Global crypto adoption continues

7 minutes reading time

After recently breaking below the previous cycle’s high for the first time in history, bitcoin provided investors much needed relief last week and bounced off its June 18 low of US$17,708.62. However, bitcoin and other cryptocurrencies have been struggling to gain solid momentum as systemic macroeconomic issues continue to impact all markets.

At the time of writing, bitcoin is at US$21,389.49.

Ethereum showed strength, returning 17.95% vs bitcoin’s 8.71% for the week.

Bitcoin’s market cap rose to US$408.6B, while the total crypto market sits at US$963.7B. Bitcoin’s market dominance decreased to 42.4%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $21,389.49 | $21,620.76 | $19,689.17 | 8.71% |

| ETH (in US$) | $1,245.43 | $1,246.75 | $1,049.75 | 17.95% |

Source: CoinMarketCap. As at 26 June 2022. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

News we’re watching

Sam Bankman-Fried providing lines of credit to stem contagion

Millennial billionaire Sam Bankman-Fried, chief executive of FTX, has offered lifelines in the form of revolving lines of credit* to some of the largest players in digital assets. The crypto lending platform BlockFi announced on Tuesday it has secured a US$250M revolving line of credit from FTX. This comes a week after Almeda, also spearheaded by Bankman-Fried, loaned US$200M and 15,000BTC under similarly structured terms to crypto broker Voyager Digital.

There have been liquidity concerns for BlockFi and Voyager Digital as both companies had, and recently liquidated, large exposures to counterparty Three Arrows Capital after the firm failed to meet obligations for over-collateralised margin loans. Bankman-Fried’s actions in the wake of volatile crypto markets have led pundits to draw similarities to the role of central banks in being a lender of last resort, with some even calling him crypto’s very own ‘Robin Hood’.

It’s not the first time Bankman-Fried has stepped in to help crypto companies in need. In 2021, FTX offered a US$120M loan to Liquid after it lost US$90M in crypto tokens from hackers. FTX later went on to acquire the company.

In a recent interview with NPR, Bankman-Fried stated “I do feel like we have a responsibility to seriously consider stepping in, even if it is at a loss to ourselves, to stem contagion.”1

*A revolving line of credit, or revolver loan, is a type of loan that allows a borrower to continue to draw on the loan amount after repayment without going through another loan approval process. They are useful for corporations that have uneven cash flows or that may need to access emergency funds to handle unexpected expenses.

ProShares launches short-bitcoin ETF

Many will recall the U.S. release of the first futures-based bitcoin ETF (BITO) in October 2021, which garnered ProShares’ historic launch of their synthetic fund more than US$1B in volume on the first day of trading, followed by US$1B in AUM on the second.

Now, ProShares have come to market with the first futures-based short bitcoin ETF (BITI), which was released last Tuesday. BITI seeks to offer an exposure, before fees and expenses, that corresponds to the inverse (-1x) of the daily performance of the S&P CME Bitcoin Futures Index.

Many have questioned the timing of BITI’s release, including interviewers from CNBC and Yahoo Finance, drawing similarities to the unfortunate timing of BITO. ProShares’ original bitcoin ETF, BITO, was released within weeks of the US$69,000 peak of BTC. While BITI was released following a roughly 70% price decline of bitcoin to the lowest level seen since 2020.

When asked about the timing of BITI’s release, Simeon Hyman, ProShares’ Global Investment Strategist, stated “We really have no intent to time this with the market… it was really just as quickly as we could put these solutions together.”2

“Bitcoin is still a durable asset”

Rick Rieder, Chief Investment Officer (CIO) of global fixed income at Blackrock, the largest fund manager in the world, recently commented in an interview with Yahoo Finance that he believes bitcoin is still a durable asset.

Asked his thoughts around the impact of fed-tightening on crypto markets, Rieder referenced two primary points. The first is how people underestimate the impact of leverage that builds across markets when monetary policy is left loose, “we’re [currently] seeing the leverage that built up around crypto coming unglued pretty darn quickly” he said. According to Glassnode, open interest in BTC Futures contracts have fallen more than 33% to less than US$10B from their month-peak on June 6.

Rieder also alluded to how investors often search for return in riskier asset classes when traditional options, such as bonds, are offering little. “It’s not terribly dissimilar from the internet bubble … if you go back to ’99 and 2000, was the internet a bad idea? No, it wasn’t a bad idea. But you created so much excess around it and you just have to de-gear that dynamic, and I think we are seeing that today.”3

On-chain metrics

Bitcoin (BTC): Unrealised Loss

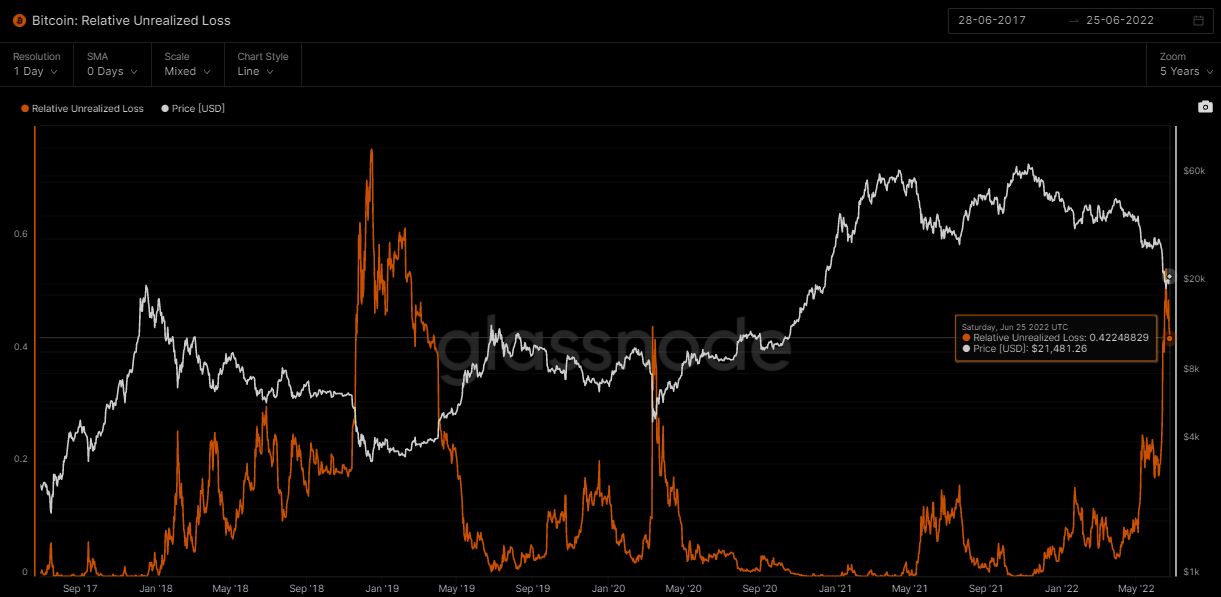

Relative Unrealised Loss is defined as the total loss, in USD, of all coins in existence whose price at most recent realisation time was higher than the current price normalised by the market cap. This metric can help in understanding the current profit and loss of stakeholders in the Bitcoin network and can shed light on investor sentiment at different stages.

Looking at data from on-chain analytics company Glassnode, the Unrealised Loss of BTC currently sits at 0.422 (or 42.2%) which is a level not seen since March 2020 when the price of bitcoin was around US$4,800. The high level of unrealised losses is surely weighing on investor sentiment.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Net Realised Profit/Loss

Net Realised Profit/Loss (USD value) is the net profit or loss of all coins spent over the relevant timeframe and is calculated as the difference between Realised Profit and Realised Loss. It provides a reflection of aggregate market sentiment, capital inflows or outflows, and trends in network profitability.

Looking at the Net Realised Profit/Loss (USD value) data for BTC, investors have realised more U.S. Dollar denominated losses in June 2022 than any other month in BTC’s history. June 13 was the worst single day of realised losses ever recorded.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

In altcoins, Elon Musk has tweeted his support for Dogecoin (DOGE) after being hit with a US$258B class-action lawsuit alleging Musk and his companies “falsely and deceptively claimed that Dogecoin is a legitimate investment when it has no value at all.”

In the lawsuit filing, the plaintiff alleges “Defendants were aware since 2019 that Dogecoin had no value yet promoted Dogecoin to profit from its trading… Musk used his pedestal as the world’s richest man to operate and manipulate the Dogecoin pyramid scheme for profit, exposure and amusement.” The filing also references comments made by Dogecoin founders who have previously mentioned they started the coin as a joke, and that it has no intrinsic value.

At its peak, Dogecoin had a market cap north of US$80B and has since fallen more than 90% in price. The only comment in relation to the case that has come from Musk was a tweet dated June 19, “I will keep supporting Dogecoin.” 4

The price of Dogecoin is up 25% since the tweet.

|

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio. |

1. https://www.bloomberg.com/news/articles/2022-06-21/bankman-fried-doles-out-credit-lines-to-stem-crypto-contagion?sref=6EQWk76O

2. https://www.cnbc.com/2022/06/20/proshares-is-launching-a-short-bitcoin-etf-this-week.html

3. https://au.finance.yahoo.com/news/black-rocks-rieder-despite-crash-bitcoin-and-ethereum-remain-durable-assets-185304312.html

4. https://www.reuters.com/legal/transactional/elon-musk-sued-258-billion-over-alleged-dogecoin-pyramid-scheme-2022-06-16/

Off the Chain will be published every Tuesday, and provide the latest news on bitcoin and the rest of the crypto market along with analysis and insights into the world of crypto.