Bitcoin ETFs: What are they and how do they work?

5 minutes reading time

- Digital assets

As at 24 September, bitcoin was trading at US$26,564, near flat over the last 7 days, despite sharp sell-offs in equity markets and a rising US dollar. Ethereum underperformed bitcoin, down 2.25% vs bitcoin’s 0.2% increase. Bitcoin’s market capitalisation sits at US$517.9 billion, with the total crypto market cap down to US$1.05 trillion. Bitcoin’s market dominance is up to 49.2%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $26,564 | $27,475 | $26,421 | 0.2% |

| ETH (in US$) | $1,592 | $1,665 | $1,575 | -2.25% |

Source: CoinMarketCap. As at 24 September 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Bitcoin Adoption Fund

Laser Digital, a subsidiary of The Nomura Group, Japan’s largest investment bank and brokerage group, last Tuesday announced the launch of its Bitcoin Adoption Fund. The fund will cater to institutional investors and offer high levels of risk management and compliance.

Sebastien Guglietta, Head of Laser Digital Asset Management, said: “Bitcoin is one of the enablers of this long-lasting transformational change and long-term exposure to bitcoin offers a solution to investors to capture the macro trend“1.

Citi Token Services

Citigroup Inc. last week announced the creation and piloting of Citi Token Services for cash management and trade finance. To upgrade core cash management and trade finance capabilities, the service will integrate tokenised deposits and smart contracts into Citi’s global network, the firm explained.

“Institutional clients have a need for always-on, programmable financial services and Citi Token Services will provide cross-border payments, liquidity and automated trade finance solutions on a 24/7 basis“2.

Tether acquires stake in bitcoin miner

Tether, the firm behind the world’s largest stablecoin by market cap, has made a strategic investment decision to invest in bitcoin miner Northern Data. The bitcoin miner currently sits in the Top 10 of the Betashares Crypto Innovators ETF (ASX: CRYP). The amount invested is undisclosed and was made as a strategic investment backing artificial intelligence (AI) initiatives.

Tether’s website said: “As the world anticipates the boundless opportunities driven by technological advancements, including blockchain, Generative AI, and scientific research, Northern Data Group emerges as a true pioneer3.”

On-chain metrics

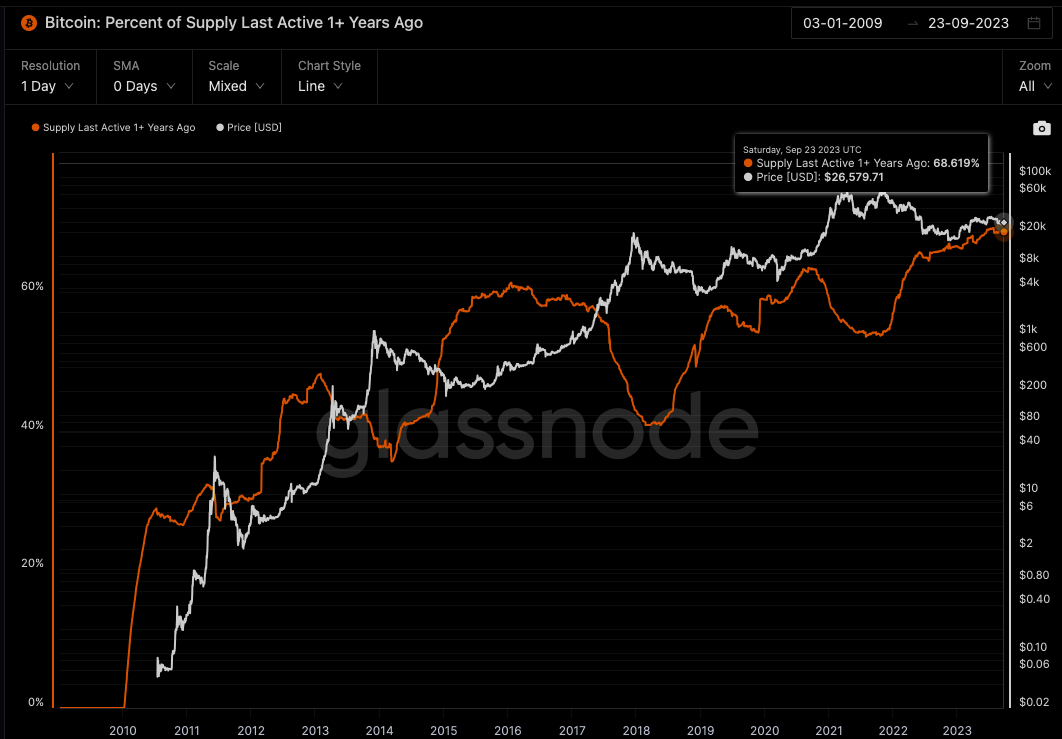

Bitcoin (BTC): Percent of Supply Last Active 1+ Years Ago

This metric displays the percent of circulating supply that has not moved for at least one year. The data suggests that investors currently are keen to hold more than they ever have been. 68.5% of supply has been inactive for at least 12 months, which represents a new all-time high.

Source: Glassnode. Past performance is not indicative of future performance.

This metric shows the percentage of unique addresses whose funds have an average buy price that is lower than the current price. ‘Buy price’ is defined as the price at the time coins were transferred into an address. At the current price, just over 63% of addresses are in profit.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Toncoin (TON) now sits in the top 10 cryptocurrencies by market cap. Helping push the price higher was an announcement of the token’s integration into Telegram. During the week, the price rose as much as 20%, but subsequently has fallen from those highs.

According to Toncoin’s website: “Toncoin is TON’s native cryptocurrency. It is used for network operations, transactions, games or collectibles built on TON4.”

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio

References:

1. https://news.bitcoin.com/nomuras-laser-digital-launches-bitcoin-adoption-fund-for-institutional-investors/

2. https://www.coindesk.com/business/2023/09/19/citigroup-unveils-token-services-for-institutional-clients/

3. https://cointelegraph.com/news/tether-acquires-stake-northern-data-ai-collaboration

4. https://ton.org/

Past performance is not indicative of future performance.

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.