7 minutes reading time

- Digital assets

If you prefer to listen to Off the Chain, please click the player below.

Bitcoin and the broader crypto market fell significantly in the seven days to 25 November 2025. Prices touched as low as US$82,000 – levels not seen since late April 2025.

Helping to push prices lower is the lingering liquidity crunch from the tariff fears of early October as well as poor crypto sentiment. This is evidenced by the Crypto Fear and Greed index falling to a yearly low of 10, coincidentally almost one year exactly since the index recorded its yearly high of 87.

Bitcoin and Ethereum were down by -10.33% and -12.17% respectively over the seven days to 23 November 2025. Bitcoin’s market capitalisation is down to US$1.7 trillion while the global crypto market fell to US$2.94 trillion. Bitcoin’s market dominance is at 58.4%.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$85,851 |

$96,458 |

$81,588 |

-10.33% |

|

ETH (in US$) |

$2,809 |

$3,236 |

$2,664 |

-12.17% |

Source: CoinMarketCap. As at 23 November 2025. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. As at 24 November 2025. Past performance is not indicative of future performance.

Source: Glassnode. As at 24 November 2025. Past performance is not indicative of future performance.

Crypto news we’re watching

Harvard’s biggest publicly disclosed holding

Harvard University has quietly expanded its Bitcoin exposure in a big way. As of 30 September 2025, the school’s endowment now holds more than 6.8 million shares in a Bitcoin ETF, valued at roughly US$443 million.

This represents a 257% increase from its previous stake of 1.9 million shares worth US$116.6 million and is the largest single-quarter increase to date. The Bitcoin ETF is now Harvard’s biggest publicly disclosed holding, according to its recent 13F filing.

Harvard Management Company, which oversees the university’s US$57 billion endowment, has effectively made Bitcoin exposure through ETFs just under 1% of total assets. While this is a small slice on paper, it represents a big shift from one of the world’s most conservative institutional investors1.

Young investors switched advisers over crypto access: Survey

A new survey suggests young wealthy investors are no longer waiting for their advisers to catch up on crypto. Research from digital asset infrastructure provider Zerohash shows that a growing share of high-earning Americans are shifting money away from advisers who don’t offer digital asset exposure.

In a poll of 500 investors aged 18 to 40, all earning between US$100,000 and US$1 million, 35% said they had already moved funds because their adviser lacked a crypto option. And when they moved, they didn’t move small amounts: more than half shifted between US$250,000 and US$1 million.

The message is clear: a new generation with real capital wants crypto on the menu, and advisers who ignore that demand are starting to feel it2.

CRYP company spotlight

Coinbase brings back digital token offerings

Coinbase (NASDAQ: COIN) shares jumped after the company unveiled a new platform that lets investors buy digital tokens before they list on its exchange. It’s the first broad pathway for US users to participate in public token sales since the space was effectively frozen follow the fizzling of the ICO (initial coin offering) boom in 2017.

With this move, Coinbase is trying to reopen a part of the market that once fuelled early crypto innovation but with guardrails that regulators previously argued were missing. The question now is whether a more structured token-sale model could restore early-stage energy back without repeating past mistakes.3

Coinbase is held in the Betashares Crypto Innovators ETF (ASX: CRYP)4. CRYP provides exposure to global companies at the forefront of the crypto economy.

Bitcoin (BTC): Total Supply Held by Long-Term Holders

This metric shows the total amount of circulating supply held by long term holders. Long- and Short-Term Holder supply is defined with respect to the entity’s average purchase date with weights given by a logistic function centred at an age of 155 days and a transition width of 10 days.

According to data from Glassnode, as of 22 November 2025, long-term holder supply peaked in July. Since then, there has been constant selling, with an acceleration in selling occurring late last week.

Source: Glassnode. As at 22 November 2025. Past performance is not indicative of future performance.

Source: Glassnode. As at 22 November 2025. Past performance is not indicative of future performance.

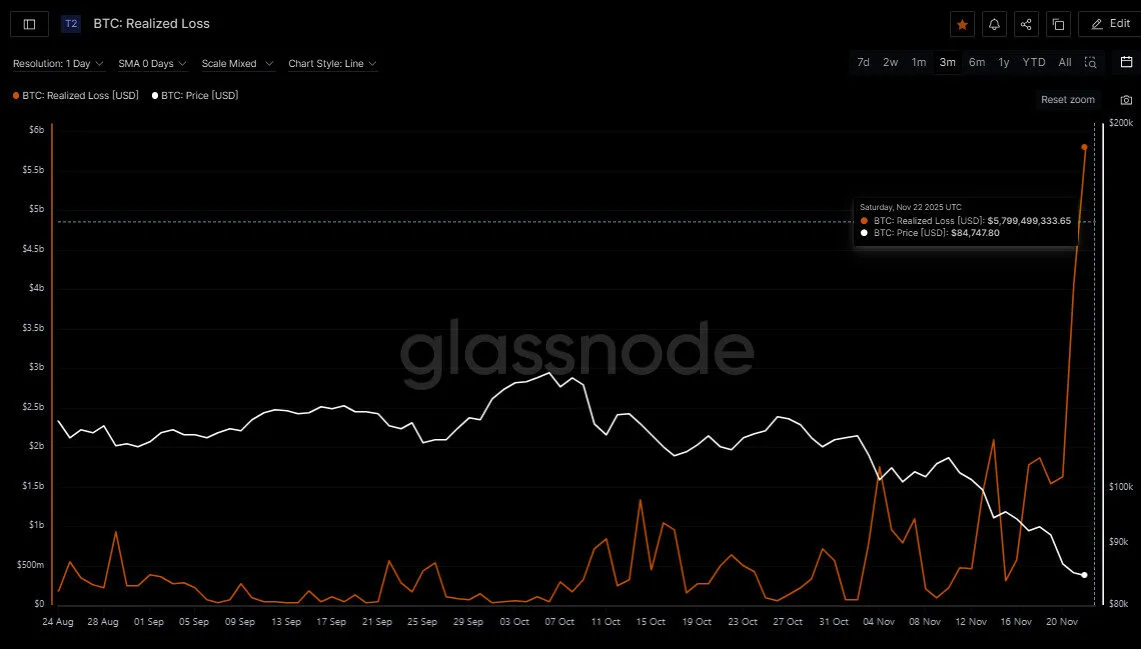

Bitcoin (BTC): Realised Loss

Realised Loss denotes the total loss (USD value) of all moved coins whose price at their last movement was higher than the price at the current movement.

According to data from Glassnode, from 20-22 November 2025, over US$11.4 billion of bitcoin losses were realised in the three-day period when prices were between US$84-86K.

Source: Glassnode. As at 22 November 2025. Past performance is not indicative of future performance.

Source: Glassnode. As at 22 November 2025. Past performance is not indicative of future performance.

Altcoin news

Most top 20 altcoins were down in the last seven days to 23 November 2025. Making headlines recently was the launch of the biggest crypto ETF debut so far in 2025. Canary Capital’s XRP ETF generated over $245 million worth of inflows on its first day of trading on 13 November 2025, which outpaced both Bitcoin and Ethereum ETFs on their debut. Nine XRP ETFs launched last week across US exchanges and analysts are expecting anywhere between US$4-8 billion in first-year inflows6.

The price of XRP is down over -9% in the last 7 days but is up over 32% in the last year to 23 November.

References:

1. https://bitcoinmagazine.com/business/harvard-triples-bitcoin-etf-stake

2. https://cointelegraph.com/news/young-investors-switching-advisers-crypto-access-survey

4. As at 21 November 2025. No assurance is given that this company will remain in the portfolio or will be a profitable investment.5. https://finance.yahoo.com/news/9-more-xrp-etfs-launch-173539823.html

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.