ETF distributions: frequently asked questions

8 minutes reading time

- Technology

- Thematic

This information is for wholesale client use only.

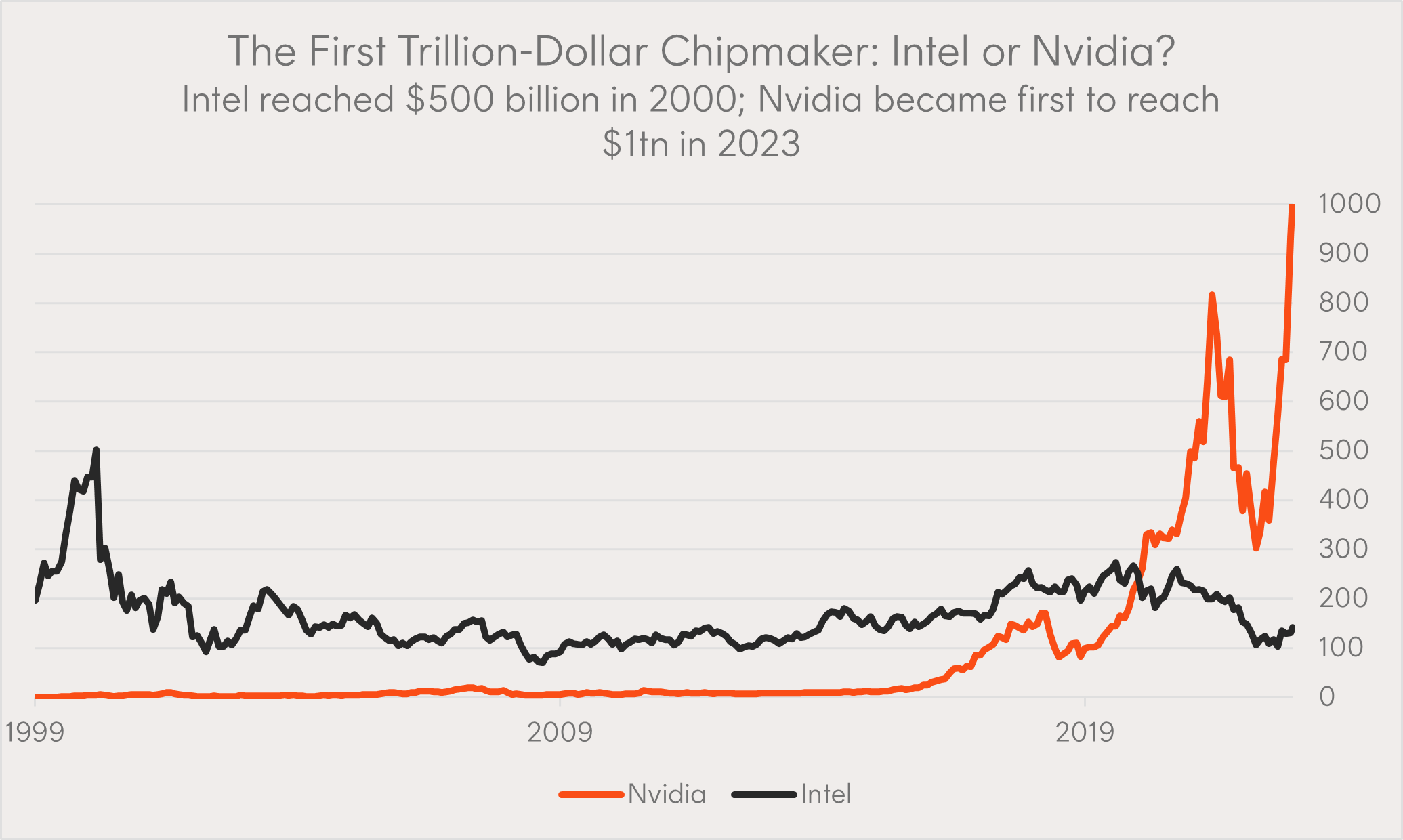

In 2000 the world’s leading chipmaker Intel looked destined to become the first US$1 trillion chipmaker reaching a US$500 billion market capitalisation, while Nvidia was a (relatively) small company focussed on providing hardware for the niche market of gaming. Fast-forward to Nvidia’s Q1 2023 earnings announcement, that Susquehanna Financial Group described as possibly “the greatest beat of all time”, Nvidia’s market capitalisation increased by US$184 billion in a single day on its way to becoming the first chipmaker and 7th US company to reach the US$1 trillion club1.

Source: Bloomberg, as at May 26 2023

Source: Bloomberg, as at May 26 2023

Nvidia’s incredible growth story started with the realisation that their graphics processing units (GPUs), originally developed to improve the rendering of 3D computer games, had applications far beyond the original use case. In 2006 researchers at Stanford University discovered that the GPU’s parallel processing architecture made them ideal for computationally intensive deep learning models. Nvidia made their GPU’s programmable, and applications expanded to fields like autonomous driving and crypto mining. Today, Nvidia has about 95% of the GPU market share for machine learning2.

The release of generative AI tool ChatGPT signalled a turning point in the comprehension of how powerful AI could be. For the first time, everyone has access to tangible evidence of the technology’s disruptive capabilities. More organisations are racing to understand how they can integrate AI into their business processes, such that they are not left behind. Nvidia now expects Q2 sales to increase by ~50% on the Q1 2023 figure. Jensen Huang, Nvidia CEO, attributed the massive increase in their order book to the upgrade of data centre infrastructure required to train and run generative AI models3.

With all the AI excitement investors needs to be mindful that the current crop of perceived AI winners have enjoyed significant YTD stock price gains. However, generative AI has the capacity to increase total global GDP by 7% over a 10-year period according to Goldman Sachs Research4. Wealth creation of this magnitude coupled with the ‘winner takes all’ dynamic of disruptive technology, means such gains may well be justified. Notwithstanding that, in rapidly emerging technology sectors like AI, it can be difficult to pick individual company winners. As a result, we see three ways that investors can gain exposure using diversified portfolios of leading global companies.

US Mega-cap exposure to AI

Five US mega-cap companies, namely Apple, Microsoft, Amazon, Alphabet, and Meta, appear set to possess a significant portion of the infrastructure necessary for developing AI tools. Their extensive scale and dominant positions in related industries, such as cloud computing and big data, have resulted in smaller companies relying on their services to create AI applications. During their recent earnings calls, the management of each of these companies dedicated the time discussing the potential of AI, their plans to rapidly integrate it into their products, and the substantial investments they will be making to develop and operate AI models and applications.

Amazon CEO Andy Jassy emphasised that only a limited number of companies have the capacity and resources to invest in training large language models capable of emulating human intelligence, such as those powering Apple’s Siri, Amazon’s Alexa, and OpenAI’s Microsoft-affiliated ChatGPT. The cost associated with training these models are projected to reach $500 million by 20305, driven by the need for more data and computing power to enhance their complexity. These companies will benefit not only from offering their own AI tools for direct utilisation but also from the dependence of specialised AI companies on their models and data for developing their own applications.

Implementation: The Nasdaq 100’s top 6 holdings Microsoft, Apple, Nvidia, Amazon, Meta, and Alphabet account for 40% of the index weight (as at 7 June 2023) with the added benefit of diversification amongst other leading technology companies benefitting from AI, like Tesla for automatic driving and chip maker Broadcom. NDQ Nasdaq 100 ETF provides you exposure to this entire index in a single trade on the ASX.

‘Pure-play’ exposure to AI

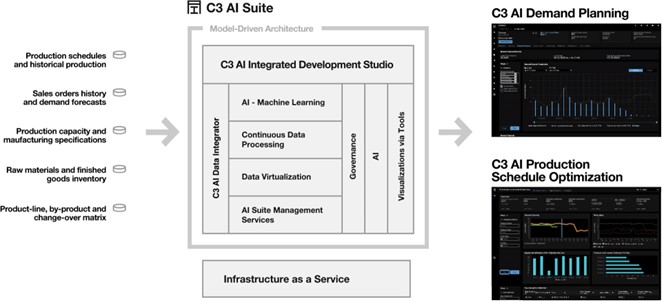

While the mega-cap companies will offer infrastructure and their own range of services, specialised AI firms will have the opportunity to capitalise on various other aspects necessary for, and facilitated by, the industry’s growth. For example, opportunities exist for bespoke solutions for problems that cannot be solved by the one-size-fits-all mega-cap model like those provided by C3.AI, an enterprise AI application software company. C3.AI works with companies to provide solutions across areas like reliability, supply network optimisation, and customer engagement. By connecting databases across multiple platforms and countries within a business network and applying machine learning software, they can identify, retrieve, and present relevant timely data. C3.AI software is already utilised by major global organisations, including Shell, Bank of America, and the U.S. Air Force, enabling them to tackle previously unsolvable problems on a massive scale.

C3.AI Example Solution for Global Agribusiness

Source: C3.AI company website

‘Pure-play’ companies like C3.AI represent a second option for investment exposure to the AI industry. Pure-play companies are defined as those deriving more than 50% of their revenue from the relevant industry, in this case to the AI segment. In addition to software solutions like C3.AI, there are specialised AI infrastructure companies like Nvidia, AI robotics companies like Uipath, and others that focus on various segments of the AI industry. These companies play a crucial role in developing the underlying technology, hardware, and robotics systems that power AI applications, offering distinct investment opportunities in the AI ecosystem.

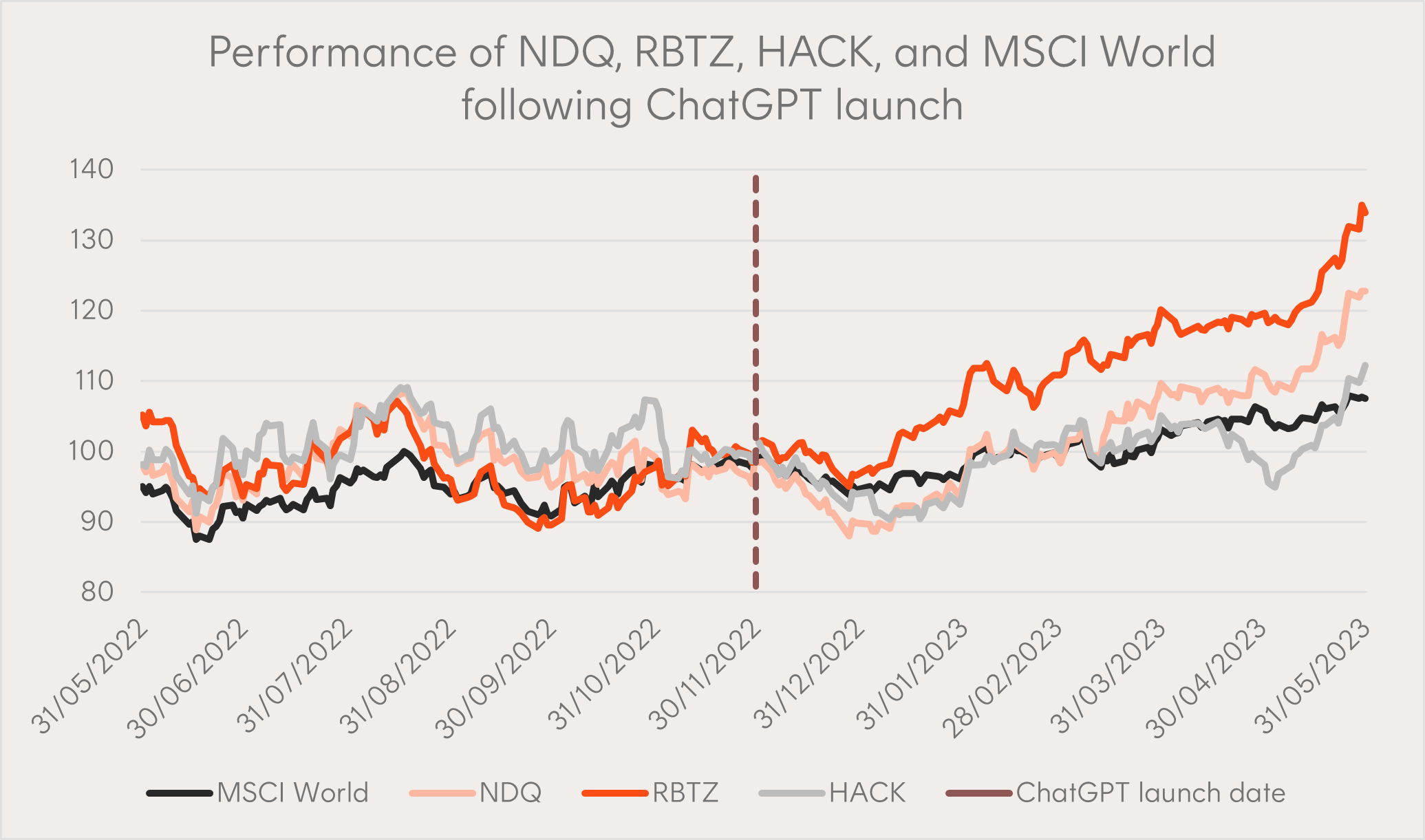

Implementation: Around 70% of the companies in RBTZ Global Robotics and Artificial Intelligence ETF (as at 31 May 2023) are directly or indirectly involved in AI in terms of development or leveraging of AI technology. Furthermore, AI ‘pure play’ companies make up ~33% of the portfolio, including names like C3.AI, Uipath, and Nvidia – which RBTZ has held since the fund’s inception in 2018.

Source: Bloomberg. You cannot invest directly in an index. Past performance is not indicator of future performance.

Source: Bloomberg. You cannot invest directly in an index. Past performance is not indicator of future performance.

How AI is creating opportunities in adjacent sectors

Rapid advancements in AI will disrupt other industries posing threats but also providing opportunities. Cybersecurity is one industry we see as a potential opportunity for investors. Maya Horowitz, head of research at leading cybersecurity software company Check Point, had her team show the potential of AI to be used in every stage of a cyberattack, from crafting convincing phishing emails to writing malware and embedding it in documents. She believes the lowering barrier to creating cyber threats will lead to a greater number of and more sophisticated cyberattacks in turn leading to a rise in corporate cybersecurity budgets. According to Gartner, information security spending is expected to reach $187 billion in 2023 as companies invest in AI-augmented security tools to counter evolving cyberattack techniques6.

The reliance on outsourced cybersecurity services is also expected to grow as cybersecurity industry leaders incorporate AI into their software, something that is often too difficult to implement at a company level. Companies like CrowdStrike, a global cybersecurity leader, have embraced AI with the introduction of Charlotte AI, a generative AI cybersecurity analyst. Charlotte AI aims to democratise security and enable users of the CrowdStrike Falcon platform, regardless of their skill level, to enhance their ability to detect, investigate, and respond to various security events, including advanced threat detection and remediation. By combining AI with human intelligence, CrowdStrike believes it can deliver unmatched security and business outcomes, highlighting the transformative potential of AI in the cybersecurity sector.

Implementation: HACK Global Cybersecurity ETF provides exposure to leading pure-play companies in the global cybersecurity sector including Check Point and CrowdStrike.

RBTZ, HACK, and NDQ are all rated ‘Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.

The Lonsec Ratings (assigned 26 October 2022) presented in this document is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445. The Rating is limited to “general advice” (as defined in the Corporations Act 2001) and based solely on consideration of the investment merits of the financial product. Past performance information is for illustrative purposes only and is not indicative of future performance. It is not a recommendation to purchase, sell or hold any BetaShares fund, and you should seek independent financial advice before investing in this product. The Rating is subject to change without notice and Lonsec assumes no obligation to update the relevant document following publication. Lonsec receives a fee from the BetaShares for researching the product using comprehensive and objective criteria. For further information regarding Lonsec’s Ratings methodology, please go to http://www.lonsecresearch.com.au/research-solutions/our-ratings.

There are risks associated with an investment in the funds mentioned in this article, including :

- For NDQ: concentration risk, market risk, security specific risk, industry specific risk, and currency risk

- For RBTZ: concentration risk, robotics & artificial intelligence companies risk, smaller companies risk, and currency risk.

- For HACK: concentration risk, cybersecurity companies risk, smaller companies risk, and currency risk.

Investment value can go up and down. An investment in the funds in this article should only be considered as a part of a broader portfolio, taking into account the investor’s particular circumstances, including their tolerance for risk. For more information on risks and other features of these funds, please see the Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

1. https://www.barrons.com/articles/nvidia-stock-price-market-cap-one-trillion-dollars-apple-tesla-ai-89ecb969

2. CB Insights

3. Nvidia Financial Results for First Quarter Fiscal 2024

4. https://www.goldmansachs.com/intelligence/pages/generative-ai-could-raise-global-gdp-by-7-percent.html

5. OpenAI

6. https://www.gartner.com/en/newsroom/press-releases/2022-06-07-gartner-highlights-three-ways-security-leaders-can-prepare-for-the-evolution-of-cybersecurity-strategy-roles-and-technology