15 minutes reading time

- Cash & fixed income

Quarterly commentary from the Betashares Fixed Income Desk, providing an overview on global macroeconomic events, central bank policy, fixed income markets, and an outlook for the period ahead.

Global macro and rates

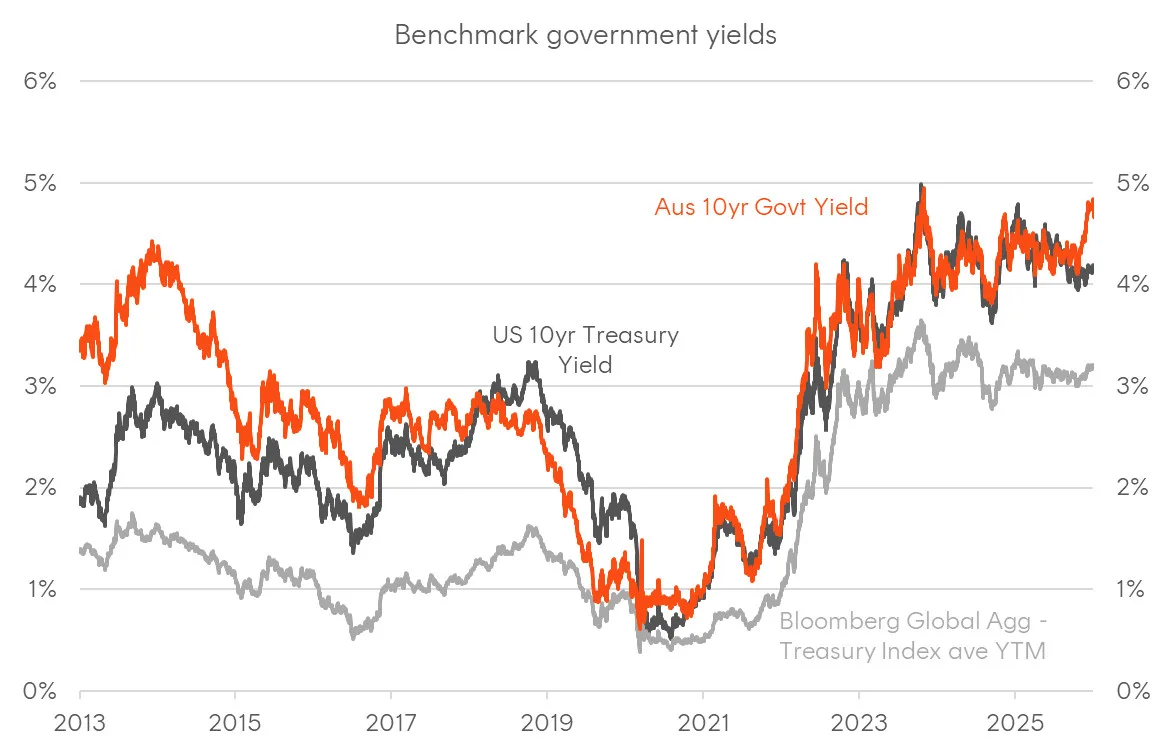

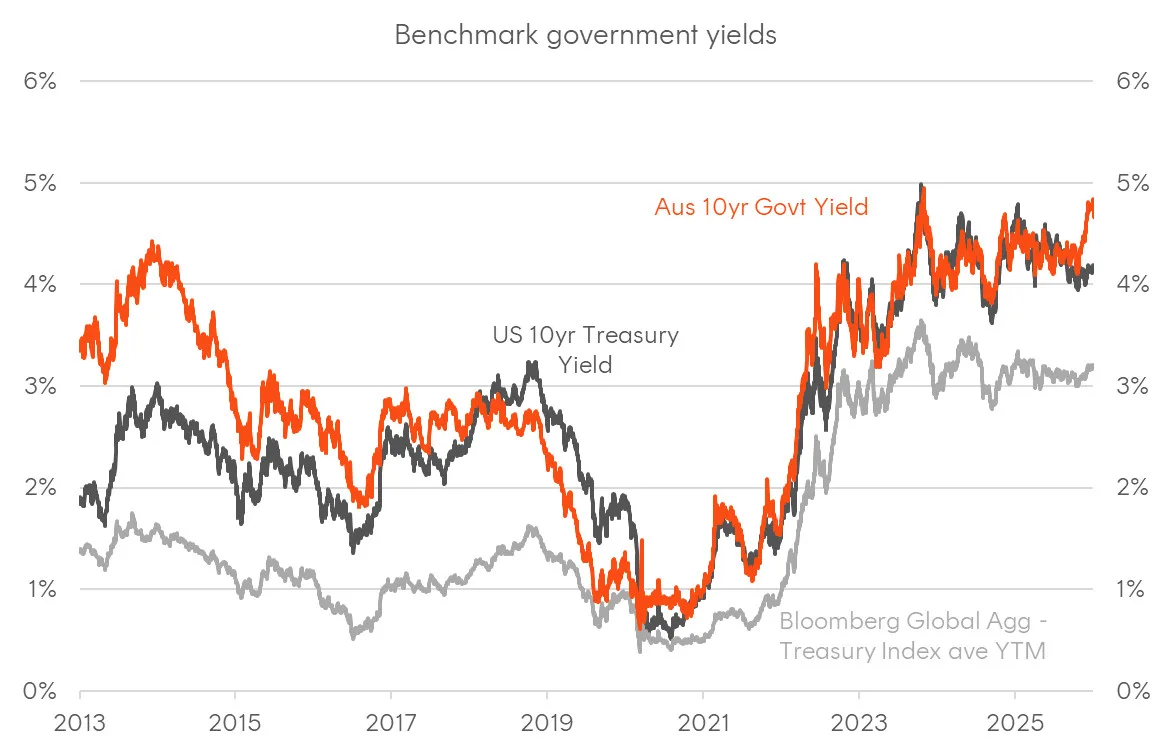

The fourth quarter witnessed widening divergence in global monetary policy expectations and dispersed bond market performance. The Bloomberg Global Treasury Index ended the quarter with yields 7 basis points higher, though this masked significant dispersion. Japanese 10-year yields surged 45 basis points to above 2% – a level last seen in 1998, whilst US 10-year yields remained roughly steady at 4.167%, with yield curves generally steepening globally. The Federal Reserve and Bank of England continued easing whilst Canada, Australia, and New Zealand paused to combat resurgent inflation pressures. The Bank of Japan hiked rates to normalise policy. After three quarters of synchronised easing, central banks have entered a “neutral seeking” regime, challenged by renewed inflationary pressures, fiscal concerns, and softening labour markets. The dual mandate of pursuing full employment whilst maintaining price stability has become increasingly delicate, leading most central banks to hold in December to reassess 2026 outlooks.

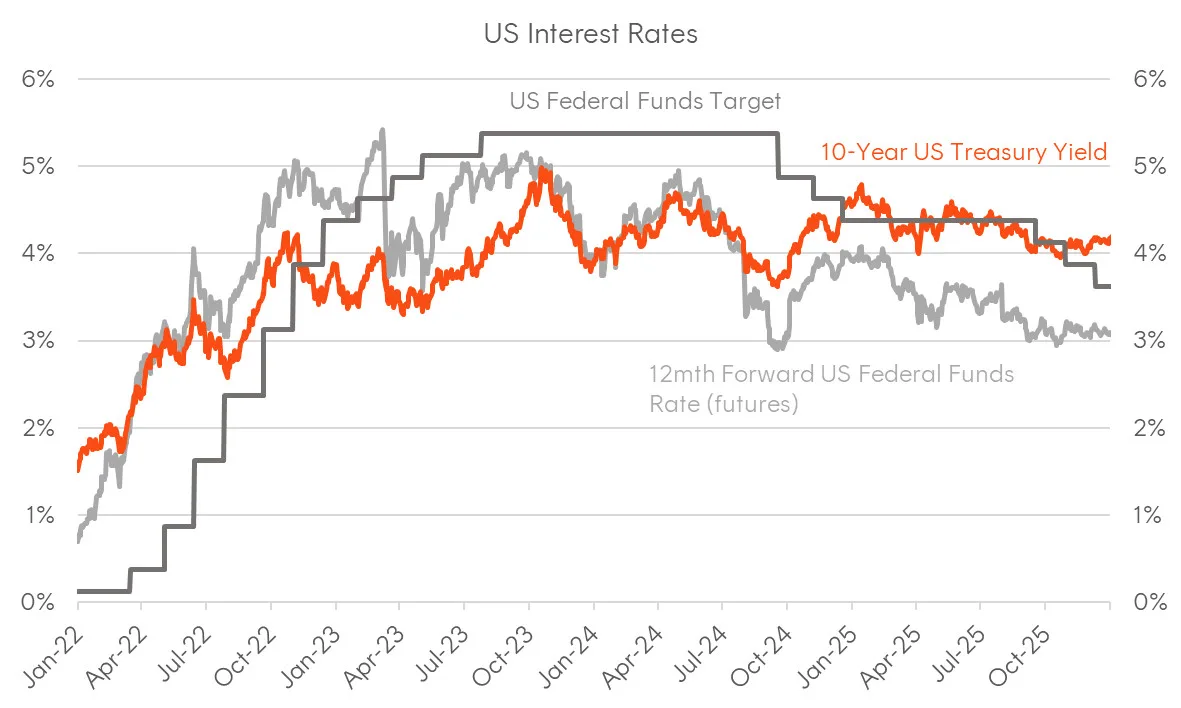

The FOMC lowered rates by 25 basis points at both the October and December meetings, ending the year at 3.50%-3.75%, the third consecutive cut since September amid a rising unemployment rate and significant slowing in jobs growth. The December meeting delivered significant policy shifts: the Fed concluded Quantitative Tightening on 1 December and pivoted to purchasing $40 billion in short-term Treasuries monthly from mid-December to stabilise funding markets. Both meetings saw historic dissents in both directions. Governor Stephen Miran advocated for larger 50 basis point “insurance” cuts at both meetings while Kansas City Fed President Jeff Schmid dissented favouring holds at both sittings, with Chicago Fed President Austan Goolsbee joining the hawkish dissenters in December.

The Bank of Japan hiked by 25 basis points to 0.75% in December – its highest level since 1995 – signalling a firm commitment to weaning the economy off ultra-loose policy despite political uncertainty. The ECB maintained rates at 2.00% for the fourth consecutive meeting, citing resilient growth and stubborn services inflation. The Bank of England delivered a 25-basis point cut to 3.75% via a narrow 5-4 split, as Governor Bailey prioritised supporting growth over temporary inflation resurgence. Both the Bank of Canada and RBNZ appeared to conclude their easing cycles, holding at 2.25% in December and November respectively.

Figure 1: Benchmark government yields

Sources: BoE, RBNZ, BoC, BoJ, ECB, Fed, RBA; as at 31 December 2025

Figure 2: Selected US interest rates

Source: Bloomberg; as at 31 December 2025

Figure 3: Selected Japanese interest rates

Sources: BoJ, Bloomberg; as at 31 December 2025

Domestic macro and rates

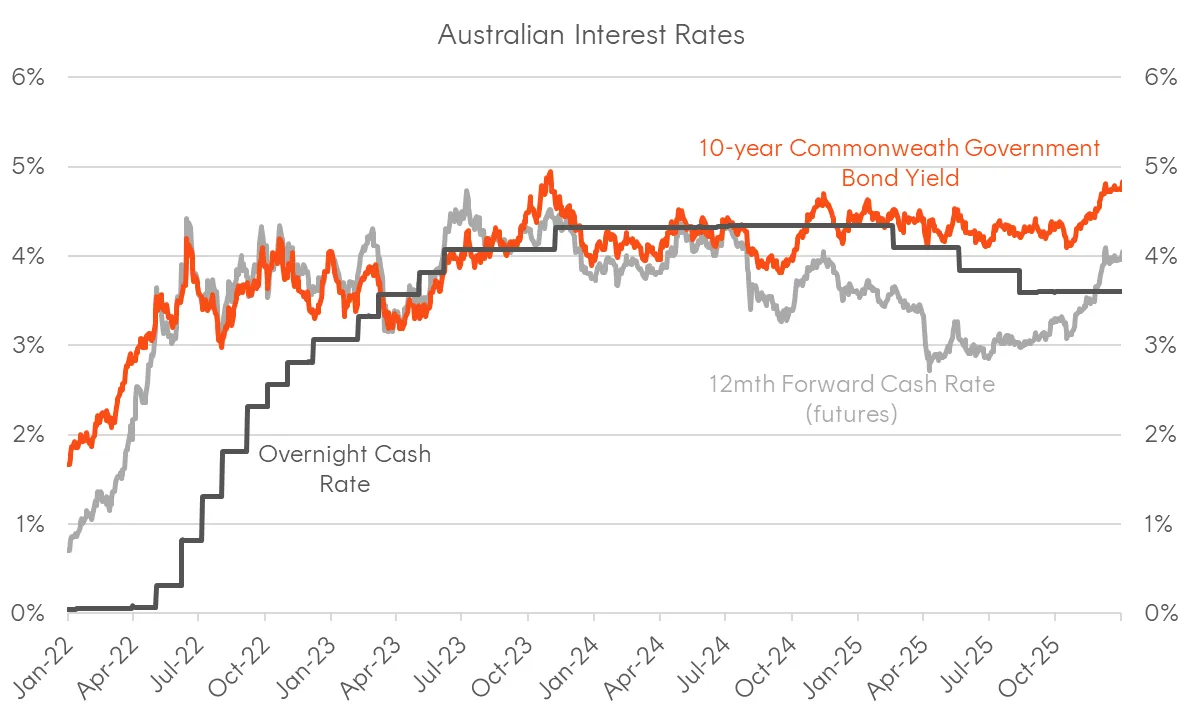

In November, Australian government bond yields broke out of the sideways chop exhibited for much of 2025, pushing higher into year-end. Market pricing for the next RBA rate change flipped from a cut to a hike as the RBA held rates unchanged since August and shifted their guidance in a more hawkish direction amid higher-than-expected inflation data. By year-end, markets were pricing in a 37% chance of a rate hike in February 2026. The hawkish repricing had a greater impact on the front end, leading to a bear flattening of the yield curve, with 3-year ACGB yields increasing 52 basis points over the quarter, versus a 39-basis point increase in 10-year ACGB yields, defying the global steepening trend.

The RBA revised its inflation forecasts higher in the latest Statement on Monetary Policy (SoMP), with the trimmed mean inflation forecast for June 2026 significantly increased from 2.6% to 3.2%, and headline CPI from 3.1% to 3.7%. The minutes of the December policy meeting also showed discussions shifting away from the timing of the next cut to debating whether the current rate was sufficiently restrictive against a backdrop of easing financial conditions. The RBA now views inflation risks as skewed to the upside and has signalled a willingness to tolerate slightly higher unemployment to ensure inflation does not become entrenched above 3%.

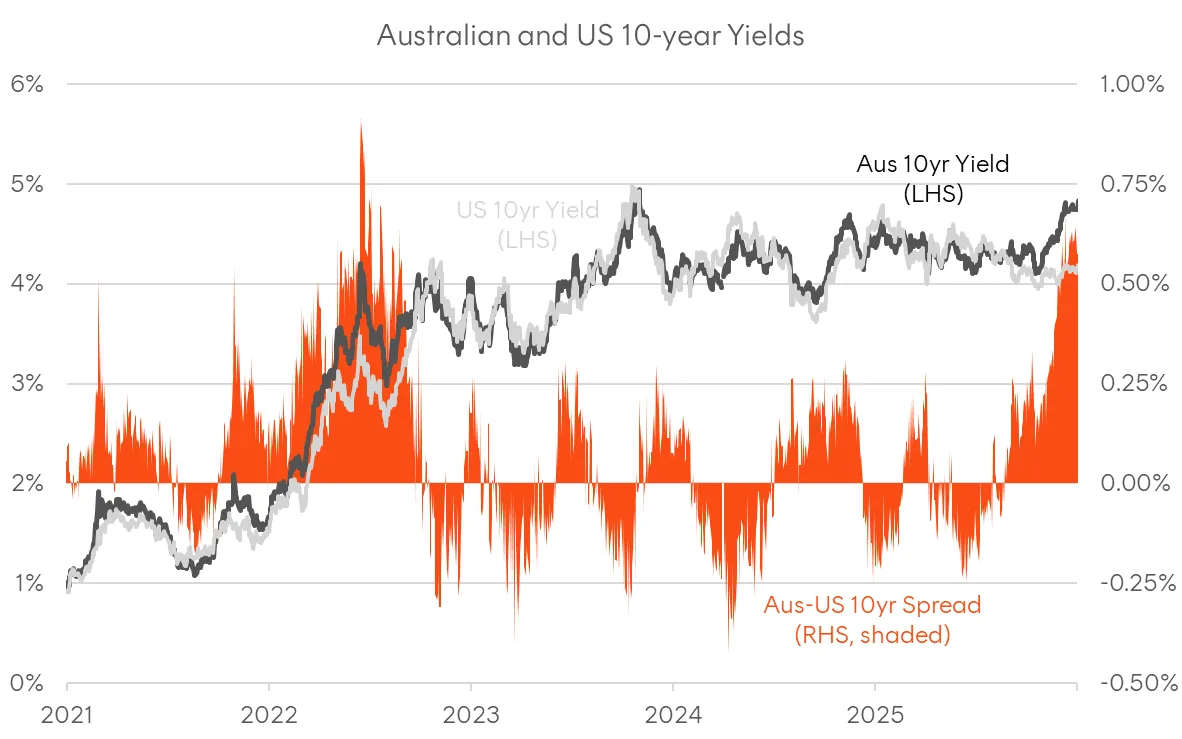

The current position of the RBA puts expectations for Australian interest rates on a clearly divergent path to that of the US. This can be seen in the spread between the 10-year government bond yields of Australia versus the US of 57 basis points at the end of the year, the widest spreads since August 2022.

Another notable development was the launch of the complete monthly CPI data by the Australian Bureau of Statistics (ABS) in November (replacing the previous ‘indicator’ series). Despite being highly data-dependent, the RBA acknowledged this new frequency but pointed to the inherent volatility of monthly prints, expressing patience for a clearer trend to emerge, suggesting they still prefer the quarterly CPI data.

Figure 4: Selected Australian interest rates

Sources: RBA, Bloomberg; As at 31 December 2025

Figure 5: Australian-US 10-year sovereign yield spread

Source: Bloomberg; as at 31 December 2025

Global credit markets

Global credit markets consolidated in Q4, with spreads ending the quarter little changed. US 5–10-year investment-grade corporate bond spreads widened 2 basis points over the quarter and over the calendar year, rising to 83 basis points by year-end. US high-yield spreads were also largely unchanged over the quarter but ended the year 19 basis points tighter.

In a year of record global corporate bond sales, a defining feature of Q4 was hyperscaler debt issuance to fund AI-related capital expenditure. Meta’s US$30 billion bond offering in late October was the largest corporate bond sale of 2025, attracting over US$125 billion in orders. Alphabet followed with US$25 billion, Amazon added US$15 billion in its first US deal in three years, and Oracle issued US$18 billion in September. In addition to traditional corporate bond sales, capex issuance was also funded via off-balance sheet asset-backed structures used to facilitate lease-back arrangements of data centres. The wave sparked some minor credit concerns as bondholders recognised a pivot from funding growth via free cash flow to funding via debt, which caused technology names to underperform both IG and HY. Oracle emerged as the market’s barometer for AI-related risk, with its 5-year CDS widening from 57 basis points to 144 basis points over the quarter.

Elsewhere, the syndicated loan market generated headlines with high-profile collapses including First Brands Group and Tricolor Auto Group, both driven by governance failures and allegations of fraud rather than broader credit deterioration. Despite severe losses in affected loan tranches, the stress remained contained and failed to spill over into broader corporate bond spreads, with the market treating these as idiosyncratic events rather than systemic warning sign.

Figure 6: Global credit spreads

Source: Bloomberg; as at 31 December 2025

Figure 7: USD corporate bond issuance

Source: Bloomberg; as at 31 December 2025

Figure 8: Hyperscaler USD debt issuance over time

Sources: Bloomberg; As at 31 December 2025

Domestic credit

Australian credit markets closed 2025 with spreads largely unchanged over Q4, consolidating after three consecutive years of tightening. For the full year, Australian 5-10 year IG spreads tightened 15 basis points, meaningfully outperforming US credit over this period. Across the Australian bank capital structure, senior FRN discount margins were largely unchanged, while Tier 2 spreads across the Big 4 banks tightened by 4 basis points on average (for 5-year time to call paper). Major bank hybrid discount margins tightened 22 basis points as the AT1 roll-off continues, with AMP and Macquarie hybrids called during the quarter.

For the full year, AUD corporate bond issuance reached a record A$165 billion, with Big Four banks issuing A$49.2 billion, other financials A$92 billion, and non-financial corporates A$24 billion. The major banks’ domestic Tier 2 programmes remained well supported, with $11.8 billion printed across 2025, continuing the elevated issuance pace seen over the past three years. Another notable theme was corporate hybrid and subordinated issuance, which saw a record year with $11.1 billion raised in 2025 as issuers including NSW Electricity Networks, Scentre Group, AusNet, Ampol, and Dexus continue to look for funding in this market.

Figure 9: Major bank discount margins

Sources: Westpac, Betashares, Bloomberg, ASX

Figure 10: Australian corporate issuance

Source: Bloomberg; as at 31 December 2025

Duration outlook

Despite broad-based rate cuts in 2025, long-term sovereign bond yields in several markets ended the year higher amid steeper yield curves. Elevated government issuance and growing risks around fiscal dominance have seen measures of term premium – the excess yield for holding long-term bonds and incurring greater interest rate risk compared to holding cash or rolling short-term bonds – remain elevated. Other measures of value in long-term government bonds, like real yields, are also elevated compared to recent history and estimates of neutral real policy rates.

However, with financial conditions broadly supportive and US fiscal policy likely to remain expansionary in 2026, the case for duration is more about capturing generous income levels rather than positioning for elevated recession risk. Although the JGB sell-off has weighed on the global long end in recent months and contributed to curve steepening, the bigger risk for global bonds in 2026 arguably stems from the US.

Against a backdrop of growing uncertainty over Fed independence and an increased likelihood of fiscal expansion, US yields and long-term inflation expectations remain well contained. However, any clear sign of a fundamental change to the Fed’s commitment to 2% would likely profoundly impact long-term inflation expectations and the back end of the Treasury curve. On the other hand, the market is yet to price in any “jumbo” rate cut demanded by the Trump Administration’s allies on the FOMC, with “terminal” fed funds pricing broadly around the FOMC’s most recent estimate of “neutral”. As a result, there are two-sided risks for Treasuries, with a reasonably high likelihood that short-term US yields drop much further once the new Chair is installed and committee’s broader composition is known, with the trend of softening labour market data giving the FOMC cover for further cuts. However, a continued steepening of the Treasury curve remains the base case in the most likely policy scenarios.

Australia stands out for its relative value. The 10-year yield spread to the US recently hit +60 basis points – the widest levels in over 3 years – amid expectations of diverging policy. This reflected hawkish domestic data, but the market’s response has arguably over-indexed on sticky inflation influenced more by administered prices and capacity constraints than wage growth or demand-driven pressures, while downplaying a softening labour market. With rate hikes are now priced in, Australian government bonds present a favourable risk-return profile. There’s also the question of how likely it is that the RBA undertakes a true hiking cycle as the Fed is still cutting rates.

In addition, the domestic AUD market also offers safe-haven appeal against fiscal and geopolitical risks emerging elsewhere. Australia stands out for its much lower public debt-to-GDP ratio, an absence of concerns over central bank independence, and its status as one of the few remaining deep sovereign bond markets with a AAA credit rating.

Figure 11: Policy rate expectations over next 12 months

Source: Bloomberg, various central banks, ASX, CME; as at 12 January 2026

Figure 12: Australian and US policy rates and expectations

Sources: Bloomberg, ASX, CME; as at 12 January 2026

Figure 13: Measures of US inflation expectations

Sources: Bloomberg, University of Michigan; As at 31 December 2025

Credit outlook

Credit spreads remain tight at the time of writing, and while the macro backdrop appears constructive for growth, helped by accommodative US fiscal and monetary policy, digesting the wave of issuance coming to market may prove challenging.

AI capex should remain a big theme heading into 2026, with the technology sector underperforming broader high yield and investment grade indices, suggesting the surge in issuance is already having an impact. Some issuers have seen particularly sharp spread widening – Oracle and the smaller “neocloud” players among them – where leverage metrics are already elevated. However, the main constraint on AI spending commitments in aggregate isn’t yet the credit markets or the cost of capital, but energy and securing sufficient power. Ultimately, the hyperscalers overall, enjoy very strong balance sheets, with some of the best credit ratings in the corporate bond universe, and low absolute borrowing costs. There’s at present no financial barrier to increasing leverage given the potential rewards of winning the AI capex race.

The complication is that elevated Treasury issuance may crowd out some USD corporate supply, particularly as this technology capital cycle clashes with a refinancing wave from the 2020–21 issuance boom. We expect spreads to widen modestly but also anticipate the hyperscalers will look to diversify funding sources away from the USD credit market. Growing expectations suggest the AUD corporate market may see US technology names return, with the last US big-cap tech issuer in the “Kangaroo” market being Apple back in 2016.

Given technology’s very low share of the AUD corporate bond benchmark, a wave of issuance from the sector would be well received and help diversify local bond portfolios. In addition, with much of the AI spend directed towards data centres, a decent proportion is likely to be financed via off-balance sheet vehicles and asset-backed securities. The local securitised debt market has seen a boom in recent years, primarily in RMBS, and it’s likely some AI capex financing will reach our shores via ABS, which will also likely be well received by local investors.

For Australian credit, the case for fixed rate exposures is compelling. With global yield curves steepening, term premia apparent in duration, and rate hikes now embedded in domestic yields, fixed rate credit offers an attractive combination of carry and potential capital upside should the RBA disappoint the hawks. Even with spreads tight, the additional carry earned on AUD corporate bonds should outpace any valuation drag from a modest spread widening.

Figure 14: USD tech-related corporate bond issuance over time

Source: Bloomberg, Betashares; as at 31 December 2025

Figure 15: USD credit spreads for selected sectors

Source: Bloomberg, Betashares; as at 12 January 2026

Figure 16: Global fixed income dashboard as at 31 December 2025

Source: Bloomberg