Bitcoin ETFs: What are they and how do they work?

5 minutes reading time

Bitcoin and the broader crypto market ended the week higher. The bitcoin price hit a high of over US$25K, a level not seen since last August. Helping push the price higher was favourable macro data that pointed to US inflation easing again for the seventh consecutive month.

As at 19 February 2023, bitcoin was trading at US$24,652. Ethereum underperformed bitcoin over the week, up 10.59% vs bitcoin’s 12.9% gain. Bitcoin’s market capitalisation rose to US$475.7 billion, with the total crypto market sitting at US$1.12 trillion. Bitcoin’s market dominance was at 42.4%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $24,652 | $25,134 | $21,460 | 12.96% |

| ETH (in US$) | $1,696 | $1,732 | $1,470 | 10.59% |

Source: CoinMarketCap. As at 19 February 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Another bond listed on public blockchain

German multinational conglomerate, Siemens, announced it will be launching a bond on the public blockchain, Polygon. It is the first time the company has issued a blockchain-based digital bond, and is one of the first in Germany to do so. The offering will be for €60 million (around US$64 million) and will have a maturity of one year. Some of the advantages of a blockchain-based bond include the ability to sell directly to investors without a bank to function as an intermediary, and the fact that paper-based global certificates and central clearing will be unnecessary.

Peter Rathgeb, Corporate Treasurer at Siemens AG, said, “[b]y moving away from paper and toward public blockchains for issuing securities, we can execute transactions significantly faster and more efficiently than issuing bonds in the past.”1

Bitcoin NFTs growing quickly

A new NFT-like project on the Bitcoin blockchain called “Ordinals” has been growing in popularity. The Ordinals project has been inscribing images directly onto satoshis, which is the smallest denomination of bitcoin (equal to 1/100 millionth of a bitcoin). As at 9 February 2023, there were 20,000 Ordinals minted, which represented an all-time high. As of the last week, over 100,000 Ordinal inscriptions (minted) are now hosted on the Bitcoin network.

The popularity of the new project has had a major impact on the Bitcoin network. The number of transactions are at a 12-month high, which has also led to the highest transaction fees in over a year.2

Japan to start CBDC pilot program

In April, Japan is planning a pilot program to test the use of a digital yen, its central bank announced last week. The Bank of Japan (BOJ) has been experimenting for two years to decide whether to issue a CBDC. Within the pilot program, simulated transactions with private financial institutions will take place in a test environment. At present, the BOJ has stated that it does not intend to conduct any actual transactions among retailers and consumers. The program will help the BOJ be ready, should the Government decide to issue a digital yen.3

On-chain metrics

Bitcoin (BTC): Bitcoin: Number of Addresses with Balance ≥ 1

This metric reflects the number of unique addresses holding at least 1 BTC.

According to data from Glassnode, this metric has spiked over the last month and sat very close to all-time highs at 980,653 as at 17 February 2023.

Source: Glassnode. Past performance is not indicative of future performance.

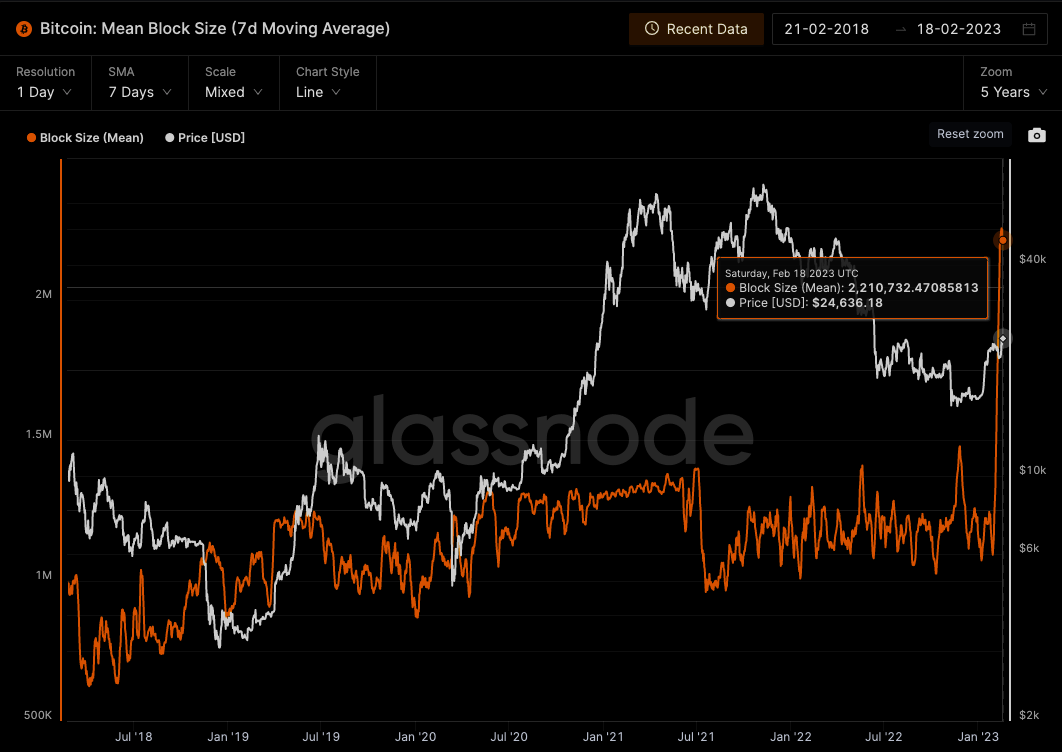

Bitcoin (BTC): Mean Block Size (7d Moving Average)

This metric shows the mean size of all blocks created within the time period (in bytes).

Based on data from Glassnode, the impact of the Ordinals project is apparent. The 7-day moving average block size for Bitcoin has hit all-time highs at 2.2 megabytes.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoin news, OKB (OKB) surged 31% over the last seven days to 19 February and hit a new all-time high, as one of the largest crypto exchanges in the world announced a new OKXChain. The OKXChain will be a proof-of-stake blockchain co-built by communities, while the OKBChain will be developed and operated by OKX.4

OKB is the utility token for one of the larger crypto exchanges in the world, OKX. OKB is an ERC-20 token (a token that uses smart contracts on the Ethereum blockchain), has its own cloud mining service, and provides access to various benefits for holders, including voting rights and trading fee discounts.5

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

1. https://press.siemens.com/global/en/pressrelease/siemens-issues-first-digital-bond-blockchain

2. https://news.bitcoin.com/bitcoin-ordinal-inscriptions-surge-past-100000-mark-spurring-development-of-supporting-infrastructure/

3. https://www.boj.or.jp/en/paym/digital/dig230217b.pdf

4. https://cryptopotato.com/crypto-exchange-okx-announces-new-okbchain-okb-skyrockets-to-new-ath/

5. https://www.okx.com/learn/what-is-okb-why-do-we-need-okb

Past performance is not indicative of future performance.

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.