ETF distributions: frequently asked questions

10 minutes reading time

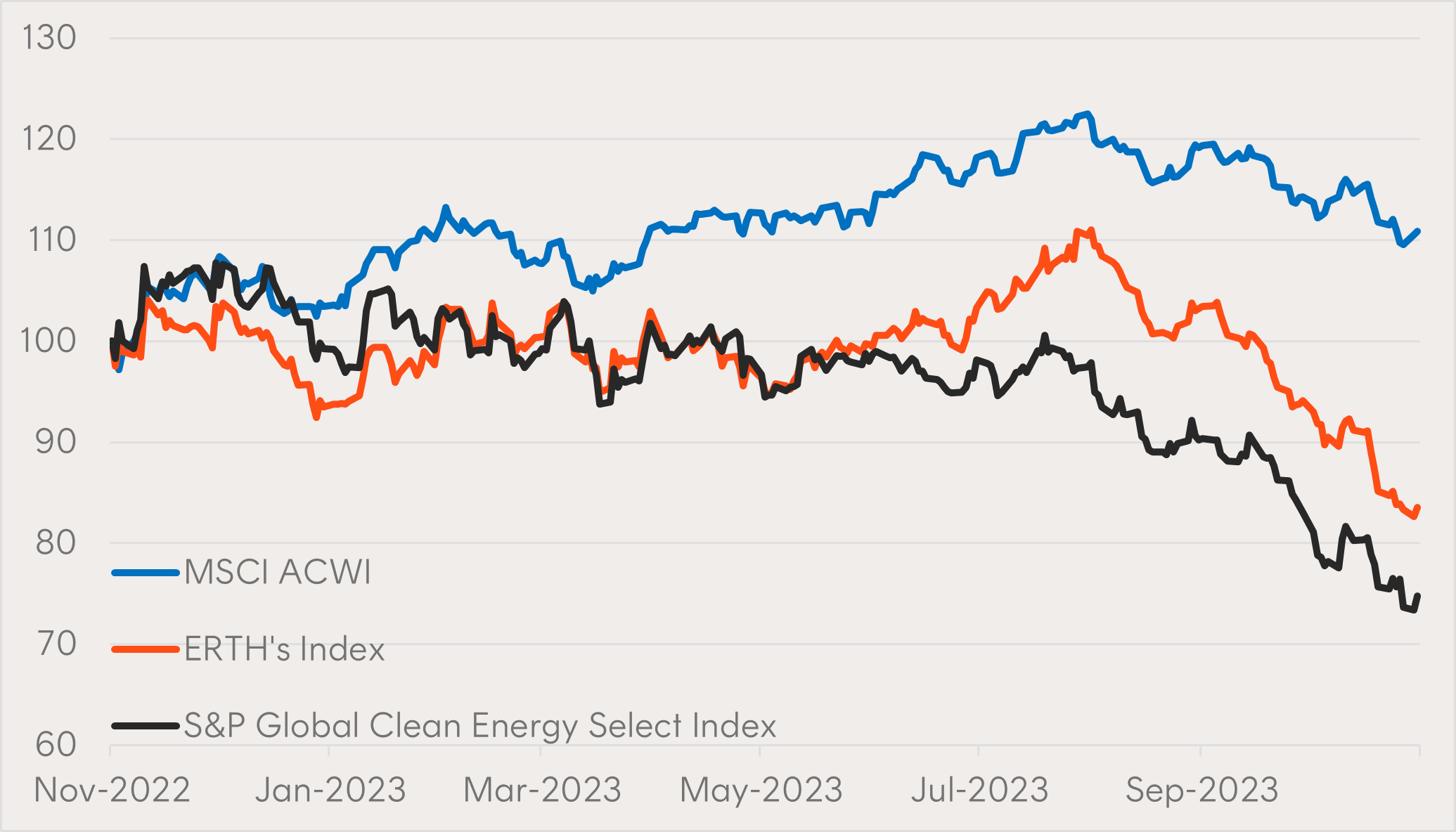

- The S&P Global Clean Energy Select Index returned -26% over a one-year period underperforming broad global markets, and climate focused funds such as ERTH Climate Change Innovation ETF , returning -16% over the same period, have largely followed suit.

- On one hand, a small number of mega-cap stocks drove broad market outperformance and on the other, macroeconomic headwinds, idiosyncratic setbacks (as can be expected in emerging industries), and cautious investors have ultimately led to the climate sector’s re-pricing.

- Current levels may offer an appealing entry point for long-term investors to what will be one of the most significant growth areas for government and private investment in the decades to come.

Over the year to 31 October 2023 the MSCI All Country World Index (MSCI ACWI) is up 11%. Meanwhile funds related to clean energy and climate change innovation, which gained significant traction with investors over the past few years, have struggled.

The S&P Global Clean Energy Select Index is down 26% over this one-year period. ERTH Climate Change Innovation ETF , which provides exposure to a broad range of decarbonisation solutions, including the clean energy segment, was down by 16% over the same period.

Chart 1: S&P Global Clean Energy Select Index v ERTH’s Index v MSCI ACWI: October 2022 to October 2023

Source: Bloomberg. As at 31 October 23. Total return indices. You cannot invest directly in an index. Graph shows performance of the index that ERTH aims to track (being the Solactive Climate Change and Environmental Opportunities Index) relative to the MSCI All-Country World Equity Index and the S&P Global Clean Energy Select Index. It does not show the performance of ERTH and does not take into account ERTH’s fees and costs. Past performance is not an indicator of future performance. ERTH’s returns can be expected to be more volatile than a broad global equity exposure, given its concentrated sector exposure.

Investors may justifiably be wondering about this performance and questioning the future potential of climate related funds that some may have expected to offer a ‘green premium’, or ‘greenium’. This note aims to explore these questions for the benefit of current and potential investors in the space.

A traditional approach to performance analysis

When discussing the underperformance of any fund over the past year compared to a broad market capitalisation-weighted index like the MSCI ACWI the first consideration to make is the impact of the ‘Magnificent 7’ (GOOGL, AMZN, AAPL, META, MSFT, NVDA, TSLA).

While you might expect to find Tesla in a climate change-related index, none of the other six companies in the Magnificent 7 would typically feature. This has weighed on the relative performance of climate funds as these six companies (excluding Tesla) have accounted for 45% of the MSCI ACWI’s total performance over the past year (Source: Bloomberg, as at 31 October 2023).

Accepting this point and putting it aside, we can focus on the other side of the equation – what climate impact funds do hold.

Using traditional attribution analysis, we can compare ERTH’s geographical and sector allocations to a broad benchmark such as the MSCI ACWI and consider whether this has materially impacted performance. In doing so we find that, despite some material variances, ERTH’s country and sector profile has not contributed to its underperformance.

What has caused the underperformance of ERTH’s index relative to the MSCI ACWI is the companies selected. That is to say that climate impact stocks across sectors and regions have underperformed their non-climate orientated counterparts over this period.

Looking under the hood

There are different approaches to climate impact investing. While some funds focus on only holding companies from a single sub-segment like clean energy or electric vehicles, the aim is to provide exposure to a broader range of climate change solutions in ERTH.

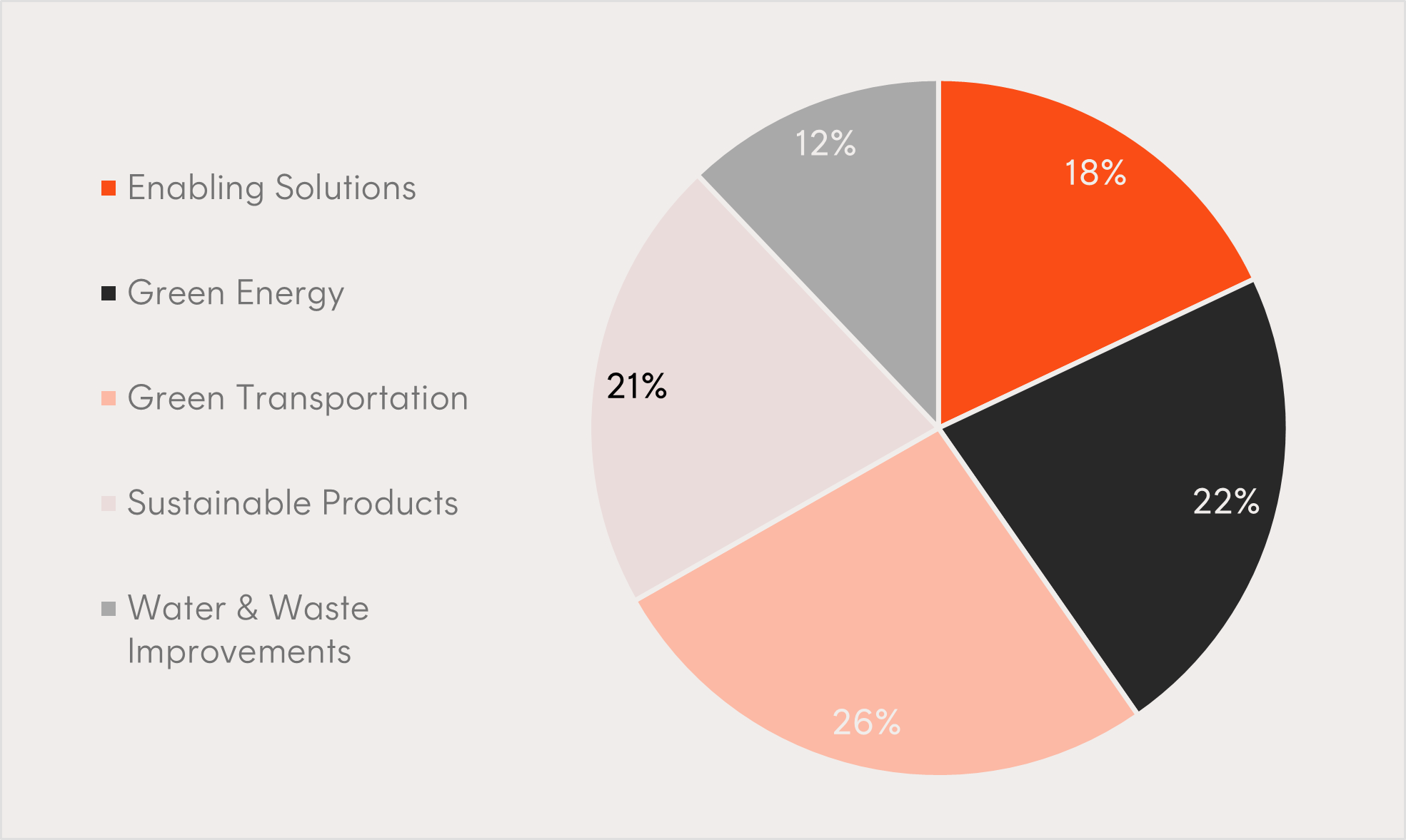

ERTH’s underlying companies are selected as those deriving at least 50% of their business from ‘green revenues’, being revenues associated with activities that enable the reduction or avoidance of CO2 emissions within one or more of five broad sectors expected to have a positive climate change and environmental impact.

This feature is particularly insightful when examining ERTH’s portfolio relative to the broader theme’s returns as it contains companies across the major climate innovation subsegments.

Chart 2: ERTH’s portfolio weight by sector

Source: Betashares

A climate attribution approach

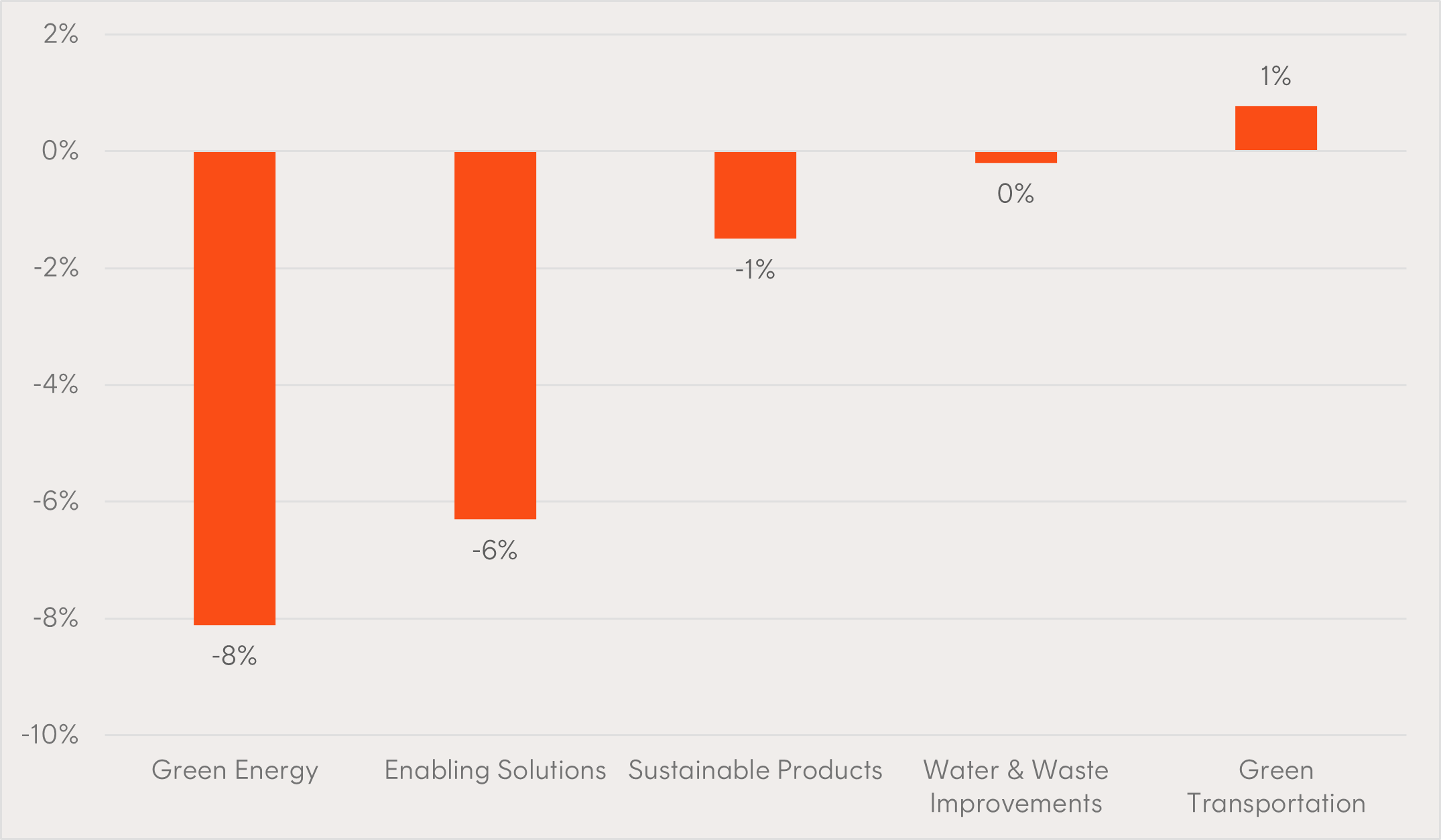

Rather than using traditional sectors, we can consider the performance of companies in each of ERTH’s climate sectors. While we find that four out of the five were negative over the past year, the two main detractors have been green energy and enabling solutions companies.

Chart 3: ERTH’s climate sector attribution over the past year

Source: Betashares, Morningstar. 31 October 22 to 31 October 23. Past performance is not an indicator of future performance.

The green energy sector covers companies that provide or enable renewable energy generation from sources like solar, wind and hydro. Among the worst performing stocks in this segment have been solar companies, they alone account for ~75% of the green energy segment’s underperformance.

The global solar energy industry has been facing multiple headwinds recently. The industry is young and relatively capital intensive, meaning many firms are struggling to deal with higher interest rates. Cheap electricity prices in the US have tapered growth across the country, while in California a new metering reform has hurt demand in the state which has historically accounted for around a third of the US market. Meanwhile, take-up of solar has been slower than expected in Europe, despite countries looking to reduce their dependence on Russian energy.

The other major detractor, enabling solutions, covers a wide range of solutions that enable the reduction of greenhouse gas emissions. This includes alternative fuels, energy storage, energy efficiency, measurement instruments and green finance.

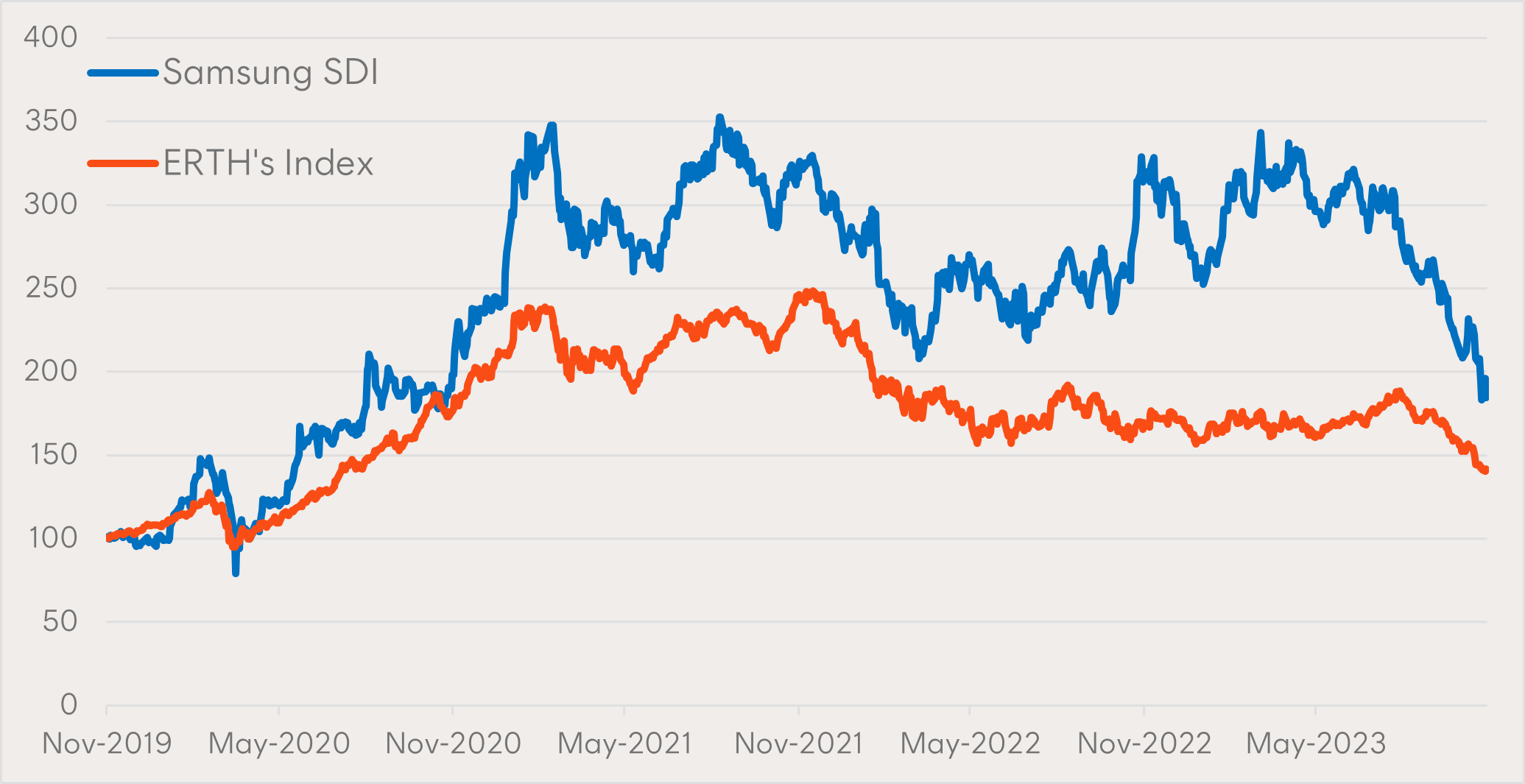

Lithium-ion battery producer Samsung SDI (SDI) led the sector’s losses. SDI is a battery manufacturer supplying General Motors and BMW, among others, with electric vehicle (EV) batteries. This year it inked a new seven-year deal to start supplying Hyundai and announced it will invest US$2 billion to build a second battery plant in the US, alongside Dutch EV manufacturer, Stellantis. Once the plant is up and running, it will produce enough batteries per year to power 1 million EVs.

Despite this, SDI’s share price was down 40% over the year. Offering a more telling story, SDI’s share price is still up 84% over a four-year period. Strong performance over a longer timeframe but recent poor performance is not an uncommon trend among climate innovation companies. ERTH’s index has returned 42% over the same four-year period.

Chart 4: Samsung SDI and ERTH’s Index 4-year performance chart

Source: Bloomberg, Betashares. Four years to 31 October 2023. ERTH’s index is the Solactive Climate Change and Environmental Opportunities Index NTR. ERTH’s index returns do not include ERTH’s management fees of 0.65% p.a. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Another of ERTH’s largest detractors in the enabling solutions sector was Proterra. Proterra ranks among the most competitive electric bus companies globally and is the largest in North America. Promisingly, the market for electric buses in the US grew by 66 percent in 2022, helped by the 2021 US Bipartisan Infrastructure Law handing out US$5.5 billion to transit agencies to fund the purchase of electric buses . Despite all this, Proterra filed for bankruptcy earlier this year in an effort to maintain operations and restructure to better address what it called “macroeconomic headwinds”.

Reflecting on this attribution analysis, these company examples, and the broader macroeconomic environment, we can start to put together a better picture of the climate industry’s recent underperformance.

The perfect storm

Climate innovation companies are typically young, growth-orientated, capital intensive and in emerging industries. When interest rates were lower, investors had a greater appetite for future growth stories and invested heavily in the sector.

Over the past two years as interest rates and inflation have risen, these same growth names have struggled as investors reprice what their future earnings are worth today. Under these conditions, these companies also face greater difficulty in obtaining and servicing financing, slowing their growth potential. And ultimately, some may not be able to weather the rapidly changing macroeconomic environment.

Further, companies in these emerging industries often face idiosyncratic setbacks, often due to regulatory changes and new competitors, to which their share prices are very sensitive.

The culmination of these factors has led to lower prices for many climate innovation companies over the past few years, and to a higher extent than the broader market. This is not an uncommon phase for growth-style companies, nor an unusual concept for investors.

Despite all this, there is still plenty for investors to be hopeful about for the future.

Looking ahead: greener pastures?

The support for climate initiatives is strong and growing. The June 2023 update of the International Energy Agency (IEA) Government Energy Spending Tracker found US$1.34 trillion has already been allocated by governments for clean energy investment support since 2020 . While groundbreaking legislation like Biden’s US$369 billion Inflation Reduction Act (IRA) continue to reshape the landscape for clean technology investment (we discuss the IRA in detail here).

Spurred by this government support, the IEA estimates global investments in clean energy will reach US$1.7 trillion in 2023 almost doubling that in fossil fuels. These investments are expected to continue growing over the coming decades, making climate initiatives one of the largest areas of spending globally.

Further, recent selloffs may be seen as a healthy repricing of climate impact stocks and an opportune entry point. It’s important that investors understand the typical characteristics of climate innovation companies and take a long-term view.

ERTH Climate Change Innovation ETF offers investors exposure to the companies solving some of our biggest environmental challenges. For more information, please visit ERTH’s fund page using the link below.

ERTH Climate Change Innovation ETF is rated ‘Recommended’ by Lonsec. You can request the research reports from your BDM or by filling in the form under the following link.

For more information on Betashares ETF platform availability please use the following link.