Equity Markets Quarterly Commentary Q1 2025

6 minutes reading time

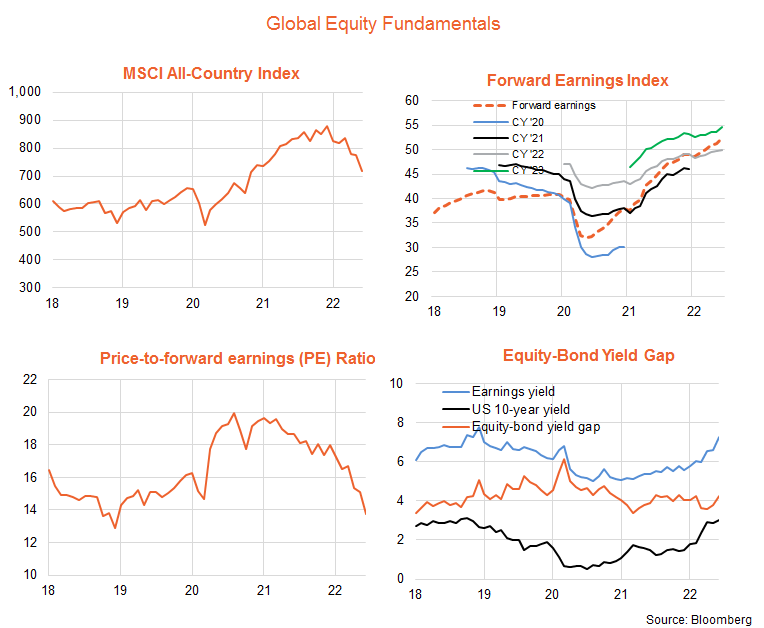

Global Equity Fundamentals – valuations OK, but earnings now a risk

After some consolidation in May, global equities weakened further in June. The MSCI All Country World Index declined by 7.4% in local currency terms, after a decline of only 0.2% in May. The trend remains firmly down.

Helping drive prices lower was a rebound in bond yields, which had stabilised somewhat in May. US 10-year government bond yields rose by 17 basis points (bps) to 3.02%, after declining 9 bps in May. A stronger than expected US CPI report goaded the US Federal Reserve into raising rates by an aggressive 75 bps at the June policy meeting.

Combined with a rise in the equity risk premium of 50 bps to 4.26%, the market’s forward earnings yield rose 67 bps to 7.3% – implying a decline in the forward price-to-earnings ratio of 9.1% to 13.8 from 15.1.

The market’s PE ratio is now below its average of 15.6 since 2013. But given US 10-year bonds yields, at 3%, are above their average of 2% over this period, the market is only in line with its average equity risk premium of 4.4%.

Forward earnings continued to grow, rising by 1.7% in the month with current market expectations consistent with further growth of 4.5% by end-22 and 7.3% over 2023. There has yet to be a material downgrade to global earnings expectations, despite rising interest rates and fears of slowing growth.

The outlook remains vulnerable. I don’t believe US inflation will slow enough to allow the Fed to pause its aggressive rate hike campaign anytime soon, most likely meaning the US economy will enter recession. If we base recession on the Australian definition of two successive quarters of negative economic growth, the US already appears to have entered recession in the first half of this year. Q1 GDP growth was negative, and partial data suggests it remained negative in Q2.

If US recession does take root, it is likely that still-bullish earnings expectations will be revised down sharply and the PE ratio may also sink lower. One upside could be that bond yields stop rising, and may even fall. This will depend on how quickly weak economic growth causes inflation to slow, which would allow central banks to pause and potentially reverse their rate hike plans.

At some point, equity markets will also try hard to look through economic weakness and focus on economic recovery. But with still very tight labour markets, we’re likely to need more pain and spare capacity to be produced before we can focus on the upside.

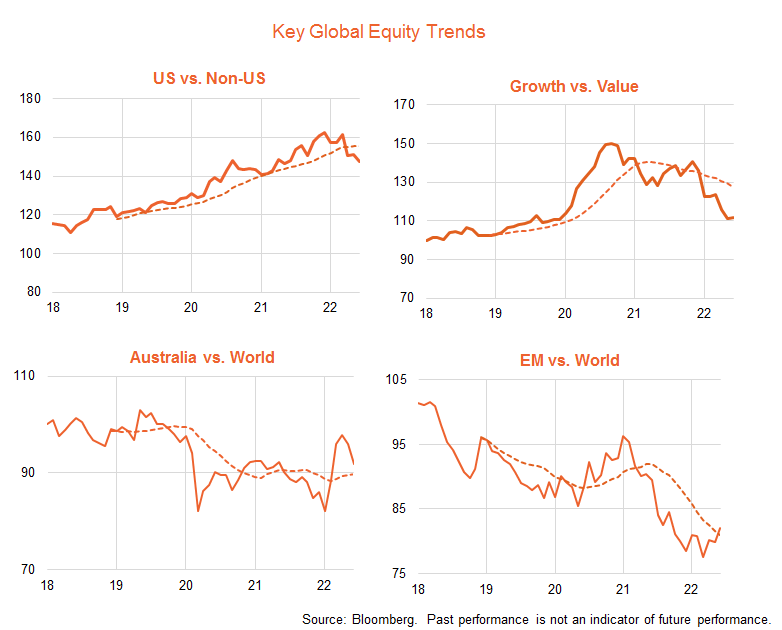

Global Equity Themes – defensives and China

The trend of relative US underperformance reasserted itself in June, even though value sectors such as energy and financials performed almost as poorly as growth and technology stocks.

The theme of the month was a broadening in sector weakness beyond energy, commodity and financials stocks. Meanwhile, concerns about economic growth rose to compete alongside concerns over inflation and interest rates. This has also been reflected in catch-up weakness in the once-resilient local equity market.

The two sectors that held up best were the relatively defensive health care and consumer staples.

One other emerging trend is the relative strength in Chinese stocks, with the economy recovering from COVID-lockdowns and an easing in the harsh regulatory approach taken to leading technology companies. This has filtered through to an improvement in the relative performance of emerging markets in recent months.

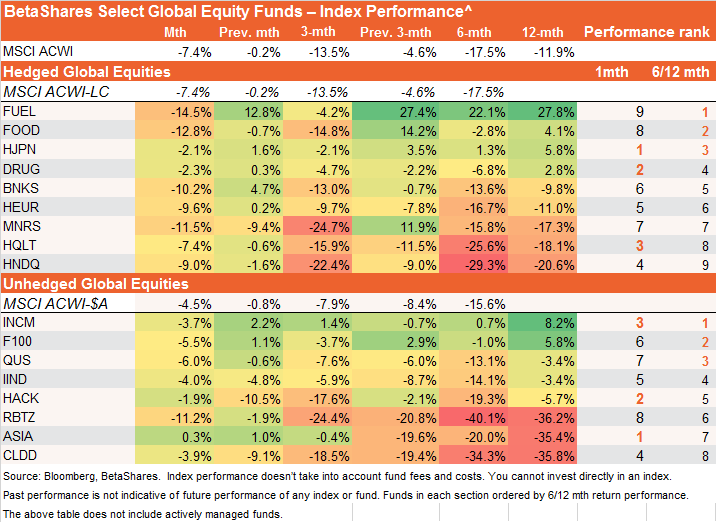

BetaShares global equity trends

Among currency hedged global exposures, in a major counter-trend move, the former market darlings, global energy (FUEL) and food producers (FOOD) were the weakest performers in June, followed by global gold miners (MNRS) and banks (BNKS). Those that held up best were Japanese equities (HJPN) – likely reflecting emerging optimism with regard to China – and the relatively defensive health care sector (DRUG).

FOOD, FUEL and HJPN have the strongest relative performance trends. Though if equities continue to weaken, DRUG may display stronger relative performance in the coming months.

Among unhedged exposures, Asian technology (ASIA) held up best last month for reasons outlined above, while cyber security (HACK) had a relatively small decline. Global income (INCM) also held up relatively well, retaining its top performance rank. This reflected its more defensive qualities – a higher exposure to utilities and infrastructure.

The more value-biased exposures, UK stocks (F100) and the S&P 500 Equal Weight (QUS) had a weaker performance in June, though retain their 2nd and 3rd longer-term relative performance ranking.

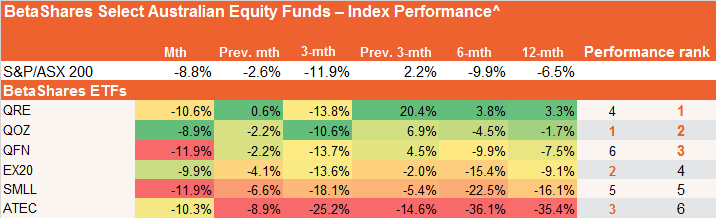

BetaShares Australian equity trends

Weakness was more broad based across Australian equity ETF exposures last month. The once resilient resources sector (QRE) came under greater downward pressure, but remains the top performer on a longer-term basis. Technology and small caps remained under downward pressure, continuing their long-term trend of underperformance.

The more value oriented financials (QFN) and our fundamentally weighted Australian equity ETF (QOZ) also weakened broadly in line with the market last month. Though they remain among the top three relative performers on a longer-term basis

Source: Bloomberg, BetaShares. ^Index performance doesn’t take into account fund fees and costs. You cannot invest directly in an index.

Past performance is not indicative of future performance of any index or funds. Performance in each section is ordered by 6/12 month return performance.

Further information on the complete range of BetaShares exchange traded products can be found here.

* Equity theme proxies: US: S&P 500; Non-US: MSCI Ex-US Developed Markets Index; Growth vs. Value: MSCI Global Growth and Value Indices; Emerging markets: MSCI Emerging Markets Index; Australia: S&P/ASX 200 Index.

** Ranking based on average of 3 and 6 month performance and 6 and 12 month performance, excluding latest monthly return performance.

*** Trend: Outright trend is up if the relevant NAV return index is above its 10-month moving average and down if the index is below this moving average. Relative trend is up if the ratio of the relevant NAV monthly return index to the return index for the MSCI ACWI is above its 10-month moving average, and down otherwise.

1 comment on this

The Federal Reserve is expected to continue raising interest rates in an effort to combat inflation. This could lead to a slowdown in economic growth and corporate earnings, which could weigh on equity prices. I want to express my gratitude for your fantastic blog post.