7 minutes reading time

- Australian shares

- Diversified

Your child’s journey of exploration starts early – from dissecting flowers to building robots, each achievement reveals their potential. As parents, we want to nurture this curiosity, and a quality education unlocks even more possibilities.

Nevertheless, the soaring costs of education coupled with the current attention given to this topic in the news is causing significant concerns for many families.

This guide equips you to navigate these expenses and build a roadmap for your child’s future. We’ll explore costs, savings options, and the role exchange-traded funds (ETFs) can play.

The price tag of education

Education costs in Australia vary by type, program, and lifestyle choices. Here’s a snapshot (figures are annual averages unless stated):

Primary school:

- Government schools are free with voluntary contributions paid by parents1.

- Catholic and private schools can be as much as $2,561 and $8,511 respectively depending on the state2.

Secondary School:

- Public schools are free with voluntary contributions paid by parents.

- Catholic and private school fees can range anywhere from $1,500 to upwards of $30,000 annually,3 depending on the state.

Vocational education:

- There isn’t data about the average cost of vocational education for domestic students, but some courses are free while a Diploma of Accounting for example from TAFE Digital costs $2,8504.

Post-secondary education:

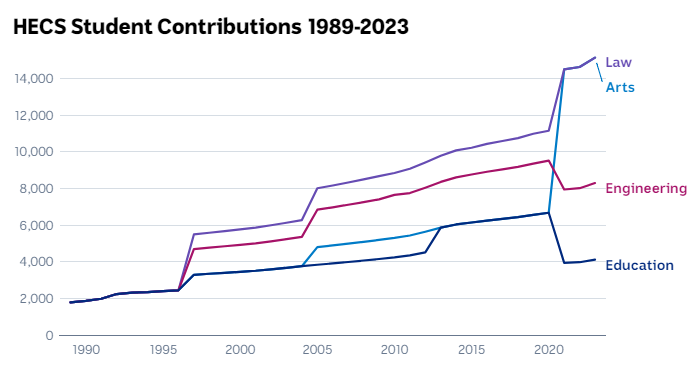

- University tuition fees range from $4,000 to $15,142 per year and have grown significantly over the past three decades as shown in the chart below5.

Sources: Australian Broadcasting Corporation, Australian Government

Incidentals and living expenses:

- The above data only considers tuition costs and school fees. It doesn’t account for incidentals such as books, electronics and uniforms.

- Living expenses add another layer of cost. The government estimates international students need $24,505 annually – a helpful benchmark for potential living expenses if your child moves out6.

The benefits of starting early

Even with a public school education and university aspirations, factoring in living expenses, the total cost could easily exceed $100,000. With student loan debt averaging $26,5007 starting an education fund early has its perks:

- Financial readiness: Be prepared to support your child’s dreams.

- Beat inflation: Grow your savings to keep pace with rising education costs.

- More choices: Help your child pursue their desired path.

- Reduced debt: Minimise student loans, giving your child a head start financially.

By starting early, you grow your funds and teach your child valuable lessons about saving and investing.

Building your child’s education fund: options to consider

ETFs can serve as an excellent choice for building a child’s education fund. They provide access to both growth and defensive assets, are cost-effective, liquid, and can also be a great way to get kids to learn about investing.

Choosing the right option

Consider these factors when deciding which options best suit your strategy:

- Time horizon: How long until your child needs the money?

- Commitment: How much time can you dedicate to managing the portfolio?

- Risk tolerance: How comfortable are you with market fluctuations?

You should also make a plan that establishes guidelines around:

- Regular contributions: A consistent savings plan based on your family’s budget.

- Portfolio reviews: Periodically assess your portfolio’s performance and asset allocation.

- Investing education: Involve your child in age-appropriate discussions about investing.

Practical thinking: How much to invest?

Predicting the exact cost of your child’s future education is tricky. Life throws curveballs, and education costs can fluctuate due to policy changes and inflation.

Maybe your child chooses a trade, reducing anticipated future expenses drastically. Whilst, aspirations for a prestigious university could significantly increase costs.

Let’s use an illustrative example to illustrate the point:

- Your child is a newborn.

- You envision them pursuing law at the University of Queensland, where current tuition for a four-year Bachelor of Law is $15,423 annually8. You assume they’ll live at home while studying.

Calculating the future cost:

- Current cost: $15,423/year * 4 years = $61,692

- Future cost projection (assuming 3% education inflation for 18 years plus the four year study period):

- Future annual cost: $15,423 * (1 + 0.03)^18 = $26,257 in the first year

- Future total cost: $26,257/year indexed at 3% over 4 years = $109,848

Investment strategy:

With $10,000 upfront and a diversified ETF portfolio with a 7% p.a. expected return, a weekly investment of $40 could potentially help your child reach their education goal (not including taxes or fees).

Change the equation:

We initially assumed the child would live at home. But how does the projection change if they move out, using the government’s annual cost of living guidance of nearly $25,000?

To move out and study would add $100,000 more to their costs over four years, which works out to $178,059 in 18 years assuming 3% inflation led by rent increases. The total cost for the same degree then spikes to $287,907 ($109,848 + $178,059)!

Notes:

- This is a simplified example only, and is designed to get parents to engage in long-term thinking and discuss how best to provide for their children using realistic assumptions.

- We assumed 3% annual price increases, reflecting the upper end of the Reserve Bank of Australia’s inflation target framework of 2-3%.

- Actual costs and returns may vary, and our examples don’t account for factors like scholarships and bursaries your child may receive, and the probability of them working.

ETF ideas for your child’s education fund

Saving for your child’s education is a great way to give them a head start. You want your investment strategy to grow alongside them. Here’s how some Betashares ETFs can be a good fit, considering both growth potential and a potential learning opportunity for your child:

- A200 Australia 200 ETF : A200 aims to track the performance of an index (before fees and expenses) comprising 200 of the largest companies by market capitalisation listed on the ASX. Think of companies your child might already know, like Woolworths or CBA. It can be a fun way for them to connect the brands they use with the stock market.

- NDQ Nasdaq 100 ETF : NDQ aims to track the performance of the Nasdaq 100 Index. The Nasdaq 100 comprises 100 of the largest non-financial companies listed on the Nasdaq market, and includes many companies that are at the forefront of the new economy. Think of tech leaders like Apple, Google, and Meta – companies that will no doubt play a big role in your child’s life.

- DHHF Diversified All Growth ETF : DHHF aims to provide low-cost exposure to a diversified portfolio with high growth potential, that may suit investors with a high tolerance for risk. The ETF provides exposure to approximately 8,000 equity securities listed on over 60 global exchanges, in one ASX trade. It can be a potential “set and forget” option for parents, but for kids, it can be fascinating to see the level of diversification between so many different countries, sectors and companies.

Conclusion

Investing in your child’s education lays a strong foundation for their future. Beginning the journey early, exploring various avenues, and considering options like ETFs can significantly ease the path to realising their academic dreams while imparting essential financial wisdom.

However, this guide serves as a preliminary step. Navigating education expenses, particularly amidst the unpredictability of inflation, your child’s choices, and governmental policy shifts affecting course fees, can make planning complex.

Thus, seeking guidance from a financial adviser about how best to approach this issue and create a long-term education fund for your child can help parents gain the confidence they need around how best to help their children.

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in each fund should only be, taking into account your particular circumstances, including your tolerance for risk. For more information on the risks and other features of Betashares funds, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.

Any Betashares Fund that seeks to track the performance of a particular financial index is not sponsored, endorsed, issued, sold or promoted by the index provider. No index provider makes any representations in relation to the Betashares Funds or bears any liability in relation to the Betashares Funds.

1. Funding for schools: a quick guide ↑

2. Back to school costs 2024 ↑

6. Change to evidence of financial capacity for Student visas ↑

7. Cutting student debt for more than three million Australians ↑

8. University of Queensland ↑

2 comments on this

Sheer insanity. With education costs rising as they are, the bank of mum and dad will need to help their kids with more than just property purchases, they’ll need to bail their kids out from carrying HECS debts into their 50s.

Are your funds and ETFs open to U.S.citizens?