5 minutes reading time

Australian ETF Industry sets new inflow record at nearly $6B

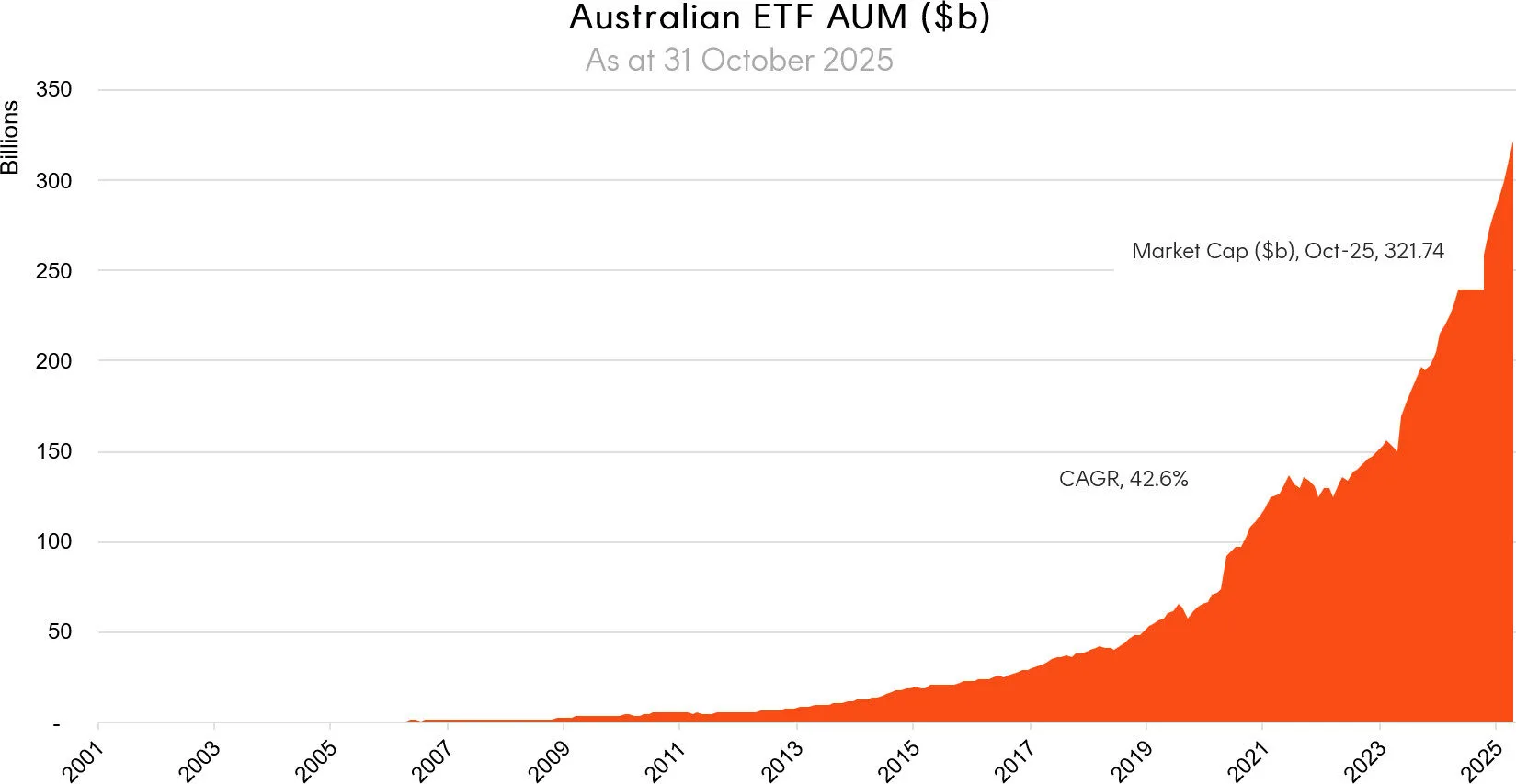

- A record $5.99 billion of inflows in October, plus positive market movements, helped the Australian ETF industry to a new record high of $321.7B in funds under management– a rise of $12.5B or 4.03%

- Industry inflows for the month were a record $5.99B – surpassing the record set in July this year, and only the third time that monthly inflows have been above $5B

- ASX trading value was ~$18B in October

- Over the last 12 months the Australian ETF industry has grown by 38.4%, or $89.2B

- 11 new funds, including the Betashares FTSE Global Infrastructure Shares Currency Hedged ETF (ASX: TOLL), launched in October

- The Betashares Global Gold Miners Currency Hedged ETF (ASX: MNRS) retains its YTD performance lead, however a Hydrogen exposure was the best performing fund in October

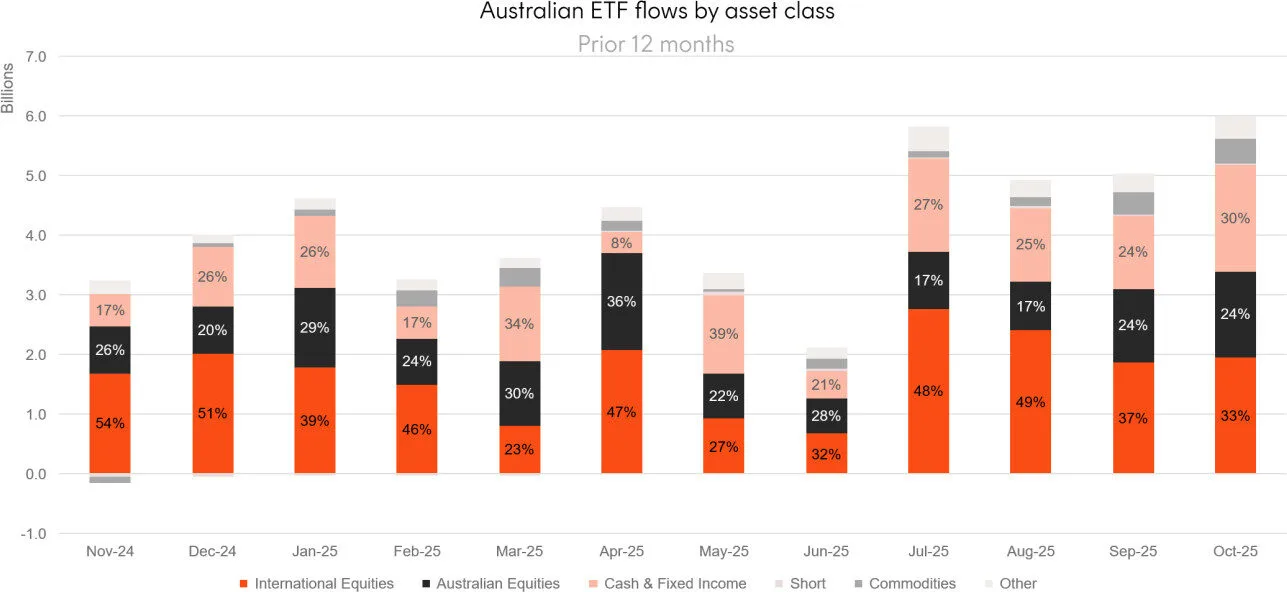

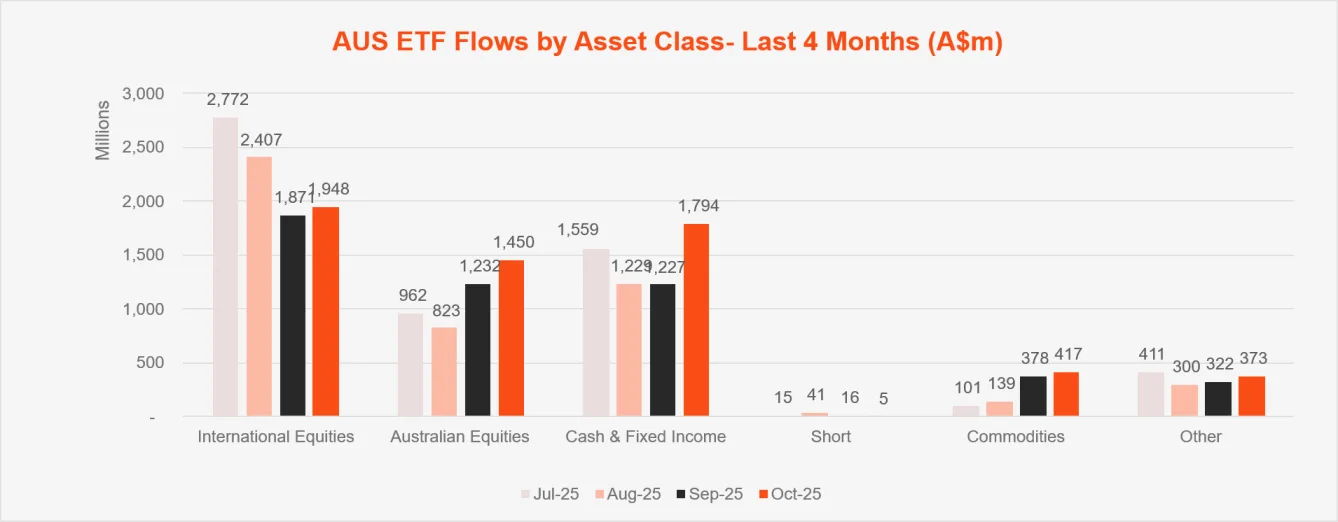

- International Equity ETFs continued their streak of receiving the highest level of flows with $1.9b, Australian Equities followed with $1.45b, while Fixed Income ($1.38b) rounded out the top three.

Australian ETF Industry AuM: July 2001 – October 2025

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $321.7B – all time high

- ASX CHESS Market Cap: $275.09B1

- Market Cap change for September: 4.03%, $12.5B

- Market cap growth for last 12 months: 38.4%, or $89.2B.

New Money

- Net inflows for month: $5.99B – all time high.

Products

- 451 Exchange Traded Products trading on the ASX & Cboe

- 11 new funds, including the Betashares FTSE Global Infrastructure Shares Currency Hedged ETF (ASX: TOLL), launched in October.

Trading Value

- ASX trading value was ~$18B in September.

Performance

- The Betashares Global Gold Miners Currency Hedged ETF (ASX: MNRS) retains its YTD performance lead, however a Hydrogen exposure was the best performing fund in October.

Top 10 products: October 2025

Top 10 Products: By Market Cap |

||||

|

Ticker |

Product |

Issuer |

Market Cap |

Rank Movement |

|

VAS |

Vanguard Australian Shares Index ETF |

Vanguard |

$22,678,424,117 |

|

|

VGS |

Vanguard MSCI Index International Shares ETF |

Vanguard |

$13,861,698,429 |

|

|

IVV |

iShares S&P 500 ETF |

iShares |

$12,899,044,293 |

|

|

A200 |

Betashares Australia 200 ETF |

Betashares |

$8,643,893,052 |

|

|

QUAL |

VanEck MSCI World Ex-Australia Quality ETF |

VanEck |

$7,974,757,759 |

+1 |

|

NDQ |

Betashares NASDAQ 100 ETF |

Betashares |

$7,906,404,354 |

+1 |

|

IOZ |

iShares Core S&P/ASX 200 ETF |

iShares |

$7,832,737,634 |

-2 |

|

MGOC |

Magellan Global Fund (Open Class) (Managed Fund) |

Magellan |

$6,789,992,056 |

|

|

DACE |

Dimensional Australian Core Equity Trust (Managed Fund) |

Dimensional |

$6,449,651,288 |

|

|

VTS |

Vanguard US Total Market Shares Index ETF |

Vanguard |

$6,410,666,785 |

+1 |

|

Other products with > $3B AUM: AAA, BGBL, DFGH, DGCE, ETHI, GOLD, HYGG, IAF, IHVV, IOO, MVW, STW, SUBD, VAF, VAP, VBND, VDHG, VEU, VGAD, VHY Average Daily Trading Value (by $) – Month |

||||

|

Ticker |

Product |

Issuer |

ADTV |

Rank Movement |

|

VAS |

Vanguard Australian Shares Index ETF |

Vanguard |

$39,259,637 |

|

|

GOLD |

Global X Physical Gold |

Global X |

$34,974,213 |

+7 |

|

AAA |

Betashares Australian High Interest Cash ETF |

Betashares |

$33,628,464 |

-1 |

|

IVV |

iShares S&P 500 ETF |

iShares |

$27,395,580 |

-1 |

|

VGS |

Vanguard MSCI Index International Shares ETF |

Vanguard |

$24,345,842 |

|

|

NDQ |

Betashares NASDAQ 100 ETF |

Betashares |

$22,580,244 |

+1 |

|

A200 |

Betashares Australia 200 ETF |

Betashares |

$21,142,698 |

-3 |

|

PMGOLD |

Perth Mint Gold |

Perth Mint |

$19,443,958 |

+14 |

|

IOZ |

iShares Core S&P/ASX 200 ETF |

iShares |

$18,009,069 |

-3 |

|

SUBD |

VanEck Australian Subordinated Debt ETF |

VanEck |

$16,182,159 |

+4 |

Top 10 Inflows (by $) – Month |

||||

|

Ticker |

Product |

Inflow Value |

||

|

VAS |

Vanguard Australian Shares Index ETF |

$329,098,290 |

||

|

AAA |

Betashares Australian High Interest Cash ETF |

$298,488,782 |

||

|

VGS |

Vanguard MSCI Index International Shares ETF |

$261,463,435 |

||

|

A200 |

Betashares Australia 200 ETF |

$228,948,965 |

||

|

VBND |

Vanguard Global Aggregate Bond Index (Hedged) ETF |

$220,359,109 |

||

|

SUBD |

VanEck Australian Subordinated Debt ETF |

$208,999,383 |

||

|

IOZ |

iShares Core S&P/ASX 200 ETF |

$195,004,905 |

||

|

BGBL |

Betashares Global Shares ETF |

$168,994,618 |

||

|

IJP |

iShares MSCI Japan ETF |

$159,612,852 |

||

|

VHY |

Vanguard Australian Shares High Yield ETF |

$145,056,683 |

||

Top 10 Outflows (by $) – Month |

||||

|

Ticker |

Product |

Inflow Value |

||

|

XALG |

Alphinity Global Equity Fund (Managed Fund) |

-$143,683,705 |

||

|

MGOC |

Magellan Global Fund (Open Class) (Managed Fund) |

-$135,520,212 |

||

|

IHOO |

iShares Global 100 AUD Hedged ETF |

-$52,486,384 |

||

|

FANG |

Global X FANG+ ETF |

-$41,618,870 |

||

|

U100 |

Global X US 100 ETF |

-$39,353,426 |

||

|

VLUE |

VanEck MSCI International Value ETF |

-$39,249,169 |

||

|

QUAL |

VanEck MSCI World Ex-Australia Quality ETF |

-$34,110,062 |

||

|

QUS |

Betashares S&P 500 Equal Weight ETF |

-$32,104,939 |

||

|

QAU |

Betashares Gold bullion ETF – Currency Hedged |

-$29,268,686 |

||

|

HIGH |

Schroder Australian High Yielding Credit Fund – Active ETF |

-$22,096,591 |

||

Industry Net Flows

Top Category Inflows (by $) – Month

|

Broad Category |

Inflow Value |

|

International Equities |

$1,948,268,922 |

|

Australian Equities |

$1,449,976,925 |

|

Fixed Income |

$1,384,360,273 |

|

Commodities |

$417,091,325 |

|

Cash |

$409,363,545 |

Top Sub-Category Inflows (by $) – Month

|

Sub-Category |

Inflow Value |

|

Australian Equities – Broad |

$1,049,558,019 |

|

Australian Bonds |

$994,906,542 |

|

International Equities – Developed World |

$881,156,080 |

|

Cash |

$409,363,545 |

|

Global Bonds |

$377,661,527 |

Top Category Outflows (by $) – Month

No outflows recorded by broad category

Top Sub-Category Outflows (by $) – Month

|

Sub-Category |

Inflow Value |

|

Australian Equities – E&R – Impact |

-$5,247,925 |

Performance

Top Performing Products – Month

|

Ticker |

Product Name |

Performance (%) |

|

HGEN |

Global X Hydrogen ETF |

27.69% |

|

IKO |

iShares MSCI South Korea Capped Index ETF |

23.36% |

|

ETPMPD |

Global X Physical Palladium |

20.04% |

|

SEMI |

Global X Semiconductor ETF |

17.61% |

|

ATOM |

Global X Uranium ETF |

16.52% |