4 minutes reading time

Indian equities have proven resilient as investors reposition under the new global tariff framework. The Indian government, under Narendra Modi, has again demonstrated a willingness to embrace change and position the economy for long-term growth. India appears well placed in the current geopolitical landscape and is a country we continue to favour over the long term due to its strong structural trends.

Resilience in the face of a global trade war

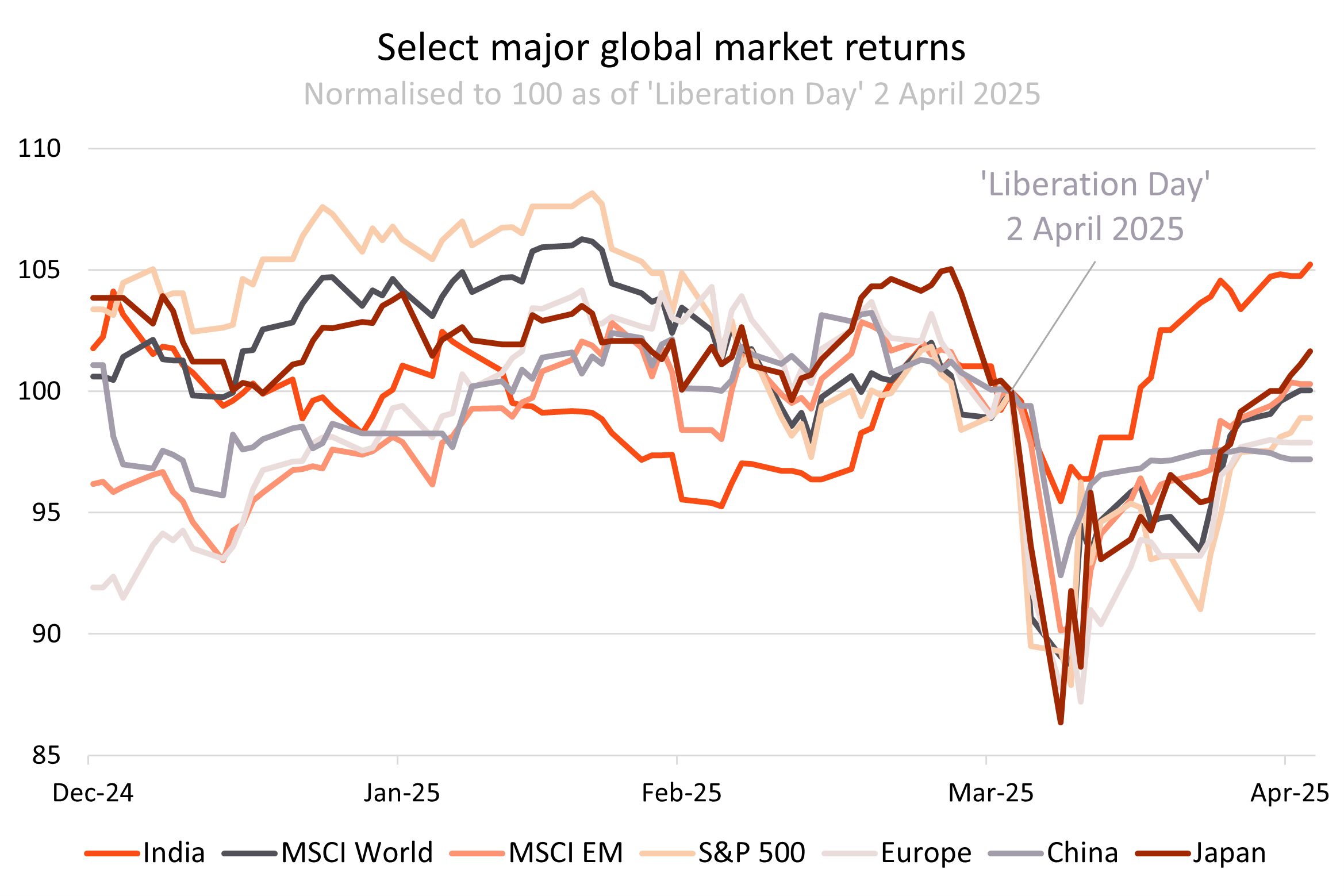

Trump’s “Liberation Day” on the 2nd of April threatened the key driver of growth for many emerging market countries: exports. It has been telling that since this date India has been one of the best performing and least volatile equity markets globally, returning 5%.

Foreign investors are currently on their longest net buying streak of Indian equities in over two years, driven by optimism about the country’s resilience to tariffs and its strategic positioning in global geopolitics.1

Source: Bloomberg. 31 December 2024 to 2 May 2025. Normalised to 100 as at 2 April 2025. Markets represented by: India = Sensex Index, Europe = Euro Stoxx 50, China = CSI 300, Japan = Topix. You cannot invest directly in an index. Past performance is not an indicator of future performance.

India derives nearly 50% of its exports from services, making it far less vulnerable to goods-focused trade barriers than countries like China and Vietnam, where services make up for 10% and 5% of exports respectively. Moreover, India’s economy is less reliant on exports, with domestic consumption accounting for approximately 70% of GDP.

Crucially, two of India’s largest export sectors, IT services and pharmaceuticals, were not subject to increased tariffs under Trump’s reciprocal measures. In addition to IT and pharmaceuticals, India is also expanding into new high-value service areas such as fintech, edtech, and digital health – sectors less sensitive to tariffs and more aligned with global digitisation trends.

India may also become a poster child in U.S. trade policy. U.S. Treasury Secretary Scott Bessent has indicated that India could be the first country to reach an agreement with the U.S. potentially triggering a short-term catalyst for stocks in the region to rally further. A deal would cement India’s role as a key strategic ally for the U.S. in Asia and could also insulate the country from market risks posed by the end of Trump’s tariff pause on July 8.

India’s neutral geopolitical stance has also allowed it to build trade relationships with both Western economies and companies highlighted by Apple’s plans to shift production of all U.S. iPhones to the country. This strategic flexibility positions India as a preferred partner in an increasingly polarised global environment. As Western firms seek China-plus-one strategies, India is emerging as a top destination for supply chain diversification.

India’s long term structural growth drivers

On top of these short-term tailwinds India’s structural growth story remains one of the strongest globally. India boasts:

- The world’s largest and one of the world’s youngest populations – with median age of just 28, ten years younger than in the U.S.

- A rapidly growing but still globally low GDP per capita of US$3,000, offering significant room for internal consumption driven growth

- The highest projected economic growth rate amongst major developed and developing nations with expectations of 6%-7% real GDP growth over the next two years2. A fact that is especially important at a time when economic growth is expected to slow globally

- Decade-long economic and market reforms encouraging exports, foreign direct investment, infrastructure development, and tech and internet access, all supporting economic growth, and

- A growing representation in global market indices with a current weight in the MSCI Emerging Markets Index of 19%, an increase of 12% over the past 10 years.

With strong structural drivers, near-term catalysts, and a surge in investor interest, India stands out as one of the most compelling growth markets globally right now.

Investment exposure

IIND India Quality ETF provides investors with a considered exposure to invest in Indian equities. IIND has greater exposure to the information technology, consumer staple, and consumer discretionary sectors – those most likely to benefit from India’s booming middle class and foreign direct investment. By contrast the benchmark Nifty Fifty is concentrated in financials, to which many Australian investors already have ample exposure, and are less exposed to benefit from India’s growth trajectory.

IIND has returned 12.1% p.a. over the past 5 years, and 9.4% since inception on 2 August 2019 (to 30 April 2025).

Sources:

1. Source: NSE provisional data and Reuters ↑

2. Source: Bloomberg. As at 2 May 2025. ↑