7 minutes reading time

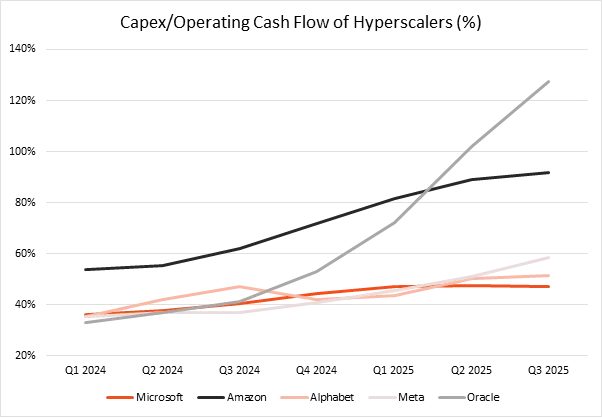

The near consensus view from Wall Street investment firms on the AI complex is one of optimism for 2026. We assess potential risks – namely funding the capex boom, the market’s tolerance for this expenditure, evidence of productivity gains, and what risks may cause an adjustment to the heady capex projections.

Can they afford it?

The AI infrastructure build out has been primarily funded by internally generated cash flows in contrast to the late 1990’s dotcom bubble, where the use of debt funding was more prevalent.

Source: Nasdaq Global Indexes, Bloomberg. As at 30 November 2025.

Much of this cash generation has come from consistent earnings upgrades and long-term profit growth across the hyperscalers’ core advertising and e-commerce business units. Historically, these companies have invested a significant amount of their cash flows into R&D initiatives, cementing their position as industry leaders.

However, capex projections in 2026 and beyond would place pressure on the hyperscalers’ consistently high levels of return on equity and risk a shareholder revolt.

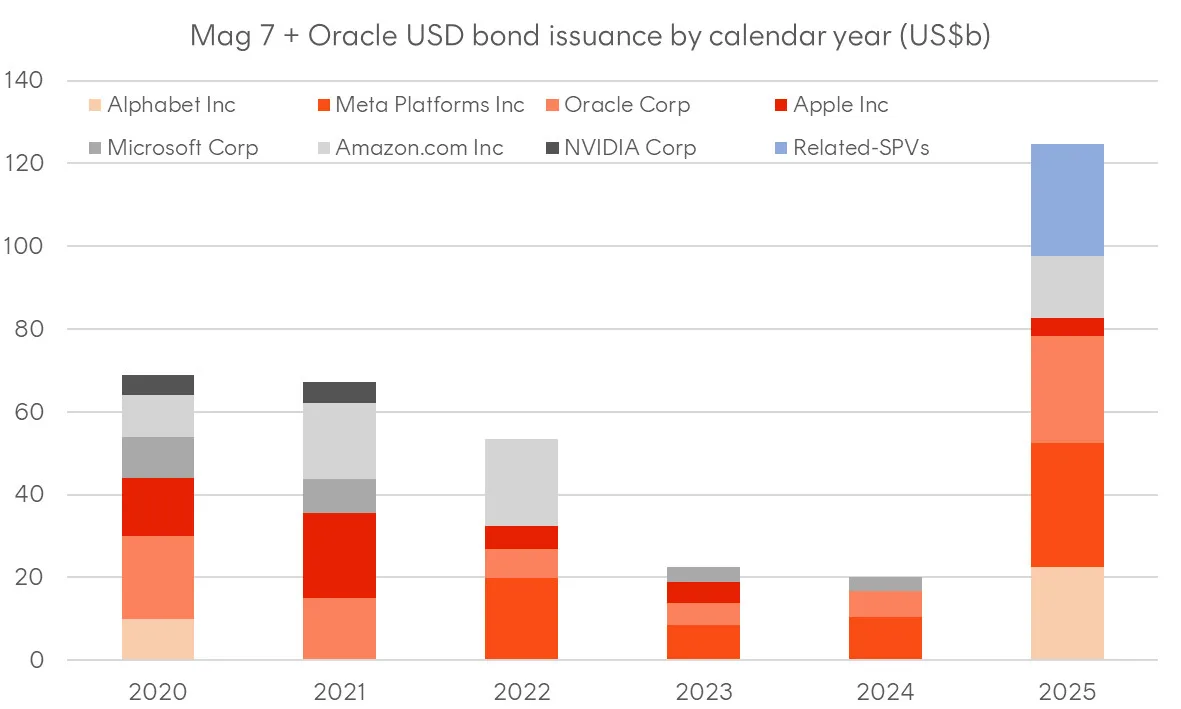

Rather than impacting shareholder returns, debt markets offer a cheaper source of capital for the hyperscalers. In Q4 2025, the AI capex boom became a meaningful part of US corporate debt issuance.

The most striking example was the record-breaking US$27 billion bond deal that will finance the previously mentioned Meta Hyperion data centre. These bonds were issued via a special purpose vehicle (SPV) and are secured against the data centres themselves, with Meta as the tenant. This “leaseback” structure enables Meta to preserve balance sheet flexibility while continuing to fund its AI ambitions, issuing around US$30 billion in its own name in Q4.

Source: Bloomberg. 2020 to 2025.

The major US technology companies raised over $120 billion in debt last year, with Meta and Oracle significant contributors. Smaller AI infrastructure players such as Coreweave and Nebius were also active in the primary market. This is only the beginning as annual AI infrastructure spending is projected to climb from around US$400 billion last year to over US$1 trillion by 2029. As a result, debt markets are expected to shoulder much of the load as leading technology firms shift from capital-light to capital-intensive business models.

Perhaps the elephant in the room is OpenAI and how it plans to finance its extraordinary spending commitments (estimated at $1.4 trillion over eight years) to the likes of Oracle, Microsoft and Broadcom. CEO Sam Altman has already hinted that entirely new financial instruments may be required, implying that much of the capex build-out will be financed via asset backed securities (ABS).

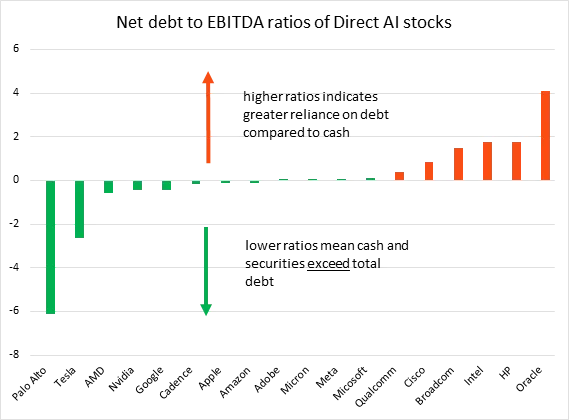

Notwithstanding these outliers (e.g. Oracle, Meta, OpenAI), the majority of AI-related companies still have net debt to EBTIDA ratios less than zero, meaning the amount of cash and securities on their balance sheets exceed total debt. The amount financed by debt is still very low in contrast to the late 1990’s.

Source: Bloomberg. As at 2 January 2026.

Show me the money

In 2026, we believe investors will increasingly prefer companies that can demonstrate a clear path to profitability from AI-related investments such that they can retain their historical return on invested capital (ROIC) and keep shareholders appeased.

Enterprise adoption is one key metric that investors are watching closely to monitor trends in AI monetisation, given companies have much larger spending budgets than direct consumers. While there remains a wide divergence in AI adoption across organisations, the good news is that those that make more consistent use of advanced AI tools have reported larger productivity gains than those whose use remained limited1.

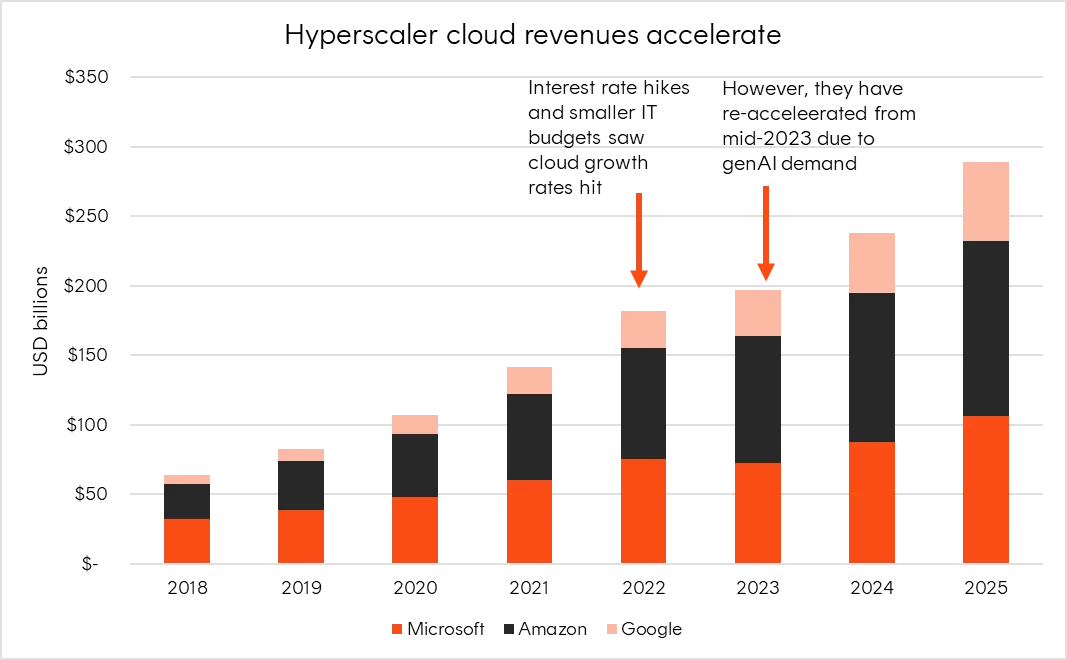

But perhaps a more direct example of AI monetisation is occurring at the infrastructure layer where hyperscale cloud providers (Microsoft Azure, Amazon Web Services, and Google Cloud Platform) have all seen earnings growth rates inflect higher from mid-2023 as the demand for generative AI services surged.

Source: Bloomberg. As at 13 January 2026. Years shown are fiscal reporting years. 2025 estimates shown for Amazon and Google.

Source: Bloomberg. As at 13 January 2026. Years shown are fiscal reporting years. 2025 estimates shown for Amazon and Google.

Moreover, the contribution that AI is having on these growth rates is becoming substantial. AI services contributed approximately 16 percentage points to Microsoft Azure’s year-over-year revenue growth of 33%2. The technology is also driving strength in advertising revenues for Meta which grew 24%3 year-over-year for Q4 2025.

We are still in the early days of AI monetisation. Adoption rates vary across industries and quantifying productivity gains remain a challenge. However, the fact that megacap tech companies laid off tens of thousands of employees last year may be a leading indicator that efficiency gains from AI are being realised4. In fact, productivity in the US grew to its fastest level in two years, by 4.9% p.a. for Q3 20255, signalling that AI could also be the driver behind both a strong economy and lacklustre labour market that the US is experiencing.

Valuations and physical constraints

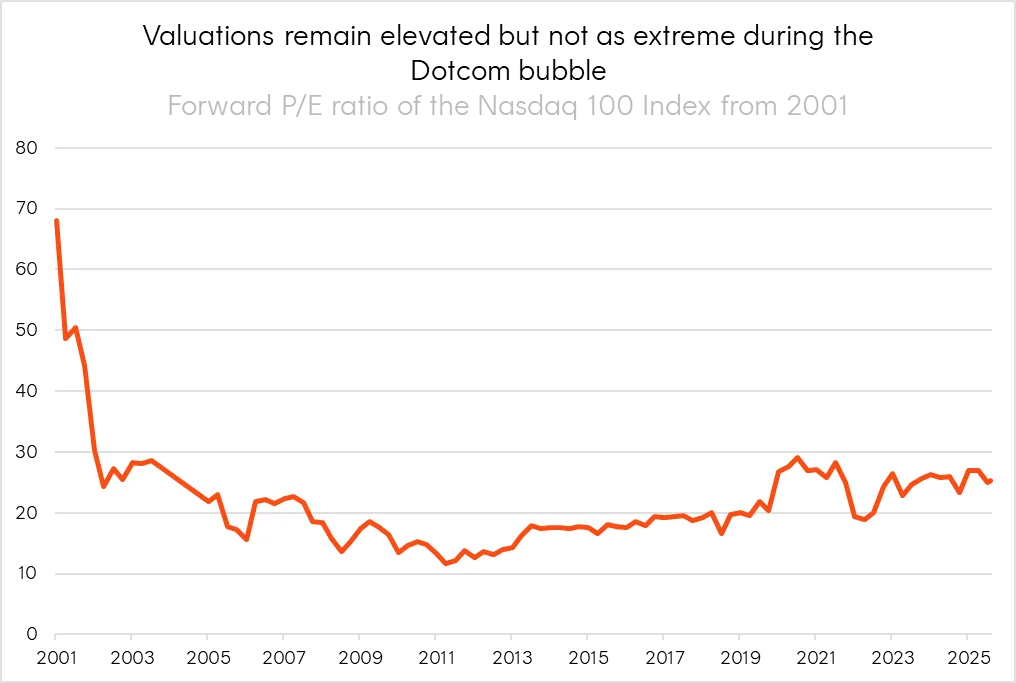

Overall with this position of strength, we believe that valuations, although elevated, appear justified and reflect a different dynamic to what we saw during the Dot-com bubble.

Source: Bloomberg. As at 13 January 2026.

Beyond investor appetite to fund the AI build out, execution remains a key risk. Data centres are voracious consumers of electricity, and their buildout is contingent on sizable, steady expansion of power generation and transmission capacity between now and 2030. US household electricity bills are already increasing in parts of the country. The cost of new generation capacity exceeds what hyperscalers are being charged by the utilities, and there is debate as to whether that generation can be built fast enough.

China’s progress in building out its own local AI ecosystem presents another left-tail risk. Will the upcoming release of DeepSeek v4 (slated for mid Fed 2026) again call into question the necessity of US hyperscaler capex?

Still, it is not clear when these roadblocks will be encountered. Our base case view is that AI-related capex will accelerate in 2026 even if total hyperscaler spending does not meet the $548 billion projected. This private sector investment will continue provide a growth tailwind for the US economy and the global AI supply chain this year.

Investment implications

A growing number of Nasdaq 100 companies are becoming integral to the AI infrastructure rollout and are harnessing AI to create end user applications, such as Advanced Micro Devices (AI chips), Palantir Technologies (data analytics) and AppLovin (gaming monetisation).

-

NDQ

Nasdaq 100 ETF

- NDQ provides Australian investors with access to the Nasdaq 100 Index. NDQ has been one of the top performing Australian domiciled global equity funds, returning 20% p.a. over the last ten years6.

-

HNDQ

Nasdaq 100 Currency Hedged ETF

- Given the potential for USD weakness in 2026 to impact returns, investors may wish to consider HNDQ in order to participate in the Nasdaq 100’s enviable earnings growth whilst seeking to minimise currency risk.

There are risks associated with an investment in the Funds, including market risk, country risk, currency risk and sector risk and, in the case of HNDQ, hedging risk. Investment value can go up and down. An investment in the Funds should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Funds, please see the relevant Product Disclosure Statement and Target Market Determination, both available on this website.

Sources:

1. https://openai.com/index/the-state-of-enterprise-ai-2025-report/ ↑

2. Microsoft Q3 2025 earnings call ↑

3. https://investor.atmeta.com/investor-news/press-release-details/2026/Meta-Reports-Fourth-Quarter-and-Full-Year-2025-Results/default.aspx ↑

4. Salesforce cut around 4,000 customer service roles late last year as AI agents can now handle millions of customer conversations that humans once did. ↑

5. https://www.bloomberg.com/news/articles/2026-01-08/us-productivity-picked-up-in-third-quarter-labor-costs-declined ↑

6. As at 31 December 2025. Past performance is not an indicator of future performance. ↑