7 minutes reading time

- Active

Financial adviser use only. Not for distribution to retail clients.

The past 5-years was a period in which investors might expect active management to outperform, and Australian managers have been advertising just that.

With heightened volatility and uncertainty during the Covid pandemic, the return of inflation and fastest RBA hiking cycle in history, the broad market’s poor returns during 2022, and the seemingly unjustifiable valuations of Australia’s banks. What a perfect environment to find opportunities in the market and provide alpha.

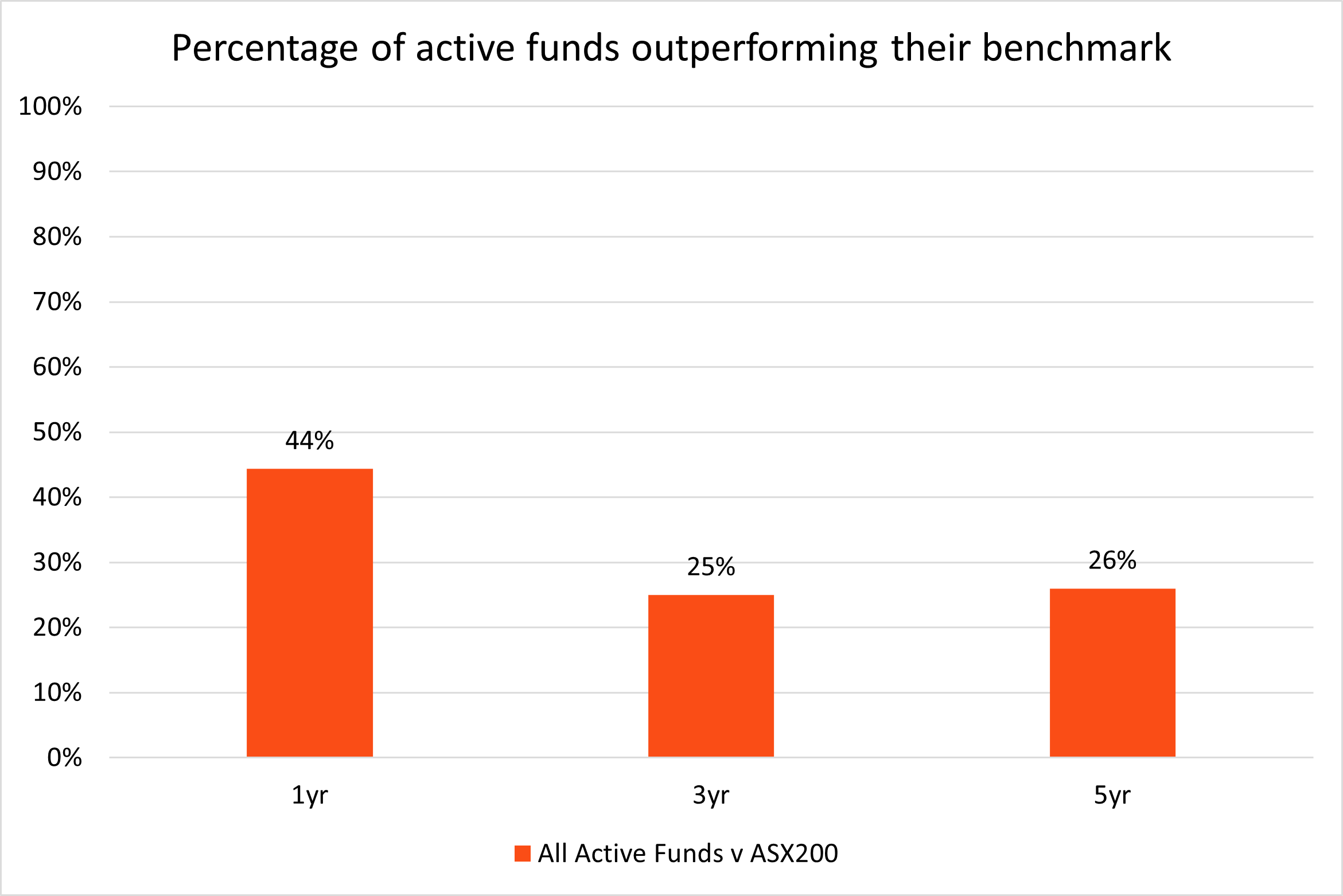

Despite this the most recent S&P Indices versus Active (SPIVA) report found that over a 5-year period 74% of Australian active managers in the Australian Equity General category underperformed the chosen S&P/ASX 200 (ASX 200) benchmark – or just 26% managed to outperform.

But is SPIVA really the best benchmark for all active managers?

Source: SPIVA Australian year end 2024.

Commonly, managers will retort that SPIVA’s benchmarks do not take into account fees and that their funds return profile and objectives might be different to what the broad market is providing. These are fair points and as both our understanding and ability to measure the drivers of investment returns evolve, we may now have better tools to assess active manager performance relative to more appropriate investable alternatives.

Active meets passive: Smart beta

Historically, investors have used the most relevant and accessible data available to them to evaluate active manager performance. First by comparing managers against one another, and currently by measuring them against broad market capitalisation weighted benchmarks, such as the ASX 200 in the SPIVA reports.

While the current approach provides useful context, it may overlook systematic sources of return that are not captured by traditional benchmarks. The growing body of research on factor-based investing has introduced an additional lens through which to view returns – highlighting that much of what was previously attributed to active skill may, in fact, be explained by exposure to well-documented investment factors.

Combined with the improvements in indexing technology, investors now have available passive, rules-based indices that aim to capture the returns of these factors. These indices may serve as a more relevant reference point, allowing investors to better isolate the skill of an active manager in providing outperformance beyond the systematic returns embedded in markets and factors.

For example, an active global equities manager with a ‘quality’ investment style, seeking out companies with high, sustainable earnings and low debt-to-equity ratios, may outperform a broad market capitalisation weighted benchmark, like the MSCI World Index, simply because the quality factor has been outperforming. However, the same manager may underperform a quality factor index, like the MSCI World Quality Index, if their stock selections lag the diversified basket of high-quality companies in the index.

Many ETFs, called ‘smart beta’ ETFs, now aim to track these factor indices, making it even more important to use the right benchmark when evaluating active managers. Investors can then use these comparisons to more appropriately guide their allocation decisions.

Betashares smart beta versus active – Australian equities

Below we aim to provide a fairer comparison for select active Australian managers over the past 5-years by comparing them against smart beta ETFs that aim to generate return from the same investment factors and looking at net of fee performance.

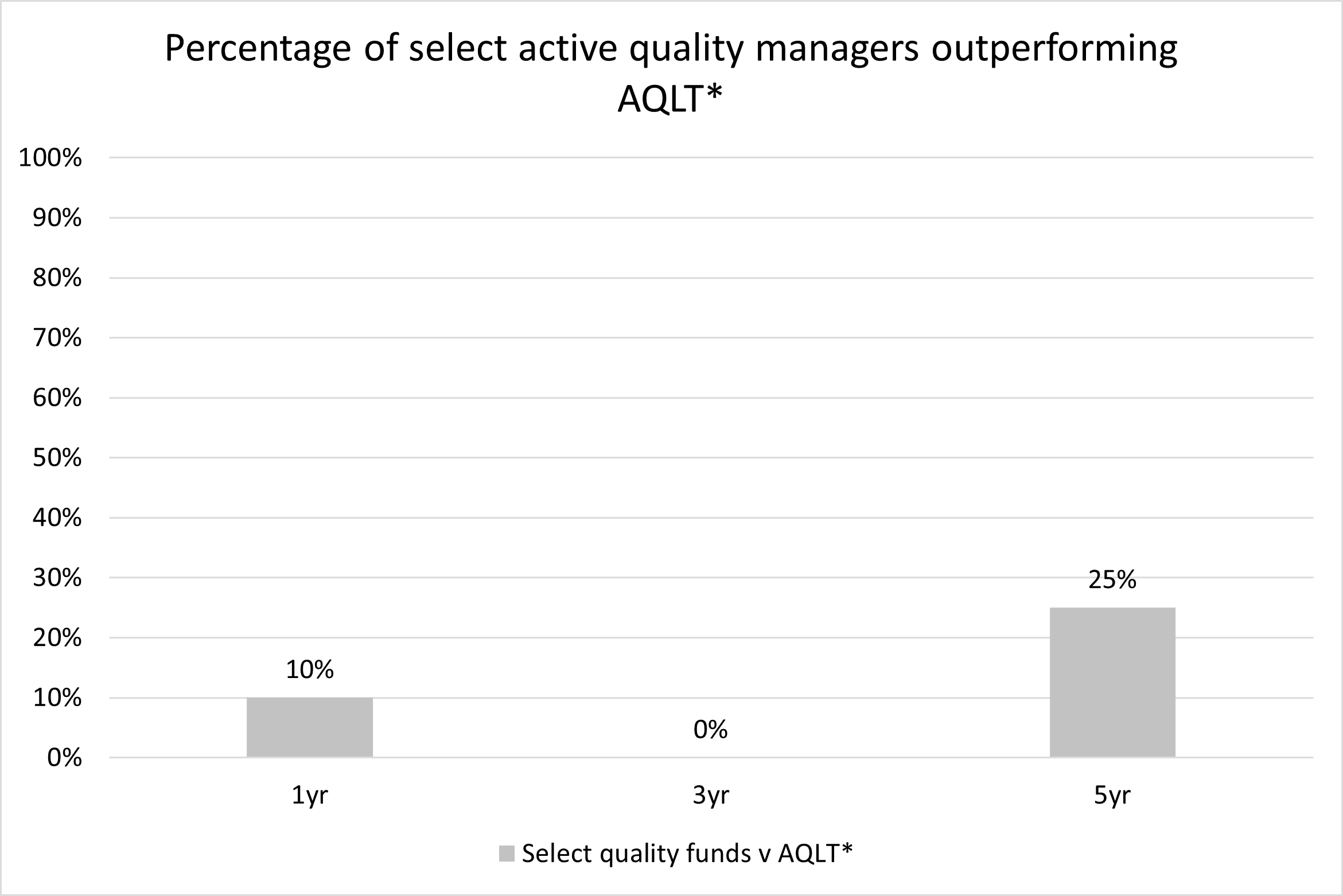

Firstly, to evaluate quality style managers we select all managers:

- in Morningstar’s Australian Fund Equity Large category (excluding geared funds),

- in the top third percentile for quality factor exposure, and

- with sufficient performance history to 31 December 2024 (to align with the most recent SPIVA scorecard).

We compare these managers performance to AQLT Australian Quality ETF . For the 3- and 5-year comparisons, we use AQLT’s underlying index (net of fees), since the Fund’s inception on 4 April 2022.

AQLT’s index selects Australian companies based on ‘quality’ metrics. AQLT sits in the top quartile for quality factor exposure amongst Australian peers.

Source: Morningstar Direct, Betashares. As at 31 December 2024. Managers selected from Morningstar’s Australian Fund Equity Large category (excluding geared funds) who rank in the top third percentile for quality factor exposure with sufficient performance history to 31 December 2024. AQLT is Betashares Australia Quality ETF. * AQLT’s index net of AQLT’s fees of 0.35% p.a. used for 3yr and 5yr comparisons as AQLT was incepted on 4 April 2022. AQLT’s index is the Solactive Australia Quality Select Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

The results show us that over the 1yr, 3yr, and 5yr time periods analysed, very few active managers outperformed the smart beta ETF. In fact, in no period was there a higher percentage of quality style active managers outperforming our chosen benchmark when compared to the generic SPIVA Scorecard which considers all active managers against the ASX 200. This points to the fact that when accounting for exposure to well-documented investment factors even fewer active managers may be outperforming than previously thought.

Over the 5-year period the active quality peer group did better than average against the ASX 200 with 37% outperforming the benchmark versus just 26% of all managers. However, and despite the inclusion of fees, AQLT proved a harder benchmark for active quality managers as it captured the systematic returns of the quality factor which outperformed over the period.

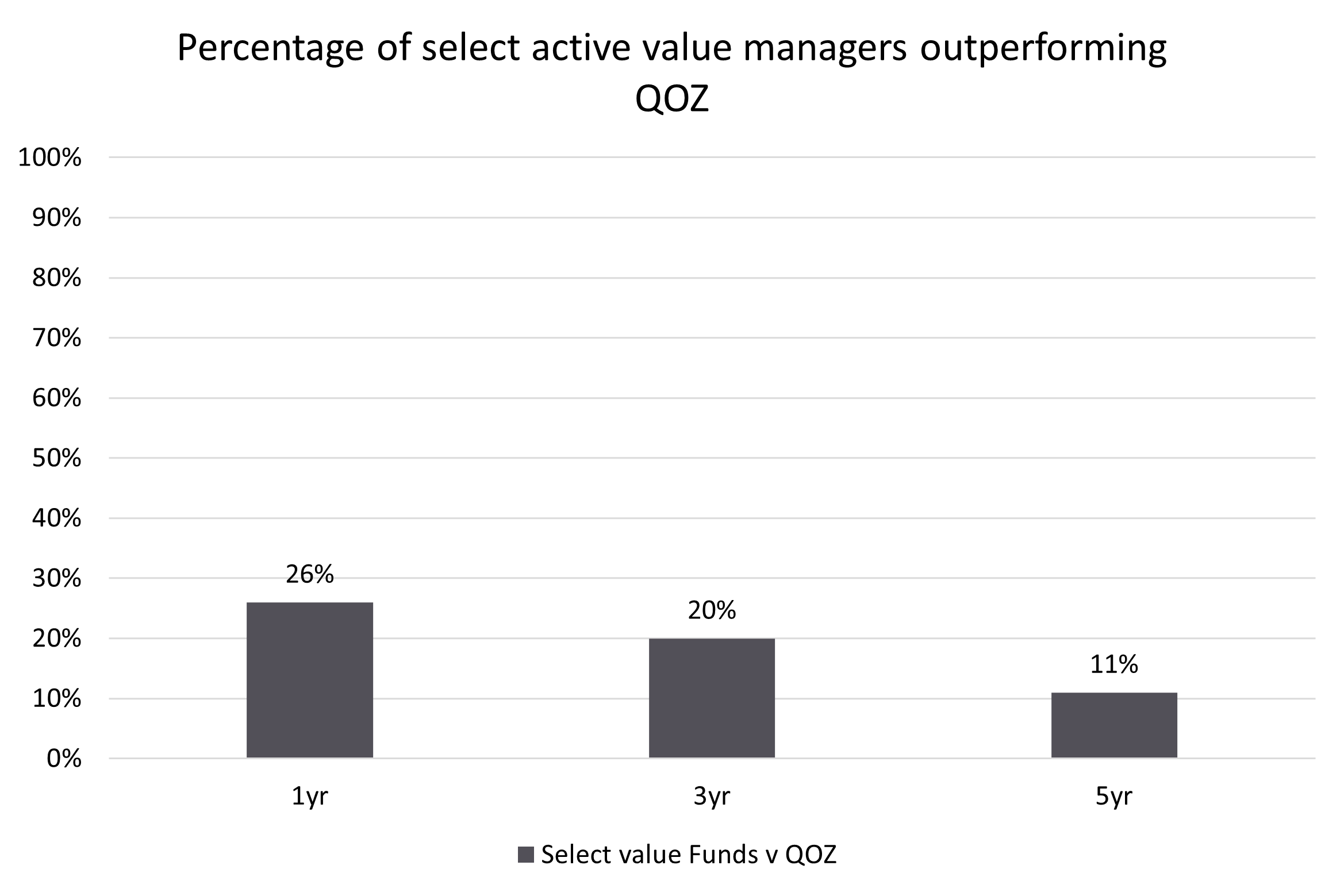

Next, we evaluate value style managers by selecting all mangers:

- in Morningstar’s Australian Fund Equity Large Value category,

- in the top third percentile for value factor exposure (to correct for potential misclassification in the self-selected Morningstar category), and

- with sufficient performance history to 31 December 2024 (to align with the most recent SPIVA scorecard).

We compare these managers performance to QOZ FTSE RAFI Australia 200 ETF . QOZ’s approach aims to deliver outperformance by selling expensive shares while buying those which are undervalued. QOZ sits in the top quartile for value factor exposure amongst Australian peers.

Source: SPIVA, Morningstar Direct, Betashares. As at 31 December 2024. Managers selected from Morningstar’s Australian Fund Equity Large Value category who rank in the top third percentile for value factor exposure with sufficient performance history to 31 December 2024. QOZ is Betashares FTSE RAFI Australia 200 ETF. Past performance is not an indicator of future performance.

Again, we find that over the 1yr, 3yr, and 5yr time periods analysed, fewer value-style active managers outperformed QOZ when compared to SPIVA’s reported numbers.

As with quality managers, value managers were more likely to outperform the ASX 200 over five years than the broader active peer group, with only 70% underperforming — however again a greater share lagged the smart beta ETF which effectively removes the benefit of systematically generated returns from the value factor by the active managers.

A better benchmark?

As smart beta ETFs become increasingly accessible, the traditional method of benchmarking active managers against broad market indices is being challenged. Our analysis highlights that when active funds are evaluated against more relevant, style-matched smart beta ETFs, rather than generic benchmarks, their performance edge narrows further.

However, this approach is not without its limitations. The use of historical performance and static factor profiles may not fully capture the evolving strategies of active managers.

Nevertheless, for investors, the takeaway is clear: benchmarking active funds against appropriate smart beta ETFs can offer a clearer view of manager skill, but this must be done thoughtfully. Investors should evaluate managers on a case-by-case basis and look to the most appropriate investible benchmarks available to make informed allocation decisions.

The decision is no longer between market beta indices and active managers. A low-cost smart beta ETF can be a very valuable addition to an investment portfolio and as the data above shows can outperform by capturing systematic sources of market returns traditionally attributed to active performance.

There are risks associated with an investment in each of the Funds. Investment value can go up and down. An investment in any Fund should only be made after considering your client’s particular circumstances, including their tolerance for risk. For more information on the risks and other features of a Fund, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.