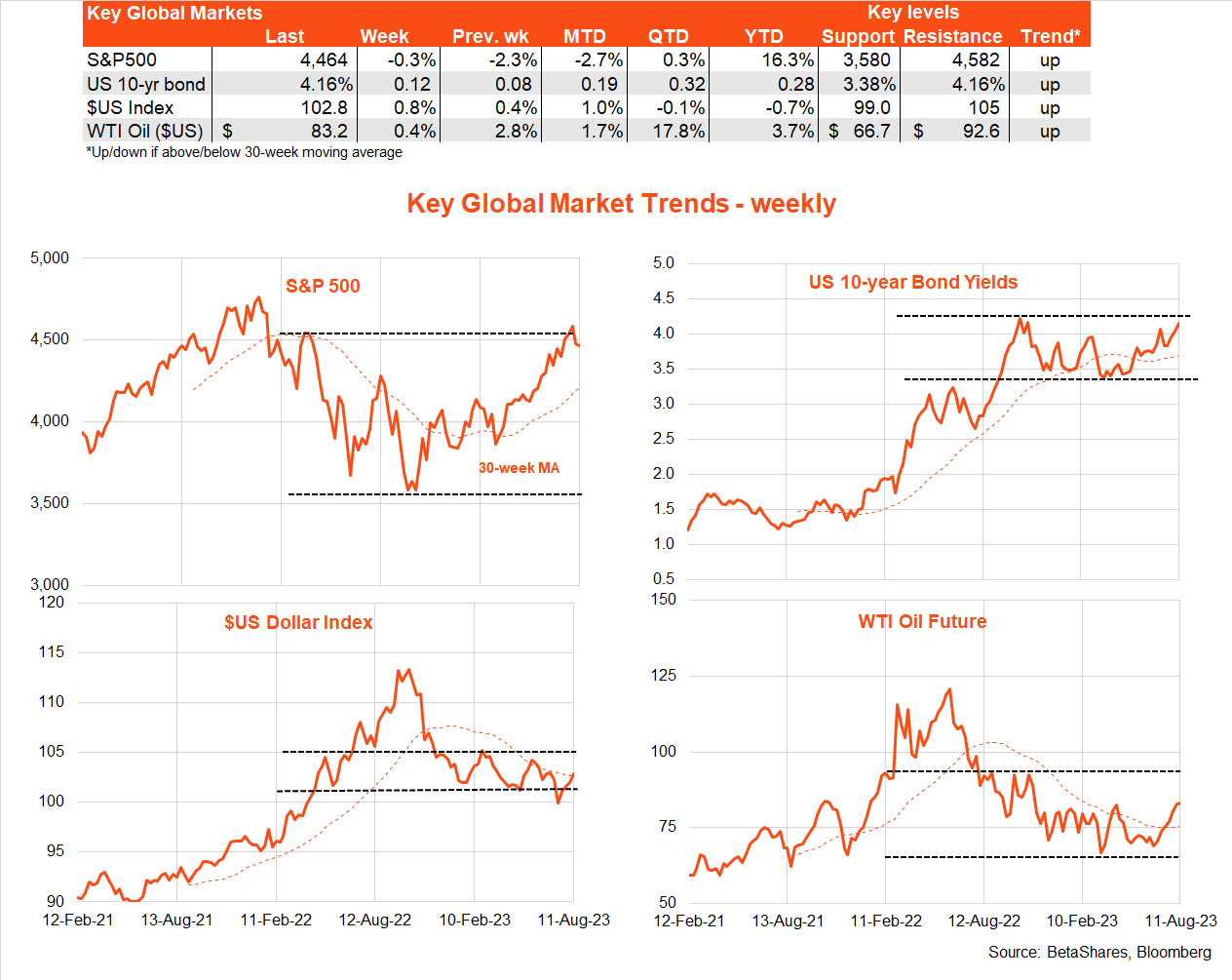

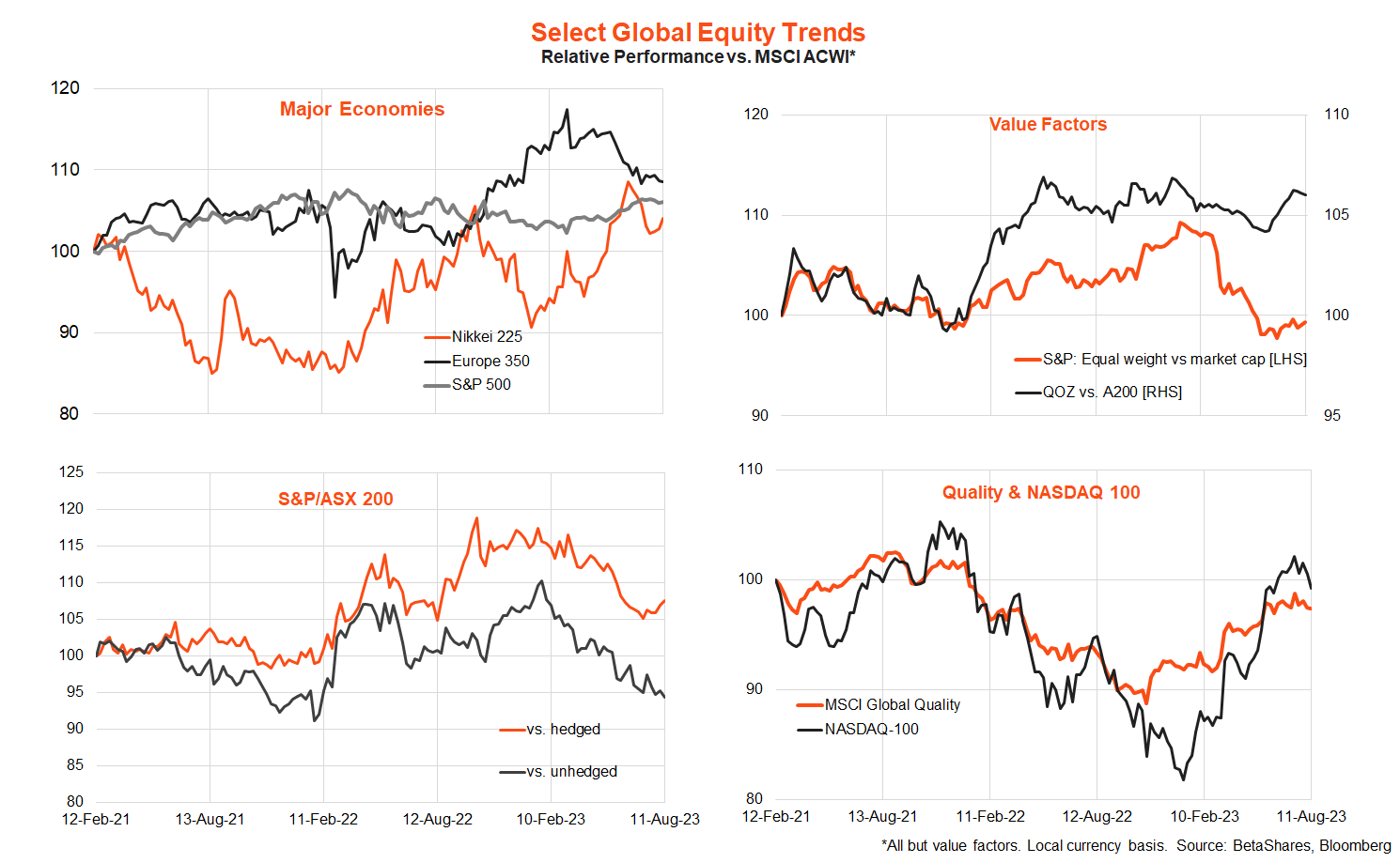

US stocks continued their consolidation last week, after a strong run over previous weeks as the ‘soft landing’ scenario started to become the consensus call. Indeed, last week there was a sense that the good news now appeared largely priced in, with equities and bonds failing to rally much on another reassuring US CPI result. Both the headline and core US CPI rose 0.2% in July, in line with market expectations.

Not helping the market is the – perhaps somewhat surprising – steady creep up in long-term bond yields in recent weeks. This likely reflects the spate of US credit downgrades (Moody’s chimed in with a credit downgrade for some mid-sized US banks last week), a recent lift in energy prices and reduced fears of a US recession any time soon.

At 4.16%, the still high level of US 10-year bond yields is making the US S&P 500 Index – which is trading at a forward PE ratio of 19.3 – uncomfortably pricey. The equity risk premium (forward earnings yield less 10-year bond yields) is now down to a skinny 1%! While waiting for a speedy rebound in earnings and/or lower bond yields to justify current valuations, these rich valuations make Wall Street vulnerable to a correction on the flimsiest of news.

One potential reason for a correction could be a backup in headline inflation given the recent lift in oil prices – which are up 20% in the past two months. One warning shot across the bow was Friday’s slightly higher-than-expected lift in producer prices, which hurt both bonds and stocks on the day.

Other key global news last week was another set of soft Chinese data, with annual consumer price inflation turning negative in July. Markets await a new stimulus package with bated breath!

Key global events this week include Wednesday’s minutes of the recent Fed meeting at which rates were hiked another 0.25%. The health of US retail spending will also be of interest, as will China’s monthly update on retail sales and industrial production.

Australian market

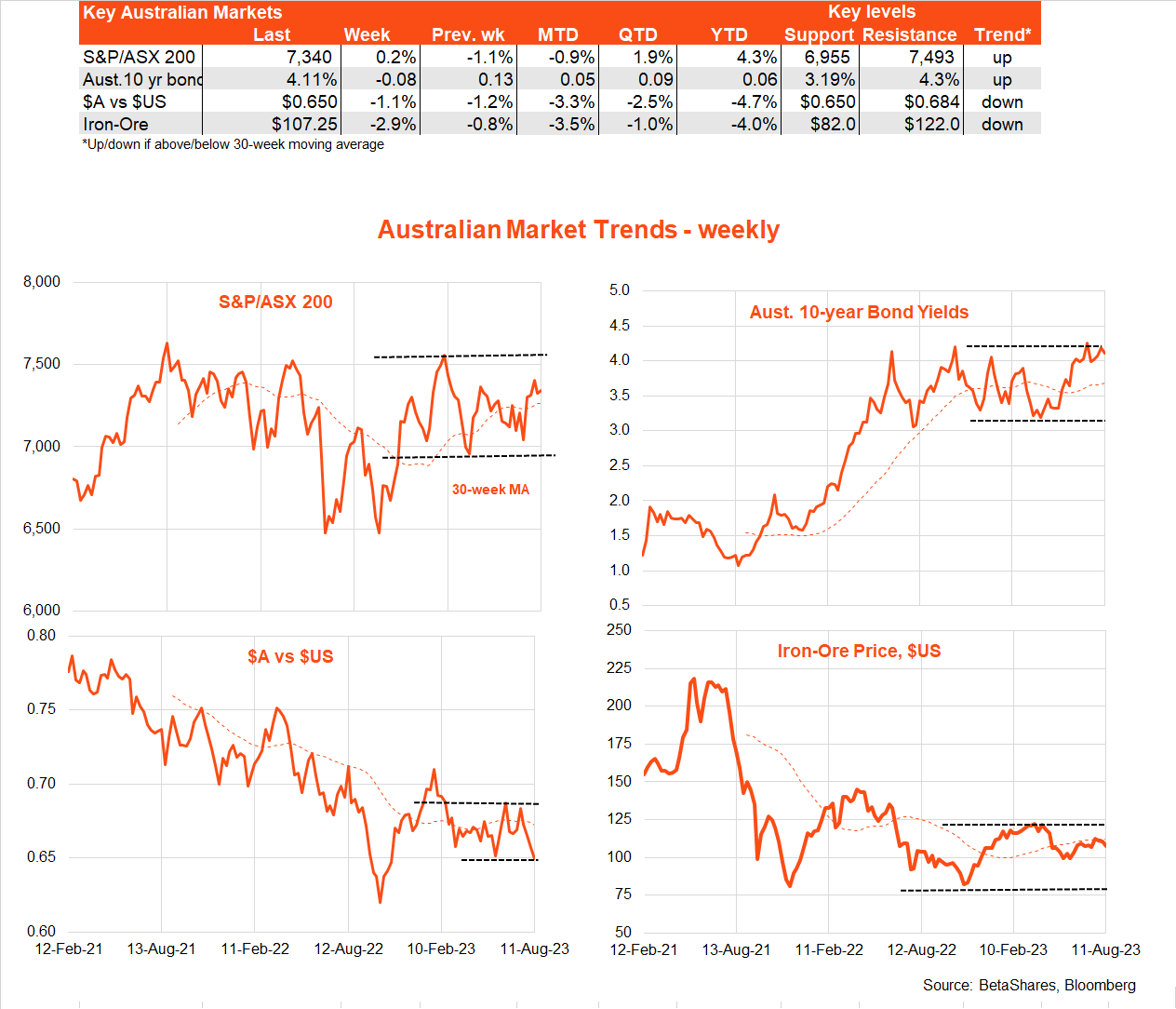

Last week’s local economic data generally painted a picture of resilience, with a small gain in ANZ Job ads in July and still firm business conditions according to the NAB monthly survey. In fact, one worry in the NAB business survey was a bounce back in wage and price indices, which may reflect the recent minimum award wage increase and lift in energy prices.

Also noteworthy last week was the slump in the $A, which at one point traded below US 65c. This reflected rising expectations that the RBA had finished raising rates, along with growing concern over the Chinese economic outlook.

Key local highlights this week include Tuesday’s minutes of the recent RBA policy meeting and the July labour market report on Thursday. The minutes are likely to confirm a modest ongoing tightening bias by an increasingly ‘data dependent’ RBA.

On this score, Thursday’s labour force report is likely to reveal a further solid employment gain of 20k – underpinned by strong immigration – with the unemployment rate holding steady at 3.5%. That should not be enough to goad the RBA into raising rates next month – for that, we’ll likely need to see a much higher than expected monthly CPI report later this month.

Have a great week!

| Top events of the past week | Comment |

| Mixed US inflation report | While benign, the US CPI report was broadly in line with expectations while producer prices were a bit higher than expected. |

| Moody’s US Bank downgrade | Following the recent Fitch US sovereign debt downgrade, Moody’s added to the angst by downgrading the credit rating on some mid-sized US banks – citing funding cost pressures and slowing credit growth. It also placed some larger banks on negative credit watch |

| Soft Chinese inflation | Although not as weak as feared, the July Chinese CPI report confirmed outright deflation over the previous 12 months. |

| Key events to watch this week | Comment |

| Fed and RBA minutes | Both central banks release minutes of their recent policy meetings, which could provide hints as to the strength of their ongoing tightening bias. At this stage markets attach a low probability to rate hikes at their September policy meetings. |

| Chinese activity data | China releases key retail spending and fixed asset investment reports on Tuesday, which may well show a faltering economic recovery. |

| Australian employment report | Underpinned by strong immigration, another solid employment gain is expected on Thursday. Of interest is whether enough jobs were created to keep up with supply – thereby allowing the unemployment rate to hold steady at 3.5% as expected by the market. |