The rise of HCRD - and where Aussie credit goes from here

10 minutes reading time

Financial adviser use only. Not for distribution to retail clients.

Welcome to Betashares Best & Worst, bringing you insights into our top and bottom performing funds for the month, as well as a spotlight on some funds with interesting recent performance stories.

August was a generally weak month for equity markets, with most major indices ending the month in the red in their local currencies. The saving grace for Australian investors was a weakening AUD, which helped to keep unhedged global equity exposures in the green. The big worry on many investors’ minds was the weak economic data coming out of China1, which was adding to concerns that the effects of the country’s property sector struggles and soaring unemployment could spill over into global markets. The one S&P 500 sector to see positive returns was energy, as the continuation of crude oil output cuts by OPEC+ (now up to 2 million barrels/day) tempered supply2.

The big news in fixed income was the US Government’s credit rating getting dropped from AAA to AA+ by Fitch ratings, citing rising debt and a “steady deterioration in standards of governance”. This, along with a high level of issuance, a yield curve tweak from the BOJ and increasing investor belief in the “higher for longer” interest rate story led to rising US treasury yields and losses in fixed income as well.

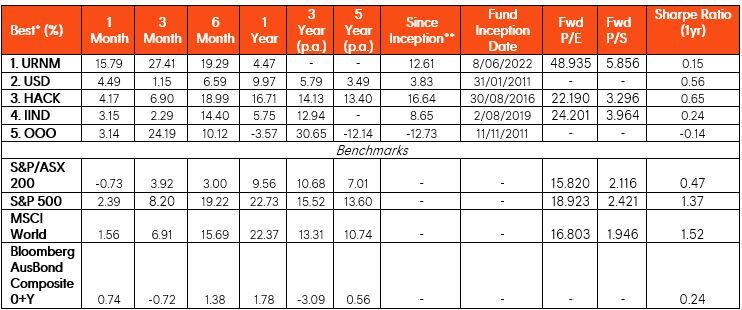

Source: Morningstar, Bloomberg. As at 31 August 2023. Past performance is not an indicator of future performance of any index or fund. All performance figures quoted in AUD.

Best:

- Betashares Global Uranium ETF (ASX: URNM): Uranium miners’ gains in August may have been helped along by an unlikely source – the recent military coup in the west African nation of Niger. The country is the world’s 7th largest producer of the metal and the 2nd largest supplier to the EU, and the politically volatile situation in the country has analysts worried about future supply3. This helped uranium to extend its gains for an eighth straight week, with uranium miners reaping the benefits of the increased price expectations. Kazakhstan-based National Atomic Co Kazatomprom (+18.85%), the world’s largest miner, led the gains after announcing a 33% increase in H1 net profit despite actual production remaining flat thanks to rising uranium prices4. Sprott Physical Uranium Trust rose 17.23%, while Cameco Corp (+9.17%) saw gains after announcing an increase in its revenue outlook on the back of rising global demand for nuclear power5.

- Betashares U.S. Dollar ETF (ASX: USD): The AUD weakened against the USD for the first half of August, as weak Chinese manufacturing and trade data increased investors’ worries about the country’s growth prospects. While the RBA’s cash rate hold was expected by markets, the AUD was further weakened by the minutes which noted that the board saw a path to the inflation target without having to raise the cash rate any further. The USD weakened slightly in the second half of the month on the back of weak US PMI numbers and slightly better figures coming out of China, but not enough to offset its gains from the first half. The AUD/USD started the month a little above 0.67, fell to a nearly 10-month low beneath 0.64, then climbed back to finish just under 0.656.

- Betashares Global Cybersecurity ETF (ASX: HACK): Cybersecurity stocks’ returns in August were largely driven by earnings announcements. Cisco Systems (+14.66%) was the largest contributor after announcing 16% year on year revenue growth and reiterating its focus on using AI to drive demand7. Splunk Inc (+16.46%) surged over 10% after reporting earnings per share of 71 cents against expectations of 46 cents8, while Indian IT giant Infosys Ltd (+8.48%) made news in Australia for charging the Federal Government A$191m to develop a calculator tool for Centrelink that processed just 784 claims before the project was cancelled9.

Source: Morningstar, Bloomberg. As at 31 August 2023. Past performance is not an indicator of future performance of any index or fund. All performance figures quoted in AUD.

Worst:

- Betashares Crypto Innovators ETF (ASX: CRYP): After a sideways couple of months, bitcoin crashed over 12% in a few days in mid-August after the news broke that Elon Musk’s rocket company SpaceX had sold off its bitcoin holdings, incurring a significant write-down in the process10. Bitcoin miners were the worst hit, with Riot Platforms (-36.24%) and Marathon Digital Holdings (-24.71%) leading the detractors. Coinbase lost 16.01% over the month, despite a small boost when the SEC approved Coinbase to offer bitcoin and ether futures trading to US-based retail customers11.

- Betashares Digital Health and Telemedicine ETF (ASX: EDOC): While the S&P 500 healthcare sector fared ok in August, returning -0.80%12, the companies within EDOC struggled, as only 11/43 holdings saw positive returns for the month. Insulet Corp (-27.93%) led the detractors as investors worried about the effect that a news class of insulin drugs called GLP-1 drugs could have on the company’s sales of insulin pumps13. ResMed lost 25.12% on the back of an earnings report in which a fall in gross margins led to lower-than-expected EPS14, while Doximity fell 30.58% after announcing it would lay off 10% of its workforce in the face of tough market conditions and slowing demand from its pharmaceutical customers15.

- Betashares Solar ETF (ASX: TANN): The global solar industry has been battered this year, demonstrated by the fact that TANN is now Betashares’ worst performing fund over 3mo, 6mo and 1yr trailing periods*. Higher US interest rates are making it harder for consumers to install new panels, and falling electricity prices are making it less attractive for them to do so. There has been a pickup in demand from Europe as a result of the Russia-Ukraine war, but not enough to offset the losses coming out of the US16. SolarEdge Technologies (-29.95%) was the largest detractor after issuing a disappointing third quarter forecast17, with Xinyi Solar Holdings (-18.51%) and Sunrun Inc (-14.32%) rounding out the top 3.

Source: Morningstar, Bloomberg. As at 31 August 2023. Past performance is not an indicator of future performance of any index or fund. All performance figures quoted in AUD.

Spotlight:

- Betashares Australian Technology ETF (ASX: ATEC): Australian technology has had a strong year, with ATEC returning 17.67% in the 6 months to 31 August, compared to 3.00% for the ASX 200. The sector has been lifted by the bull run in US tech and the hype around A.I. and semi-conductors, but Australian tech companies look very different from their overseas counterparts. While major US indices are now dominated by big tech, the IT sector makes up only around 2% of the ASX 200. Xero was the largest contributor to performance, gaining 61% in the last 6 months. The stock dropped almost 60% over the course of 2022, so the recent run-up is likely a result of paring back those losses as the economy proved far more resilient to the recent rate hiking cycle than was predicted. Carsales.com Ltd (+29.37%) and REA Group Ltd (+35.87%) benefited from resilient consumer demand and increased prices for used cars and real estate.

- Betashares Global Sustainability Leaders ETF (ASX: ETHI): With a 5-year return of 15.58% p.a, ETHI was in the top 20 best performing broad global equities large cap funds in the world over the period18. The fund invests only in companies that are in the top third of their industries for carbon efficiency and have also passed strict ethical and environmental screens. The result is a portfolio of companies that have a strong focus on long term sustainable growth. The technology sector was the largest contributor to ETHI’s outperformance over the MSCI World Index over the period. The sector contributed just over half of the fund’s 5-year returns, with Nvidia (+51.28% p.a.) and Apple (+30.95% p.a.) being the largest contributors. The third largest contributor was Tesla, which had a per annum return of 128.40% in ETHI, compared to 70.33% in the MSCI World over the 5 years. The reason for this is that Tesla was removed from ETHI in 2021 after being in a number of environmental, social and governance controversies without making any meaningful attempt to respond to or address the concerns at the time. As well as helping the fund align with prevailing investor sentiment around ESG issues, this also allowed ETHI to benefit from Tesla’s strong growth from 2018-2021 while avoiding the turbulence of the last 2 years.

- Betashares U.S. Treasury Bond 20+ Year ETF – Currency Hedged (ASX: GGOV): It’s been a difficult 12 months for investors in long dated government bonds, as the asset class was hit by the steepest interest rate hiking cycle in decades. This, along with a high level of corporate bond issuance, led to 10-year yields reaching 4.34% in August, up from a pandemic low of just 0.5%19. Their prices have continued to fall in the last few months as the US yield curve underwent a period of bear steepening, that is the currently inverted long end of the yield curve rising to meet the short end, leaving GGOV down 3.39% for the month and 13.92% for the 12 months to 31 August. The bear steepening occurred as inflation proved stickier than many expected, and investors who were previously hoping for a Fed pivot began to price in the scenario that interest rates might stay higher for longer than previously expected, made possible by the unexpected resilience of the US economy. Despite this, there has been a resurgence of interest in long term government bonds. For one, if the long-predicted US recession were to eventuate and the Fed started cutting rates, long duration bonds would be expected to see capital appreciation. As well, the yield on 30-year government bonds is now not too far behind the latest earnings yield of the S&P 500, meaning the equity risk premium has compressed significantly. Given that yields made up 87% of the annualised total return on 30-year government bonds over the last 30 years19, it’s understandable that some income-focused investors may be willing to take on the duration risk to receive the (nearly) default-risk-free yield that US treasuries provide.

For trailing performance of all Betashares funds please see: Betashares Monthly Performance – August 2023

*Excludes short and geared funds

**Annualised for funds with more than 1 year’s performance history.

^ No forward P/E estimate available

1: https://www.nasdaq.com/articles/august-2023-review-and-outlook

2: https://www.iea.org/reports/oil-market-report-september-2023IEA

3: https://www.iea.org/reports/oil-market-report-september-2023Reuters

5: https://financialpost.com/commodities/mining/uranium-cameco-hikes-outlook-rising-nuclear-demand

6: https://business.nab.com.au/the-aud-in-august-2023/

7: https://www.fool.com/investing/2023/08/17/why-cisco-systems-stock-was-up-thursday/

8: https://siliconangle.com/2023/08/23/splunk-shares-surge-strong-earnings-revenue-outlook-beats/

12: https://www.spglobal.com/spdji/en/documents/commentary/market-attributes-us-equities-202308.pdf

14: https://www.fool.com.au/2023/08/10/why-has-the-resmed-share-price-crashed-19-in-a-week/

17: https://www.barrons.com/articles/solaredge-stock-price-earnings-e54cc9fb

18: Morningstar Direct. Universe includes all ETFs and Open-Ended Funds (oldest share class only) in Global Category “Global Equity Large Cap”, totalling 7222 funds. 5 years returns are in AUD.

19: https://www.barrons.com/articles/treasury-bonds-buy-sell-c8a5f1b4

Betashares Capital Limited (ABN 78 139 566 868, AFSL 341181) (Betashares) is the issuer of the Betashares Funds. This information is general only, is not personal financial advice, and is not a recommendation to invest in any financial product or to adopt any particular investment strategy. You should make your own assessment of the suitability of this information. It does not take into account any person’s financial objectives, situation or needs. Past performance is not indicative of future performance. Investments in Betashares Funds are subject to investment risk and investors may not get back the full amount originally invested. No assurance is given that any of the companies mentioned above will remain in the relevant fund’s portfolio or will be profitable investments. Any person wishing to invest in a Betashares Fund should obtain a copy of the relevant Product Disclosure Statement and Target Market Determination from www.betashares.com.au and obtain financial and tax advice in light of their individual circumstances.

Future results are inherently uncertain. This information may include opinions, views, estimates and other forward-looking statements which are, by their very nature, subject to various risks and uncertainties. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in such forward-looking statements. To the extent permitted by law Betashares accepts no liability for any loss from reliance on this information.