The rise of HCRD - and where Aussie credit goes from here

5 minutes reading time

- Fixed income, cash & hybrids

Many investors want a place to invest some of their funds without too much return volatility, and with ready access to their money if needed.

Typically, the easiest place to park such funds would be in an Australian bank account, either at call or perhaps in a term deposit with a short term to maturity. Our popular Betashares Australian High Interest Cash ETF (ASX: AAA), launched in 2012, is an exchange traded fund that was designed to make this process even easier, by providing exposure to cash deposits held with selected banks in Australia.

Institutional investors such as superannuation funds, however, usually try to make their spare cash work a little harder – as they have the time and expertise to invest in a range of money market securities.

The problem for most investors is that investing in these more sophisticated products is not easy – due to high minimum investment hurdles and the level of investment expertise typically required.

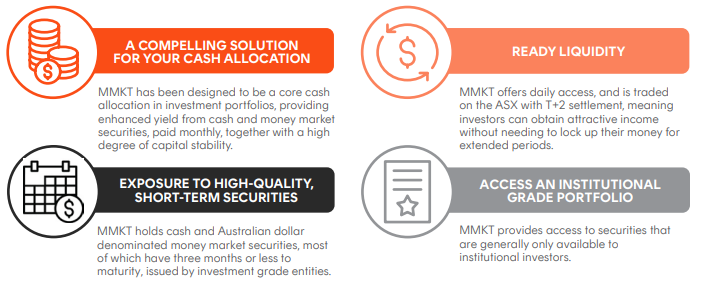

To address this, we have just launched Betashares Australian Cash Plus Fund (managed fund) (ASX: MMKT), which aims to provide enhanced income returns by enabling retail investors to access money market securities that generally are available only to institutional investors.

How do institutional investors park their money?

When institutional investors such as superannuation funds want to park money in low volatility cash-type products – either temporarily or as a long-term strategic allocation – few consider simply using a bank account.

After all, while Australian banks are sound and their deposit facilities can offer a dependable income stream, better returns are generally available across a range of money market securities that are often able to offer similarly low capital volatility and high liquidity, without needing to tie up investors’ money for extended periods.

What are money market securities?

Money market securities are securities with, usually, low credit risk, low capital sensitivity to movements in market interest rates, and a term to maturity of less than 12 months.

These investments include low volatility securities such as negotiable certificates of deposits and commercial paper. They may also include floating rate bonds with a relatively short remaining term to maturity (less than 12 months) – and whose capital value, therefore, is not very sensitive to changes in the general level of market interest rates.

Being designed for large institutional investors, the minimum investment in many of these securities tends to be beyond the reach of all but the largest investors. Given the diversity of instruments on offer, a level of expertise is also required, not to mention, an ability to deal in Australia’s wholesale money market.

Invest like the institutions do

To address these problems, and ‘democratise’ access to these often-better yielding cash-like investments, Betashares has launched Betashares Australian Cash Plus Fund (managed fund) (ASX: MMKT).

MMKT invests not just in cash and bank deposits, but also in a range of other money market securities as described above, with a high level of liquidity and low capital return volatility.

The Fund aims to provide an attractive yield (before fees and expenses) that exceeds the institutional investors’ most widely followed cash return benchmark, the Bloomberg Ausbond Bank Bill Index. Like all other Betashares cash and fixed-income funds, income returns on MMKT will be paid monthly.

High-quality and low-duration investments

Like all Betashares exchange traded products, you can buy or sell units in MMKT on a daily basis, ensuring you can access your funds within T+2 ASX settlement.

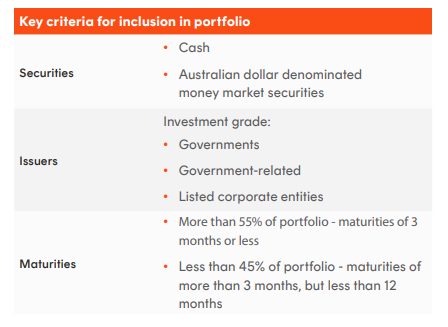

With the aim of providing a high level of liquidity and limited capital volatility, more than 55% of Fund assets are invested in cash or money market securities with three months or less to maturity from the date of acquisition of the instrument or security (which are generally regarded as ‘cash equivalents’). All other deposits and money market securities must have a remaining term to maturity of less than 12 months.

MMKT – key criteria for inclusion in portfolio

All securities in MMKT’s portfolio must be from investment grade issuers, with at least 25% of fund assets held in securities with a AAA to AA- S&P long-term credit rating.

Conclusion

MMKT aims to provide attractive monthly income to investors by offering diversified exposure to not only Australian bank deposits, but also a range of more sophisticated cash-like money market securities usually only available to institutional investors.

To learn more about MMKT, visit the fund page. There are risks associated with an investment in the Fund, including interest rate risk, credit risk, and market risk. Investment in the Fund does not receive the benefit of any government guarantee. Investment value can go up and down. An investment in the Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

Betashares Capital Ltd (ABN 78 139 566 868 AFSL 341181) is the issuer of the Betashares Fund. The information in this article is general only, it is not personal advice, and is not a recommendation to buy units or adopt a particular strategy. It does not take into account any person’s financial objectives, situation or needs. Any person wishing to invest should read the relevant PDS and TMD available at www.betashares.com.au and obtain financial advice in light of their individual circumstances.

“Bloomberg®” and Bloomberg AusBond Bank Bill Index (“Index”) are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited, the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by Betashares. Bloomberg is not affiliated with Betashares, and Bloomberg does not approve, endorse, review, or recommend the Fund. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to the Fund.

3 comments on this

AAA has a yield of less than 4% whereas term deposits are returning 5% right now. So may as well stick with a TD!

agree,

don’t know why you would recommend such a product that is still subject to market fluctuations, and yet pays less than sitting in a bank account with a government guarantee up to 250k

Hi Steve & Kym.

The current interest rate earned on AAA’s bank deposits, net of management costs, is 4.44% p.a., as of 6 December 2023. The distribution yield is backwards-looking, so doesn’t provide an indication of the current rate being earned.

Unlike term deposits, AAA allows you to access your cash at any stage (subject to the usual ASX settlement periods).

Kym – I’m unsure if you’re referring to AAA or MMKT, but unlike bonds, the capital value of AAA will not decline in a rising interest rate environment. AAA owns nothing other than cash deposits with major banks, providing high levels of capital stability and security.

MMKT is a different product of course. It’s designed to provide a high degree of capital stability by investing in high-quality, short-term securities. Monkey market securities are able to offer low capital volatility and high liquidity, while aiming to produce higher returns than at-call deposits. MMKT’s current estimated yield to maturity, net of fees, is 4.66% p.a. (as at 7 December 2023).

Regards,

Patrick