4 minutes reading time

When it comes to thinking about returns from your Aussie shares, for many people, dividends are a big part of the story, and historically dividends have made up a significant proportion of the total returns of Australian sharemarket.

Australian companies on average have among the highest dividend yields1 and payout ratios2 in the developed world.

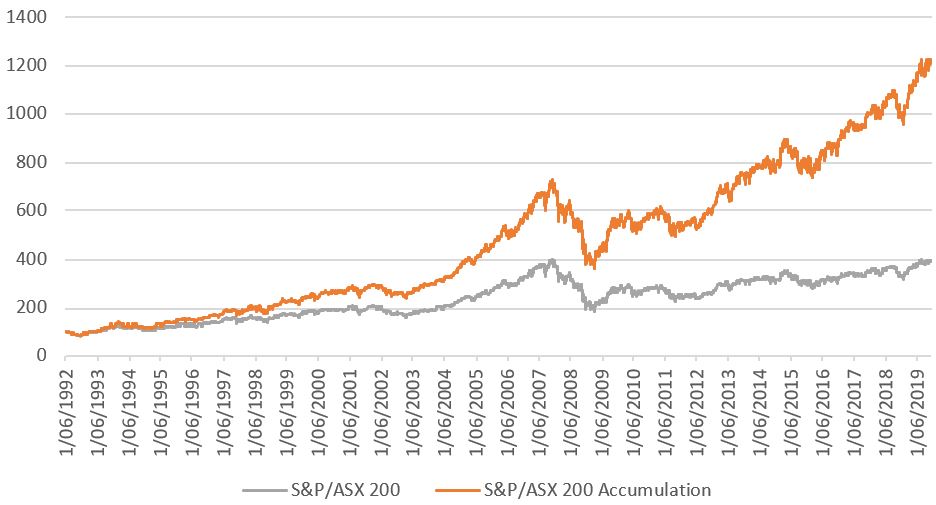

As a result, when it comes to total returns derived from the Australian sharemarket, being the sum of price movement and dividends, the majority of total returns over the last two decades or more have historically come from the latter, as shown in the chart below.

The chart below compares the performance of the S&P/ASX200 Index with that of the S&P/ASX200 Accumulation Index, which includes dividends. The Accumulation Index strongly outperforms due to the large proportion of returns attributable to dividends (along with the highly important effect of compounding, which we have written about previously).

S&P/ASX 200 vs. S&P/ASX 200 Accumulation Index

Source: Bloomberg. Past performance is not an indicator of future performance.

Why does Australia have such a high payout ratio compared to other developed markets?

One reason may very well be because of the unique impact of franking credits in our system and the nature of the industries which dominate our economy.

Under our franking credit system, Australian taxpayers who hold shares in Australian companies receive a tax credit for tax already paid by the company on profits. This system was introduced in 1987, then in 2000 the tax break was extended to provide cash ‘refunds’ when franking credits exceed tax payable. This incentivises companies to pay out profit, to pass on the added benefit of franking to shareholders.

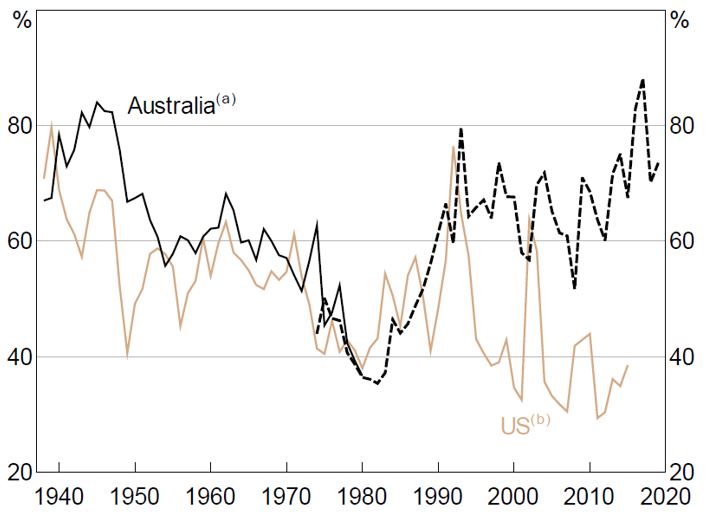

According to the Reserve Bank of Australia, on average around 65% of listed company earnings were paid back to investors in the form of dividends from 1917 until June 20193. The payout ratio has, however, varied over time. As shown in the chart below, the ratio, which was already on the rise, increased significantly after the introduction of franking credits.

Dividend Payout Ratios, Australia vs. U.S.

Notes: (a) Solid line shows series calculated from RBA dataset, dashed line shows implied ratio from Datastream data. (b) Excluding 2008.

Source: Thomas Mathews, A History of Australian Equities, RBA Research Discussion Paper 2019-04

The overall high yields may also be a symptom of Australia’s large, maturing sectors such as banking and mining, which typically have less growth potential than the tech-dominated U.S. market and more stable, income-generating business models. All this results in a relatively high yield of ~4.5%4 from Australian equities.

Australian investors should bear in mind that when investing domestically, dividends form a large part of total return. Growth investors may want to consider participating in Dividend Reinvestment Plans (DRPs), which automatically reinvest dividends into new units/shares, producing compounding returns over time.

Betashares offers several high-yielding domestic equity strategies, including:

Betashares Legg Mason Equity Income Fund (managed fund) (ASX: EINC) – aims to provide an attractive and growing income stream by investing in an actively-managed diversified portfolio of high-quality income-oriented Australian shares. It targets lower volatility than the broader Australian sharemarket through active stock selection and less concentrated stock and sector exposures.

Betashares Australian Top 20 Equity Yield Maximiser Fund (managed fund) (ASX: YMAX) – invests in a portfolio of the 20 largest stocks listed on the ASX and employs a call option writing strategy aimed at generating extra income and reducing portfolio volatility compared to holding the share portfolio alone.

Betashares Australian Dividend Harvester Fund (managed fund) (ASX: HVST) – aims to provide regular franked income that is at least 1.5X the income yield of the broad Australian sharemarket, by periodically rotating out of shares that have gone ex-dividend into high dividend-paying, large cap Australian shares that are about to go ex-dividend.

1. Source: http://siblisresearch.com/data/global-dividend-yields/, 2019.

2. Source: Source: Bloomberg.

3. Source: Thomas Mathews, A History of Australian Equities, RBA Research Discussion Paper 2019-04.

4. Source: Bloomberg – 12 month trailing net dividend yield for the S&P/ASX200 as at 22/11/2019.

Note: There are risks associated with an investment in the Betashares Funds, including market risk, security risk, use of options risk (for YMAX) and sector concentration risk. The risk management strategy for a fund may not be effective and selling futures in rising markets can be expected to limit the fund’s capital growth. For more information on risks and other features of each Betashares Fund, please see the applicable Product Disclosure Statement.