6 minutes reading time

Financial adviser use only. Not for distribution to retail clients.

Q1 2025: A broad-based beat with robust growth

The US equity market has delivered again.

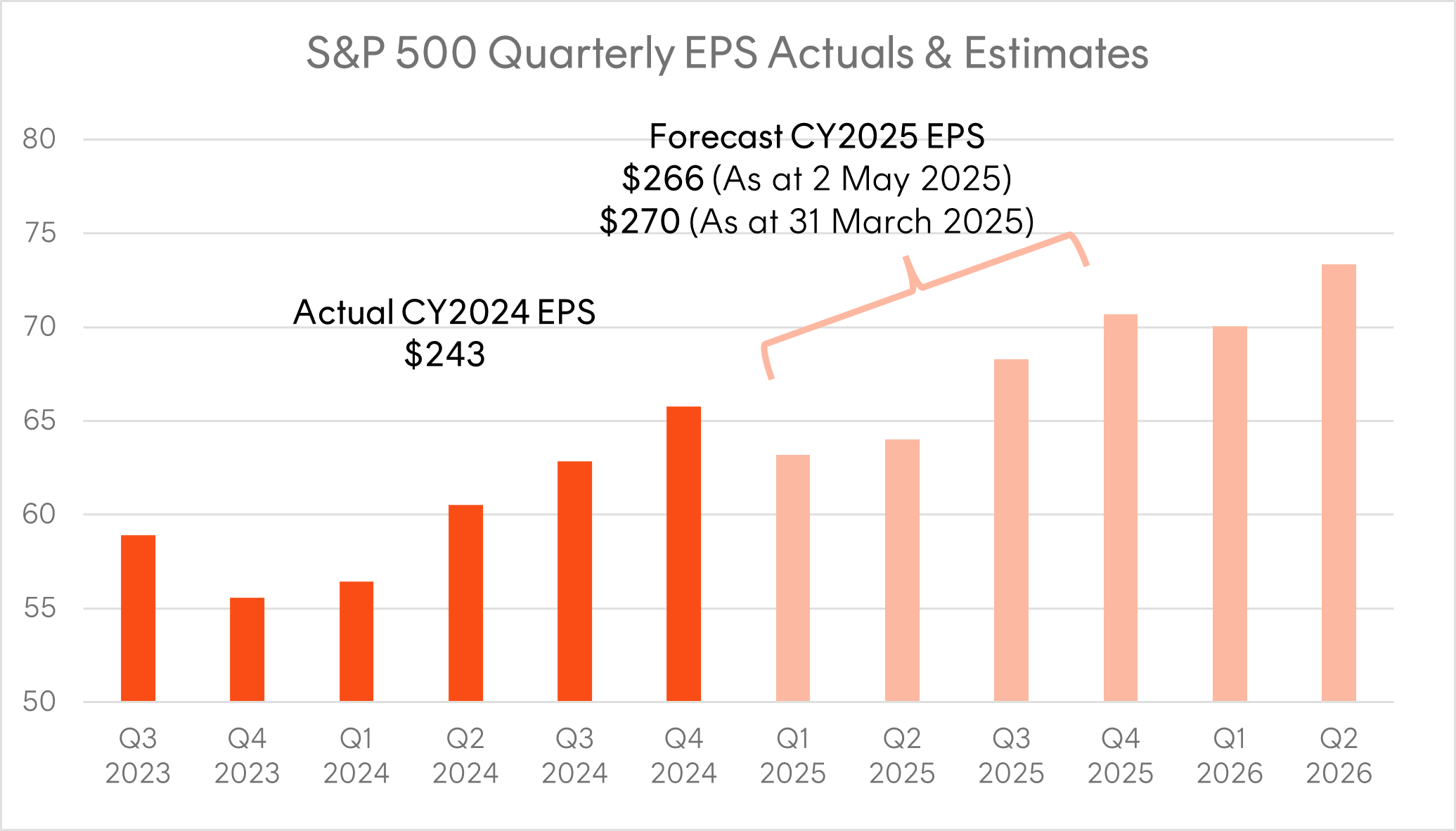

All things considered, this US earnings season has seen some strong results. As at 5 May, with about 72% of the S&P 500 now reported, year-on-year EPS growth stands at +12.8%, marking a second consecutive quarter of double-digit gains. About three quarters of companies beat earnings expectations.

Top line revenue growth is exceeding expectations, suggesting that corporations performed well in Q1 despite widespread concerns about tariffs, and profit margins remain high, helping drive the bottom-line earnings growth.

The Communication Services, Financials, Health Care and Information Technology sectors have been the largest contributors to the increase in the earnings growth rate for the S&P 500 index since prior to Liberation Day. The index level earnings growth would be even higher if it weren’t for Energy. In addition, Energy has been the only sector to see downward revisions since the end of the quarter, caused by the dramatic fall in the oil price.

Source: Factset, as of 2 May 2025. Past performance is not an indicator of future performance.

Looking further ahead: Guidance is the soft spot, earnings forecasts are falling

As one would expect, management tone is noticeably cautious. Company commentary has been focused on the risk of recession and the potential impact of tariffs. 24% of S&P 500 companies reporting so far have mentioned the word “recession” on their conference calls, compared with just 2% last quarter.

So far this reporting season, a slightly lower proportion of companies are offering forward guidance than average. Many high-profile names like General Motors, American Airlines and Walgreens have withdrawn guidance altogether, citing tariff uncertainty. Among those that have continued to guide, many have caveated that their guidance does not incorporate the impact of tariffs.

Despite the solid results for Q1, stock analysts have cut forward EPS estimates. S&P 500 bottom-up consensus Q2 earnings have been revised down by 3.4% over April, with cuts across all sectors, but Energy again hit particularly hard.

The expected calendar year earnings growth has fallen from 11% to 9.5% since Liberation Day, largely on lower margins as analysts incorporate pricing pressure from tariffs. Earnings estimates tend to be a lagging indicator, and we expect further negative revisions to consensus estimates throughout the second quarter. Countering that however, we believe investors are generally aware that consensus estimates are too high.

Source: Factset, as of 2 May 2025. Dark orange data points are Actuals, light orange are Estimates. Past performance is not an indicator of future performance.

Notable beats: Big Banks and Big Tech do well

Financials, a sector we have been watching closely in recent earnings seasons, once again surprised to the upside, despite incoming tariff headwinds.

The big four US banks all beat expectations, however tariff related uncertainty led to mixed performance across divisions. M&A activity, which had been rebounding from multi-decade lows, slowed again as the economic outlook deteriorated. Even so, the banks’ trading businesses were able to capitalise on high market volatility to generate record profits.

Looking ahead, the key drivers are:

- Tariff uncertainty: Banks are well positioned to continue to profit from elevated volatility, however a resolution on tariffs could also help M&A and lending growth.

- Deregulation: Banking deregulation from the Trump administration may water down Basel III “Endgame” rules or even unlock additional capital at a time when banks are holding near-record excess reserves and accelerating buybacks amid low valuations.

These dynamics underscore the sector’s diversity in earnings and its still-promising outlook.

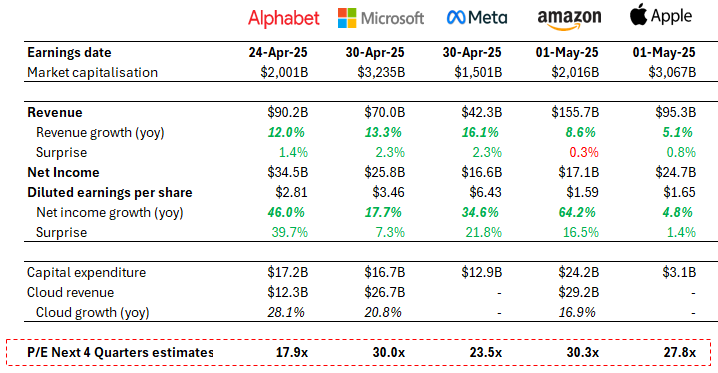

Big Tech’s Q1 results can be characterised as a reaffirmation of the AI narrative, but with a clear delineation in terms of the market’s assessment of future tariff risk:

- Apple expects a US$900 million increase in costs this quarter as a result of tariffs and is facing increased local competition in the Chinese smart phone market. Amazon guidance was lower than expected (despite AWS performing well), as third-party sellers that use their e-commerce platform may have few options to offset higher tariff costs. Both stocks were down post earnings announcement.

- In contrast, Alphabet, Microsoft and Meta traded higher following their respective earnings reports given greater exposure to areas like software and digital advertising, which are more insulated from tariff policies. Strong cloud revenue growth in Google Cloud and Microsoft Azure continue to demonstrate that demand for AI and compute capacity remains resilient despite the challenging economic environment.

Big Tech Q1 Earnings Dashboard

Source: Bloomberg. Market capitalisation and P/E estimates data as of 2 May 2025. Revenue, earnings and capital expenditure data as at relevant company’s earnings date. In US dollars. Revenue and EPS surprises from FactSet, Nvidia from Bloomberg. Tesla excluded on the view that its business model is not within the AI infrastructure/hardware supply chain as the companies represented above.

Price dispersion since Liberation Day

The recovery in the S&P 500 since the Liberation Day sell off has been notable, with the index back to its 2 April level one month later.

However, if we look beneath the surface, there has been significant dispersion. Large Cap growth stocks have underwritten the recovery. These stocks are well represented in the Tech and Communication Services sectors, and have experienced very low earnings variability versus Cyclicals like Energy companies.

S&P 500 Sector total returns since Liberation Day

Source: Bloomberg, as of 2 May 2025. Past performance is not an indicator of future performance.

The Tech sector has now delivered 18 straight quarters of revenue growth and remained positive through both the 2022 inflation shock and the 2023 S&P 500 earnings recession.

Investment implications

Sticking with high quality large cap companies – This earnings season investors have been willing to reward companies with less earnings variability. Companies more exposed to structural earnings growth should be more insulated than Cyclicals from what may be a more uncertain Q2 earnings season.

Healthcare provides defensive growth exposure at undemanding valuations – Healthcare has sold off on supply chain tariff fears while producing strong organic earnings growth and upgrades. The US Healthcare sector is currently trading at a Forward P/E ratio of 16.5, well below its 5-year average, the S&P 500 Index level or other growth sectors such as Tech.

Banks: earnings resilience and potential deregulation to come – While banks have greater earnings cyclically than Tech and Healthcare, they are arguably far less exposed to tariff uncertainty than Energy, Consumer Discretionary and parts of Industrials. Balance-sheet strength and the ability to generate higher trading revenue in a volatile market, together with the potential deregulation tailwinds, all provide a strong case for holding exposure to banks right now.