Navigating an evolving threat landscape

6 minutes reading time

Having been in a downward trend since the rise of inflation in 2021 a recent bout of unsupportive data has seen the Australian dollar (AUD) fall to an 11-month low.

Considered a ‘risk on’ currency, the Australian dollar’s key drivers have historically been interest rate differentials, global economic growth and the associated demand for commodities in which Australia is a large exporter. However, the past 2 years have been marked by slowing economic growth, with fears of conditions worsening, and relative strength for the ‘safe haven’ US dollar.

Broad US dollar strength has come on the back of higher US real yields. Inflation continues to subside in the US at a greater pace than Australia. The interest rate differential between the two countries has also widened from 0% to 1.40% over the past 18 months. These factors make holding and earning interest on US dollars and debt relatively more appealing. Investors also look to the US dollar as an alternative to riskier assets, like equities, during periods of market volatility.

China’s sluggish re-opening, disappointing policy response, and re-emergence of credit stress in the property and shadow banking sectors is also impacting the Australian dollar. China accounts for 70% of global shipments of iron ore and the slowing pace of their economy has stoked concerns about demand for both Australia’s mining and energy export industries.

Given this weakness in the AUD – how should investors think about their currency exposure?

Currency implications in portfolio construction

In most cases, a decrease in the value of the Australian dollar leads to an increase in returns of overseas assets, when converting returns back into Australian dollars. For instance, if the Australian dollar were to decline by 10 percent relative to the US dollar, the value of investments denominated in US dollars would typically increase by 10 percent in Australian dollar terms, assuming no changes in the investments’ prices themselves.

Using a more practical example, from the peak AUD/USD exchange rate in February 2021 of US80c to the current level of US65c currency movements would have contributed approximately 23% to an Australian’s US denominated investments.

The Australian currency’s tendency to depreciate relative to the US dollar in risk- off environments can create a buffer during market downturns for Australian investors. During the first half of 2020, markets sold off heavily due to fear around the emergence of Covid. This sell-off coincided with the Australian dollar falling from US67c to US58c before recovering to the same level two months later. In the chart below, we compare the performance of an unhedged global equities index to the same index that is hedged for currency movements.

The result in returns for the two exposure is the same, as the AUD/USD exchange rate returned to the same level over the period. However, the return buffer from the depreciating Australian dollar on the unhedged index meant it experienced a lower drawdown, of 20% compared to 33%, lower volatility, and better risk adjusted returns over the period.

Source: Bloomberg. 31 January 2020 to 1 June 2020. Global equity index hedged represented by Solactive GBS Developed Markets ex Australia Large & Mid Cap Index AUD Hedged. Global equity index unhedged represented by Solactive GBS Developed Markets ex Australia Large & Mid Cap Index. You cannot invest directly in an index. Past performance is not an indication of future performance.

What options do investors have to currency hedge portfolios?

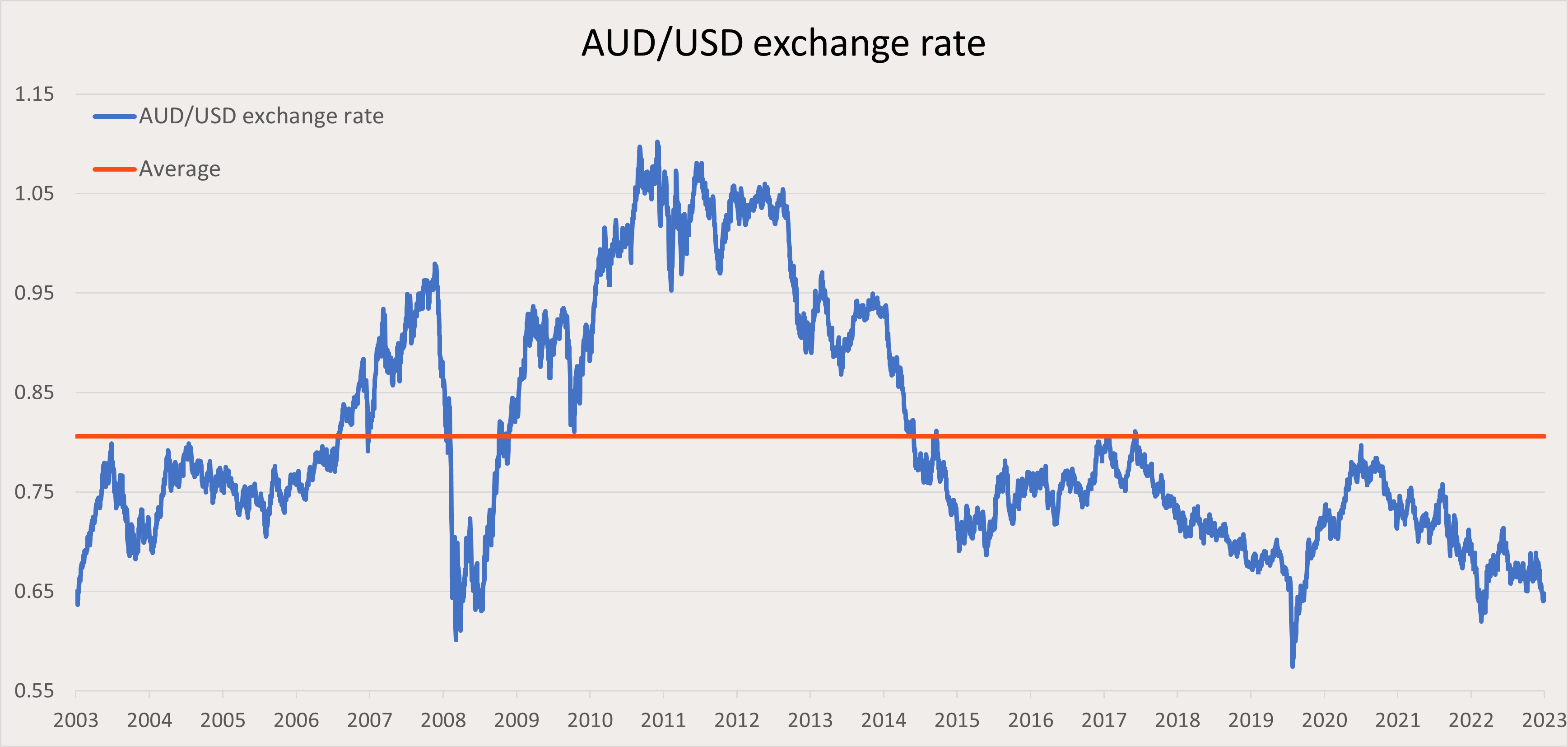

Currency hedged ETFs seek to substantially offset a fund’s exposure to movements in the value of foreign currency. Historically, we have observed US65c being a key level for investors considering whether to start investing into currency hedged ETFs. The Australian dollar recently fell below this mark for just the 5th time in the past 20 years. The long-term average exchange rate has been around US81c, as shown in the chart below. If the Australian dollar mean reverted to this level from US65c, investors in unhedged US dollar exposures would suffer approximately 20% in losses due to currency returns.

Source: Bloomberg. 25 August 2003 to 25 August 2023. Average is the average over the period. Past performance is not an indicator of future performance.

Betashares offers currency hedged versions of our core equity funds, namely:

HNDQ

Nasdaq 100 Currency Hedged ETF

,

HGBL

Global Shares Currency Hedged ETF

,

HQLT

Global Quality Leaders Currency Hedged ETF

, and

HETH

Global Sustainability Leaders Currency Hedged ETF

Betashares has also adopted TOFA treatment for efficient tax outcomes from hedging in these ETFs. Learn more about TOFA here.

The other option Betashares offers investors are currency funds, such as the AUDS Strong Australian Dollar Complex ETF and YANK Strong US Dollar Complex ETF .

AUDS generally expects to generate a positive return of between 2% and 2.75% for a 1% rise in the value of the Australian dollar against the US dollar on any given day (and a corresponding negative return when the Australian dollar falls in value on a given day)1. YANK offers the same with respect to the rising value of the US dollar against the Australian dollar.2

You can find more information on currency hedging and Betashares’ currency hedged funds, including sector and regional funds, here.

You can find here a client friendly video to help explain currency hedging.

For more information on Betashares’ ETF platform availability, please use the following link. Please reach out to your respective BDM for any additional information including fund research reports.

2. See footnote 1.