5 minutes reading time

Reading time: 4 minutes

Technology companies continue to push the boundaries of what’s possible, and the Fourth Industrial Revolution (i.e. driven by technology) is dramatically changing the way we live. People familiar with the US-based Nasdaq 100 Index will no doubt be aware of the phenomenal growth the technology sector has seen since the Global Financial Crisis, with many of today’s largest companies having been around for only twenty years (or less). But what about the innovation that exists outside of the US technology giants, and are we able to participate in a rapidly-developing industry from the ‘ground floor’?

Enter the Asian Technology Tigers – with fast growth to date, whilst these companies may not be household names in the West, they are far from a flash in the pan.

8 reasons why the outlook for Asian Technology Companies appears bright

1. Asia is growing three times faster than the developed world

Economic growth in Asia is outpacing the rest of the world. Countries across the region have seen much higher GDP expansion over the last two decades than in the G7 advanced economies. In turn, rising wealth is fueling consumer spending, thanks to high employment levels and wage growth. Given more of our lives are spent online, and accessed through technology – spending in these areas is anticipated to increase significantly.

2. Technology and demographics are driving rapid growth

Asia’s population has now reached 4.5 billion, accounting for around 60% of the world’s population1.

It’s not just the increase in numbers, but also demographic trends that are driving Asian growth. As Asian economies develop, education levels increase, and urbanisation proceeds, poverty levels are falling and income levels are rising.

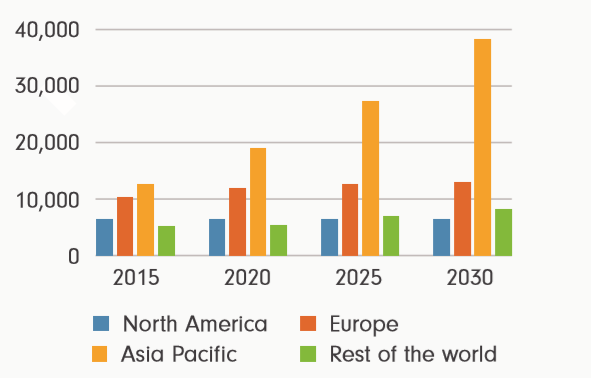

The growing ranks of the middle-class are expected to drive demand for goods and services in the region for the foreseeable future.

Spending by Asian middle class is forecast to top US$35 trillion by 2030

Source: The Brookings Institution, The Unprecedented Expansion of the Global Middle Class, 2017. Actual outcomes may differ from forecasts.

The digital revolution is also playing a central role in Asian economic growth, given Asia’s position as one of the key players in the technology industry. According to the IMF, technological innovation has accounted for nearly a third of Asia’s per capita growth over the last two decades2.

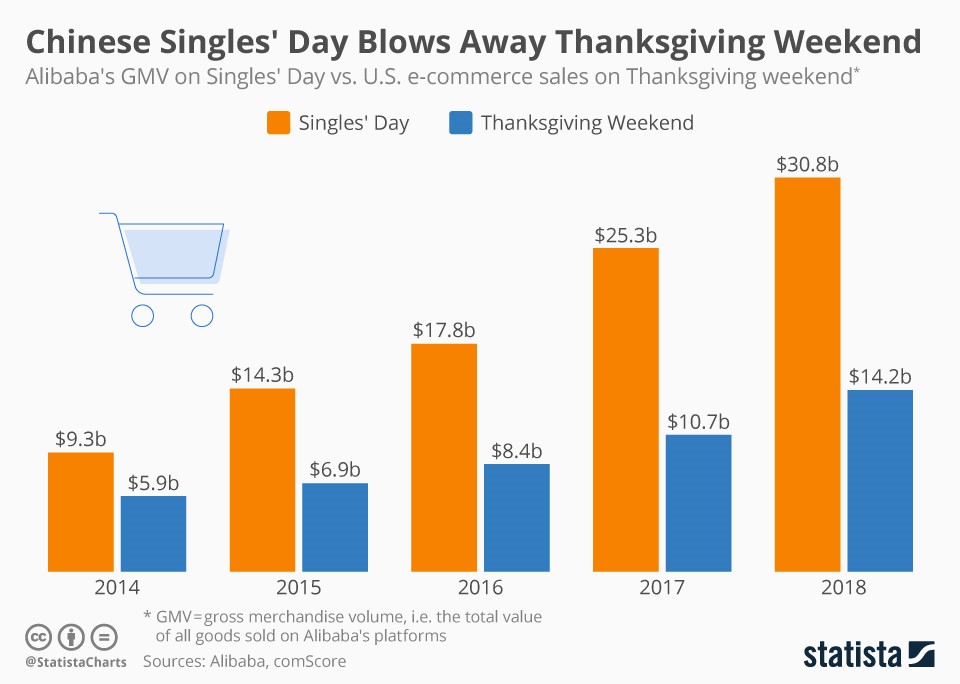

3. China Singles Day now the largest e-commerce event worldwide

As an indication of the increasing dominance of Asian technology, sales figures show that China’s online Singles Day (held every year on 11/11) is now the dominant e-commerce event worldwide. The online shopping festival, held in November, has in recent years had over double the sales of Black Friday and Cyber Monday put together – showing the sheer volume of online consumer transactions powering the Asian e-commerce revolution.

4. The Asia-Pacific region dominates the global video game market

The Asia-Pacific region has been the dominant global video game market for many years. In 2018, it was calculated that revenue from the games market in that region alone amounted to US$71.4 billion3 (A$104.1 billion), double the revenue generated by the second-ranked U.S. gaming market. In 2018, the Chinese video game industry revenue reached 214 billion yuan (~A$45 billion), representing remarkable growth of 196 billion yuan (~A$41 billion) since 2008. With unprecedented levels of growth, the online gaming industry offers an interesting insight into the rapidly developing Asian economy.

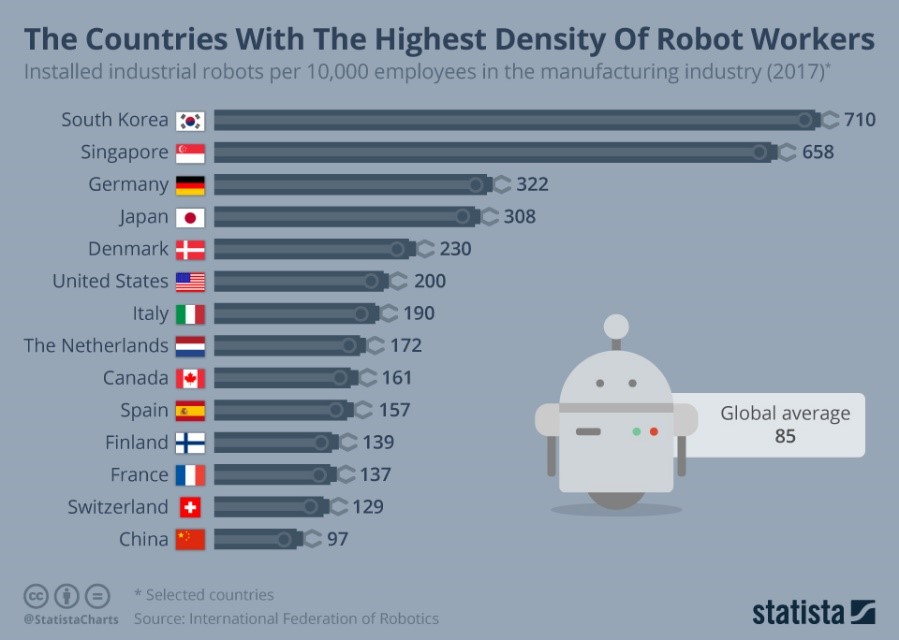

5. Asia is ahead of the curve in implementing supply chain robotics

Asian nations are embracing robotics to counteract ageing populations and increase supply side capabilities. Manufacturing countries such as Singapore and South Korea have more robots per employee than other major nations across the world – companies understand that demographics are shifting and are investing in technology to protect their business interests.

6. More graduates in technology and engineering than any other region

Asia tops the leaderboard for countries with the most STEM (Science, Technology, Engineering and Mathematics) graduates, producing the innovators of the future. In 2016 China had 4.7 million STEM graduates, India 2.6 million – with North America just 600,0005.

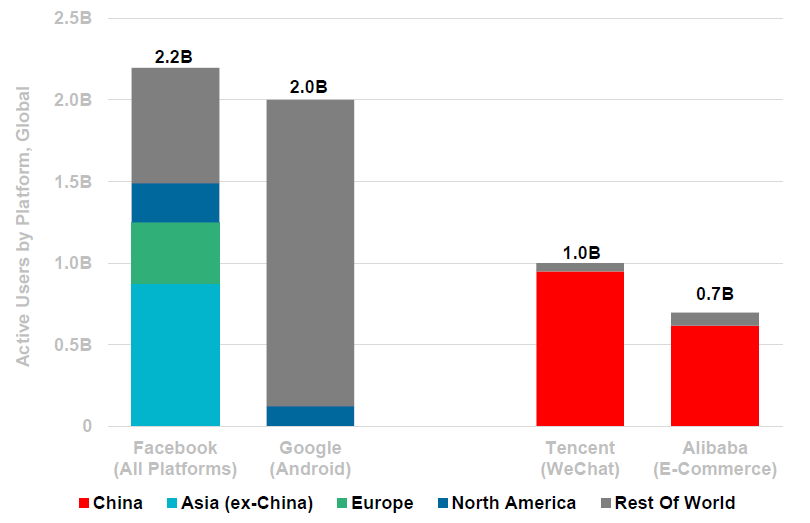

7. Chinese companies dominate their local market but haven’t yet branched out

China’s two online giants, Tencent and Alibaba, dominate the domestic market, generating massive profits. Perhaps more interesting is that these companies have only just started to encroach on Western counterparts, representing a significant growth opportunity.

Active users by platform

Source: Mary Meeker, Kleiner Perkins, Internet Trends 2018. Chart used various data points from January 2018 – May 2018.

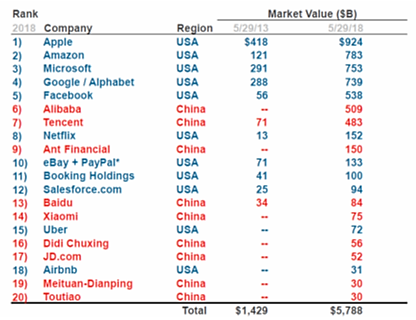

8. 9/20 top global internet companies are based in China… and growing

The growth in Chinese technology is evident in the chart below, with companies not listed last decade now among the largest internet companies in the world. All things considered, this looks likely to continue over the next decade.

Top global internet companies ranked by market capitalisation (US$) 29 May 2018

Source: Mary Meeker, Kleiner Perkins, Internet Trends 2018

Gaining exposure to Asian technology companies

ASIA Asia Technology Tigers ETF aims to track the performance of an index (before fees and expenses) that provides access to the 50 largest Asian technology and online retail companies, by market capitalisation, including Alibaba, Tencent, Baidu and JD.com – companies that are revolutionising the lives of billions of people in the Asian region, and should be well-positioned to tap into the growth potential of this region.

1. Worldometers, Asian Countries by Population, 2019

2. IMF Data, The Digital Revolution in Asia, April 2019

3. https://www.statista.com/topics/2196/video-game-industry-in-asia/

4. https://www.statista.com/topics/2196/video-game-industry-in-asia/

5. Statista and World Economic Forum, 2016

Note: There are risks associated with an investment in the Fund, including information technology sector risk, concentration risk, emerging markets risk and currency risk. For more information on risks and other features of the Fund please see the Product Disclosure Statement.