4 minutes reading time

- Currency hedged

Over the past month we have seen increased appetite for currency hedged global equity ETFs. This includes very significant inflows into our own Global Shares Currency Hedged ETF (ASX: HGBL) from asset allocators seeking to position their portfolio for an appreciating Australian dollar.

Most financial professionals are familiar with the concept of currency hedging and how it can impact portfolio returns, we discussed this here.

However, when considering which currency hedged funds to use there is another very important detail that is lesser known but vitally important to investor outcomes.

Avoiding nasty surprises

Investors may have experienced currency hedged funds with lumpy distribution profiles that, at times, pay significantly higher distributions relative to an equivalent unhedged strategy.

These outcomes are likely the result of a fund manager not making certain tax elections for its currency hedging strategy. More specifically, this can happen when a fund manager does not make specific TOFA (Taxation of Financial Arrangements) elections for their funds. Not making these elections can create an undesirable burden for investors who either do not receive the income they would expect or face an unexpectedly high tax bill come financial year end.

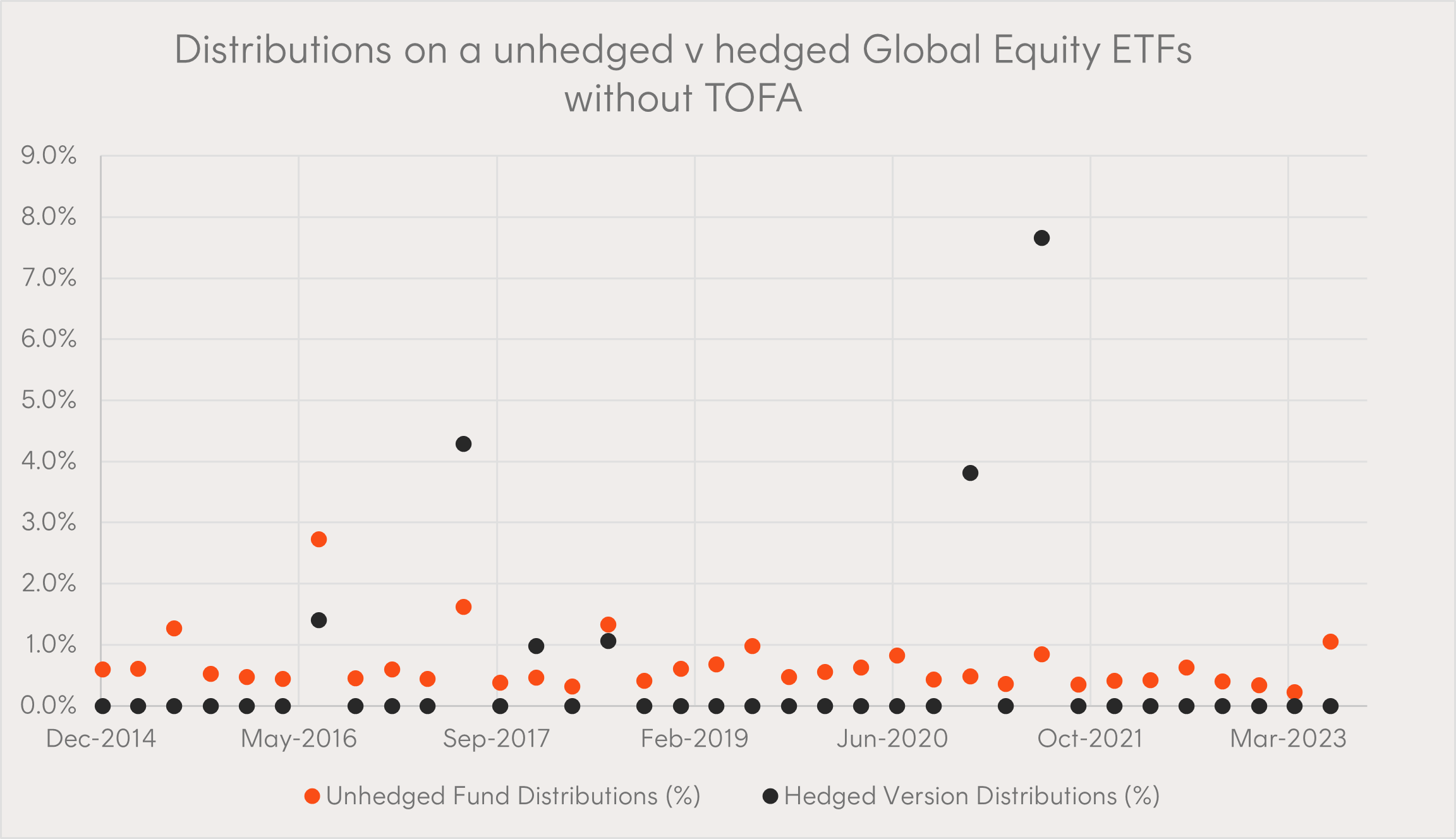

Chart 1 below shows an example of the distribution profile for two ETFs that aim to track the same global equity index, holding the same underlying portfolio of shares. The only difference is that one ETF provides unhedged exposure and the other employs currency hedging. Over the past five years, the hedged ETF has experienced a volatile distribution pattern. Four out of these five years, the hedged ETF distributed 0%[1], and in the other year the yield was 11%, potentially leading to a significant tax event for investors.

Chart 1: Distributions of unhedged v hedged Global Equity ETF without TOFA

Source: Bloomberg, as at Aug 2023. Past performance is not an indicator of future performance.

TOFA and currency hedging

TOFA rules permit certain tax elections to be made on a fund’s gains and losses. For an equity fund with a currency hedging strategy, there is a TOFA hedging election that allows the manager to align commercial outcomes of the hedging strategy with tax outcomes. This ultimately results in a better matching of gains/losses from the currency hedging strategy with the gains/losses arising on redeeming underlying assets.

Specifically, when FX forward contracts are used for currency hedging, TOFA allows for any P&L realised on the monthly “rolling” of those contracts to be linked to the underlying assets of the fund from a tax perspective. As such this P&L does not need to be treated as taxable income assessable at the time of realisation, but deferred until the underlying assets of the fund are disposed of (and therefore also effectively included on capital account rather than income account).

Where a currency hedged fund has not elected into TOFA, the additional tax payable by the end investor may be quite material.

Making the TOFA election

Betashares has made TOFA elections for our core currency hedged global equity funds. This includes:

If you had any questions about TOFA elections or were after currency hedged fund comparisons, please reach out to your respective BDM or to [email protected].

This is not a recommendation to buy units or adopt any particular strategy. You should make your own assessment of the suitability of this information. Past performance is not an indication of future performance. No assurance is given regarding the future performance of the Funds or the payment of any distributions. Betashares Capital Ltd (ACN 139 566 868 AFS Licence 341181) (“Betashares”) is the issuer of the Funds. This is general information only and does not take into account any person’s particular circumstances. Investors should read the relevant PDS (at www.betashares.com.au) before deciding to buy or hold units. Investors may buy units on ASX through a broker or financial adviser. To the extent permitted by law Betashares accepts no liability for any loss from reliance on this information. Future outcomes are inherently uncertain. Actual outcomes may differ materially from those contemplated in any opinions, estimates or other forward-looking statements given in this information.

References:

1. One distribution during this period amounted to 0.001%.

2 comments on this

Good article Tom .

Empirical research by Prof Phil Dolan at Macquarie Funds- pre ToFA- showed (some years ago )that ‘over the long term’ currency hedging international equities to Aud made little difference to overall returns. ( ie hedge returns were similar to unhedged returns) Hedging portfolios just differed in the timing of the cash flows. The ToFA election smooths the volatility of the timing. Im wondering if it still means mean that a 50% hedged portfolio is the ‘ risk -on -neutral hedged’ portfolio ‘

Hi Stephen,

Thanks, hope you’re doing well. I have read similar studies pointing to this fact – although a lot depends on the timeframe and starting points. A lot allude to the fact that a some currency pairs, like the AUD/USD, tend to have a mean reverting level hence the similar returns of hedged v unhedged portfolios over the long-term. The short-term differences can be very significant which I touched on more in a previous article – https://www.betashares.com.au/insights/currency-hedge-your-portfolio/

With regards to a 50% hedged portfolio being the ‘risk-on neutral hedged portfolio’ I would think TOFA enhances this theory due to the better control of tax outcomes – helping to neutralise another investment risk.