4 minutes reading time

Overview

- The FOMC held cash rates unchanged at 4.25%-4.5% for the fifth straight meeting.

- Historic dissent: Fed Governors Christopher Waller and Michelle Bowman voted for a rate cut – first time two governors dissented since 1993.

- The FOMC statement was mildly dovish and the 2 key changes were a downgrade on Economic Activity with the assessment now becoming “moderated” compared to “solid pace” from June and a slight change on Economic Uncertainty which “remains elevated”.

The press conference felt a lot more hawkish and the key takeaways are below.

- Powell has given no guidance on rate decisions in September and further suggested that the current rate setting is only “modestly restrictive”. He then goes on to say that by not raising rates the Fed is essentially “looking through” the tariff effects.

- Powell considers the “modestly restrictive” monetary policy as well justified based on the Fed’s dual mandate. The labour market is still in balance and strong and inflation remains above target. However, in further explanation, Powell notes the dynamics underpinning the measures are important. While labour market demand has slowed, it’s met by lower labour supply keeping employment in balance. In a similar tone, there is also evidence goods inflation is picking up while service inflation is receding.

- Powell also commented on the slower economic growth observed in the first half of the year, but comes back to the Fed’s objective being Employment and Inflation.

- Lastly, he made remarks about central bank independence and said it’s an arrangement that has served the public well.

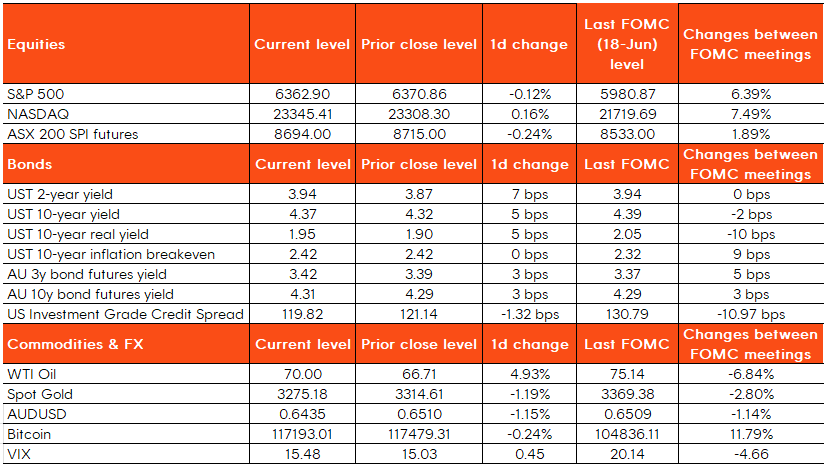

Market Reaction

The equity market was only slightly negative based on closing levels but has seen large reversals intraday. The S&P 500 hit session highs before the FOMC decision and remained positive after the statement was released. However, it tumbled 0.94% during the press conference as the market interpreted the messaging as a hawkish tilt. The index rallied towards market close thanks to tech stock gains.

UST yields drifted higher into the FOMC due to Treasury’s quarterly refunding announcement, which had forecast a massive borrowing increase for Q3 (July-Sept) to be $1.007 trillion, an increase of $453 billion from what was originally expected in April. The short-term yield spared some losses post the FOMC decision, but rose again during the press conference. The UST curve flattened at the end of the day with 2yr yields increasing 6bps and 10yr yields ending up 4bps.

September rate cut probability dropped from 68% before the FOMC to 47% during the press conference.

Desk commentary

Powell’s press conference is clearly hawkish and represents a near-term recalibration of the Fed’s policy; however, it is worth noting the broader rate-setting committee seems dovish on balance due to the historical dissent from 2 Fed governors, and one of them being in the running to succeed Powell when his tenure finishes in May next year. It is likely the post-Powell Fed will be quite dovish and could turn quickly due to the enormous political pressure from Trump, who, a few weeks back, suggested a whole 3% rate cut is needed in one of his social media posts.

Post today’s rate decision, the market is still expecting 1.5 rate cuts by year end. With September’s decision being a coin toss, most people are expecting a rate cut in the December meeting. The likely path forward is still a data-dependent one, and in the short term the focus is on core PCE inflation and non-farm payroll this week, as well as the unemployment rate to be released next week.

Additionally:

- We’re seeing some counter-trend moves emerging, like US curve flattening again after an extended period of steepening and the broad USD may have put in a short-term bottom.

- Real yields are still fairly generous and the TIPS curve remains steep, producing very high implied forward real yields, and that seem at odds with a Fed that’s likely to be more dovish post-Powell.

- DXY likely to make push towards to 200DMA but will likely meet overhead resistance there. 2s10s also reflecting a recent hawkish tone (even prior to today).

US 2s/10s Curve

US Dollar Index