Charts of the month: March 2025

8 minutes reading time

This information is for the use of licensed financial advisers and other wholesale clients only.

Commentary from the Betashares portfolio management desk by Head of Fixed Income Chamath De Silva, providing an overview on fixed income markets:

- We’ve gone from 7 Fed rate cuts priced to under 2 just this year, and while the remaining cuts might easily be removed if US inflation data continues to surprise on the upside, the bar for rate hike expectations to appear is much higher.

- In contrast to the forward rate market still showing US rate cuts being priced in for 2024, the options market suggests an unchanged Fed is now the base case.

- The TIPS market is still indicative of long-term inflation expectations being anchored, with much of the move in Treasury yields a repricing of longer-term “neutral” real interest rates.

The evolution of policy expectations

Considering the sell-off we’ve seen across global fixed income, this WHIB will focus purely on rates, and we’ll try to get into the weeds of current market pricing ahead of this week’s FOMC.

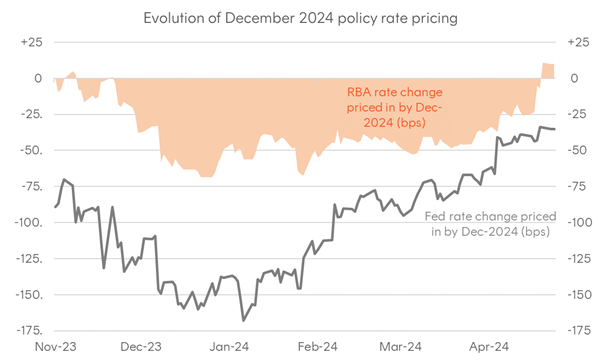

We started the year with close to 7 Fed rate cuts priced in, and now we’re at 1.4 amid a run of hotter-than-expected US inflation data and a broader pattern of price pressures re-accelerating, in addition to renewed concerns around issuance (with the Treasury’s next quarterly refunding announcement taking place this week). In Australia, we’ve also largely matched these developments in RBA pricing, with the 3 cuts that were priced into cash rate futures at the start of the year now fully unwound, and the market is now pricing in a 40% probability of one hike this year.

Regarding US rates, where we go from here depends on not only the data but very much on the Fed’s official guidance. It’s an easier bar for the remaining rate cuts to be priced out than it is for a resumption of rate hikes to be priced in. The Fed has repeatedly been on record as saying that they see the current stance of policy as restrictive, and their most recent dot plot estimate still implies a neutral rate of under 3%. For the FOMC to signal a resumption of hikes, it would imply a major shift in where they see neutral, and such a development would likely need months’ worth of ‘hot’ economic data and some major revisions in the next Summary of Economic Projections and ‘dot plot’ in June.

While the risks of a push higher in yields and an unwind of rate cuts were ever-present, given the size of the sell-off, the risk-reward of duration is now much more favourable compared to just a few weeks ago, and counter-trend rallies should still be expected even if ‘higher for longer’ is the destination. Digging a little deeper into market pricing shows that while 1-2 rate cuts are still the expected outcome from forward interest rate markets, looking at the entire probability distribution suggests that a ‘hold’ is now the most widely held view. The 10-year US yield could easily retest 5%, but a break higher beyond that would likely require the modal outcome in the distribution moving from ‘hold’ to ‘hikes’.

Figure 1: Evolution of December 2024 policy rate pricing for Fed and RBA; Source: Bloomberg

A deep dive into market pricing

Although interest rate futures provide us with a good picture of overall policy rate expectations, they still are a ‘point’ estimate and hide the broader distribution of outcomes. The options market on interest rate futures allows us to delve into this next layer of market pricing. In the US, the most liquid options market on rates is the market for options on SOFR (Secured Overnight Financing Rate) futures. This is among the most actively traded US interest rate derivatives and is now the main market for trading forward 3-month US interest rates, closely related to Fed funds expectations. The SOFR futures curve covers quarterly expirations—every March, June, September, and October—all the way out to 2033, covering a much broader range of forward dates than Fed funds futures.

The options market on SOFR futures gives us a view into which parts of the distribution of potential future interest rates market participants are either speculating on or hedging against. The option deltas of calls and puts of various strikes allow us to construct the so-called option-implied probability distribution. Option deltas are the market-implied probability of a particular put or call expiring in the money, or put another way, the implied probability of a given interest rate prevailing at a future date.

Based on data provided by Bloomberg on option deltas of various interest rate strikes for a December 2024 expiration, we see that the highest probability outcome for year-end is rates in a 5%-5.5% range, which effectively shows no change. The options market is also implying a 22% probability of the rate hiking cycle resuming this year, which, while plausible, seems aggressive over the short term given the Fed’s guidance. We also see that the probability of a ‘hard landing’ this year is now extremely low. Assuming a recession would require around 200 basis points of emergency cuts from the Fed (taking the fed funds rate below 3.5%), the options market currently assigns a probability of 7% for such an outcome this year.

Figure 2: US option-implied probability distribution from Dec-2024 SOFR futures; as at 29-Apr-2024; Sources: Bloomberg, Betashares

What the TIPS market tells us about long-term US inflation expectations

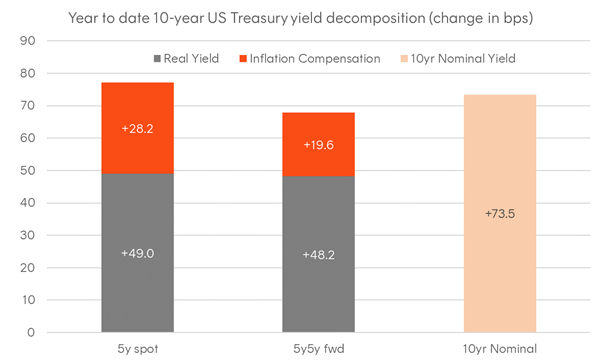

Although the 10-year (nominal) Treasury yield is still the global fixed income benchmark for most, it’s worth remembering that this yield can be decomposed in many ways. Not only does the 10-year yield theoretically consist of current and forward shorter-term yields, which themselves can easily be traded directly via various interest rate derivatives markets (such as the SOFR futures mentioned earlier), but because of the existence of the Treasury Inflation Protected Securities (TIPS) market, we can also trade both the real yield and inflation expectations (‘breakeven’) components. I personally like to decompose the 10-year nominal yield into 10-year real yields and 10-year breakevens, and then further break each down into a 5-year maturity and a 5-year maturity starting in five years’ time (the so-called 5y5y forward). This decomposition gives us a better sign of what underlying factor is driving the broader US Treasury market, as well as seeing whether some of the emerging narratives are priced in.

One such narrative is the idea that the FOMC is relaxing its commitment to the 2% inflation target. Several participants and pundits are convinced that this is now a given, but I’d argue that this isn’t reflected in the market to any meaningful degree. 5y5y forward inflation breakevens from TIPS provide the best read on longer-term inflation expectations and function as the market’s referendum on Fed inflation-fighting credibility over the long-term with respect to the 2% inflation target. This measure, currently at 2.45%, is only slightly above the average of 2.15% since the Fed formally began inflation targeting in 2012. If the Fed were to truly relax this policy, or if the market were to suspect it, we’d see this measure blow out and drive an extremely aggressive bear steepening across the nominal Treasury curve.

The behaviour of TIPS over the past couple of years has been interesting for several reasons. Investors often underestimate the interest rate risk in ‘linkers,’ and the repricing in real yields in 2022 caught many who thought they were protected by the jump in inflation completely off guard. We should remember that real yields in 2021 were the most negative they’ve ever been in the TIPS era, but now they are the most positive they’ve been in well over a decade, and the size of the repricing wouldn’t be without consequence. It’s been the irony of the surge in inflation that inflation-linked bonds now offer even higher inflation-adjusted yields, and it’s been curious that each hot inflation print in recent months has flowed through primarily to higher real yields, and far less so to higher inflation breakevens. This, to me, suggests that the market is revising its expectation of the long-term neutral real interest rate and not so much inflation expectations. For investors who believe the contrary, or simply that real yields are currently being dragged higher by issuance concerns, then TIPS offer compelling value.

Figure 3: YTD change in US 10-year yield and decomposition; as at 29-Apr-2024 Source: Bloomberg

Chart 4: US 10-year Treasury yield decomposition over time; Source: Bloomberg