4 minutes reading time

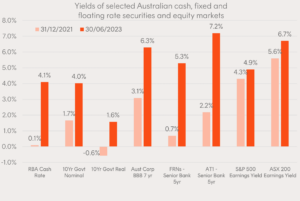

2022 was the worst year on record for fixed rate bond returns. But, as the chart below shows, as of 30 June 2023, yields have lifted across all categories of fixed income. Bonds now look attractive versus equities, as the equity risk premium has compressed. And importantly, stock-bond correlations have reverted to being negative in 2023, as last year’s concerns about inflation have now shifted to concerns about growth and corporate earnings.

Source: Bloomberg, Westpac. 10Yr Govt Nominal, 10Yr Govt Real, Aust Corp BBB 7 yr are yield to worst. FRNs – Senior Bank 5yr, AT1 – Senior Bank 5yr are all-in-yields. S&P 500 Earnings Yield and ASX 200 Earnings Yield are inverted 12 month forward P/E ratios. Yields are subject to change.

When it comes to fixed income, Betashares currently manages more assets and has received more new investor capital than any other Australian ETF provider1.

Core fixed income building blocks

Betashares fixed income ETFs have been designed to provide efficient building blocks to help investors tailor their defensive allocations to meet their needs – whether it be for diversification, capital stability or income.

Betashares currently has 11 cash, hybrids and fixed income ETFs that can be easily bought and sold on the ASX. We highlight four of the funds below:

Betashares Australian Composite Bond ETF (ASX Code: OZBD)

OZBD Australian Composite Bond ETF is designed to be a singular core portfolio allocation for Australian fixed income. It aims to track the performance of an index (before fees and expenses) that provides exposure to a diversified portfolio of high-quality Australian government and corporate fixed rate bonds selected on the basis of risk-adjusted income potential, while controlling for overall interest rate and credit risk. OZBD offers the potential to deliver superior returns to both active and simple liability-weighted passive investment approaches.

OZBD’s management cost is 0.19% p.a.*

Betashares Australian High Interest Cash ETF (ASX Code: AAA)

AAA Australian High Interest Cash ETF ’s assets are simply invested in cash deposit accounts held with selected banks in Australia. As at 21 August 2023, the interest rate earned on AAA’s deposits sat at 4.19% p.a. (net of management costs)2. AAA’s annualised interest rate (net of management costs) has been above the RBA Cash Rate since its inception in 20123.

AAA pays monthly distributions and has the added benefit of being exchange-traded.

Betashares Australian Bank Senior Floating Rate Bond ETF (ASX Code: QPON)

QPON Australian Bank Senior Floating Rate Bond ETF ’s assets are invested in a quality portfolio of senior floating rate notes issued by Australian banks, which are among the most liquid and highest credit-rated corporate bonds issued in Australia. QPON has the potential to provide regular attractive income and capital stability, as well as lower interest rate sensitivity compared to fixed rate bonds, and has historically exhibited low correlation to equities.

QPON’s management cost is 0.22% p.a.*

Betashares Australian Government Bond ETF (ASX Code: AGVT)

AGVT Australian Government Bond ETF invests in a portfolio of relatively long duration Australian government and ‘government-related’ bonds (e.g. bonds issued by supranationals and sovereign agencies). AGVT targets bonds with a maturity of 7-12 years seeking to enhance defensive characteristics, with a longer duration profile and high credit quality (with an average credit rating of AAA4).

AGVT’s management cost is 0.22% p.a.*

In conclusion

Core portfolio construction must address the issues of diversification, cost and performance, in what is a difficult market to navigate.

The ‘normalisation’ of interest rates means fixed income again may be deserving of its role within the asset classes mix. This rate reset may be an ideal time to re-evaluate what defensive allocations are now offering, and whether portfolio adjustments should be made.

Build a stronger core with Betashares

Betashares core ETFs provide a range of diversified building blocks to construct robust portfolios for your clients.

Learn more about Betashares core funds here.

* Other costs, such as transaction costs, may apply. Refer to the applicable Product Disclosure Statement, available at www.betashares.com.au, for more information.

There are risks associated with an investment in each Betashares Fund. Investment value can go up and down. An investment in any Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on the risks and other features of a Fund, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.

References:1.Based on Morningstar data as at 30 June 2023. Includes current FUM and 1 year net flows for all ETFs available on ASX and CBOE Australia classified by Morningstar as “Fixed Income” or “Money Market”2.AAA’s interest rate is variable and may be lower at time of investment. Excludes any brokerage or bid-ask spread incurred when investors transact on the ASX3.Past performance is not indicative of future performance. 4. Source: Betashares, as at 13 July 2023. Average credit rating for the bonds in the portfolio. Credit ratings are opinions only and are not to be used as a basis for assessing investment merit. Ratings are subject to change.