Bitcoin ETFs: What are they and how do they work?

6 minutes reading time

Bitcoin and the broader crypto market fell slightly but were relatively stable over the last week. The US Fed’s latest interest rate hike of 25 bps had very little impact on the bitcoin price. At its lowest, the price fell below US$29K which was a monthly low.

As at 30 July, bitcoin was trading at US$29,294. Ethereum outperformed bitcoin over the week, down -0.04% vs bitcoin’s -2.07% loss. Bitcoin’s market capitalisation is at US$569.5 billion, with total crypto market cap down to US$1.19 trillion. Bitcoin’s market dominance is at 48%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $29,294 | $30330 | $28,934 | -2.07% |

| ETH (in US$) | $1,874 | $1,904 | $1,836 | -0.04% |

Source: CoinMarketCap. As at 30 July 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Westpac and Commonwealth Bank involved in world first

In a world-first between mainstream regulated banks, Westpac and Commonwealth Bank used a CBDC (central bank digital currency), being a digital version of the Australian dollar backed by the RBA, to trade and pay for market securities. Imperium Markets hosted the trade last Thursday.

The benefits of running on decentralised ledgers are improved liquidity and efficiencies in payments, reconciliation and clearing. A lot of the debt markets processes are still manual, operating via phone calls, emails and spreadsheets, creating operational risks. Given new technological risks and need for regulations, banks will proceed with caution.

David Walker, Westpac Chief Technology Officer, said: “A major advantage is the ability to instantly access cash for wholesale investors which they can’t today as it currently takes hours to days. This will allow them to better manage intraday liquidity, creating greater operational efficiency, while also providing transparency for regulators1.”

Bank of Italy partners with Polygon and Fireblocks

Italy’s Central Bank, looking to explore tokenisation of real-world assets, has partnered with Polygon, the Ethereum scaling solution, and crypto custodian Fireblocks, to develop a DeFi ecosystem for traditional finance.

Over the next six months, Milano Hub, the innovation centre of Italy’s central bank, will look to develop an “Institutional DeFi for Security ecosystem.” The goal is to help traditional finance firms experiment with security tokens and transact using DeFi in a safe and regulated manner.

Milano Hub said, “DeFi is an innovative financial technology based on decentralised protocols that aims to replicate existing financial services in an inclusive transparent manner2.”

CRYP company spotlight

Applied Digital Shares hit ATH (Nasdaq: APLD)

Top 10 holding in the Betashares Crypto Innovators ETF (CRYP) (as at 31 July), Applied Digital, ‘designs, develops, and operates next-generation datacentres across North America to provide digital infrastructure solutions to the rapidly growing high performance computing HPC industry’, according to its website. Currently, 100% of its revenues still come from hosting crypto mining activities, but it has plans to diversify away from crypto mining industry into artificial intelligence (AI).

Last Tuesday, the company announced fiscal Q4 sales had almost tripled and signed its first AI client, which sent shares 17% higher. Revenue went from US$7.5m in the quarter ending May a year ago to US$22m this year. Losses also widened from US$2.3m the previous year to US$6.5m, but the market seems to be hopeful that the signing of two new contracts with AI customers, totalling up to US$640m over 36 months, may prove they have a real AI pipeline3.

On-chain metrics

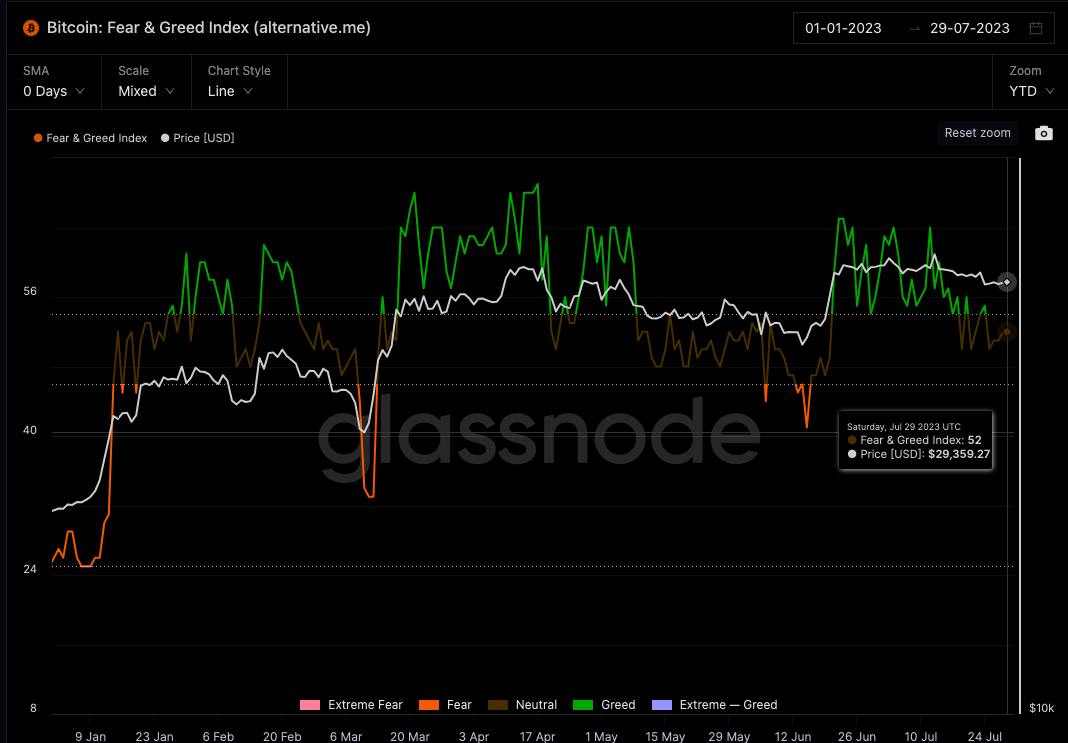

Bitcoin (BTC): Fear and Greed Index (alternative.me)

The Crypto Fear & Greed Index is an indicator from Alternative.me that aims to capture investor sentiment in a single number by incorporating data from multiple sources. The index ranges from 0 to 100, where 0 denotes “extreme fear”, and therefore periods of exaggerated negative investor sentiment. On the other hand, 100 means “extreme greed”, and is an indication of maximum fear of missing out.

According to data from Alternative.me, as at 29 July, the index is currently at 52, which is a neutral score.

Source: Glassnode. Past performance is not indicative of future performance.

Ethereum (ETH): Number of Addresses with Balance ≥ 32 ETH

This is the number of unique addresses holding at least 32 ETH, being the number of potential validators for ETH 2.0. Only Externally Owned Addresses (EOAs) are counted, and contracts are excluded.

Based on data from Glassnode, as at 29 July, there were approximately 126,572 addresses with at least 32 ETH. This is off the all-time highs of 131,239 back in March.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Over the week to 30 July, the largest mover within the Top 20 was Dogecoin (DOGE), with a 11.31% gain. Dogecoin moved to a two-month high on speculation that it could become a payment option on the Twitter platform that has rebranded to X. Twitter owner, Elon Musk, also added the DOGE symbol to his bio.

Musk’s vision for X is that it becomes an “everything” app similar to WeChat in China. Twitter CEO Linda Yaccarino tweeted that: “X is the future state of unlimited interactivity – centred in audio, video, messaging, payments/banking – creating a global marketplace for ideas, goods, services, and opportunities. Powered by AI, X will connect us all in ways we’re just beginning to imagine4.”

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio

References:

2. https://thedefiant.io/bank-of-italy-taps-polygon-for-institutional-defi-pilot

4. https://news.bitcoin.com/biggest-movers-doge-surges-as-elon-musk-launches-x/

Past performance is not indicative of future performance.

Off the Chain is published every 2nd Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.