7 minutes reading time

- Global shares

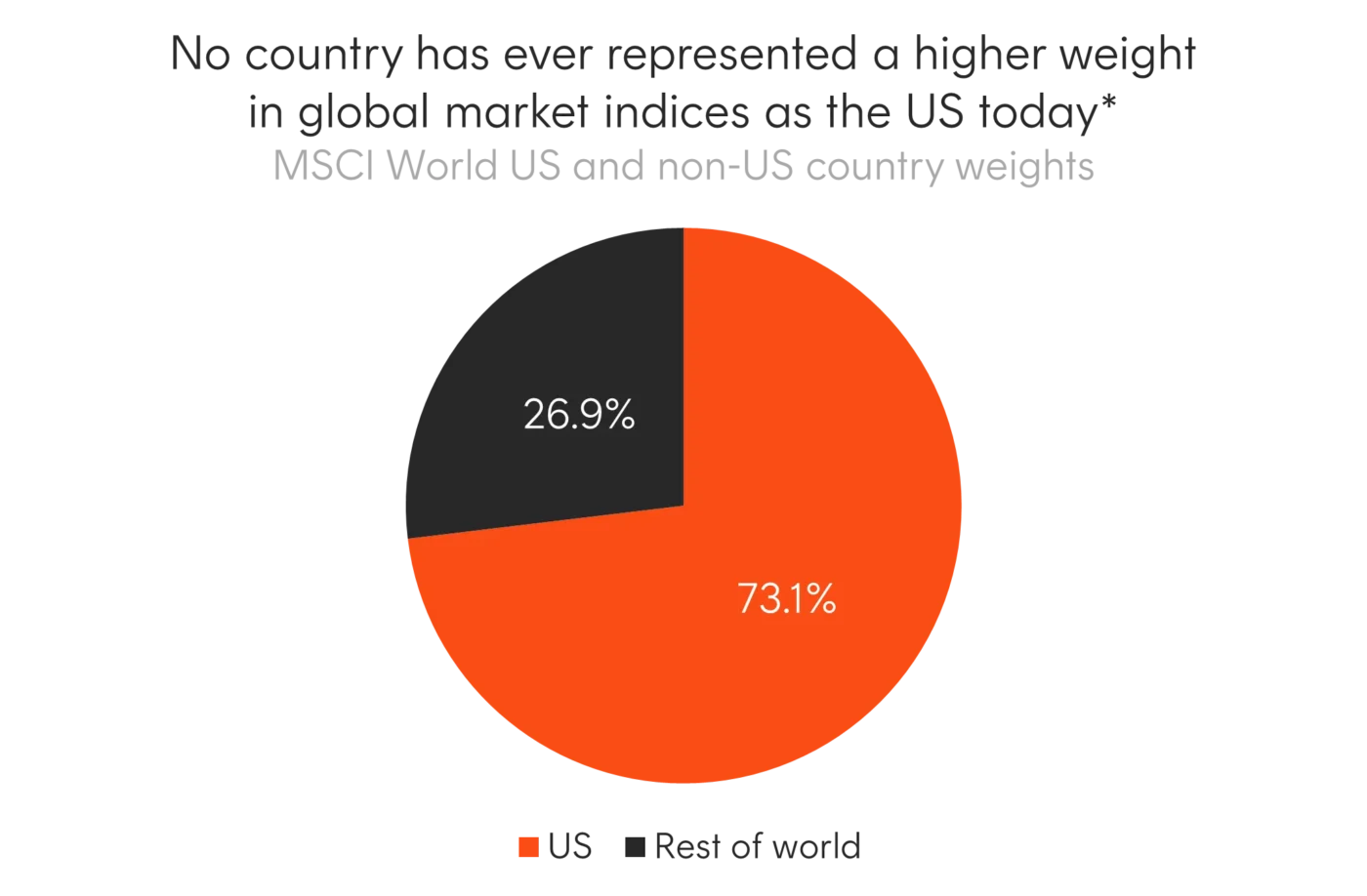

US companies have grown to represent over 70% of the MSCI World Index1. This is a truly historic level, only one other country, Japan during its 1980’s asset price bubble, has ever represented more than 40%. And the US itself has never had a weight this large in the index2.

While this has benefited many investors, as it has come about due to strong US outperformance over the past decade, it also creates concentration – exposing portfolio risk and return drivers to a narrow range of companies, macroeconomic conditions, policy environments, and sector imbalances.

Source: Bloomberg. Regional weights in MSCI World Index as at 31 October 2025. * Elroy Dimson, Paul Marsh, and Mike Staunton, Triumph of the Optimists, Princeton University Press, 2002, and subsequent research, Bloomberg. 1900 to 2025.

Within this context, Betashares is proud to launch EXUS Global Shares Ex US ETF . EXUS is a thoughtfully constructed ETF designed specifically for Australian investors, offering greater control over concentrated US exposures and broader strategic asset allocation.

An ETF built for the Australian allocator

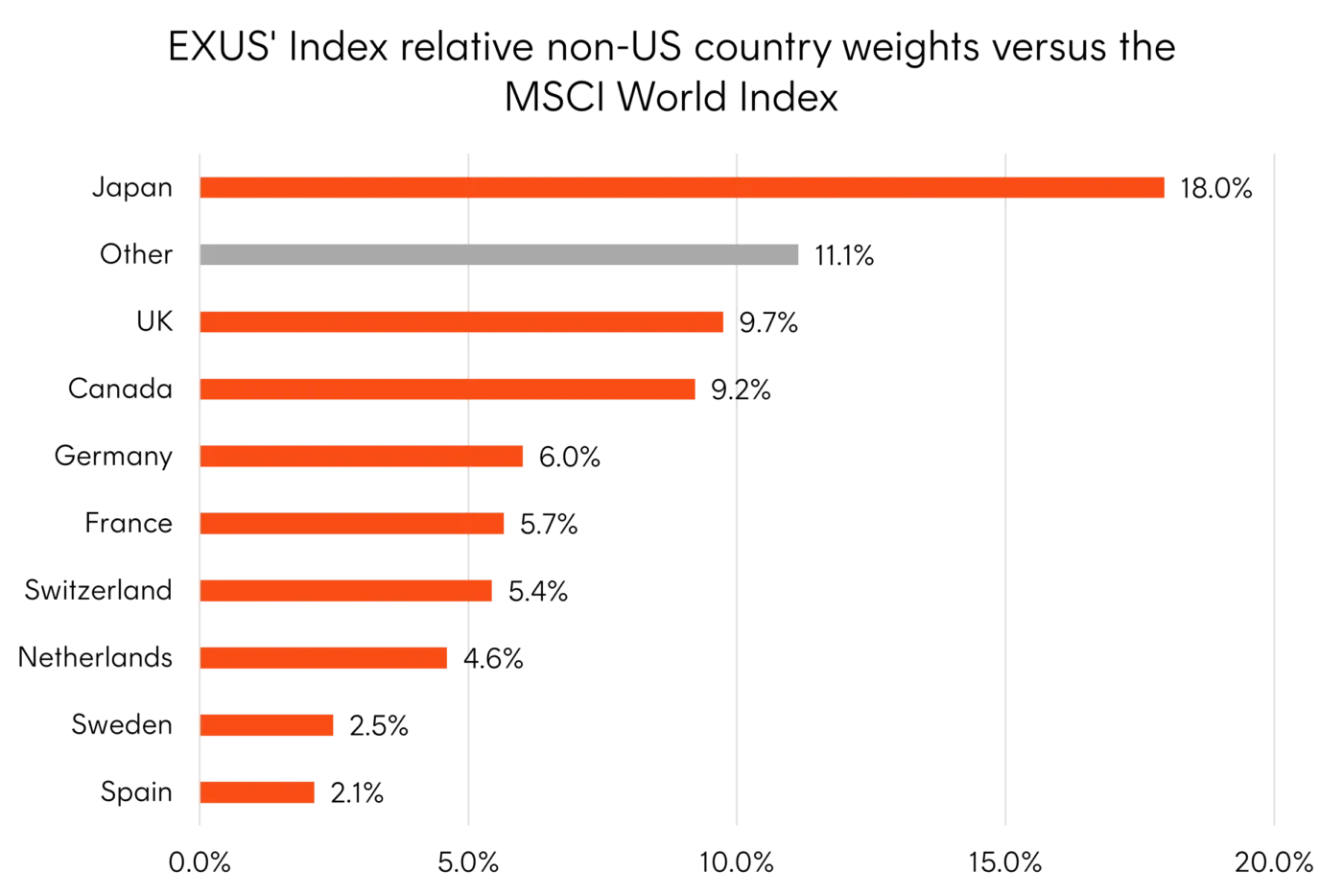

The index EXUS aims to track the performance of the Solactive GBS Developed Markets ex Australia and United States Large & Mid Cap AUD Index, before fees and expenses (the Index), was created specifically with the Australian allocator in mind.

The index is designed to provide exposure to the world’s largest developed market companies, based on their free-float market capitalisation, excluding both Australia and the US.

The exclusion of Australian equities, alongside US, is unique for a broad global ex-US ETF in the Australian market3 and reduces holdings overlap for Australian investors. By comparison, in the FTSE All-World ex US index, Australia is the 8th largest country allocation and CBA and BHP are the 16th and 27th largest individual holdings respectively4.

Source: Solactive, Bloomberg. As at 31 October 2025. EXUS’ Index is the Solactive GBS Developed Markets ex Australia and United States Large & Mid Cap AUD. Index constituents are subject to change.

The Index also invests only in companies incorporated in developed markets5, excluding emerging markets from its allocation. By comparison emerging markets currently make up 27% of the FTSE All-World ex US index6.

This is done both to remove the limitations of practical index tracking that arises with emerging market equities as well as to allow allocators greater control over their strategic allocation to emerging markets.

An efficient fund structure for the Australian market

In launching EXUS Betashares also took the Australian investor into consideration when choosing the fund’s structure.

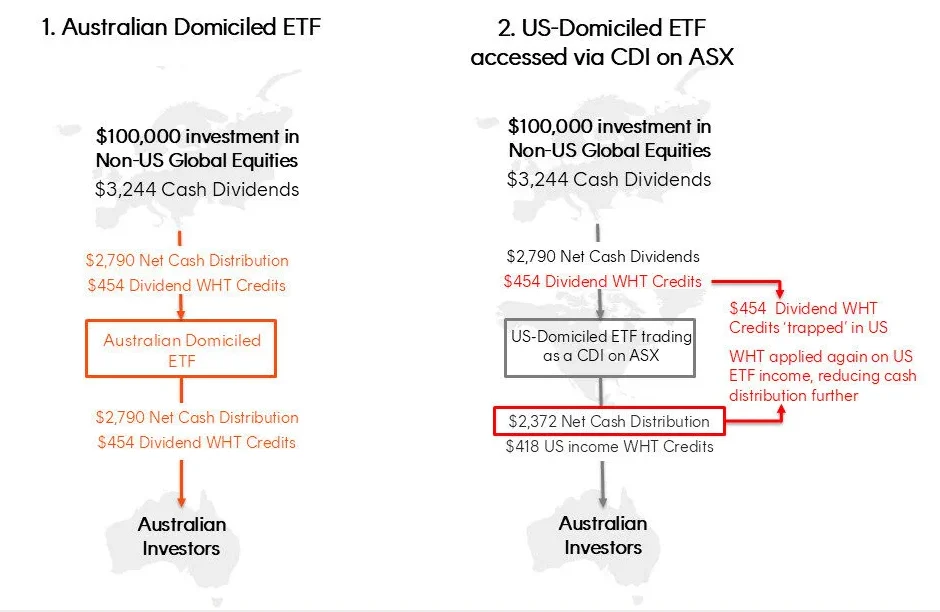

EXUS is an Australian domiciled ETF that invests directly in underlying companies. As is typical for a fund of this nature and structure, EXUS will use a sampling strategy with the aim of efficiently tracking the Index.

By directly investing in underlying companies, EXUS entitles investors in the ETF to receive withholding tax (WHT) credits associated with relevant foreign dividends7.

Alternate ETFs listed on the ASX but domiciled offshore forgo dividend WHT credits which are not passed through to Australian investors.

The illustrative example below demonstrates how these two frictions could potentially impact the income generated from a $100,000 underlying investment in non-US global equities exposure accessed either through a US-domiciled ETF versus an Australian-domiciled ETF. Yield and tax assumptions used are set out in the below graphic.

Example of the dividend and tax entitlements through different structures

Note: All figures are in Australian dollars, and based on a cash dividend yield of 3.244% for both the non-US Global Equities portfolio and the Australian domiciled ETF. A WHT rate of 14% is applied to non-US sourced income, and a WHT rate of 15% is applied to US sourced income. In the case of the US-domiciled ETF it is also assumed the investor has submitted a W8-BEN.

The value of the lost tax credits depends on individual tax payers tax rate, however, by comparison, the quantum for an ETF of this nature can be greater than a typical low-cost index tracking ETF’s management fees8. Not all Australian investors will be able to claim the foreign income tax offset.

Investment implications and portfolio construction

EXUS can be utilised with the purpose of not excluding US companies from portfolios all together, but instead facilitating the reallocation of capital amongst other developed market opportunities.

Alongside Betashares other core global equity building block ETFs, investors can achieve greater strategic asset allocation control, improve portfolio diversification and create the foundations of a robust core portfolio through efficiently structured funds made for the Australian investor. These ETFs include:

- Betashares Global Shares ETF (ASX: BGBL)

- Low-cost exposure to approximately 1,300 companies from more than 20 developed market countries.

- Betashares MSCI Emerging Markets Complex ETF (ASX: BEMG)

- One of Australia’s most cost-effective emerging markets ETFs, structured to help minimise deviations of the Fund’s returns from the index and enhance exposure to markets that are costly and complex to access directly.

For more information on EXUS, please visit the fund page here.

Sources:

1. Source: Bloomberg. As at 31 October 2025. ↑

2. Source: Elroy Dimson, Paul Marsh, and Mike Staunton, Triumph of the Optimists, Princeton University Press, 2002, and subsequent research, Bloomberg. 1900 to 2025. ↑

3. As of 31 October 2025.. ↑

4. Source: Bloomberg. As at 27 October 2025. Country and single security allocations are subject to change. ↑

5. Eligible companies are assigned to their respective country, based on their country of primary listing/country of incorporation. If a company is incorporated and listed in different countries, Solactive will consider the company’s country of domicile and country of risk to determine the appropriate country classification. ↑

6. Source: Bloomberg. As at 30 September 2025. Emerging markets allocations are subject to change. ↑

7. Where an Australian domiciled ETF invests directly in companies listed in a foreign country with which Australian has a double taxation agreement. Not tax advice. ↑

8. Based on Betashares’ analysis of the distributions and associated WHT credits between between July 2024 and June 2025 for an ASX listed ETF, which is a CHESS Depository Interest in a US domiciled ETF, with similar underlying holdings to EXUS. Calculations assume the same distribution yield applies to both the Australian ETF and US domiciled ETF. ↑

1 comment on this

Hi Tom, one of the few articles that isnt associated with a performance comparison? Is that available?