Betashares Australian ETF Review: May 2025

3 minutes reading time

January 2023 Review: New Year, new all-time highs!

The year 2023 started with a bang for the Australian ETF industry, with the global sharemarket rebound and net investor inflows causing the industry to grow to a new all-time high in assets under management. Read on for details, including best performers, asset flow categories and more.

Exchanged Traded Funds Market cap

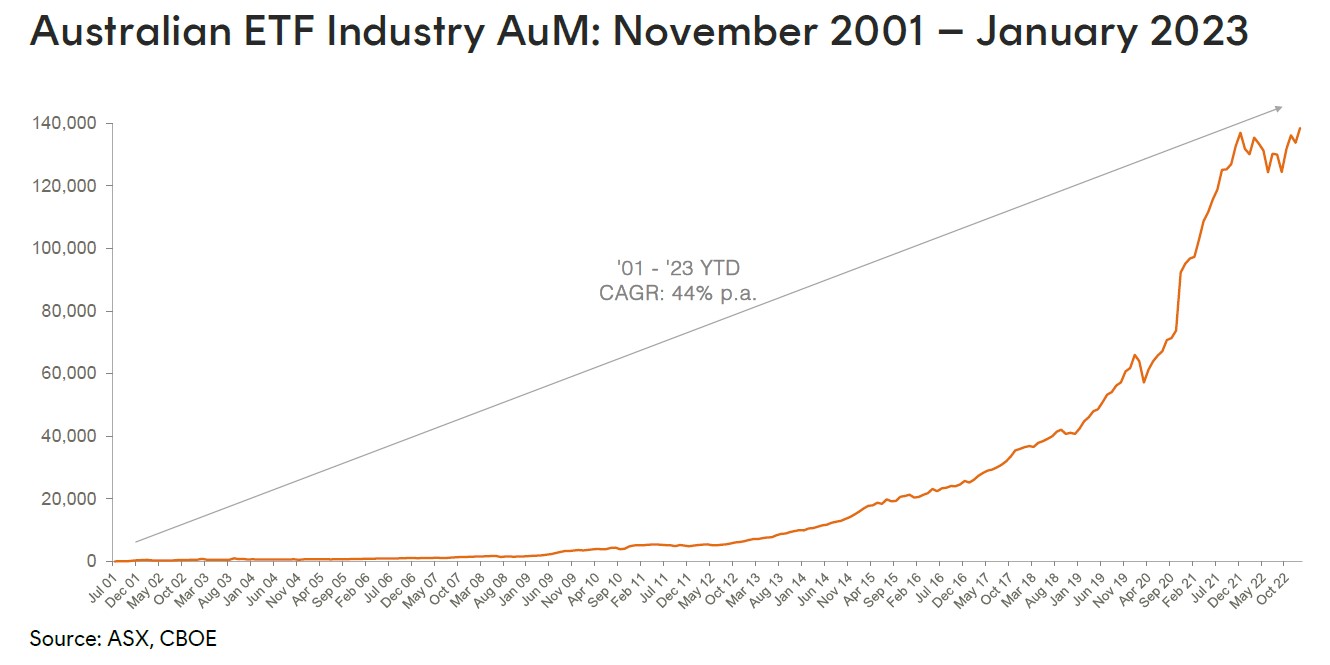

- Australian Exchange Traded Funds Market Cap(ASX + CBOE): $138.5B – new all time high

- Market cap increase for month: 3.6%, $4.7B

- Market cap growth for last 12 months: 5.1%, $6.7B

Comment: The Industry’s AuM grew 3.6%, for a total monthly market cap increase of $4.7B. Industry assets under management ended the first month of the year at $138.5B, eclipsing the all-time record set back in December 2021.

New money

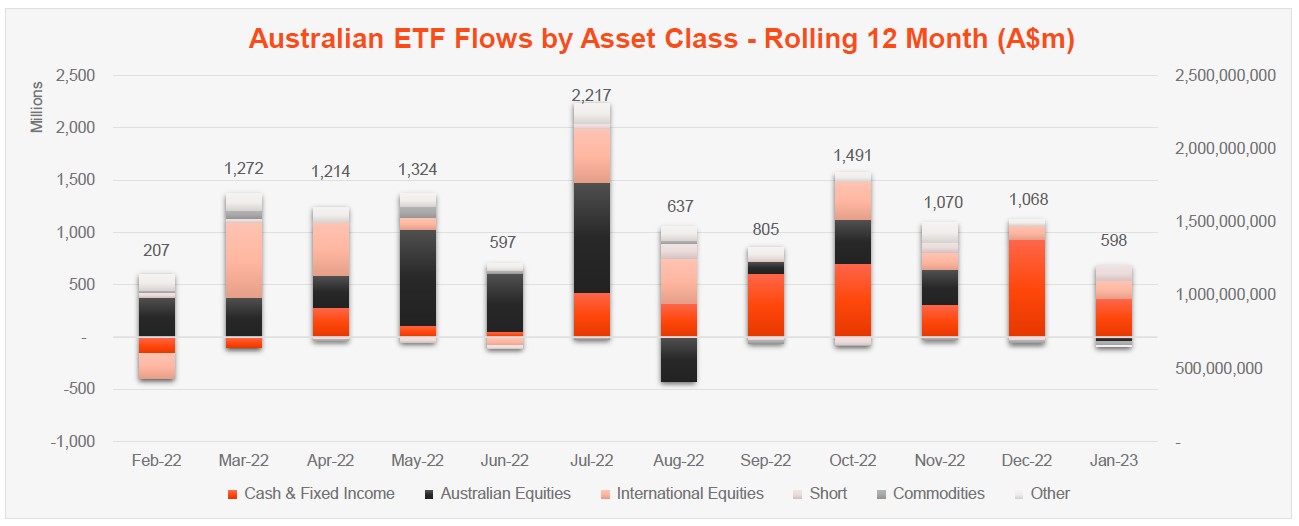

- Net inflows for month: +$0.6B

Comment: The sharemarket rally contributed the bulk of industry growth this month, with only ~12% of the growth attributable to net flows (net new money), which amounted to $0.6B.

Products

- 322 Exchange Traded Products trading on the ASX

- 3 new products launched this month 3 active ETFs and 2 new issuers on ASX: Milford launched an Australian hedge fund and Alphinity launched two global equity Active ETFs

Trading value

- ASX ETF trading value increased 5.1% for the month, for a total of $7B

Performance

It was a dramatically positive month for performance in the crypto space which recorded a significant turnaround. As such our CRYP Crypto Innovators ETF was the best performer in the industry this month, returning ~48% for the month. Tech also rebounded heavily and so tech-focused exposures rallied – our IBUY Online Retail and E-Commerce ETF , for example, returning 15% for the month.

Top 5 category inflows (by $) – January 2023

| Broad Category | Inflow Value |

| Fixed Income | $233,246,076 |

| International Equities | $169,446,625 |

| Short | $147,560,057 |

| Cash | $135,908,948 |

| Multi-Asset | $11,655,465 |

Top category outflows (by $) – January 2023

| Broad Category | Inflow Value |

| Commodities | ($42,411,808) |

| Australian Equities | ($37,916,695) |

| Listed property | ($16,002,534) |

| Currency | ($3,682,746) |

Top sub-category inflows (by $) – January 2023

| Sub-category | Inflow Value |

| Cash | $135,908,948 |

| International Equities – US | $100,372,366 |

| US Equities – Short | $98,498,916 |

| Global Bonds | $97,284,639 |

| Australian Bonds | $97,127,400 |

Top sub-category outflows (by $) – January 2023

| Sub-category | Inflow Value |

| Australian Equities – Sector | ($62,074,626) |

| International Equities – Sector | ($43,855,303) |

| Australian Equities – E&R – ESG Lite | ($43,634,390) |

| Gold | ($42,139,876) |

| International Equities – Europe | ($39,199,886) |

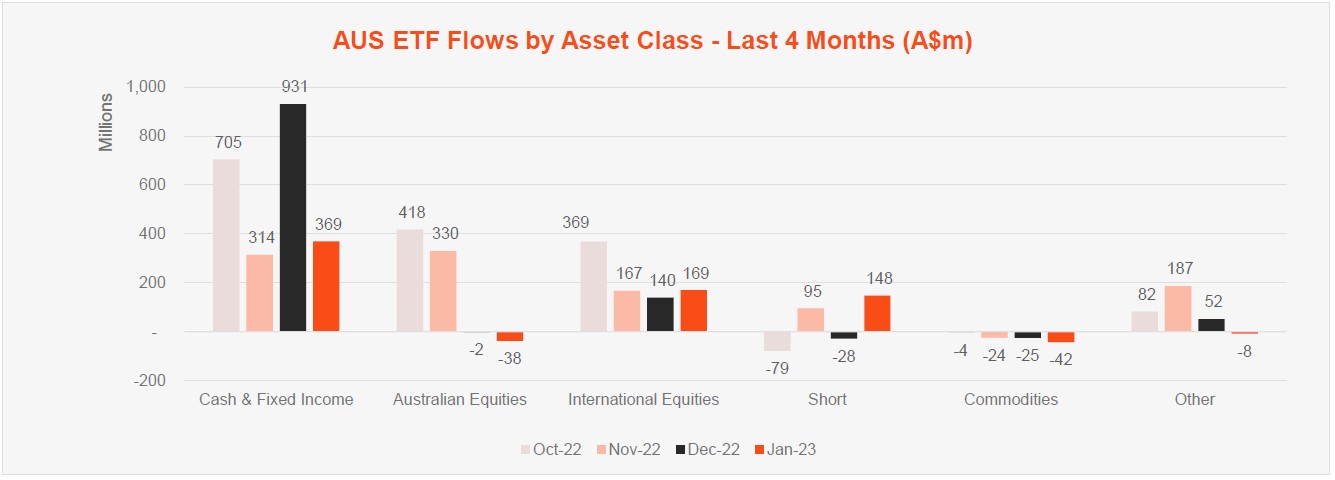

Comment: As has been the case for the last few months, we once again saw the Fixed Income category receiving the highest level of inflows ($233m) followed by International equities ($169m), with investors this month shunning the usually popular Australian equities category which received net outflows of $38m. Notably, however, and notwithstanding the strong gains for the month, investors continued to buy Short exposures which received ~$150m of net inflows – potentially illustrating that investors believe the worst is not yet over for the sharemarkets.

Finally, this month we saw a notable, and rare, change at the top end of the ETF manager ‘league table: Betashares jumping a place to become the 2nd largest ETF manager in Australia ahead of iShares as at end January.

*Past performance is not an indicator of future performance.