Bitcoin ETFs: What are they and how do they work?

5 minutes reading time

Bitcoin and the broader crypto market rocketed higher over the last seven days. Helping fuel the rise in crypto markets was CPI data out of the US showing a reduction in inflation, and the expectation that the next rate hike will not exceed 0.50%.

At the time of writing, bitcoin has hit highs not seen since November, and is trading at US$20,736. Ethereum underperformed bitcoin for the week, up 20.79% vs bitcoin’s 22.36%.

Bitcoin’s market capitalisation is at US$399.4B, with the total crypto market sitting at US$973.8B. Bitcoin’s market dominance is up to 41%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $20,736 | $21,075 | $17,093 | 22.36% |

| ETH (in US$) | $1,526 | $1,563 | $1,286 | 20.79% |

Source: CoinMarketCap. As at 15 January 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements. Source: Glassnode. Past performance is not indicative of future performance.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Ethereum’s Shanghai upgrade slated for March

Ethereum developers are targeting an early February date to launch its public testnets for the Shanghai upgrade, tentatively scheduled for March 2023. This follows the successful Merge upgrade which took place in September last year. However, assets put up for staking have been locked up as part of that upgrade. The Shanghai upgrade seeks to enable validator staking withdrawals so that coins that have been staked on the network can be accessed following the planned hardfork. All other upgrades have been taken off the table for the first quarter as developers prioritise the Shanghai upgrade.1

El Salvador’s Legislative Assembly has passed a digital assets bill called “Digital Asset Issuance”. The bill outlines a definitive regulatory framework for tokenised securities, altcoins and businesses that wish to transact or offer services focused on bitcoin or other digital assets. With the new law in place, the plan to issue bitcoin-backed bonds, aka the Volcano Bonds, may soon become a reality. The idea to issue $1 billion in bonds was first floated in November 2021, but has been delayed many times due to the downturn in the bitcoin and crypto market.

The new legislation also marks the creation of the National Digital Assets Commission, an agency responsible for protecting the rights of buyers and issuers of digital assets in the nation, implementing securities laws and preventing fraudulent entities from operating.2

Coinbase announces second round of layoffs

One of the largest crypto exchanges, Coinbase, will reduce its headcount by around 950 people. The exchange laid off about 18% of its employees in June last year, citing adverse macroeconomic conditions. Citing the prolonged crypto bear market, Coinbase CEO Brian Armstrong said the decision was made as part of the company’s long-term strategy to cut costs. He also noted that this is the first ‘crypto winter’ that has coincided with a broader economic downturn, another factor contributing to the layoffs.

Armstrong said: “While it is always painful to part ways with our fellow colleagues, there was no way to reduce our expenses significantly enough, without considering changes to headcount.” However, Armstrong has indicated that he remains confident that, once the bear market ends, Coinbase will stand as one of the leaders in the field.3

On-chain metrics

Bitcoin (BTC): Percent supply in profit

This metric shows the percentage of circulating supply in profit i.e. the percentage of coins whose price at the time they last moved was lower than the current price.

According to data from Glassnode, with BTC recently rallying to $21K, over 21% of the circulating supply has returned to profit since the beginning of the year.

Source: Glassnode. Past performance is not indicative of future performance.

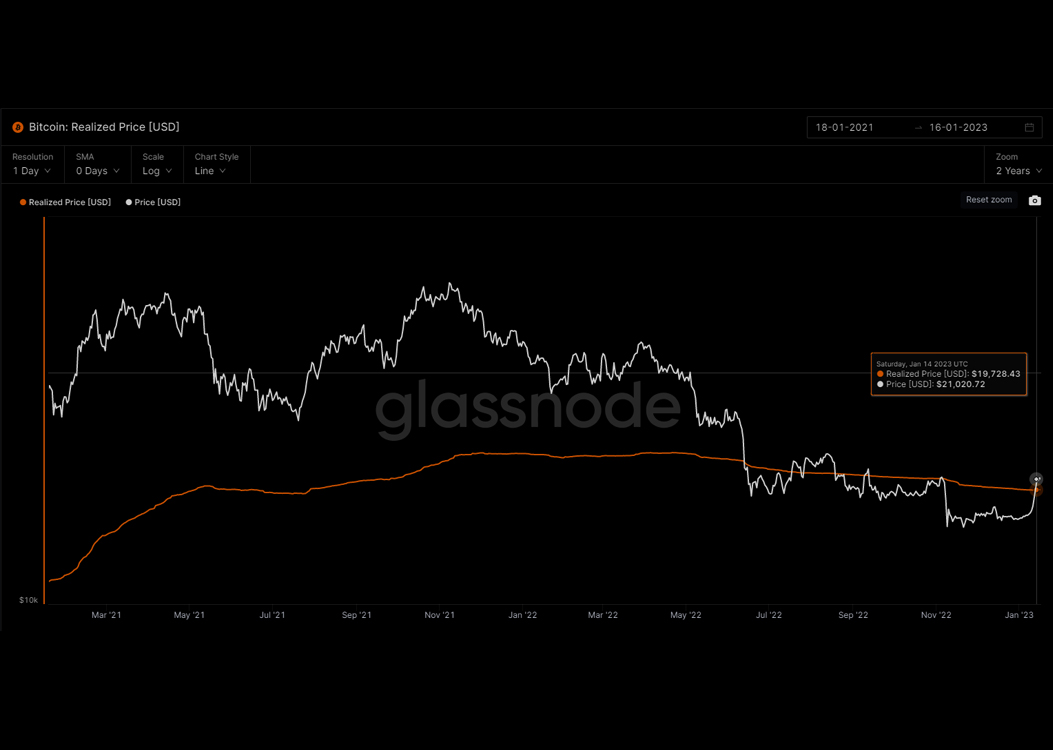

Bitcoin (BTC): Realised price

This metric shows the realised price, which is the realised cap divided by the current supply. The metric is useful to look at as it shows the economic state of the bitcoin market at an overall level. When the BTC market price is above the realised price, then on aggregate, the market participants are in profit.

According to the data on Glassnode, the market price is now trading higher than realised price for the first time since 6 November 2022, and over 68% of supply is now back in profit.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

As crypto markets moved higher, the best-performing Top 20 cryptocurrency was Avalanche (AVAX), an “open, programmable smart contracts platform for decentralised applications”4, which returned more than 37% over the last week. In addition to positive macro news, helping push the token higher was an announcement that Amazon Web Services (AWS), the world’s leading cloud computing service provider, has teamed up with Ava Labs.In a tweet, Avalanche said it was chosen by Amazon to bring scalable blockchain solutions to enterprises and governments.

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://cryptopotato.com/ethereums-shanghai-public-testnet-to-hit-the-floor-in-february-end/

2. https://www.bloomberg.com/news/articles/2023-01-11/el-salvador-passes-law-that-would-enable-bitcoin-bond-issuance?sref=6EQWk76O

3. https://www.coindesk.com/business/2023/01/10/coinbase-plans-to-cut-950-jobs-by-end-of-q2/

4. https://www.avax.network/

Off the Chain is published every Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

1 comment on this

Well I sincerely liked studying it. This tip offered by you is very helpful for good planning.