Bitcoin ETFs: What are they and how do they work?

5 minutes reading time

- Digital assets

The broader crypto market rallied and bitcoin hit new all-time highs following Donald Trump’s victory in the US presidential election.

Bitcoin and Ethereum were up 15.2% and 29.61% respectively over the seven days to 10 November. Bitcoin’s market capitalisation is above US$1.56 trillion. The global crypto market cap is up to ~US$2.63 trillion, while bitcoin’s market dominance sits at 59.2%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $79,016 | $79,606 | $66,694 | 15.28 |

| ETH (in US$) | $3,18 | $3,212 | $2,370 | 29.61% |

Source: CoinMarketCap. As at 10 Nov 2024. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Crypto hopes renewed on Trump victory

Crypto sentiment is running high as President-elect Donald Trump has vowed to remove current US Securities and Exchange Commission (SEC) Chair, Gary Gensler, on his first day of office. Gensler has adopted a ‘regulation by enforcement’ strategy towards digital asset regulation over the last few years.

It is reported that over US$135 million was spent by the crypto industry in this year’s US elections. Other jurisdictions such as Singapore, UAE and Europe are ahead in figuring out their regulatory regimes, leaving the US as one of the last major markets to set crypto regulations. The next four years are expected to be more favourable to crypto, which may alleviate fears of deals between crypto companies being blocked or business lines being declared illegal.1

J.P. Morgan positive on bitcoin into 2025

Global investment bank J.P. Morgan remains bullish and thinks cryptocurrency is poised for gains well into 2025, according to a recent report released last Thursday. The report indicated that the Trump win should be positive for both bitcoin and gold, which are components of the ‘debasement trade’. The incoming President’s policies focusing on tariffs, geopolitical strains and fiscal measures that increase debt may spur inflation. The debasement trade strategy is to acquire assets that tend to hold value in periods of currency devaluation.

J.P. Morgan has also forecast that retail investment into bitcoin and gold, which recently accelerated, is likely to continue through cryptocurrency ETFs well into 2025 with the Trump administration.2

CRYP company spotlight

Crypto stocks surge

Crypto shares rallied on the Trump win with companies such as Microstrategy, Coinbase, and Galaxy all surging double digits the day after the election. Crypto companies were big donors to Trump’s campaign, hoping for a more ‘crypto-friendly’ government to come into office. Earlier in the year at the annual Bitcoin conference, Trump said Bitcoin is the “steel of the future”, and he wants it to be “mined, minted and made” on American soil3.

The companies mentioned above are held in the Betashares Crypto Innovators ETF (ASX: CRYP)4. CRYP provides exposure to global companies at the forefront of the crypto economy.

Bitcoin (BTC): Fear and Greed Index

The Crypto Fear and Greed Index is an indicator from Alternative.me that aims at capturing investor sentiment in a single number by incorporating data from multiple sources. The index ranges from 0 to 100, where 0 denotes ‘extreme fear’, and 100 means ‘extreme greed’ and is an indication of maximum fear of missing out.

The index has recently pushed through ‘extreme greed’, which tends to coincide with new all-time highs.

Source: Alternative.me. Past performance is not indicative of future performance.

Source: Alternative.me. Past performance is not indicative of future performance.

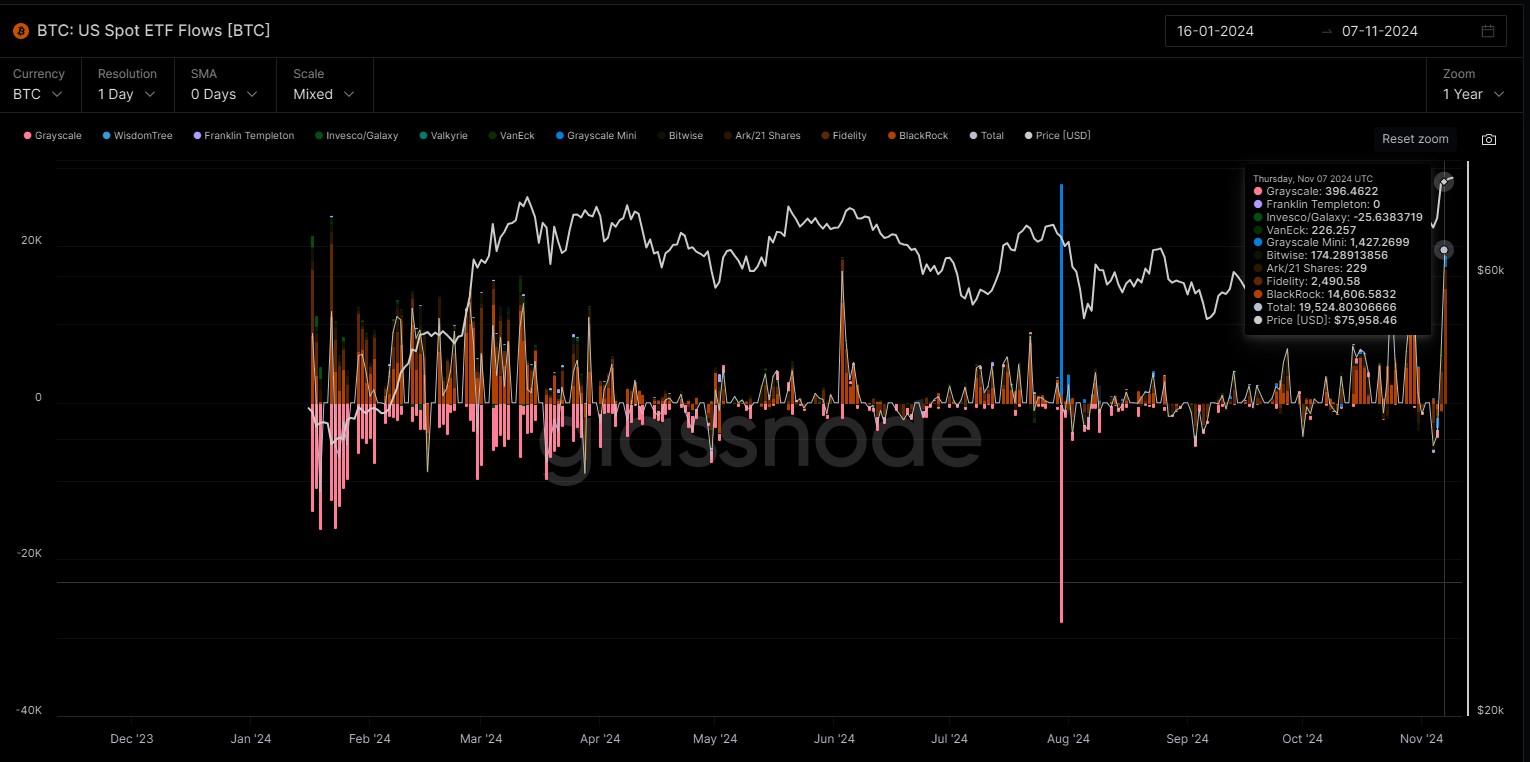

Bitcoin (BTC): Spot ETF Flows

This metric is an estimate of the daily net flow of funds within the leading bitcoin ETFs traded in the US.

According to data from Glassnode, other than a couple of days just prior to the election, US spot ETF flows generally grew heading into the election and have spiked even higher post-election.

Altcoin news

Altcoins soared following bitcoin’s price action, and Dogecoin (DOGE) has risen over 49% over the last seven days and 221% over the year to 10 November. DOGE has been connected with Elon Musk, as his companies Tesla and SpaceX both accept DOGE as payment.

Musk has been a vocal supporter of Donald Trump and may potentially have a role in the new administration. Over the past few weeks, Musk has championed a so-called ‘Department of Government Efficiency’5.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets..

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://economictimes.indiatimes.com/markets/cryptocurrency/crypto-pins-hopes-on-reshaped-sec-for-deal-revival-under-trump/articleshow/115107824.cms?from=mdr

2. https://news.bitcoin.com/jpmorgan-stays-bullish-we-are-positive-on-bitcoin-into-2025/

3. https://qz.com/coinbase-microstrategy-tesla-crypto-stock-trump-1851690962

4. As at 10 November 2024. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

5. https://www.forbes.com/sites/digital-assets/2024/11/06/100000-by-2025-donald-trump-and-elon-musk-fuel-huge-bitcoin-price-predictions-as-dogecoin-soars/

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.