ETF distributions: frequently asked questions

8 minutes reading time

- Global shares

Almost half of current ETF investors say that getting access to overseas markets is one of the reasons they use ETFs1, and in recent years, the US has been one of the most popular investment destinations. In fact, on a combined basis in 2023, Australian ETFs that provide exposure to US equities drew more inflows from investors than international equities ETFs that provide exposure to the rest of the developed world2.

But following several years of strong performance for US equities, investors may be asking themselves how to diversify their international equities exposure outside the US. This can present a challenge however, as many broad global equity indices (and the ETFs that track them) hold large positions in US stocks. For example, for the MSCI World Index, one of the most widely known global share indices, over 70% of its constituents are US listed companies3.

But the options for Australian ETF investors have expanded considerably over the last decade, and there is now a range of ETFs available offering exposure to specific overseas markets. Here are three that are worth a look.

The stealth outperformer

When most people think of Japanese equities and the economy, they think of the enormous bubble in the 1980s, and the ‘lost decades’ since then. But just last month, Japanese equities finally passed the high watermark set all the way back in 1989, setting a new all-time high for the first time in 34 years.

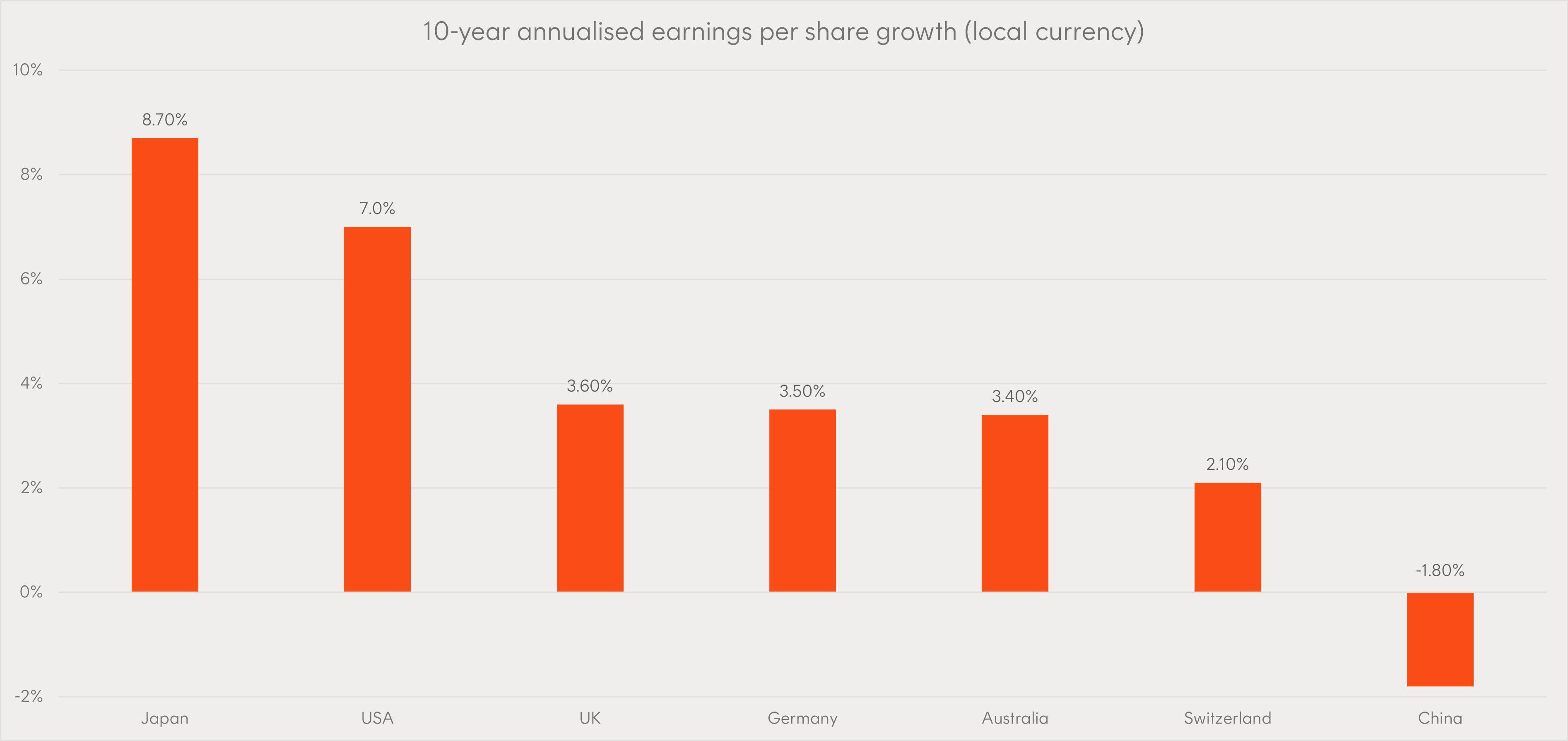

More surprisingly though, for AUD hedged investors, Japanese exporters have outperformed global equities, US equities, and Australian equities over the last 10 years (remembering of course that past performance is not indicative of future performance)4. And as the chart below shows, Japanese equities have experienced earnings growth that’s outstripped many developed markets over the last decade.

Source: Morgan Stanley Research, Datastream, MSCI. Note EPS calculated in local currency. Based on MSCI indices. As at 31 December 2023. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index.

Japan has recently enjoyed economic tailwinds that have allowed its equity market to outperform many global peers and is now looking well-positioned for the future. Japan has been one of the major beneficiaries of both the geopolitical tension between China and the west, as well as the economic struggles of the world’s second largest economy. ‘Friendshoring’ has seen Japan turn into the go-to jurisdiction for the relocation of certain supply chains, especially for national security-sensitive industries such as semiconductors5.

Japanese inflation has stayed much lower than most large economies, which has allowed the Bank of Japan to maintain very accommodative monetary policy. This has kept the Yen relatively weak, which has had dual benefits for HJPN Japan Currency Hedged ETF . As HJPN’s index is focused on exporters, a weak Yen has helped to make those companies more price competitive, while the currency hedging overlay has helped the index to materially outperform its unhedged peers in AUD terms over the last one and three years.

Additionally, low Japanese interest rates are allowing the hedged index to enjoy a ‘carry’* benefit that is currently adding ~5.1% p.a. for Australian investors6.

*’Carry’ refers to the income received (or cost incurred, if negative) from implementing a currency hedge. Currency hedging (in relation to HJPN) involves selling Japanese Yen and buying Australian dollars. The carry is a result of the difference in interest rates for the two currencies.

The world’s new manufacturing hub

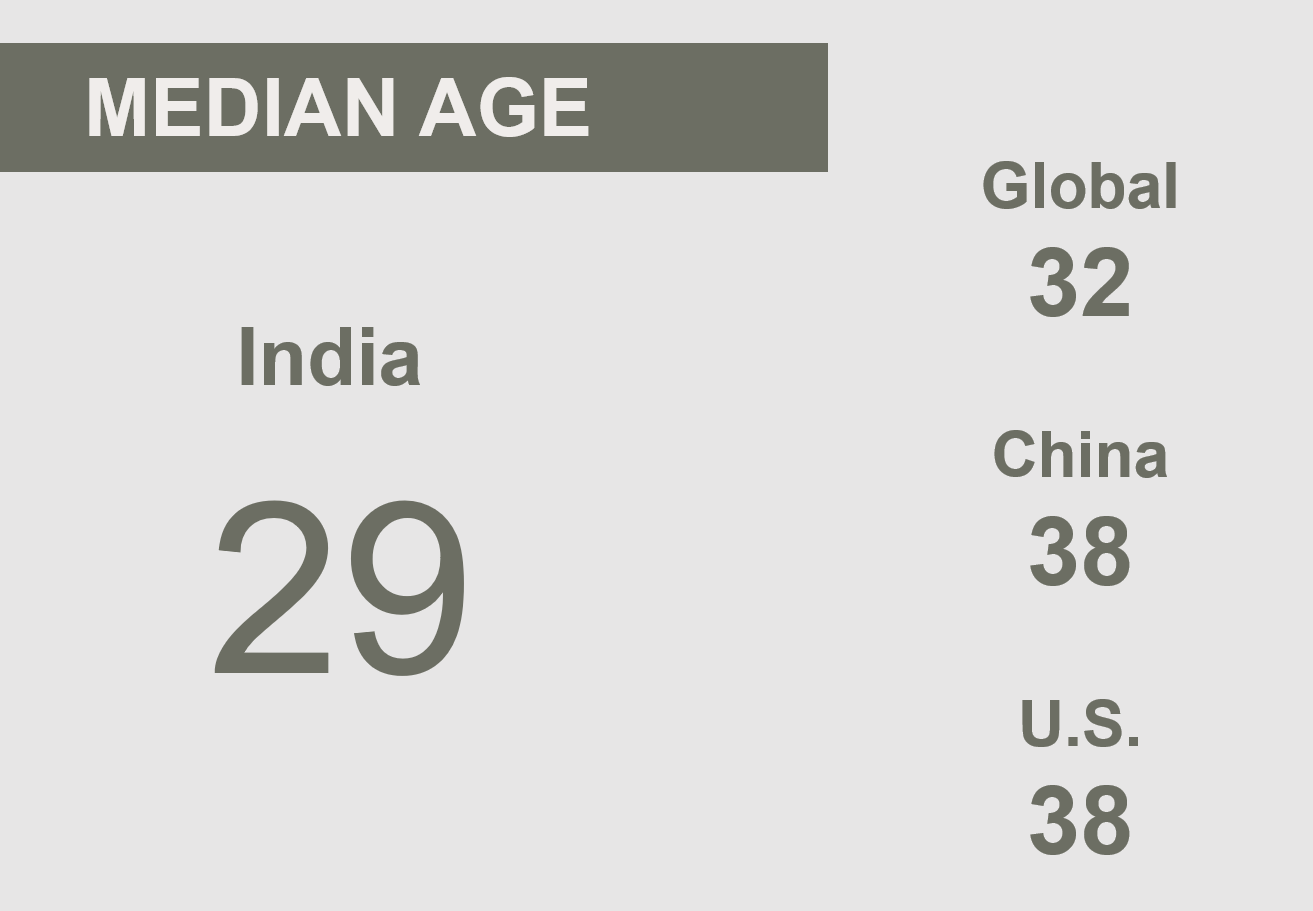

Like Japan, Indian equities could be in the early stages of a period of long-term growth. India’s large, young, educated workforce is expected to provide both the foundation to fuel economic growth, as well as a bourgeoning domestic consumer base. Should its GDP per capita continue to accelerate, household incomes rise, and a new middle class emerge, this could drive a structural rise in domestic consumption and increase the potential for a private credit boom. This might sound familiar to some, as it’s a very similar setup to what was seen in China in the early 2000s.

Source: The World Factbook 2022, CIA.

Arguably a larger catalyst for growth in the near term has been the Indian government’s recent shift in their approach to economic development, as the focus has switched to attracting foreign investment and providing support for the rerouting of global supply chains. Corporate tax reform and incentives have been aimed at fostering a more business-friendly environment for multi-nationals and transforming India into a global manufacturing hub.

India has benefitted from China’s struggles, positioning itself as the natural successor to China’s decades long claim as the world’s manufacturing hub. Global manufacturers are seeking to reduce their dependence on China, so the ‘friendshoring’ theme may still have a long way to go. India looks to have repositioned itself as the primary global alternative for labour-intensive manufacturing – working with major companies including Samsung, Lenovo, Dell, and iPhone manufacturers.

IIND India Quality ETF screens companies based on quality factors while including both large and mid-cap Indian stocks. IIND seeks to provide an exposure that is representative of the broader domestic Indian economy and the emerging consumer, rather than a more concentrated market-cap weighted exposure skewed towards energy and financials.

Effective diversification for Australian investors

Europe is not as homogenous as many may perceive. Its geographical diversity allowed respectable returns from powerhouses Germany and France to be supported by strong performances from some smaller markets, such as Spain, Italy and the Netherlands, over 2023. Much of this performance has been attributed to optimism in the markets, after formerly downbeat forecasts of the effects of inflation and energy prices on growth proved to be overblown, with anticipation of possible rate cuts fuelling a rally late in 20237.

Despite being a region that is often overlooked by Australian investors, Europe, and particularly the exposure offered by HEUR Europe Currency Hedged ETF , presents attractive diversification and promising fundamentals. HEUR’s exporter focused index only includes companies generate at least 50% of their revenue from regions outside the eurozone. This results in a mix of sectors that are not well represented in the Australian market, with more than 50% of the fund comprised of Consumer Discretionary, Industrials and Information Technology stocks.

A wide range of options for ETF investors

While diversifying outside Australia or the US sharemarket was once a challenge for Australian investors, the range of options now offered by Betashares’ ETFs make it easy to build a well-diversified equities portfolio with the potential for strong growth.

| Funds | 1 Year | 3 Years (p.a.) | Since Inception (p.a.) | Inception Date* |

| HJPN | 48.15% | 16.97% | 17.31% | 19/07/2019 |

| IIND | 29.90% | 13.30% | 10.70% | 2/08/2019 |

| HEUR | 14.87% | 10.29% | 8.39% | 19/07/2019 |

Source: Morningstar, Bloomberg. As at 29 February 2024. Past performance is not an indicator of future performance. Returns are calculated in Australian dollars using net asset value per unit at the start and end of the specified period and do not reflect brokerage or the bid ask spread that investors incur when buying and selling units on the ASX. Returns are after fund management costs, assume reinvestment of any distributions and do not take into account tax paid as an investor in the relevant fund. Current performance may be higher or lower than the performance shown.

*In respect of HJPN and HEUR, ‘inception date’ refers to the inception of the fund’s current investment strategy. Prior to the inception date, each of these funds traded under a different investment strategy, Information about each fund’s performance prior to the current strategy inception date is available by calling 1300 487 577 or by emailing [email protected].

Thanks to Alexander Parker and Tom Wickenden for their contributions to this article.

There are risks associated with an investment in each fund, including market risk and country risk, as well as (in respect of IIND) index methodology risk, concentration risk and currency risk. Investment value can go up and down. An investment in each fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each fund, please see the applicable Product Disclosure Statement and Target Market Determination, both available at www.betashares.com.au.

1. Source: Betashares Investment Trends 2023 ETF Investor and Adviser Report, based on survey undertaken between June – August 2023 involving over 1750 respondents. ↑

2.Source: Betashares Australian ETF Review: End Year 2023. ↑

3.As at 29 February 2024. Source: MSCI. ↑

4.As at 18 March 2024. Source: Bloomberg. Japanese exporters represented by S&P Japan Exporters AUD Hedged Index NTR (which Betashares Japan ETF – Currency Hedged seeks to track after fees and expenses), global equities by MSCI World Ex Australia Hedged AUD Net Total Return Index, US equities by S&P 500 AUD Hedged Net Total Return Index, and Australian equities by S&P/ASX 200 Total Return Index. You cannot invest directly in an index. ↑

5.Source: Financial Times ↑

6.As at 18 March 2024. Source: Betashares. Subject to change. You cannot invest directly in an index. Past performance is not indicative of future performance of any index or fund. ↑

7.Source: Morningstar ↑