3 minutes reading time

This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

The US SEC decision to approve spot bitcoin ETFs from 11 fund managers is a watershed day for the maturity of bitcoin.

The decision should add further confidence to the digital asset ecosystem and could pave the way for Wall Street to move deeper into cryptocurrencies as an asset class.

Bitcoin ETFs now provide US-based investors with an option to invest in bitcoin via a familiar and regulated investing structure. The response from investors was ground-breaking with first day trading volumes across the 11 ETFs topping US$3bn.

According to forecasts by Standard Chartered Bank, if the price of bitcoin were to behave in a manner similar to gold after ETPs providing exposure to gold prices were launched in the US in 2004, it is possible that the price of bitcoin could get to levels closer to US$200,000 by the end of 2025.

Further, while traditional finance has talked a big game about moves into digital assets, the reality has been more mixed in the wake of continued volatility for the sector. The decision by the SEC is expected to provide further confidence and legitimacy to the digital assets ecosystem as it matures as an asset class.

Finally, the move may provide a long-term tail wind to the companies which service the crypto ecosystem. Similar to why investing in gold companies is seen as a leveraged play on investing in gold through the use of operating leverage and financial leverage, investing in the ‘picks and shovels’ of the crypto economy will perhaps see higher demand for many of their services as traditional finance moves deeper into the sector.

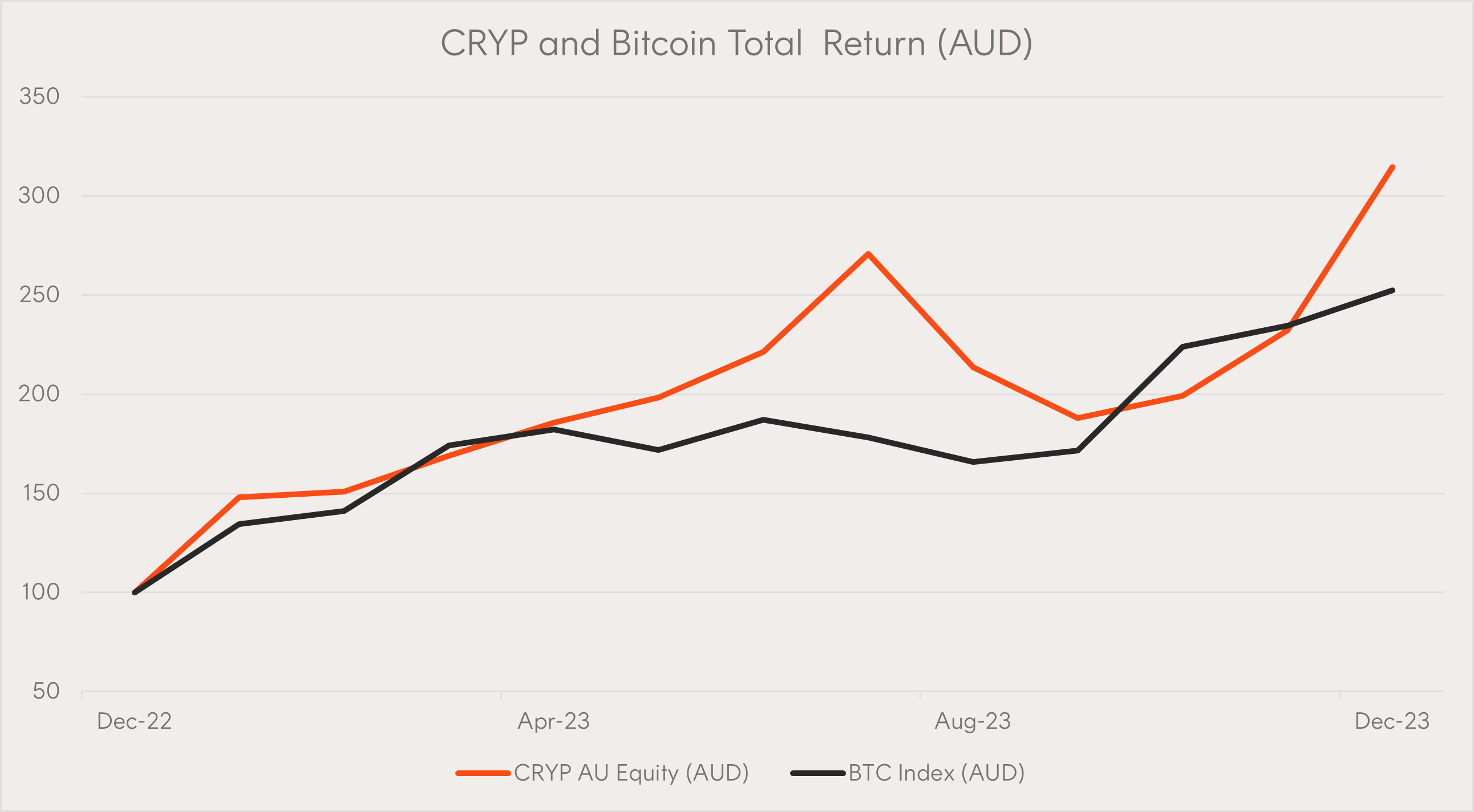

In a bullish bitcoin market, there have been some periods where an exposure to companies that service the crypto-asset industry, such as Betashares Crypto Innovators ETF (ASX:CRYP), has outperformed the price of bitcoin. (In a bearish bitcoin trend, the opposite generally tends to hold true, and the companies typically have underperformed). Of course, it’s important to remember that past performance is not indicative of future performance.

Source: Bloomberg. Past performance is not indicative of future performance of any index or ETF.

CRYP aims to track the performance of an index (before fees and expenses) that provides exposure to global companies at the forefront of the dynamic crypto economy.