6 minutes reading time

When it comes to investing in shares, many Australians have a natural inclination to put most of their money in domestic companies, a tendency known as home country bias.

According to the latest ASX Australian Investor Study 20231, 58% of investors held Australian shares, but that figure was only 16% for international stocks. This preference is even more prevalent among self-managed super funds (SMSF), with 73% holding Australian shares, but only 23% holding international shares.

This home country bias can result in a concentrated portfolio and potentially affect the time it takes you to reach your investment goals, as well as denying you the benefits of diversification.

In this article, we explore why you should diversify your portfolio, and how you can avoid a home country bias.

Sector exposure, and why it matters

Australian shares can be particularly attractive to local investors in part because we are familiar with the companies listed on our domestic market, some of which we may see and use in our daily lives e.g. A2 Milk and Commonwealth Bank.

Not only this, but local shares also offer investors a unique tax benefit. Australia is one of the few countries where companies can pay franked dividends, meaning that shareholders get a credit for tax the company has already paid on the profits that fund the dividends.

While these qualities certainly support the case to include Australian shares in your portfolio, having a concentrated portfolio of just Australian shares may not result in the best investment outcome.

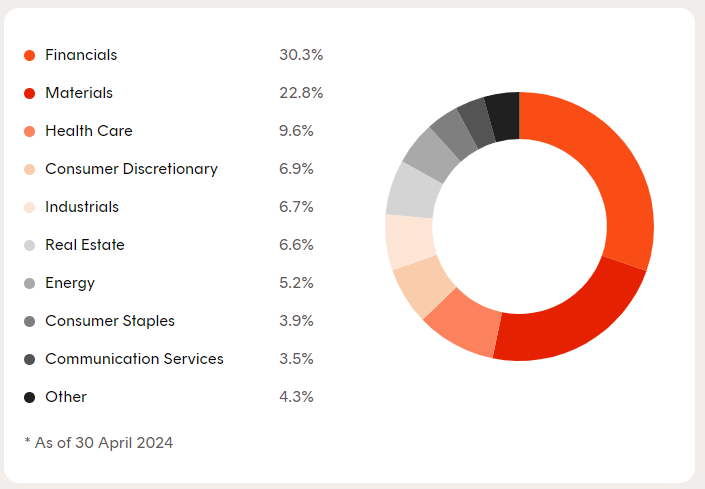

As shown below, the two most prominent sectors in the top 200 ASX companies account for over half the market capitalisation of the index – namely Financials (30%) and Materials (23%).

ASX: A200 Australia 200 ETF Sector allocation

Source: Betashares Australia 200 ETF (as at 30 April 2024)

You can see the index is significantly underweight sectors such as Industrials, which comprises just 6.7% of the index, and Technology, which is such a small component of the index that it falls under ‘Other’ at 4.3%.

The reality is that Australia does not offer what countries – particularly the United States – can when it comes to technology, healthcare and industrials.

Our economy is dominated by traditional companies like ANZ, BHP and Woolworths. In contrast, the US, Europe and Asia offer a plethora of companies at the forefront of innovation in technology, artificial intelligence (AI) and medical science.

Consider the brands that play an instrumental role in your daily life: Microsoft and Netflix for your content subscriptions; Apple and Samsung for your devices; Google to find information and directions to where you want to go; and Airbnb for booking holidays.

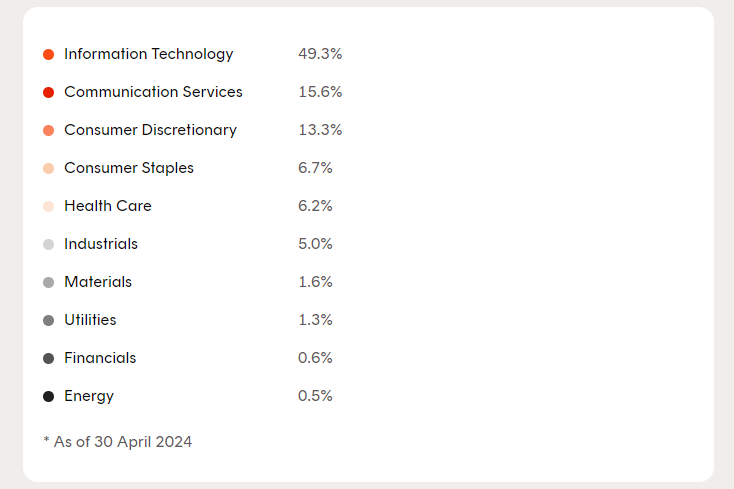

The NDQ Nasdaq 100 ETF offers focused exposure to the information technology, consumer discretionary, and communications services sectors, which comprise nearly 80% of the fund. This can help counterbalance the significant financials and materials weighting within the Australian market.

Nasdaq companies should not be seen as US-centric businesses. With scalable platforms that transcend national borders, Nasdaq companies generate revenue from a globally diverse customer base.

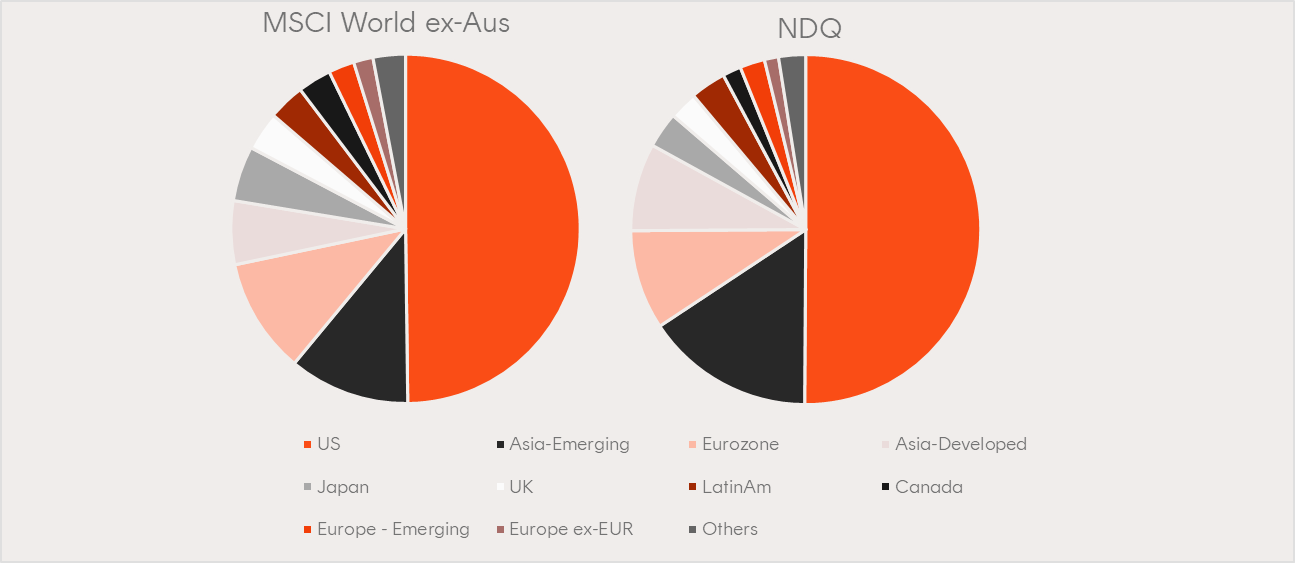

Revenue exposure by region

Source: Morningstar, data as at 30 April 2024.

This is evident looking at the revenue source by country of the Nasdaq 100 (on the right) with a very similar split to global equities (as shown for the MSCI World benchmark on the left). This proportion of non-US revenue share has increased over time for the Nasdaq 100, and is now greater than the S&P500 non-US revenue share of only 40%.

ASX: NDQ Sector Allocation

Source: Betashares Nasdaq 100 ETF (as at 30 April 2024)

Why does this matter?

A portfolio that is invested solely in Australian shares risks being highly dependent on the performance of the Financials and Materials sectors, and missing out on higher returns that may be generated in other sectors.

Not only this, but if the Australian economy experiences a downturn that is worse than that of the international economy, investors with a portfolio heavily concentrated in Australian equities could suffer greater losses.

In short, there will be periods when the Australian sharemarket, or important sectors of it, underperform international counterparts.

As an example, A200 has returned 8.17% p.a. over 5 years compared to NDQ, which returned 19.73% p.a. over the same period to 30/04/2024. It is important to note, of course, that past performance is not an indicator of future performance and, over other periods, it may be possible that the Australian market outperforms the Nasdaq-100.

Benefits of diversification, and how to achieve it

Simply put, diversification is spreading your investments across multiple geographic regions, industry sectors and asset classes.

In a diversified investment portfolio, your investment risk is spread. This means that if one part of your portfolio underperforms over a period, it may be balanced out by gains in another, reducing the risk of a significant overall loss.

Allocating your investment funds across several major asset classes, including shares, fixed income and commodities, is one important way to diversify.

It’s also important to diversify within an asset class. Ideally, the equities component of your portfolio should include exposure to both domestic and global equities. The point here is not to choose between the two, but that having a diversified portfolio with an allocation to both Australian and global equities may result in the best long-term outcome.

Fortunately, it has never been easier to achieve this.

Investors looking to add international diversification to their Australian core equities portfolio may consider ASX: NDQ.

NDQ aims to track the performance of the Nasdaq 100 Index (before fees and expenses). The Nasdaq 100 comprises 100 of the largest non-financial companies listed on the Nasdaq market, and includes many companies that are at the forefront of the new economy.

ASX: NDQ can be used in combination with other core allocations – to Australian shares (for example via the Betashares Australia 200 ETF – ASX: A200), fixed income, and cash – as the building blocks of a robust, well-constructed portfolio.

Key takeaway

While a predisposition to invest in Australian companies is understandable, diversification into global shares not only provides exposure to markets with potentially higher returns but also lowers your overall portfolio risk.

Source: